How Loan Payment Personalization Helps Reduce Costs

Consumers have come to expect personalized experiences in nearly every business interaction—from ordering a pizza to ordering a rideshare. This demand and desire for an easy and seamless payment experience has become increasingly important for lenders who want to attract and retain customers. And it’s not just about meeting customer demand; it can also impact their bottom-line.

Personalization is a vital strategy to drive down the cost of payment acceptance, and climb higher on the payment priority ladder.

Making a loan the easiest bill to pay is a powerful way to encourage customers to prioritize it and consistently pay on time. Personalization is a critical part of that, and it often includes automated, self-service workflows that help lenders reduce costs.

What’s key to understand is that lenders don’t have to do all the work of personalizing payment experiences. In many cases, better outcomes—such as lower costs and less delinquency—can result from giving customers flexible options that allow them to personalize the experience to their needs.

In our 2024 consumer research, we explored perceptions and preferences surrounding loan repayment. A number of trends emerged, including strong demand for personalized options. Here we’ll look at some opportunities for targeted improvements that can help lenders increase on-time payments, improve customer retention and gain a competitive advantage.

Give customers a personalized link for loan payment

Nearly 70% of consumers told us it’s important to have a personalized loan payment experience where the platform recognizes them and tailors their billing information. An effective approach is to deploy personalized links (via email and text message) that provide one-click access directly into a customer’s payment flow.

Why is this so important? It solves a customer pain point by eliminating the need to remember password or account number, giving them fast, easy self-service access to make a payment. More importantly, it can result in significant savings for lenders by reducing inbound calls. According to Gartner, 52% of payment-related calls are due to website login issues, and those calls can cost an organization up to 80x more than self-service channels.

69% of consumers say a personalized loan payment experience is important

Personalized access for loan payment also ensures screens are pre-populated with a customer’s account details. This is no small thing, considering 80% of consumers said it’s a key factor in making bill payment easier.

Allow customers to choose their preferred ways to pay

Offering more flexible payment options, including digital wallets, is an essential way to improve on-time payment. It enables personalization via self-service choices that better align with how many consumers now prefer to pay. For example, nearly 60% of consumers surveyed said they would be very likely or likely to pay their loans with digital wallets such as PayPal, Venmo, Apple Pay or Cash App Pay if those options were available.

Another reason to consider offering digital wallet payments is that unbanked and underbanked consumers often store cash balances in a digital wallet in lieu of a bank account. In fact, 38% of people surveyed said they would like to pay their loans with a stored wallet balance.

Enabling personalized options may make it easier for people to pay on time, which in turn, helps lenders avoid the costs associated with past-due collections. Optimizing digital self-service can also reduce costly in-person and phone payments, which frees up staff to focus on more strategic loan servicing work.

