How to Nail the Payment Experience to Improve Customer Success

Updated May 2025

Today’s e-commerce experiences are fast, easy and invisible. Think about grabbing an Uber—no swiping cards, no logging in. The payment just happens.

That same simplicity now defines how consumers move money, whether they’re sending cash through Venmo, PayPal or tapping to pay with a mobile wallet. So why do so many loan payment experiences still feel so—for lack of a better word—dated?

Paying a loan is often one of the most frequent touchpoints you have with your borrowers, so it’s important you provide an exceptional experience. These critical moments during each billing cycle have the potential to positively—or negatively—define the customer experience for your business. When the payment experience is seamless, it elevates the entire relationship.

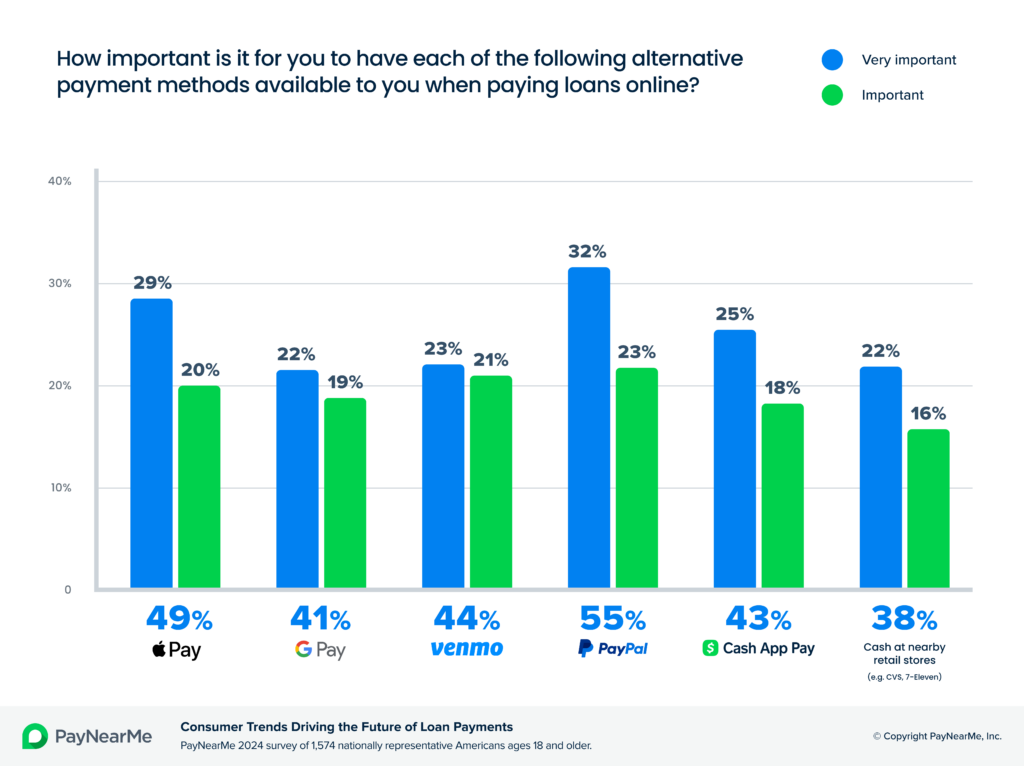

As you work to design a better payment experience, consider consumer research that validates mobile-first payment options as a key requirement.

Consumers expect a low-effort, mobile payment experience

Consumers want more mobile-friendly options for how and when they pay their bills, and PayPal tops the list of preferred payment methods. According to our loan payment study, more than half of U.S. consumers (55%) say the convenience of using PayPal to pay bills is important or very important. Apple Pay is a close second at 49%, while Venmo came in as the third most important alternative payment method at 44%.

How important is it to meet your customers where they are with mobile payments? When you consider nearly one in three adults say paying bills causes them stress, a modern payments strategy is essential. In fact, the study revealed that more than 60% of respondents pay loans with their smartphone, nearly twice as many as those using a computer.

