Personalized Payment Experiences: Transforming Transactions Into Meaningful Interactions

The days of impersonal, one-size-fits-all financial transactions are numbered. The question is no longer whether to personalize, but how quickly a financial institution can implement Payment Experience Management to deliver personalized experiences.

At its core, Payment Experience Management is an integrated approach that brings together software and money movement services to improve every step of the payment journey—from the customer interface to back-office operations. It ensures that every stakeholder in the payment process has an easier, more efficient experience.

For customers, Payment Experience Management simplifies how they pay by unifying all preferred payment methods in one intuitive place. For support teams, it means faster call resolutions and fewer manual interventions. And for operations, it delivers the transparency and automation needed to simplify reconciliation and reduce costs.

By aligning these functions, Payment Experience Management helps financial institutions accelerate payments, improve cash flow and lower the total cost of acceptance.

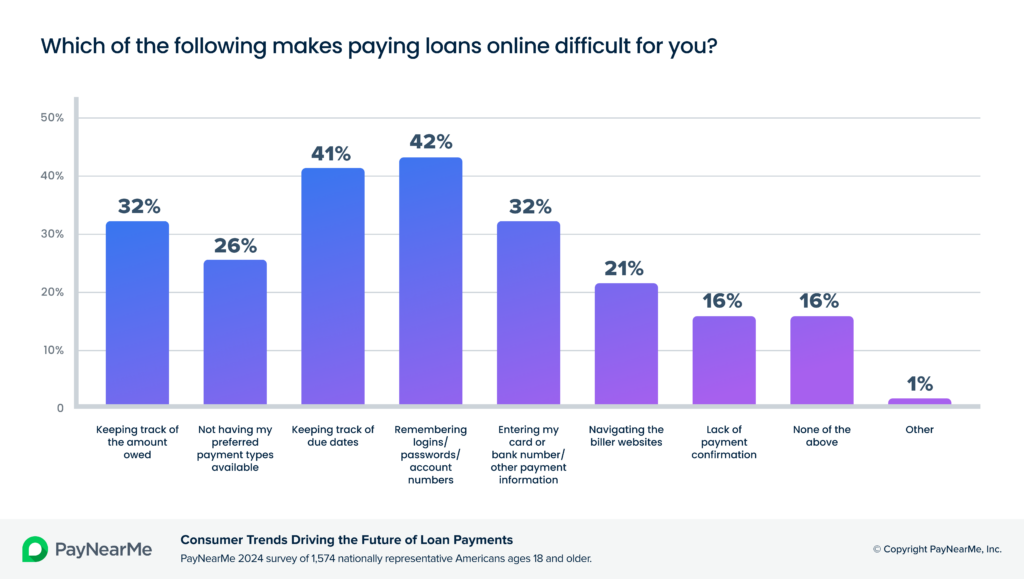

Let’s look at three takeaways from a recent survey of more than 1,500 loan-paying consumers and what the data reveals about why personalized experiences matter for one critical stakeholder in the payment process: the customer.

1. Consumers find bill payment increasingly difficult and stressful.

Despite the shift toward online, self-serve payment, consumers still struggle with bill payment. In fact, 51% say they experience anxiety when managing and paying loans—a 76% increase since 2021. Their top frustrations include remembering passwords (42%), due dates (41%) and amounts owed (32%).

These poor payment experiences are already driving a wedge between consumers and the financial institutions they choose to do business with. Consumers have become accustomed to a one-click e-commerce payment experience and they expect that same experience when they pay their bills.

2. Personalization makes loan payment easier.

Simplifying payments means eliminating the need for customers to repeatedly enter familiar information. The data backs it up: 69% of consumers value platforms that tailor billing to their preferences and behaviors, and 96% want personalized reminders.

Personalized experiences don’t just reduce friction—they build confidence. When payment interactions feel intuitive and relevant, customers are more likely to complete payments on time.