Provide options for personalizing autopay

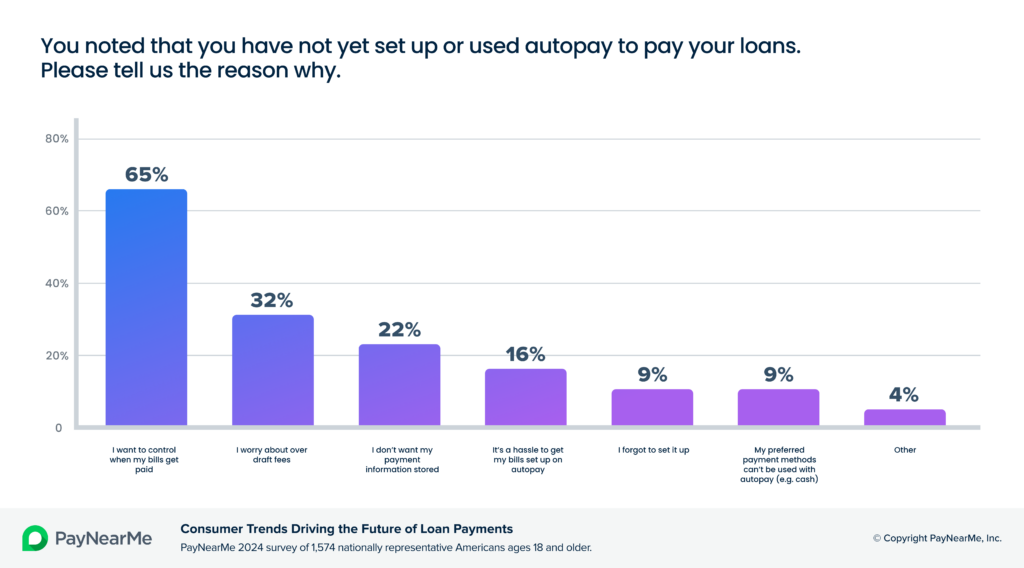

Understandably, lenders love autopay because it creates predictable cash flows and reduces the cost of accepting payments. But all too often, options are limited and rigid, so customers avoid it. Our research found that 65% of people who do not use autopay say it’s because they want more control over when bills get paid.

Building flexibility into autopay can increase enrollment by allowing customers to personalize settings based on how they manage their monthly finances. For example, borrowers may prefer to choose a due date that syncs better with when they receive their paycheck. Others might find it easier to chip away at their monthly balance by paying weekly or bi-weekly. In fact, 54% of consumers noted that splitting payments within a month, instead of paying a lump sum, would make it easier to pay on time.

With a modern payments platform like PayNearMe, lenders can offer autopay personalization, including monthly, weekly, twice-monthly or customized payment dates. Customers can even choose to vary the payment methods they use at different times.

Another consideration to drive autopay adoption (that also factors in personalization) is providing a quick-access link to enroll when a customer makes a regular payment. Our survey found that 60% of people would like to see personalized recommendations after completing a payment, and offering autopay could be one of them.

Personalize cash payment for cash-preferred customers

Processing cash payments in person at a loan office is costly and risky. And if customers live far from an office or cannot get there during business hours, it can lead to late or skipped payments. Even so, some people still prefer to pay bills in cash, and lenders need a more cost-efficient solution.

More than a third (36%) of the consumers we surveyed said they pay loans with cash. As long as that is the case, lenders need to accept cash to ensure they are meeting the needs of all of their customers. Offering customers an easy way to pay their loan at a convenient neighborhood location where they frequently shop, such as 7-Eleven, Walmart and CVS, using a digital cash option is the icing on the personalization cake these consumers are looking for.

Leverage payments data to enhance personalization

As a growth and cost-saving strategy, tapping into payments data is particularly valuable. It’s part of how industry leaders like Amazon and Apple have achieved a massive—and loyal—customer base. They excel at using data to personalize engagement and make payments seamlessly simple.

Lenders can seize the same opportunity to reap benefits from payments data, but it takes commitment to modernizing the loan payment experience. Legacy systems may offer basic money movement, but here’s the hard reality: a sub-par payment experience could be contributing to delinquencies, as well as missed opportunities to attract and retain customers.

82% of people we surveyed said a poor loan payment experience would influence their decision to switch to a different lender in the future. On the flipside, 68% said they would be likely or very likely to recommend a lender that offers a highly personalized experience.

With a modern payments platform, lenders can capture rich data about user behaviors and transactions to gain actionable insights for making better decisions. It can help your organization more deeply understand consumer preferences and needs to personalize payment options, improve collection strategies to reduce default and tailor marketing offers to increase upsell and cross-sell opportunities.

Take action to drive down costs with personalized payments

For lenders, servicing loans cost-efficiently and dodging delinquencies are top challenges. Optimizing the payment experience with strategic options for personalization can be a game-changer.

Lenders can modernize the payments experience by accepting all the payment types and channels their customers desire. Meanwhile, with the right partner, they can increase efficiency and lower payment acceptance costs by automating payment-related processes, powering a more profitable business.

Learn more about how PayNearMe can help lenders improve their bottom line. Click here to view an instant, on-demand demo.