And what makes paying loans difficult for borrowers? The data is clear, having to remember logins, account numbers and payment due dates makes for a cumbersome payment experience. In fact, for 42% of consumers, the biggest hassle in paying loans is remembering their login, password and account information.

When you improve the payment experience, everyone wins, and a better experience requires a mobile-first payments strategy. Your first step should be identifying technology platforms that enable your business to accept all forms of digital payment. For example, PayNearMe offers a full suite of payment types such as debit, ACH, cash and mobile-first payment methods including PayPal, Apple Pay, Google Pay, Cash App Pay, Venmo and even cash at retail—with a single platform.

Pro tip: Ensure the technology platform gives you the flexibility to add future payment types and channels as the industry evolves.

Mobile payments and digital wallets make it easier to pay loans on time

Not only do your borrowers want more mobile-friendly payment options, but they also say flexible payment options would make it easier to pay their loans on time, including the option to pay using different payment types for each billing cycle. In fact, two in five (40%) of those surveyed said the ability to use different payment types each billing cycle would make it easier to pay their loans on time.

Making loan payment easy and convenient for your customers is the name of the game when designing an improved customer experience. Look for ways to remove as much friction as possible. For example, consider enabling customers to store bills in an Apple or Google Wallet and pay via a smartphone. When done right, this can dramatically reduce the number of steps your customer must take to pay a bill. It can be a simple, three-step process:

- The payer goes to the payment screen and chooses the “Add to Wallet” option. A “biller card” or “wallet card” for that bill is automatically placed in the payer’s wallet.

- Each billing cycle, payers can receive a push notification to prompt payment. These reminders can include a personalized link that takes them directly to a payment screen, no login required.

- Payers choose their preferred method of payment and complete the transaction.

Allowing borrowers to store bills in their digital wallet makes loan payment easier—and more convenient. In fact, 31% of U.S. adults say this feature would make it easier to pay loans on time.

When consumers store bills in a digital wallet, they can enable push notifications to allow engagement communications from the biller, such as electronic payment reminders, which can further increase on-time payments. According to our study, 47% of consumers say receiving a text message or email reminding them when the bill is due would make on-time payment easier. Meanwhile, a notable 80% of respondents said it’s very important or important to have screens pre-populated with payment details, demonstrating the importance of delivering a personalized loan payment experience to your borrowers.

Pro tip: Ensure the technology platform automatically updates each borrower’s mobile wallet with current billing information such as the amount due, payment deadline and remaining balance so they have their billing history and current payment details available on their smartphone at all times.

Why it’s time to rethink your payment strategy with Payment Experience Management

It’s easy to assume that adding new payment types or offering a mobile app is enough. But if your borrowers are still struggling to pay on time—or your team is bogged down with exceptions—it’s time for a different approach.

That’s where Payment Experience Management comes in.

Payment Experience Management is a modern framework that combines software and infrastructure to optimize every part of the payment journey—across customers, agents and operations. It’s not just about accepting payments; it’s about removing the friction that leads to missed payments, high service costs and manual back-office work. Lenders that embrace this approach can reduce the total cost of acceptance, increase on-time collections and build a more profitable business.

Think of it as shifting from a transactional mindset to a strategic one—where every payment touchpoint becomes an opportunity to improve outcomes. For borrowers, that might look like a tap-to-pay experience that takes seconds. For agents, it’s the ability to complete payments quickly and correctly during a call. For operations teams, it means fewer exceptions, lower costs and better data.

The result? Happier borrowers. Leaner operations. And a payment experience that actually works for you—not against you.

Consumers expect to pay their loans as effortlessly as they buy a coffee or catch a ride. With PayNearMe, that kind of seamless experience is no longer out of reach.

Lenders of all sizes can improve the end-to-end payments experience and drive down the cost of acceptance with the PayNearMe payment platform.

Learn more and request a demo. See PayNearMe in action with a personalized demo, or email us at sales@paynearme.com.