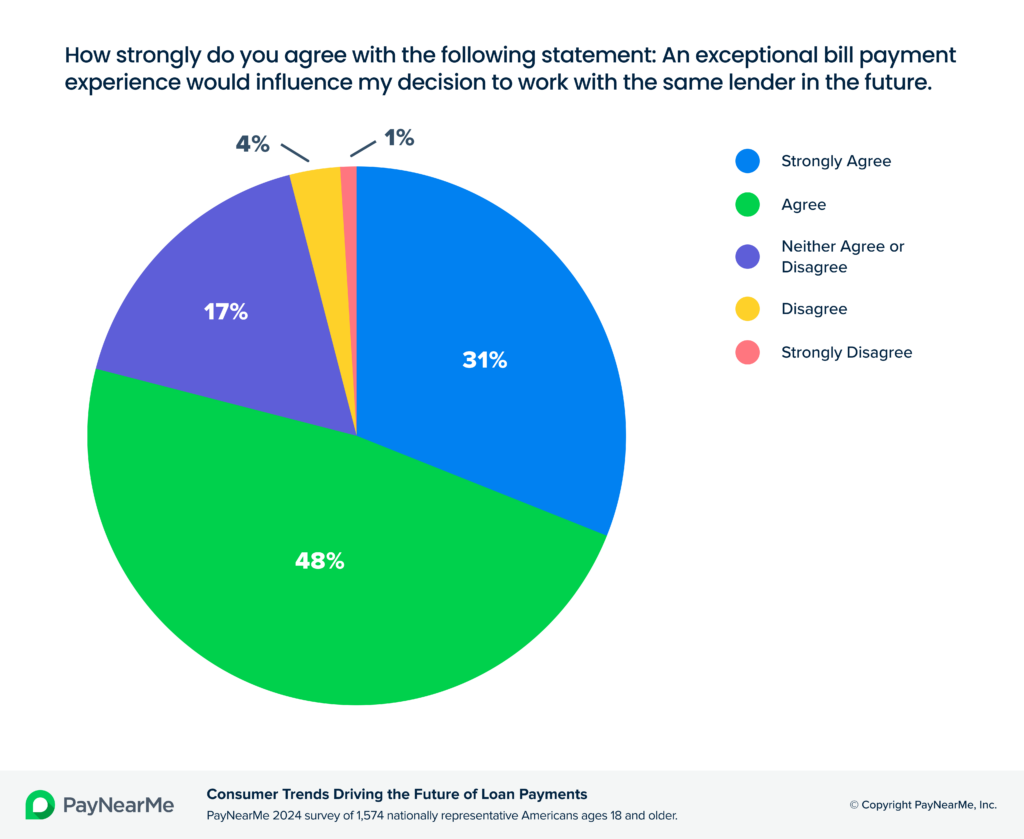

3. When consumers have a personalized experience, billers reap rewards.

Just as e-commerce businesses drive sales by providing personalized shopping experiences, financial institutions implementing Payment Experience Management will discover that personalized payment experiences open up new revenue opportunities.

For instance, 60% of survey respondents said they would like to see personalized recommendations for other products and services after completing a loan payment. This presents financial institutions with a unique opportunity to cross-sell or upsell products, potentially increasing revenue per customer.

Personalization also can significantly boost customer satisfaction and loyalty. Nearly 8 in 10 respondents (79%) said they would be likely to use the same lender if they have an exceptional bill payment experience, and 69% said they would likely recommend a lender that offers a highly personalized experience.

Conversely, 82% say a poor payment experience would drive them elsewhere—a clear warning for financial institutions that failing to meet borrower expectations for personalized, seamless payment experiences can lead to significant customer attrition.

This data aligns with McKinsey’s research that notes, personalization is a force multiplier—and business necessity—one that more than 70% of consumers now consider a basic expectation. Given the importance of personalization, here are four ways financial institutions can get some quick wins:

- Deliver a one-tap payment experience. Send personalized Smart Links via text or email directing customers to their payment flow securely, eliminating the need for the customer to login.

- Dynamically adjust and display preferred payment options. Use AI to customize the payment interface by reordering payment methods based on a borrower’s previous preferences, making the payment process intuitive and frictionless.

- Personalize payment reminder messages and timing. Send personalized payment reminders at times most likely to result in on-time payments, based on individual customer behavior and payment history.

- Predict and prevent payment challenges. Utilize machine learning models to identify customers at risk of late payments and proactively reach out with personalized communications that offer solutions like adjusted due dates or payment splitting options.

Looking ahead

The future of financial services is not about transactions—it’s about interactions. Consumers expect intelligent, adaptive experiences tailored to their financial lives. The technology to deliver them exists today; what matters is how quickly institutions act. The winners will be those that personalize payments not as an afterthought, but as a strategic advantage.