Lenders: Fight Back Against Chargebacks with Apple Pay

Chargebacks can be a costly affair. It’s estimated that for every $100 charged back, you will lose ~$240 when labor and fees are considered. For lenders that operate on tight margins, these costs can create a significant strain on operations—especially during tough economic times when chargebacks tend to accelerate.

Of course, you can always attempt to challenge each dispute, but the low odds of winning coupled with the added expense can make this an uphill battle for lenders. That’s why we tend to advise our clients that the best way to win chargebacks is to avoid them completely.

This is where Apple Pay enters the conversation. Since we began offering the mobile payment service in early 2020, we’ve noticed an interesting trend: Apple Pay transactions seem to have a lower rate of chargebacks, and a better win rate overall.

Data Considerations

Before we share our findings, there are some considerations we must take into account. First, we have to note that the sample size is significantly smaller than our overall card transaction volume, representing a small but growing proportion of total lending payments.

Second, we have to consider that Apple Pay is still a nascent technology in bill pay, meaning that the subset of customers using this payment type may have different behavioral traits than the general population. Other factors may also skew the results in unexpected ways.

Despite these caveats, we’re excited about early indicators, and have seen statistically significant differences between chargebacks with Apple Pay and general card transactions.

Lower Chargeback Rates

In the past year, we’ve seen that the rate of chargebacks for Apple Pay has been 25% lower than for total card payments in lending. This is great news for lenders who want to reduce chargebacks while also offering a fast, secure and easy payment experience for borrowers.

Our theory is that Apple’s authentication protocols are partly responsible for this trend. Payers must add their cards to Apple Pay and authenticate every transaction with either FaceID or TouchID, decreasing the likelihood of fraud.

This is especially true in loan repayment, where there is less incentive for fraudulent “pay and return” scams compared to ecommerce or retail environments.

Improved Chargeback Win Rates

Not all chargebacks can be avoided, and sometimes it may be worth it for lenders to challenge a dispute to try to collect the payment. These situations are much less frequent, but in the past year we’ve seen that PayNearMe merchants have won 7x more chargebacks with Apple Pay transactions versus all other card transactions.

Again, we theorize that this is due to biometric authentication and the concrete paper trail associated with Apple Pay transactions. Borrowers who complete a payment with Apple Pay will have “signed off” on the transaction with a fingerprint or facial recognition consent.

While encouraging, we do believe that this number will begin to settle closer to the average as more data is collected and as Apple Pay adoption reaches the mainstream. Still, lenders that offer Apple Pay today should benefit from these early findings.

Winning More Chargebacks

Outside of promoting Apple Pay as a payment method for your borrowers, there are other steps you can take to avoid or win more chargebacks. Below are some resources we’ve compiled in the past to help you.

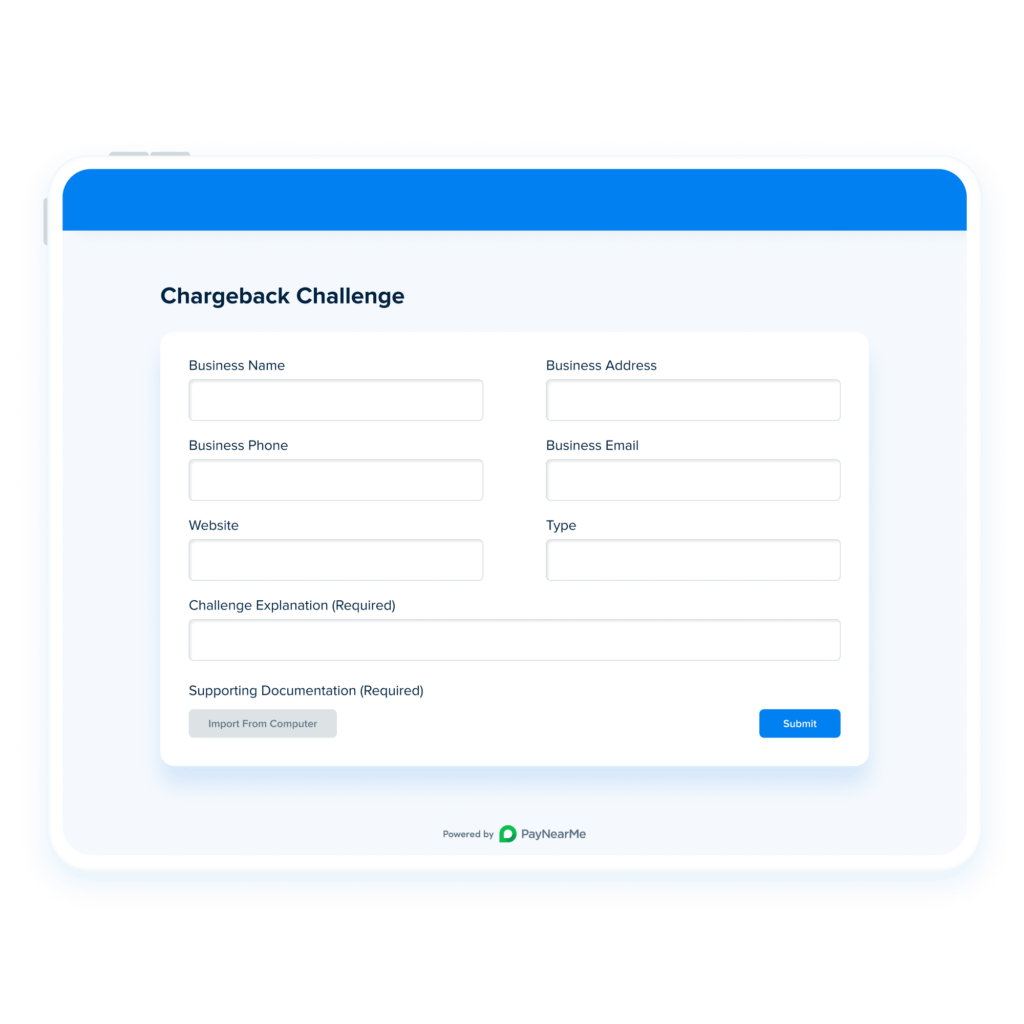

PayNearMe clients have access to additional resources regarding chargebacks. Our payments platform includes an interface for managing chargebacks, allowing you to easily upload documents, view chargeback statuses and track your results in one place.

Our professional compliance team continues to work with our product team to introduce new features and risk processes that help to identify and reduce the likelihood of chargebacks across our entire clientbase.

To learn more, contact our team to see how we can help you collect every payment, every time.