Five Proactive Ways for Lenders to Reduce Repossession Rates

It doesn’t take a rocket surgeon to understand that repossessions should be the last resort for dealers and lenders. The outcomes of a repo negatively affect the customer, the dealer, and even the automobile:

- The process is expensive for dealers

- Customers are typically angry and distressed by the process

- Reputational, legal and financial risks increase

- The car is often left in a much worse condition than before the repo

While there’s no way to completely eliminate repossessions, there are steps you can (and should) take to reduce the frequency of vehicle recovery at your business. Here are five proven ways to reduce your dealership’s repo rates for good.

Update Your Underwriting Tech

Underwriting technology has come a long way over the past two decades, offering new ways for you to evaluate risk and choose the right buyers. Broad criteria like credit scores can paint some of the picture for you, but many unbanked and underbanked customers (sometimes known as “thin-files) are misrepresented by the big three reporting agencies.

Starting with a pool of customers that align more closely with your internal risk thresholds can make a big difference in your repo rates. And while this kind of investment may be costly up front, it can quickly pay for itself as you increase on-time payments and paid in full accounts.

Incorporate Autopay at Onboarding

For many buyers, one of the biggest challenges of bill pay is remembering when they need to pay. This issue becomes compounded when you see the sheer number of bills that consumers are paying each month, a number that often reaches into double digits.

Make sure your bills don’t become one of the “forgotten few” each month by setting your customers up with autopay at the time of origination or onboarding.

This can be done manually by having them fill out paperwork with their bank account or card information. Alternatively, you can opt for a modern payment system (such as PayNearMe) that lets your finance team set up autopay in a few clicks, or even send an autopay enrollment link via text or email. This will help your customers “set it and forget it” so that your bills are paid on time each month.

