A Guide to Mobile Wallet Payments for Billers

Mobile wallet payment methods (such as Venmo, Apple Pay, PayPal and Cash App) have experienced serious growth in the U.S. recently. And with the WSJ report that Bank of America, JP Morgan, Wells Fargo and four others will be teaming up to create a new bank-sponsored wallet to challenge these fintech disruptors, competition will only continue to heat up. With this in mind, 2023 is poised to become a breakout year for mobile payments.

According to research by the Atlanta Fed, two-thirds of consumers had used one of these payment methods in 2021—a significant 5% increase from the prior year.

What was once considered a niche activity for digital natives has become a mainstream way to pay.

By 2021, 66 percent of consumers had used an online payment account to make a purchase or pay another person in the prior 12 months, up from 61 percent in 2020.

The 2021 Survey and Diary of Consumer Payment Choice

But in this scenario, like many others in the payments industry, consumer expectations aren’t in sync with biller adoption. Many billers, including consumer finance orgs, still don’t offer their customers the ability to pay with mobile payment methods. The same Atlanta Fed research shows that nearly 76% of bill payments were paid with more traditional methods, namely bank account (online bank bill payment and bank account number payment in the chart below), debit card and check payments.

Luckily, markets loathe a gap in expectations as much as nature abhors a vacuum, and 2023 is poised to be the year where mobile wallet payments take a more prominent role in bill payments.

What are mobile wallet payments?

The rapid proliferation and expansion of new payment types over the past decade has created some confusion in the market. So before moving forward, let’s attempt to understand the mobile payment ecosystem.

Mobile wallet payments, sometimes called digital wallets, online payment accounts or P2P payments, are often smartphone apps that enable consumers to send, receive and manage money from different funding sources. These apps tend to have an emphasis on security, customer experience and versatility—helping to facilitate both in-person and remote transactions.

This article focuses primarily on the big name players in the U.S. market:

- Apple Pay

- Google Pay

- Venmo

- PayPal

- CashApp

While there are other up and coming mobile payment types (bank-sponsored Zelle comes to mind), these five dominate mindshare and market share, and serve as a good representation of the trends in mobile payments.

Mobile payments vs mobile wallets vs. P2P

Even within this small subset of mobile payment brands, there is some confusion due to the inconsistent naming conventions and the march towards creating “payment super apps”.

Mobile wallets are a way for consumers to add payment cards, bank accounts and other documents into a single app for facilitating transactions. Think of the wallet app on your Google or Apple device; you can add a boarding pass, a debit card and even a digitized license in some states. Many of these wallets will also allow you to store funds in the wallet, such as Apple Cash or a PayPal balance.

Mobile payment types are stored in the wallet, and serve as a digital proxy for a card, bank account or cash.

As Apple clearly puts it on the Apple Pay website:

Apple Pay is the safe way to pay and make secure purchases in stores, in apps, and on the web. Apple Wallet is the place where you store your credit or debit cards so you can use them with Apple Pay.

Peer-to-peer (or P2P) payments can be thought of as a digital cash equivalent. Think of the origins of Venmo and Cash App—these apps grew in popularity by making it easy to send funds to trusted connections as a replacement for handing over paper money or checks.

The five apps mentioned in this article have most or all of the above traits, further blurring the lines between these different concepts and creating some confusion in the market. What’s important is that the combination of wallets, P2P and mobile payments combine to create a winning combination for tens of millions of U.S. adults, leading to their fast ascent into the mainstream financial landscape.

For simplicity, we’ll just refer to all of these as “mobile wallet payments” for the remainder of this write-up.

The rise of mobile wallet payments

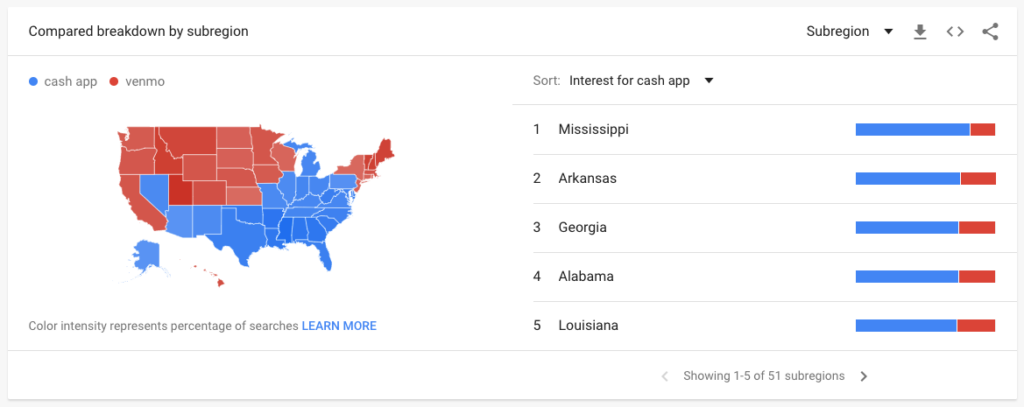

Many factors have led to the rise of mobile wallet payments, but the COVID-19 pandemic is arguably the biggest accelerator of the trend. Looking at Google search results over the past five years for Venmo and Cash App, there is a clear spike in interest in March of 2020—the exact start of the pandemic lockdowns in the US. Correlation doesn’t prove causation, but it’s hard to ignore in this case.

