Five Common Pain Points in the Customer Payment Experience (and How to Solve Them)

Consumers don’t think about how payments work. They only think about payments when they don’t work. A failed autopayment, a forgotten password or a biller that won’t accept the funds in their digital wallet quickly turns into frustration.

These aren’t just customer experience issues—they’re business problems hiding in plain sight. The true costs aren’t in the transaction fees, but in the friction-filled experiences that drive up late payments, call center volume and exceptions.

That’s why more organizations are moving beyond traditional payment processing and embracing Payment Experience Management—an approach that optimizes every step of the payment journey across customers, agents and operations to lower the total cost of payment acceptance and increase revenue.

And the stakes are high. These friction points aren’t just inconvenient—they’re costly. Every time a customer calls support or manually enters credentials, it adds operational burden. For lenders, the impact is especially acute: the charge-off rate nearly tripled from 0.37% in Q4 2021 to 1.09% in Q4 2024, exerting serious pressure on earnings, according to Point Predictive.

Let’s explore five of the most common payment experience pain points—and how Payment Experience Management helps fix them at the root.

1. Friction that stops payments before they start

Imagine this: A customer receives a bill but doesn’t want to mail a check. They go online, only to be forced through an app download, login setup and account verification. By then, many abandon the process or call support—both of which drive up costs.

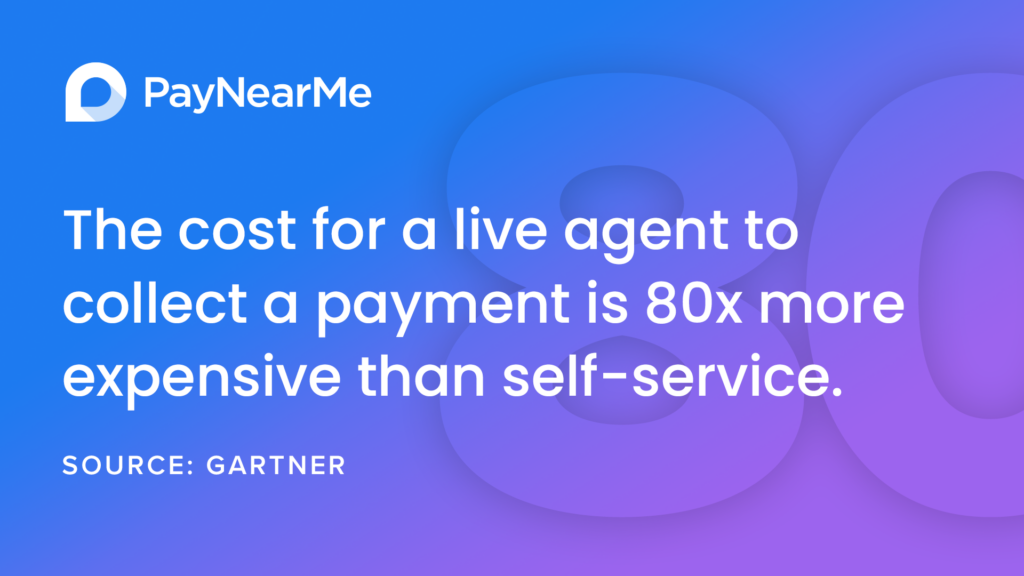

Consider that each support call costs about $8, whereas self-service costs only $0.10 per interaction. When payments are embedded and intuitive, customers self-serve. And when they self-serve, businesses lower the total cost of payment acceptance.

Payment Experience Management removes the friction from the customer experience. Imagine how easy it would be if there was a QR code with an embedded Smart LinkTM on the bill that customers could scan with their phone to instantly access a payment screen without having to login where they can pay with debit, PayPal, Venmo or the option of their choosing. The result? More completed payments and fewer costly exceptions.

