3 Strategic Reasons Cash Remains Critical for iGaming Operators

In this digital age where cash may seem obsolete, it is still significantly important to both iGaming operators and players for a variety of reasons. For operators it doesn’t have to be an either/or proposition—fintech innovation has brought cash payments into the digital space.

Delivering a frictionless deposit and payout experience is key to driving growth and profitability. Why is cash a critical part of that? Here we look at three strategic business advantages for operators, and what to look for in a next-generation payments platform.

1. Help increase deposits & retention by satisfying player preference

Many people who are used to betting with cash in casinos or at sports events may prefer the continuity of funding iGaming accounts with cash as well. Others may opt to use cash for privacy concerns, or because they don’t want to connect their bank or card account to an app.

In fact, PayNearMe’s 2022 research with players using iGaming and sports betting apps, 63% of bettors said they would be likely to deposit cash for online betting if given the opportunity, including 78% of frequent bettors. That’s a critical audience that operators don’t want to risk losing.

43% of frequent bettors would make larger deposits more often

if they could fund iGaming and accounts with cash

When asked to rank the importance of various deposit options for funding their online accounts, nearly half of all players surveyed said it’s important to be able to pay cash in person – with 47% wanting the option of cash at cage and 46% wanting to fund with cash at a retail location. Perhaps even more important to operators, 43% of frequent bettors would make larger deposits more often, if their preferred iGaming apps offered a cash deposit solution to fund accounts.

2. Reduce fraud & losses with guaranteed payment

There’s a lot to be said for cash-in-hand customers. Many operators struggle with challenges related to cashless payments—from card declines that can drive away players, to soaring fraud rates.

Card declines are the most common hurdle in making deposits, affecting more than a quarter (26%) of bettors, according to our 2023 iGaming research. Why this matters most to operators is that 32% of bettors abandon an iGaming app if it takes too long to fund the account, and 23% who had funding issues left a betting site or app and never came back. Offering cash deposits as part of the payments mix could reduce some friction to help retain players.

23% of bettors who had funding issues

left a betting site or app and never came back

Accepting cash also helps reduce fraud risk. iGaming digital fraud attempts rose 393% in Q2 2021 over the previous year, and in Q1 2022, fake account registrations spiked 85%, as reported by security experts Sumsub. And cash funding avoids the hassles and costs of ‘friendly fraud’ chargebacks, where players who’ve lost bets may claim digital deposits were unauthorized.

Cash is a guaranteed deposit. Once a cash transaction is completed it’s final; it cannot be rejected or charged back. Operators can improve overall acceptance rates, and bettors can jump right into playing.

3. Help increase responsible gaming

A core tenet of responsible gaming is that bettors “should not gamble more than they can afford to lose.” Enabling players to fund accounts with cash is one way to support that.

In fact, the UK’s Gambling Commission found that “79% of gamblers feel that paying with cash helps them to feel in control of their spending, and 70% report that paying with cash makes it easier to set limits on spending.”

79% of gamblers feel that paying with cash

helps them to feel in control of their spending

Some experts have noted that gambling with cash may hit closer to home with bettors. Unlike funding iGaming with credit cards, the hard reality of limited cash can help deter problem gamblers from too much impulsive betting. Professor Jay Zagorsky from the Questrom School of Business at Boston University suggests that cash can be a natural moderator for problem gambling, as cash introduces a ‘necessary friction’ to betting that may not exist with the seamless nature of digital payments.

But the issue is not only about protecting players’ financial health. Operators can be at risk if they don’t take measures that help reinforce responsible gaming. Case in point for Ladbrokes, one of the largest and oldest sports betting bookmakers in Britain. In 2022, Ladbrokes was fined nearly $21 million USD —the biggest fine in UK iGaming history — for compliance failures related to anti-money laundering (AML) and responsible gaming, according to Sumsub reports.

Enabling cash deposits can be a strategic bet for both operators and players, and a payments platform like MoneyLine™ (powered by PayNearMe) makes it easy. Using a QR code in the MoneyLine mobile app, bettors can pay cash at more than 60,000 retail locations across the U.S. It offers the best of both worlds—players gain the flexibility to fund iGaming in their preferred way, and operators can count on seamless digital transactions for cash deposits that simplify accounting and reduce security risks.

Help differentiate and drive growth with MoneyLine

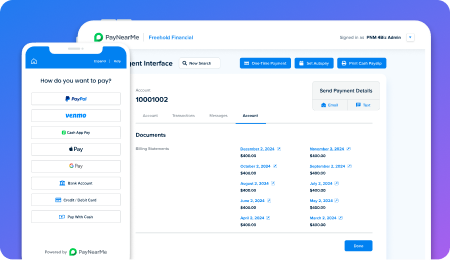

In the world of iGaming payments, the MoneyLine platform stands out – and helps operators differentiate as well. It gives online casino and sports betting businesses a complete deposit and withdrawal solution to enable secure payments in cash, cards, ACH and digital wallets like PayPal, Venmo and Apple Pay.

Unlike other cash providers, PayNearMe’s proprietary technology empowers operators to deliver optimal payment experiences for funding accounts with cash. For instance, players are never exposed to ‘convenience fees’ (that can turn people off), their personalized cash QR code never expires and they can reuse it for all their deposits, and even change payment amounts easily.

Learn how MoneyLine can help boost player satisfaction, lower conversion costs, improve reliability and future-proof your business. Contact our team or view an on-demand demo.