Future-Proofing Payment Experiences with Cost-Efficient Configurability

Bill pay has come a long way since the days of writing checks. Yet many billers still struggle with how to modernize and ‘future-proof’ payment experiences with more flexible options.

Adopting a one-size-fits-all solution is rarely feasible, as it may not support how the business actually operates, or adapt to the unique needs of specific customers. However, a custom-built solution may be cost-prohibitive, particularly to keep evolving it over time.

Fortunately, there’s a practical and cost-effective third option: a highly configurable payments platform designed, developed and managed by fintech experts. Billers can configure functionality and personalize the interface to match their brand—all at an affordable cost—while delivering a flexible payment experience for their customers.

Why configurable beats customized

While building a customized, tailor-made payments platform may sound like an ideal solution, companies often find it comes with significant downsides in cost and complexity. By contrast, a configurable payments platform enables billers to quickly and cost-efficiently gain the capabilities they need, without all the hassles.

Consider the key advantages:

- Fast delivery and lower cost: Developing a modern payments platform that integrates the latest technologies and capabilities takes specific expertise that most businesses don’t have in-house. Partnering with a fintech provider, like PayNearMe, companies can reap the benefits of an optimized digital payments platform they can configure to their needs, without the heavy expense and long timeframe of building a custom solution from scratch.

- Seamless updates: A custom-built solution can be challenging to maintain and upgrade. Billers need to ensure they have the right experts on hand to resolve issues, address security threats and stay on top of the latest payment industry trends and changing regulatory requirements, such as PCI and NACHA.

The right payments platform provider handles all the maintenance, updates and upgrades, making sure the system runs optimally, is protected from risks and remains compliant.

Bottom line: A configurable payments platform gives billers the best of all worlds. They gain the latest technologies in an agile solution that keeps pace with evolving company needs and market factors—all while saving money and freeing up staff to focus on other business-critical tasks.

What to look for in a configurable solution

When evaluating payments platforms, billers should look for a fintech partner that empowers their organization to configure the solution on a variety of critical levels.

Align the interface to the biller’s brand

The right platform should enable the company to incorporate the look and feel of their brand into the user interface, such as brand colors, logos and key language and terminology.

The goal is to ensure the payments interface is a seamless extension of the company, regardless of where and how customers choose to pay. Having cohesive branding across all payment touchpoints helps guide payers through the entire funnel, so they don’t get confused and abandon payment.

Tailor the payment experience

Billers should be able to configure parameters of the payments platform including:

- Payment types (e.g., debit and credit cards, ACH, cash at retail and mobile wallets such as Apple Pay, Google Pay, PayPal, Venmo and Cash App Pay).

- Allowable payment channels (e.g., web, text, mobile app, IVR, walk-in cash payment at participating retail locations, agent-assisted).

- Billing details screens that provide helpful context or account information (e.g., a mortgage payment breakdown with unpaid balance, interest rate, loan terms and foreclosure status). 77% of consumers say it would be helpful to have access to their entire bill, not just the payment amount, when paying bills online.

- Payment reminders (email or text) in both English and Spanish.

63% of consumers say that digital reminders would make it easier to pay bills on time.

Payment providers like PayNearMe can help companies import or create parameters, or turn specific data fields on or off so customers and contact center agents have the precise information they need.

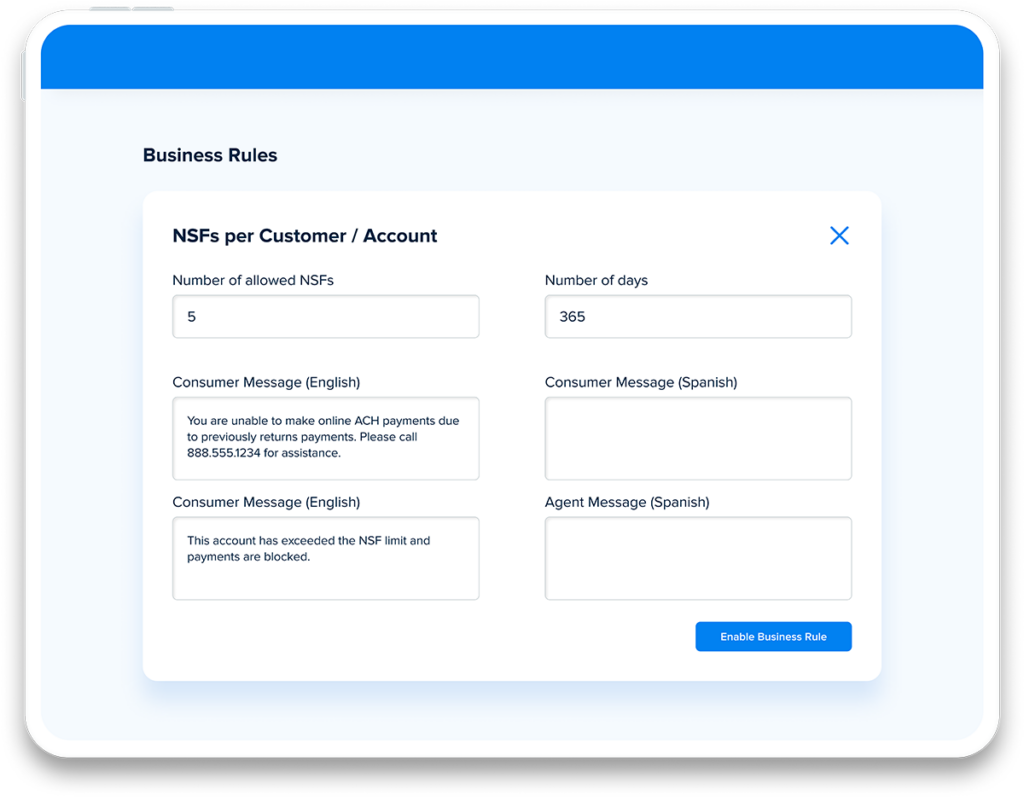

Increase efficiency and reduce risk with automated Business Rules

Automating processes with Business Rules helps billers minimize manual data entry and related errors, while increasing control over payment behavior. A payments platform provider can create logic-based business rules to automate processes that can apply to some or all customers.

Examples of rules include:

- Applying minimum and maximum payments to guard against factors like users typing errors when entering payment details or the biller being charged excessive interchange fees

- Controlling payment amount and number of transactions to protect against fraud

- Limiting acceptable payment types for customers with a history of non-sufficient funds

- Setting parameters around payments to prevent overpayments and reduce ACH returns

- For delinquent loans, restricting payment to only verifiable tender types

The right fintech platform partner can help billers determine which rules will address their unique business requirements, both now and as their needs evolve over time. The provider can also help companies scale operations, such as moving from file-based integration to API real-time posting that updates their system automatically.

Future-proofing payments with the right partner

The payments industry is evolving more rapidly than ever. Billers need to keep pace with changing consumer expectations, emerging technologies and new regulatory requirements—all amid a volatile economy.

Even the best custom-built payments solution could be behind the curve by the time it goes live. Speeding time to market—while ensuring flexibility and scalability—is key. That’s where a configurable payments platform like PayNearMe can deliver measurable business value.

Billers no longer need to struggle between a costly custom solution and a ‘lite’ out-of-the-box platform. With PayNearMe, companies gain a feature-rich, configurable payments platform for providing optimized payment experiences today and every day in the future.

PayNearMe offers a full range of platform options, including tailored solutions for consumer finance, auto dealer financing and other specialized businesses.