iGaming Player Retention: Research Shows Payment Experience Matters More Than Ever

The race is on, as iGaming operators strive to win market share for online sports betting and online casino gaming. In the U.S., sports betting apps gained a whopping 71% increase in revenue in 2022 over the previous year, and analysts expect the global iGaming market to reach $124 billion by 2027. With so much opportunity on the table, it’s mission critical for operators to optimize every aspect of the bettor experience – particularly payments.

Understandably, operators are laser focused on making their site or app entertaining for fantasy sports, live events or casino games. But they may not realize how problems in the payment experience could be driving players to switch to a competing brand.

In PayNearMe’s latest iGaming research report, we spotlighted key pain points that frustrate players, and how negative payment experiences are costly for operators. Here we’ll touch on some important takeaways about why operators need to prioritize the payments journey to help drive growth and player loyalty.

Losing Players at the Gate

iGaming is about entertainment, and making it easy for players to get started helps fuel their enthusiasm. If bettors cannot easily fund a new account and quickly cash out their winnings, they may abandon that site or app and choose another.

27% of players who had issues depositing or withdrawing money said it’s the top reason for discontinuing play on an app

— PayNearMe and Betting Hero’s 2023 Research

Losing players from the get-go is preventable, yet it happens all too often. As an example, our research revealed that 32% of bettors said they would delete or abandon an app if it takes too long to fund the account. And 23% of those surveyed who were unable to deposit funds left the app and never came back.

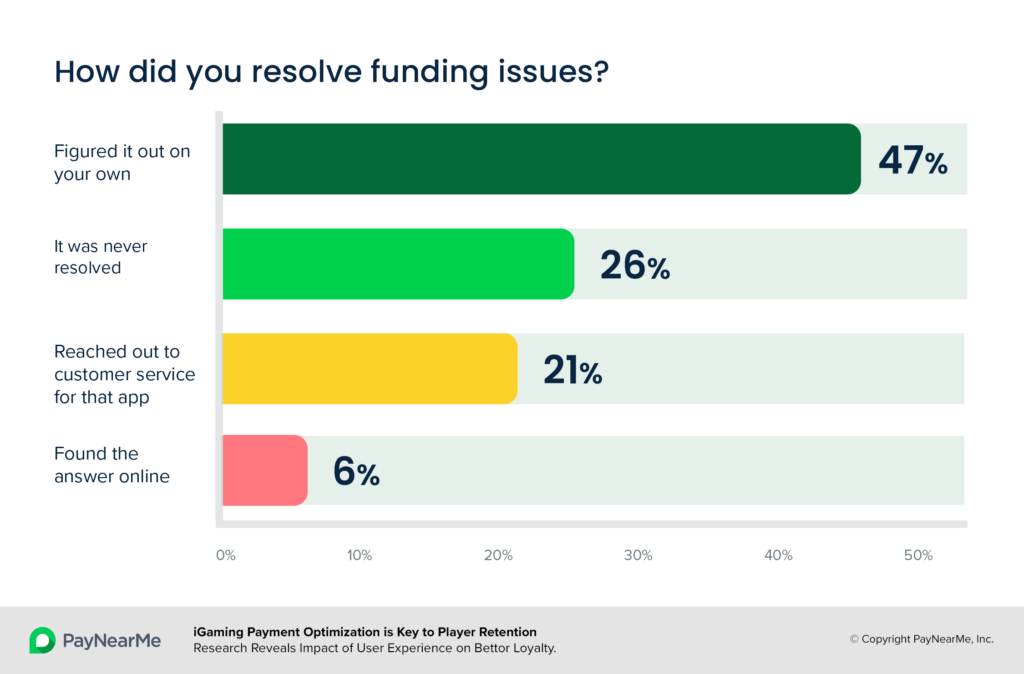

26% of players who tried various fixes for account funding issues were never able to resolve the problem, and thus, never able to place a bet. That’s revenue lost for an operator, and most likely a customer who won’t give them a second chance.

Even when bettors solve payment problems on their own (47% resolved their deposit issues and 38% fixed their payout issues themselves), operators may still be at risk of losing players. Getting things to work successfully may have been time-consuming, and involved repeated efforts or trying other payment methods, all of which can frustrate players and drive them away.

In fact, 22% of players cited user interface or technical issues as their biggest day-to-day frustration. 44% said they would delete or abandon an app if the site is glitchy or non-responsive. These statistics underscore the fact that today’s consumers have a low tolerance for a negative user experience, even more so when their money is involved.

