Streamline Operations & Cut Costs with Payment Experience Management

In the hyper-competitive world of online gaming, razor-thin margins and high customer expectations leave no room for inefficiency. Many gaming operators focus on reducing cost per transaction—and while that matters, it’s just one piece of a much bigger puzzle. According to PayNearMe’s white paper Beyond Transaction Fees, the real costs of payment acceptance extend far beyond the fees you see on your statements.

What gaming operators often underestimate—and where they often overpay—is the cost of exceptions, fraud, system fragmentation, player abandonment, customer service overhead and more. An all-in-one platform that focuses on managing the holistic payment experience can tackle many of these hidden costs, simplify operations, improve the player journey and ultimately increase both retention and profitability.

Here’s why having one payment solution that handles everything (including all popular tender types, risk & fraud, player data management and more) is increasingly essential—and how it helps operators streamline business operations while lowering total cost of acceptance.

The hidden cost drivers beyond transaction fees

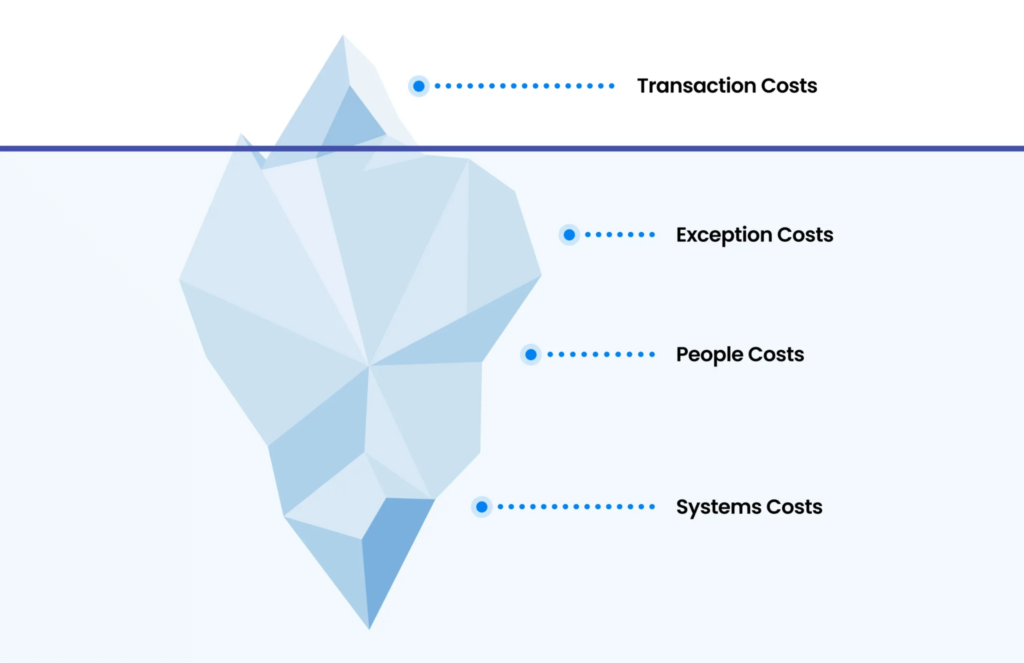

Before talking about the solution, it helps to understand what’s eating into profits beyond just transaction fees. These “below the line” cost drivers include:

