Benefits of PayNearMe Electronic Payments

Electronic payment methods are changing the landscape of how merchants receive payment and customers make payments. Today, merchants are riddled with challenges such as scattered payment channels, where different partners are used to accept cash vs. debit card vs. credit card and ACH payments and different partners to send payment reminders. To add to these challenges, merchants face a high cost for payment acceptance, as well as the lack of timeliness and reliability. Though electronic payments can be leveraged for new and improved customer payment experiences, these challenges pose a problem that threatens the reliability and reputation of going digital.

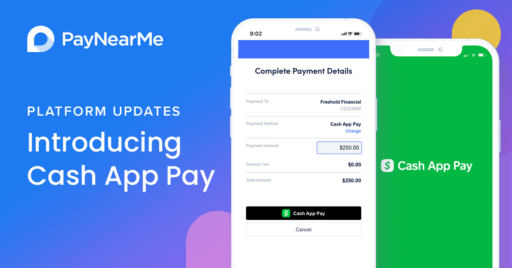

For merchants looking to elevate the electronic payment process and experience, PayNearMe’s consolidation of cash, debit, credit and ACH payment channels, along with payment reminders offers an innovative solution. Our mobile and desktop platforms provide a uniform, easy-to-use, and streamlined interface. With APIs, batch file, and mobile wallet integration, (Apple Wallet and Google Pay), you have the power to customize payment experiences to your liking by seamlessly introducing PayNearMe on existing apps and websites. Our service empowers you to be more operationally efficient, receive guaranteed cash payments. There is no risk of fraud, minimal chargebacks, and this expands your ability to better serve your customers.

Not only will our electronic payments help you more efficiently centralize payment processes, but our services will also make life easier for your customers. With a mobile-first mindset, we can better appeal to a large rising millennial consumer market.

According to an article by Accenture, the 80 million millennials in the United States alone spend roughly $600 billion each year, and their buying power is projected to grow even more. The simple 3-step flow for payments is intuitive, not to mention our lower processing fees and secure confirmation for every payment. PayNearMe provides full transparency to your customers with a breakdown of each bill and no hidden fees. SMS, email, and push notification payment reminder options make sure your customers never forget another bill; and with multiple ways to pay, sending fast and secure payments has never been more convenient.

Trusted, Reliable, Transparent and Innovative — PayNearMe offers a simple, convenient, valuable and low-cost alternative way to accept payments. With the accessibility of 24/7 payment locations for cash, the security of guaranteed payments and real-time postings, and the ease of digitized payment options, our services will help you stand out and equip you to service your customers’ electronic payment needs.