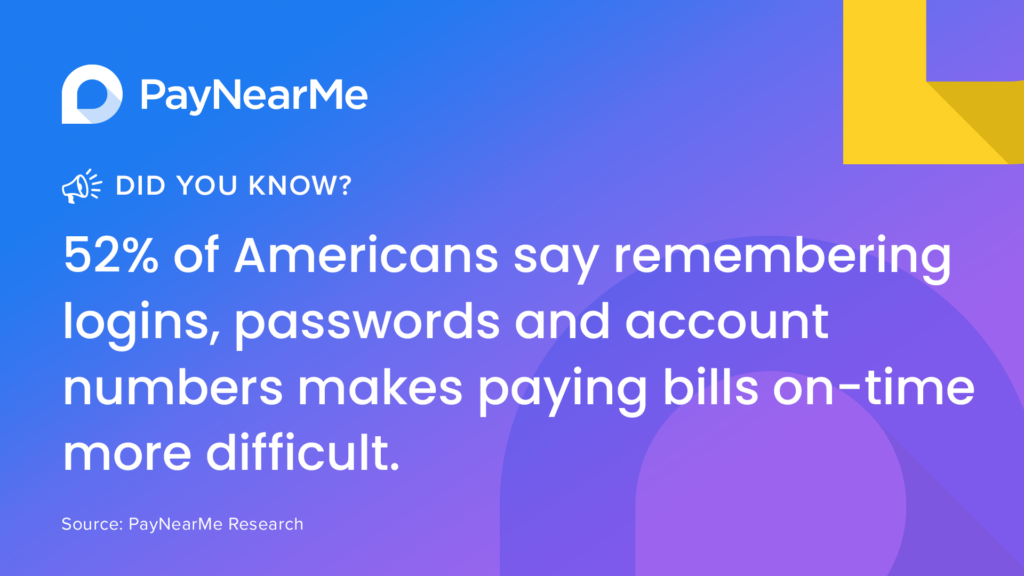

2. Login barriers that drive late payments

Speaking of logins, according to PayNearMe research, 52% of respondents said that remembering logins, passwords and account numbers makes paying bills on-time difficult. Eliminating the need for people to remember and enter a username and password solves a major pain point and removes a potential barrier to paying on time

With a modern platform that looks beyond transaction fees with a Payment Experience Management approach, billers can simply text or email customers a personalized URL tied to their account, allowing them to seamlessly pay in a few taps. Customers can even save their personalized link to their mobile wallet for easy, one-click access to make future payments.

3. Offering limited ways to pay

Offering only debit or ACH may have once been enough, but not anymore. Today’s consumers want to pay using whatever funds they have—whether that’s in PayPal, Venmo, or even with cash at a retail location. In fact, 59% of consumers say they’re likely to pay loans with a digital wallet.

But it’s not just about payment types. Flexibility plays a critical role in improving the payment experience. In fact, 40% of survey respondents say the ability to use different payment types each billing cycle would make loan payment easier.

PayNearMe gives businesses the ability to say “yes” to every payment preference. With one platform, you can offer a full range of payment types, from cards and digital wallets to cash at retail. You can also support flexible schedules and recurring payment plans tailored to each customer’s needs.

The result? Higher payment completion rates, better customer satisfaction and fewer exceptions that drive up operational costs.

4. Confusing experiences that trigger exceptions

Confusing error messages, unclear instructions and technical jargon can quickly derail payments. For non-English speakers, the challenge is even greater. These aren’t just poor design choices—they can lead to real consequences such as failed transactions, abandoned payments and higher call volume.

When you improve the payment experience, messaging is clear, consumer-friendly and dynamically tailored to each user. Built-in analytics reveal exactly where users are dropping off, helping teams fix the issue before it becomes an exception.

5. Creating decision fatigue in the payment experience

When it comes to paying bills, simplicity wins. Yet many payment flows still overwhelm users by lumping numerous actions—such as entering account numbers, selecting payment types and confirming terms—into a single, cluttered screen. It’s no wonder consumers abandon the process.

This kind of decision fatigue isn’t just bad design—it directly contributes to payment drop-offs, delayed revenue and higher call center volume. Consumers today are used to experiences that guide them, not confuse them. Think: one-tap checkouts on Amazon or a seamless Uber ride where payment happens invisibly in the background.

When your payments partner develops thoughtfully sequenced payment flows that include pre-filled account information and previously used payment methods, you can remove the friction and fatigue from the entire payment experience.

This reduces the cognitive load for your customers so payments get completed faster, more often and with less support. Simplicity isn’t just good design—it’s good business.

Lower the total cost of acceptance with Payment Experience Management

In today’s fast-paced world, consumers don’t have patience for payment roadblocks—and businesses can’t afford the hidden costs they create. Payment Experience Management isn’t just about modern interfaces or adding more ways to pay. It’s a strategic shift in how organizations think about, manage and optimize the entire payment journey.

With Payment Experience Management, businesses can reduce the total cost of acceptance, increase customer satisfaction, and turn payments into a source of efficiency—not frustration.

The PayNearMe platform empowers organizations to automate exceptional, self-service payment experiences that lower the total cost of acceptance, improve profitability and create a better customer experience.

To learn more, contact us here or email sales@paynearme.com for more information.