The Role of a Modern iGaming Payments Platform

Payments used to be just transactions between customers and businesses. While often clunky and slow, they met a basic need. Now, however, payments are a focal point in the overall customer experience—and that’s especially true for online gaming and sports betting. Enabling players to seamlessly fund their accounts and quickly receive payouts is an essential part of delivering a winning experience that keeps bettors coming back.

That’s the ideal, but what if you are one of the many operators still challenged by an older, rigid system?

A modern payments platform is about exponentially more than processing transactions. It’s about delivering a more competitive experience that helps you increase market share and player retention. It’s also about simplifying compliance and back-office operations, and keeping pace with both regulatory requirements and evolving payment technologies.

So what should you look for in a new payments provider?

First and foremost, the right-fit payments platform should solve your biggest problems. It should make life easier for your players and your business, so you can deploy capital and resources toward growth, cost reductions and profitability.

In this overview, we’ll discuss some key capabilities you’ll want to gain from a modern payments platform.

Enable fast, frictionless payments

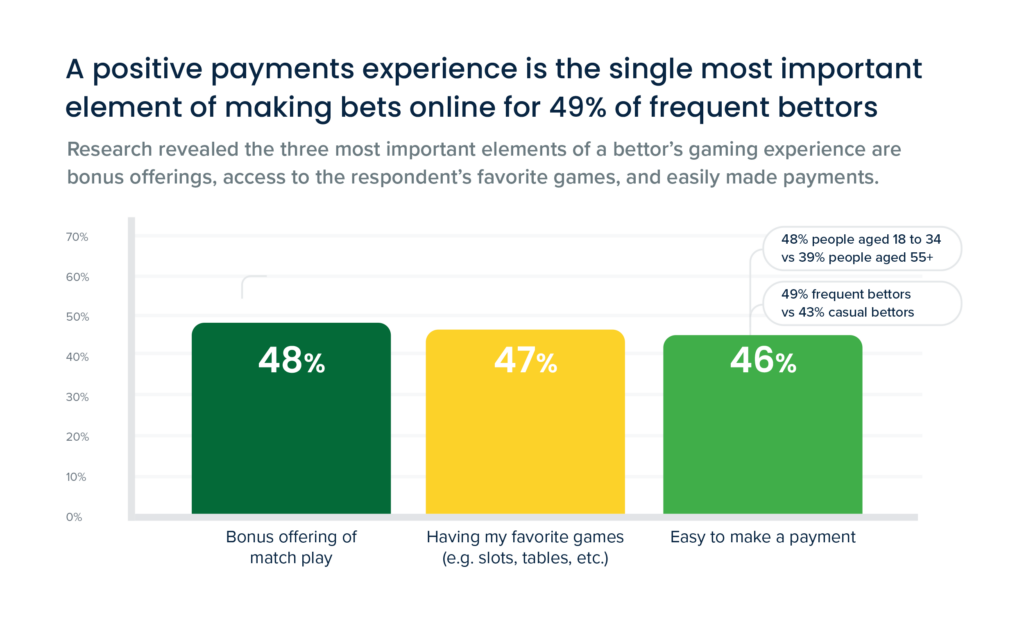

Some operators may think that simply enabling deposits and withdrawals is enough, as long as bets get placed. But today’s players are now influenced by seamless payment experiences they get with other lifestyle activities like Uber rides and shopping on their mobile phone. In fact, PayNearMe’s consumer research found that nearly half of all frequent bettors surveyed (49%) say that a positive payments experience is the most important factor in making bets online.

Surprisingly, being able to easily fund their account was almost equally important to players as an operator’s bonus offers and available games.

A negative experience, however, can do more damage to your business than you may realize. More than one-third (32%) of bettors surveyed said they would abandon a betting app if it takes too long to fund their account. And nearly a quarter of players (23%) will walk away and never come back if a gaming app doesn’t offer their preferred payment types.

Fintech innovators can remove these roadblocks. A modern platform can enable you to offer a range of flexible payment options (e.g., cards, online banking, and digital wallets like PayPal, Venmo, Apple Pay and Google Pay) in a simple, user-friendly interface that’s personalized and mobile-optimized.

And don’t forget about cash bettors. Even though people are making bets and gaming online, they might still prefer to fund their account using cash. With the right payments provider, players can make cash deposits at retail locations they frequent, like CVS or 7-Eleven. As a payment option, it’s more popular than you might think. One PayNearMe study found that 63% of bettors would be likely to deposit cash for online betting if given the opportunity, including 78% of frequent bettors. Taking that further, 43% of frequent players said that using cash, they would make larger deposits more often.

Prioritize instant payouts

Obviously, for bettors, a positive payment experience also includes being able to quickly and easily collect their winnings. Fast payouts are essential for players to sustain the entertaining momentum of betting, and take advantage of other gaming opportunities.