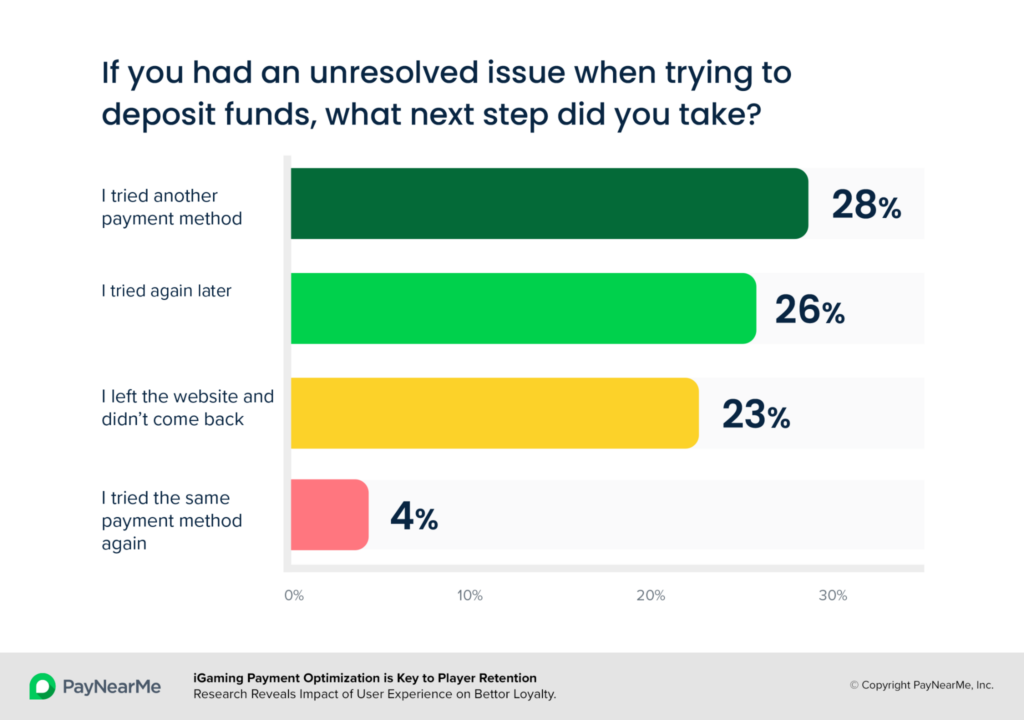

- Exceptions: These include chargebacks, returns, non-sufficient funds (NSF) and delayed settlements. Then there are experiential exceptions, when poor user experience during the deposit flow leads players to drop out. This can lead to loss of player lifetime value, as PayNearMe research found that 23% of customers will abandon a betting or gaming app and never return after a decline during payment.

- Fraud & chargeback risk: Without good risk scoring, fraud detection, and the ability to respond to disputes, chargebacks become costly—not just in direct amounts, but also in the time, operational overhead and reputational cost.

- Manual work & people costs: Supporting failed payments, fixing mismatched integrations, reconciling multiple systems or handling withdrawal requests manually—all of these eat up staff time. Each support interaction can cost 10s of dollars compared to virtually nothing for a self-service, frictionless flow.

- System complexity & downtime: Fragmented systems lead to more integrations to maintain, more failure points, more vendor relationships and a higher chance of outages. During high-volume sporting events, downtime can hit especially hard.

The problem with fragmented technology & disjointed solutions

Operators often end up with a patchwork: one vendor for credit/debit cards, another for ACH or online banking, others for digital wallets or prepaid—plus additional separate systems for fraud/risk scoring, player behavior data and manual reconciliation across several silos. The result:

- Vendor management headaches: Multiple APIs, multiple contracts and multiple support teams to contact

- Inconsistent or clunky UX for players: Some payment methods might drop off or fail; declines are handled differently across rails; error messaging is inconsistent

- Data silos: Player and risk data stored in multiple locations prevents the ability to make smart, real-time decisions

- Duplication of work: Reconciling payments and receipts across different providers; having multiple risk or fraud systems that don’t talk to each other; assembling evidence for chargebacks manually

- Higher likelihood of abandonment: When the payment flow is clunky, the player doesn’t care about which vendor is behind it—they just leave

While the transaction fee seems like the easiest metric to optimize, it often leads operators to pick the cheapest rails or providers, which increases the likelihood of other costs—abandonment, fraud, customer service, etc. —that more than offset any savings on fees.