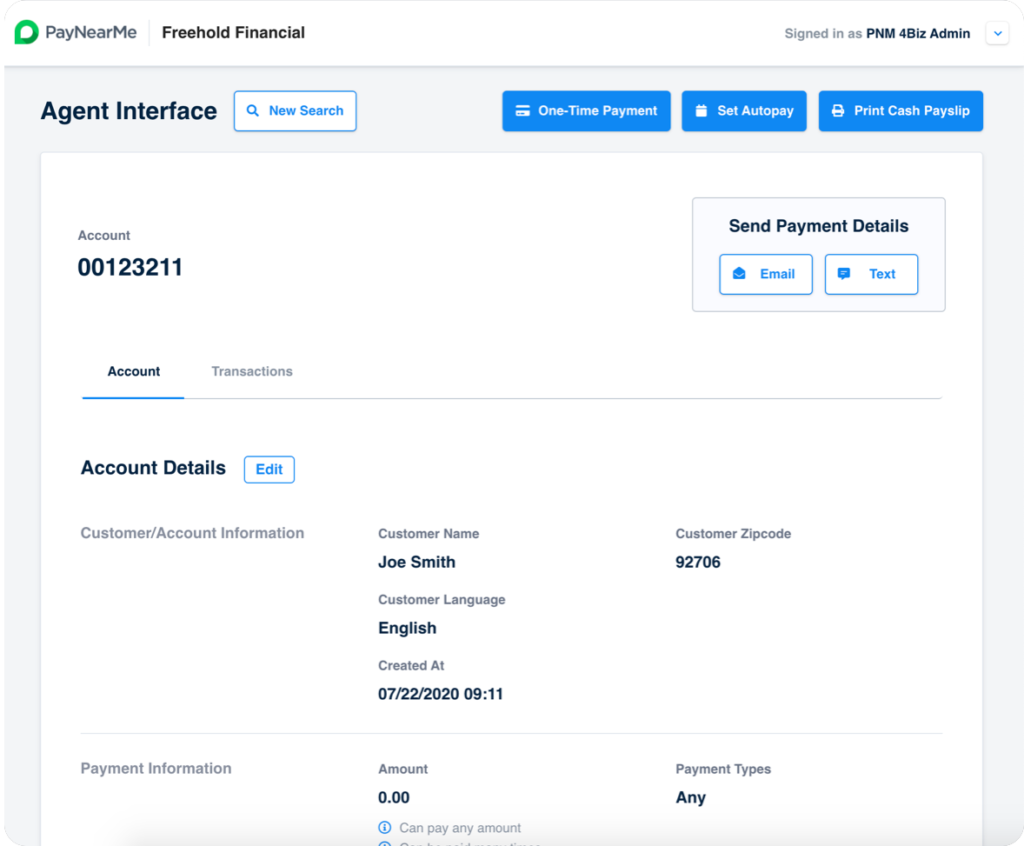

Give Your Collectors Better Tools

If you employ an internal collections team or have a call center staffed to take payments, it’s crucial that you give them the right tools to collect payments. Start by simplifying the number of screens they have to work with to take payments over the phone. By making it fast and easy to find customers and complete transactions in a few clicks, your staff will be able to increase the number of customers they can reach out to each day.

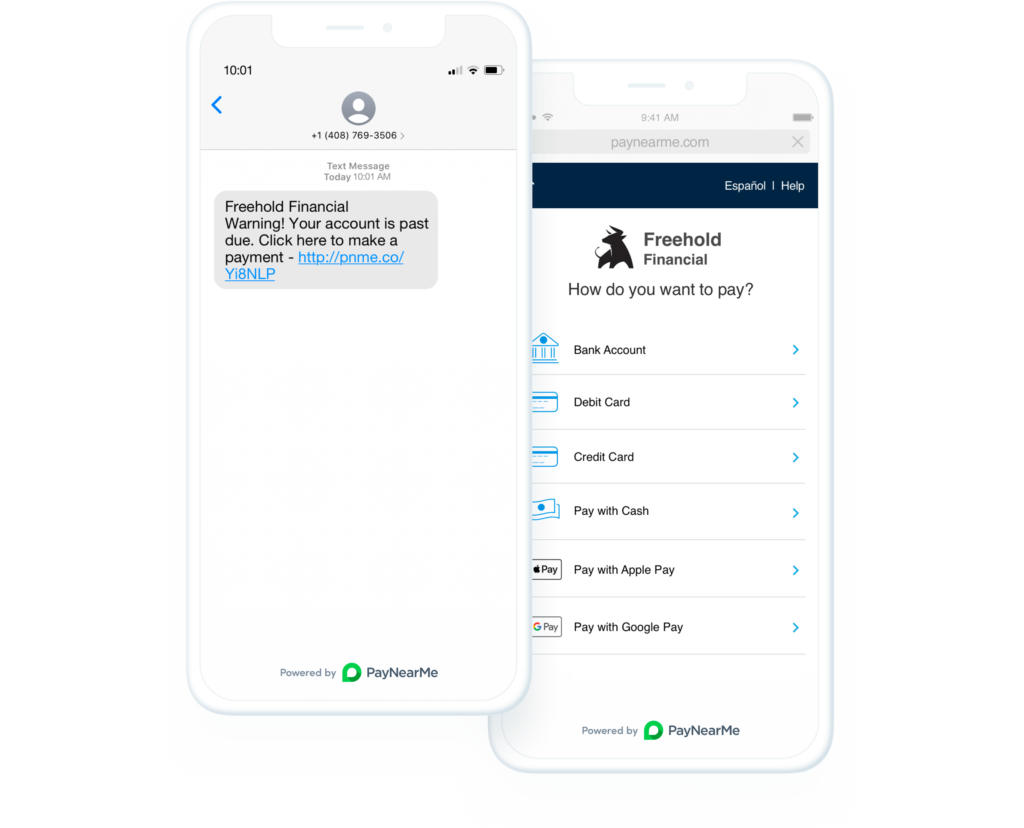

Providing your collectors with pay by text is another way to help them reach more customers. With tools such as PayNearMe’s Agent Interface, your agents can send an SMS payment reminder link to a customer in a single click. Smart Link(TM) technology then allows the customer to click the link and make their payment without having to login or type in an account number—resulting in a fast and seamless transaction for both agents and customers.