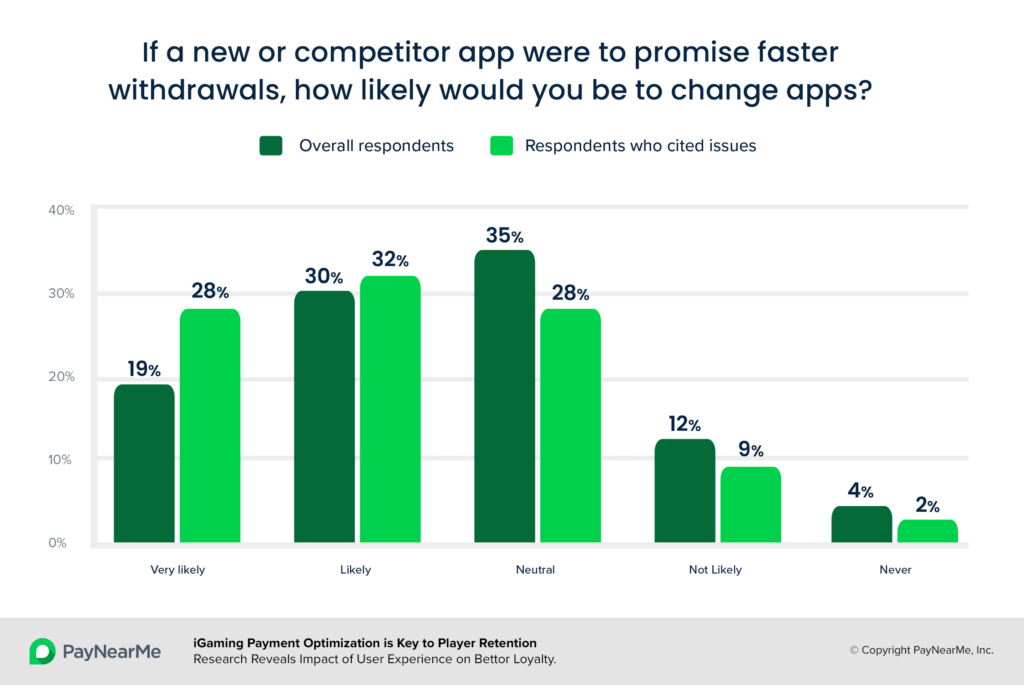

When payouts are a hassle, you risk losing players. As an example, nearly 60% of bettors who experienced payment issues said they would be likely to switch to a competitor app if it promised faster withdrawals.

Along with the risk of losing players, slow or difficult payout processes mean your business is incurring higher costs. When faced with delays, bettors often contact customer support to resolve issues, which is costly for your business and frustrating for players. Many head straight to social media to complain about the betting app, which can damage your brand reputation.

The right modern platform should enable frictionless money movement for fast payouts, using each player’s preferred payment type.

Reduce costly exceptions

As an operator, one of your biggest cost drivers is exceptions, such as declines due to non-sufficient funds (NSF) or other errors. Over a quarter of players (26%) we surveyed have encountered card declines. Even if your acceptance rates are improving, it’s likely still an ongoing problem, given that banks have been slow to accept online gambling transactions.

Look for a payments platform that is built to reduce exceptions and enable faster resolution when issues do occur. For instance, imagine you could minimize failures by setting custom rules that detect players with frequent NSFs and redirect them to another payment type for their deposit (such as cash or a stored digital wallet balance). Or have the system identify payment methods that often result in chargebacks or reversals, and either block them or prevent withdrawals.

Another advantage of a modern platform is that it equips you to more easily manage chargebacks. With the right provider, you can save time and win back disputed payments through a chargebacks dashboard, and tap into a library of best practices to prevent and manage disputes.

Any and all of these capabilities (and more) should be integrated into your next payments platform to help you reduce costs, complexity, and administrative burden.

Automate and speed up back-office processes

Along with processing incoming and outgoing payments, your business has to deal with complicated reconciliation. Older systems may require management across multiple payment providers, all with separate reporting for transactions and exceptions. It can mean many hours of work for your accounting staff that drives up your overall cost of accepting payments.

If your business is running lean or struggling to compete, you want to focus resources on customer acquisition and retention, not on mundane tasks. Your next payments provider should help you streamline and automate operations. For instance, the platform should integrate all payment rails into one system, enabling you to automate processes and consolidate reporting to dramatically simplify reconciliation and increase back-office efficiency.

Eliminate the complexity of multiple siloed solutions

Providing more payment options and increasing fraud protection are critical, but complicating your payments stack with many disparate point solutions can be complex and costly. For example, integrating proprietary non-bank payment types and fraud mitigation tools adds more layers of expensive and time-consuming development work to ensure they work seamlessly with your existing systems.

Aim to find a modern platform that provides a complete and fully integrated payment stack for deposits and payouts. It should also incorporate functionality for mission-critical applications such as robust controls for fraud detection and anti-money laundering (AML), chargeback management, reporting and more.

Provide flexibility for today and far beyond

As an iGaming operator, if you’re looking to increase profitability by optimizing your payment capabilities—focus on future-proofing as a high priority. It’s vital to choose a modern payments platform that is configurable to meet today’s needs, and extensible to scale with your business and evolve along with changes in the payments industry and regulatory requirements.

In addition to flexible technology, it’s important to partner with a provider that has a roadmap and support structure that aligns with your vision. The right fintech partnership should be highly collaborative to help you take advantage of innovations that elevate your business and increase efficiency so your staff can focus on strategic work that drives growth.

Take the next step and check out PayNearMe’s Buyer’s Guide for operators with tips and an RFP worksheet: Choosing Your Next Payments Provider.