How a Payment Experience Management platform can help

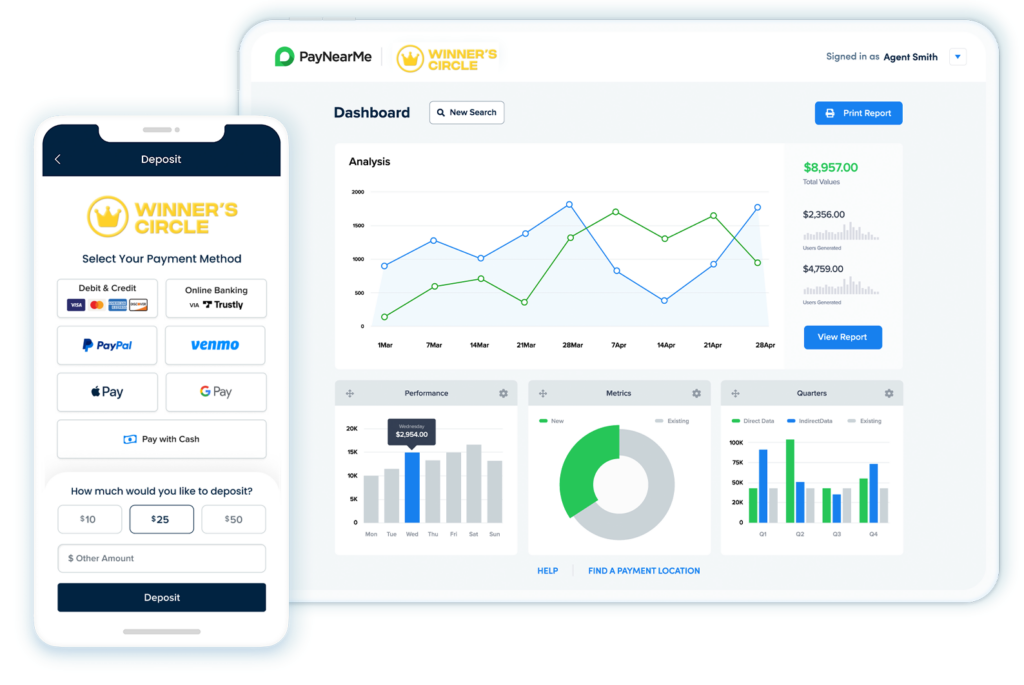

PayNearMe pioneered Payment Experience Management, a combination of software and money movement services that optimize every touchpoint in the payment journey across customers, support and operations. With a Payment Experience Management platform, operators can mitigate many of these issues we’ve already mentioned. Here are the ways an all-in-one platform can streamline operations and lower costs (and the things operators should be looking for in a payments provider):

- Reducing exceptions and increasing completion rates: By offering the right mix of payment options—with real-time feedback, retry logic, fallback rails, guaranteed online banking and more—operators can reduce declines and deposit failures, reduce abandonment and improve player lifetime value.

- Built-in fraud, risk scoring and chargeback tools: Having embedded tools for fraud detection—AI/ML risk profiling (using payment, behavioral and external data), dispute management and more—eliminates the need to bolt on many external solutions. This cuts cost, reduces latency, improves response to fraud and helps win more disputes.

- Better UX and payment journey personalization: A unified solution can gather player behavior and payment data, enabling operators to present preferred or familiar payment options first to each user, which improves conversion. Clear, actionable messaging in cases of declines and transparent payout flows help reduce support tickets and abandonment.

- Operational efficiency with reduced overhead: A single platform offers less vendor management, fewer disparate systems to reconcile and fewer manual interventions (with support, reconciling transactions, reviewing withdrawals and more). That means fewer errors, faster settlement and payouts, lower customer support costs and staff can focus on higher-value tasks.

- Resilience and reliability: Modern platforms offer redundancy in payment processors, smart routing and reliable monitoring. During peak events or when one rail is down, the platform can failover. That means lower downtime, maintaining revenue throughput and avoiding reputational damage.

- Future-proofing and flexibility: As consumer preferences shift when it comes to popularity and availability of tender types, an integrated platform makes it much easier to switch new payment methods off and on, adapt risk rules, add fraud tools and more—without massive development or vendor-onboarding costs.

Lower your total cost of acceptance with PayNearMe

Focusing only on minimizing transaction fees is like focusing only on the tip of the iceberg. Below the surface lie many sources of cost—exceptions, fraud, abandoned deposits, system complexity and operational pain. Fragmented payment systems can amplify all of these, making it harder to deliver a good player experience, scale and compete effectively.

A modern, all-in-one payment platform doesn’t just reduce visible fees—it addresses the hidden costs, simplifies back-end operations, improves reliability, and boosts brand loyalty. For online gaming operators looking to sharpen their edge, streamline business and protect margins, consolidating onto a unified payments platform is increasingly not just a nice-to-have, but a must-do.