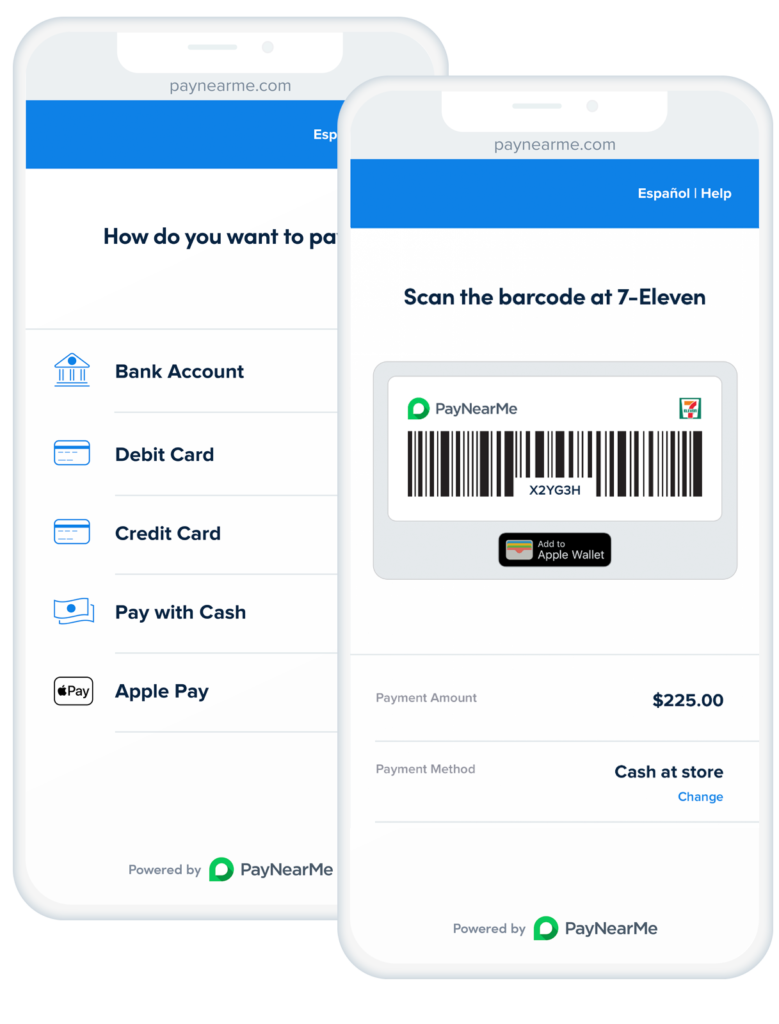

Offer Flexible Payment Options

Another way to help customers make on-time payments and avoid default is to allow them to pay with whatever payment method they can, wherever they are. For some customers, this means allowing debit payments that can be completed on their phone at any time. For others, it may mean offering a cash payment option at local retailers.

You may also wish to extend flexibility into the amounts or frequency of payments. For example, with PayNearMe you can allow customers to pay part of their bill in cash and then complete the payment with a card.

Our flexible platform lets you choose to offer an “open” payment option that allows your customers to break up their payments. Additionally, our robust autopay features allow customers to set up schedules that work for them—including weekly, biweekly, monthly or twice a month on dates of their choosing.

Use Escalating Reminders

Sometimes, customers don’t realize just how late they are on a payment. This is where escalating reminders come in. Using technology, you can build automated text messages or email reminders that are triggered by how many days past due the customer is.

For example, PayNearMe client Turner Acceptance was able to use escalating messaging to not only improve on-time payments, but also to reduce the number of inbound and outbound calls to their call center. This type of communication can help you identify and prioritize the borrowers who are most at risk to enter default.

Lowering Repo Rates Starts with Smart Technology

Regardless of how you choose to move forward, smart technology options such as PayNearMe can help you to significantly reduce the number of delinquent payments you receive each month.

To learn more about PayNearMe, click here to request an interactive demo. Or, view our instant demo at your convenience.