Venmo and Cash App

While interest for both has risen steadily since, there are some differences to point out. In general, Venmo has a much higher interest on the coasts and the northwest, while Cash App has dominated in the central and southern regions of the country. Looking at average credit scores by state, there is also a correlation where Cash App is most popular in states with lower credit scores, while Venmo tends to gravitate towards higher credit score states.

This may be of interest to billers who service different consumer credit profiles, though more research is needed to make a clear connection.

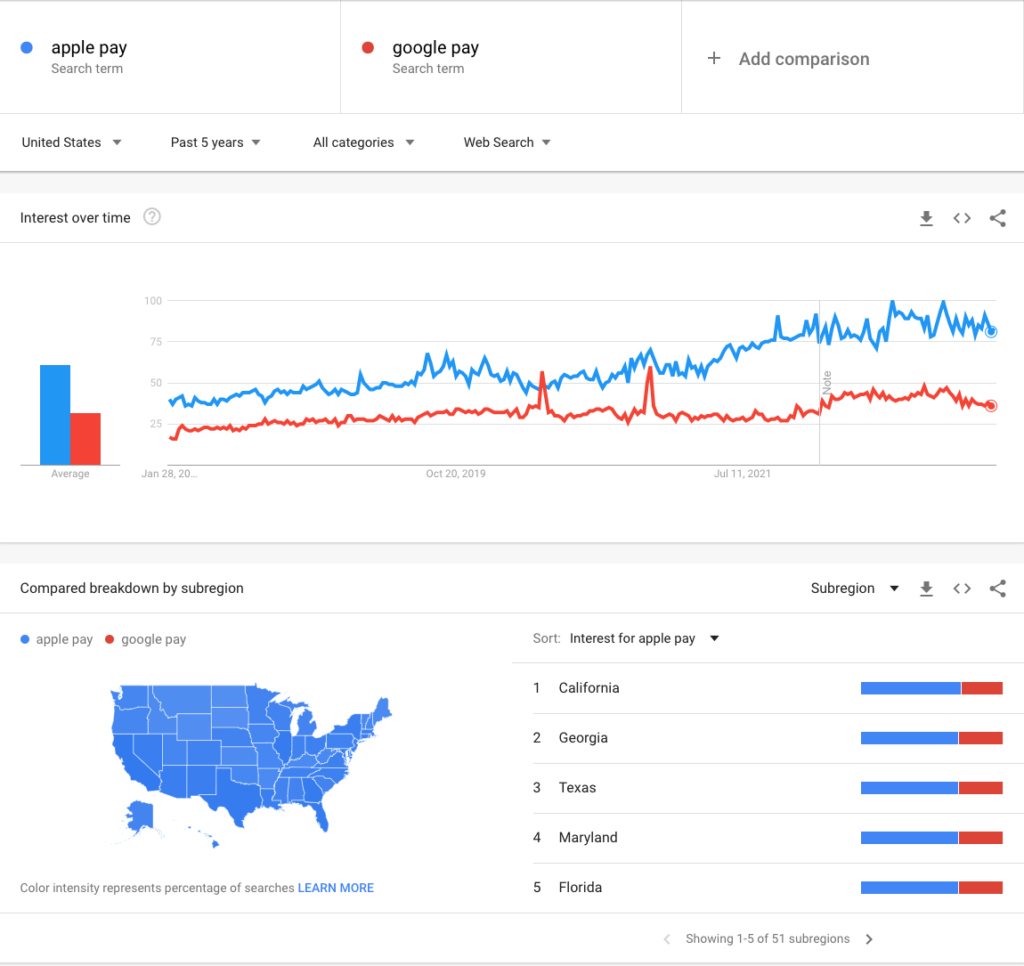

Apple Pay and Google Pay

Apple Pay and Google Pay have also seen significant growth since 2020. In this case, Apple Pay is the dominant player in terms of mindshare, owning search interest in all 50 states. Both Apple Pay and Google Pay benefit from being pre-installed on iOS and Android devices, respectively, which constitute nearly every smartphone sold in the U.S.

Unfortunately, actual usage numbers for both services remain murky at best. Estimates from Insider Intelligence show that 45.4 million U.S. consumers over age 14 have actively used Apple Pay in 2022, but official primary sources tend to convolute real adoption numbers.

The benefits of mobile wallets for consumers

There are compelling reasons why consumers would want to add mobile wallet payments into their financial lives. These payments offer significant benefits over many traditional payment methods.

Financial Consolidation: In many cases, mobile wallets simplify the payment process by providing access to multiple payment methods in a single user interface. For example, a Venmo user can keep a debit card, a bank account, a Venmo-sponsored credit card and a balance of stored funds in a single account. This consumer can run all payments through their mobile device, without the need to carry or risk losing the physical counterparts.