The New Standard for Payments

Players now expect seamlessly simple payment experiences. That’s the bar set by e-commerce giants like Amazon and Uber, where transactions are nearly invisible and offer a wide range of payment methods.

Attracting new bettors through promotions isn’t enough. Winning long-term player loyalty requires quick and easy money movement, particularly with younger players. In our research, the average age of surveyed bettors was 30 –a generation that has grown up familiar with digital commerce– and a strategic audience for operators to win and retain to effectively compete and drive growth.

iGaming operators may need to adhere to many regulations and KYC steps to securely process money, but players don’t care about those behind-the-scenes hurdles. They want sportsbook and casino apps to be easy to use and have flexible payment options, including debit and credit cards, ACH, mobile wallets like PayPal, Venmo and Apple Pay, even cash.

“Other industries seem to get funds moved more quickly than any type of gaming payments.”

— Surveyed bettor

Increasingly, players won’t settle for less. 18% of surveyed bettors said they would delete or abandon an app if it lacks their preferred payment types. For players who had funding or payout problems, a lack of flexible options was key to the problem. 13% of those with deposit issues and 26% of those with cashout problems said the iGaming app lacked a payment method they were willing to use.

In this fiercely competitive market, operators need to keep pace with new player demands or they may be left behind. Optimizing the payments experience can give operators a greater chance to become the app of choice.

Amplifying Value with an Optimal Payment Experience

Payments may not seem like part of the entertainment experience – but the easier bettors can manage money in an iGaming app, the more it can fuel the excitement of betting. And that keeps players in the game.

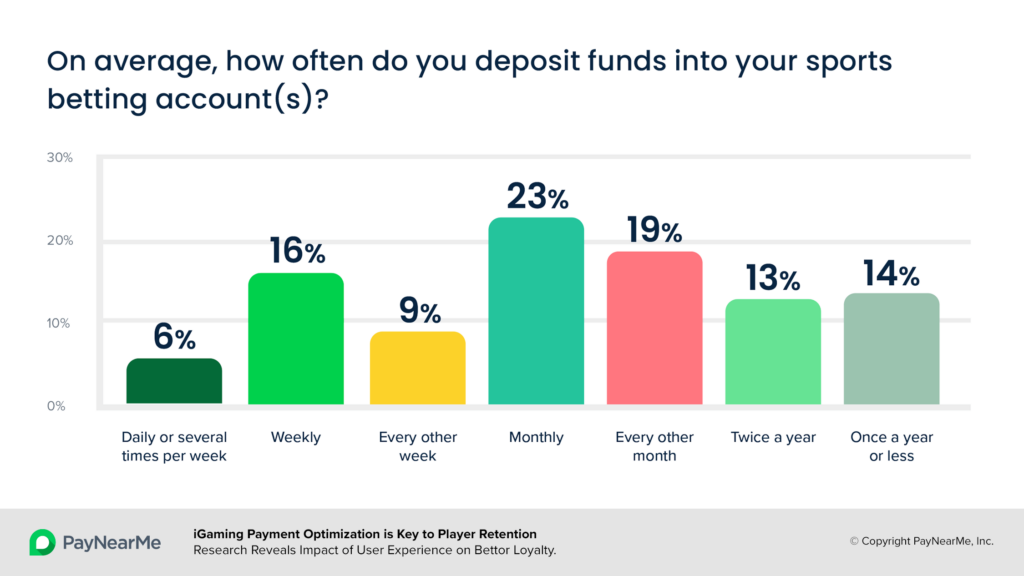

Building and capitalizing on momentum is a key strategy for operators, and payments are a central part of that. Considering that many players are frequent bettors, delivering a fast, flexible payment experience becomes even more important.

Of the bettors surveyed, 16% make weekly deposits into their iGaming apps, while nearly one quarter (23%) of players fund their account monthly. Making money movement quick, easy and convenient helps ensure betting momentum does not get stalled out, so operators retain loyal players.

Ultimately, the value is bigger than payments. Resolving common pain points and simplifying how users meet important needs shows players what they want to see: that the business is committed to delivering a great customer experience in order to earn their loyalty.

iGaming operators can simplify end-to-end money movement with MoneyLine™, a modern payments platform powered by PayNearMe. It delivers the most reliable payment experience across key touch points with bettors, including cashiering, deposits, payouts, cash at cage, engagements and more.

Download the PayNearMe 2023 iGaming Research Report:

iGaming Payment Optimization is Key to Player Retention