Convenience: From a user experience standpoint, mobile payments offer a more frictionless experience than keying in traditional payment methods. For example, when a consumer wants to pay with Venmo, they will not need to type in card numbers or bank details. They can simply authorize the payment in their installed Venmo app, using biometrics or a pin to complete the transaction in seconds.

Security: A major selling point for mobile payments are the extra levels of security they offer consumers. On a technical level, features such as tokenization and biometric authentication help to ensure payment data remains secure. In addition, full payment details aren’t stored on devices for most mobile wallets. Even if your phone is stolen, bad actors would have a difficult time pulling your payment account data from these apps.

Trust Signals: Unlike many other tech trends (think new social networks or trend AI services), the big mobile payment options are all backed by established tech behemoths. Apple, Alphabet (Google’s parent), PayPal (who also owns Venmo) and Block (Cash App) are all Fortune 500 entities with financial stability and best of breed tech. Consumers trust these brands with sensitive financial information.

Why smart billers are adopting mobile wallet payments

Like consumers, billers can benefit greatly from accepting mobile payment types in addition to stalwarts like cards, ACH and cash payments.

Simplify the Bill Pay Process: When asked what would make bill pay easier, 35% of consumers said paying via Apple Pay or Google Pay would help, while 30% cited other mobile payment options such as PayPal and Venmo. When asked what mobile payment options they wanted most, PayPal floated to the top with 43% of respondents saying it would be important to them.

Climb the payment priority ladder: Accepting mobile payments means tapping into readily available consumer funding sources. For example, if a biller allows payments from Venmo, the consumer can potentially pay with a debit card, a bank account or stored funds in the app. If the consumer prefers to pay with stored funds first, they may prioritize any biller willing to accept this payment—potentially putting them at the top of the priority ladder.

Good funds: In many mobile payment transactions, funds must be available at the time of payment for the transaction to successfully post. This is similar to a “good funds” model, which reduces the likelihood of a bounced or rejected payment. In industries like lending, where margin for error is low, high authorization and acceptance rates can be a difference maker in the bottom line each month.

Reduced user input errors: User input errors can also be a source of pain for billers and consumers. Keying in the wrong account number or zip code, especially on smaller mobile keyboards, can cause an honest payment to fail without warning. Many mobile wallets pre-authorize the payment account before it can be added to the consumer’s wallet, helping to reduce these errors both at the initial payment and for follow up payments.

For example, Apple Pay will verify a new card with the issuer before adding it to the wallet. Even an error to CVV or billing zip code will trigger a red flag, helping to fix issues before the consumer ever uses Apple Pay for a monthly bill payment.

This logic also applies to agent-assisted payments. For example, in PayNearMe’s Agent Interface, a customer service agent can initiate a payment request by pushing a SMS or email to a consumer. The consumer can then click the link and make a mobile payment in a few taps or clicks, without the agent having to take the payment information over the phone. This not only reduces user input errors, but can also help to reduce compliance scope for billers.

What has slowed down biller adoption?

Given the laundry list of benefits experienced by both parties, it’s curious that mobile payment types have yet to make a serious dent in bill pay market share. Without primary research it is difficult to pin down the exact reasons, but the following factors likely play a large role.

Legacy payment vendors: Perhaps the most obvious reason for a slow rollout of mobile wallet payments falls not on billers, but on their payment processing vendors. Many payment providers haven’t integrated all the major mobile payment methods into their respective platforms, leaving billers with no options for acceptance. Only a select few, such as PayNearMe, offer a complete set of mobile and alternative payment options for billers.

Cost concerns: Despite its flaws, there’s a reason ACH continues to be the payment method of choice for most billers: it sports one of the lowest transaction fees across payment methods. But what often gets ignored is the cost of a failed ACH payment—each one can result in return fees, customer service expenses and potential collections costs to avoid delinquency. Presenting mobile payment types to consumers who have multiple NSF errors or other failed authorizations can be a way to offset repeat offenders and drive down the total cost of acceptance, which can be done with tools like PayNearMe’s automated Business Rules.

Lack of industry knowledge: As stated at the onset of this piece, mobile payment types have only recently broken into the mainstream. Couple this with the low number of payment providers offering mobile payments and it is clear that billers lack knowledge on the particulars.

For example, many billers are concerned about consumers making “debt on debt” payments by paying down a loan or mortgage with a credit card housed inside a mobile wallet. In reality, payment providers like PayNearMe have tightly configured integrations that prevent this scenario, while also pulling in MCC codes and other pertinent data to ensure each transaction is correctly mapped and reported on.

Getting started with mobile payments for bill pay

PayNearMe offers a full set of mobile payment options for billers, including specific solutions for consumer finance, transportation and other specialized verticals. Get all payment types in a single platform, including cards, ACH, cash at retail and “the big five” in mobile payments.

To learn more, contact our team today.