Three Must-Have Bill Pay Features for Mortgage Servicers

The COVID-19 pandemic has forced many financial institutions to re-examine how they do business. The mortgage industry is no exception.

Mortgage servicers are facing unique challenges in light of the global pandemic. Historically low interest rates have caused many to refinance or purchase new homes, causing a spike in new volume. On the other hand, high unemployment and economic uncertainty have caused many to seek temporary forgiveness or experience late payments.

This rapid spike in activity has caused slowdowns in communication, lengthy call center waiting times, and payment processing confusion as servicers try their best to handle the increased volume.

As a mortgage servicer, you want to provide streamlined care while addressing these unique challenges. Modern, tech-driven payment processing features can help alleviate some of this pain.

This guide defines essential payment processing features mortgage servicers should adopt to enhance operational efficiency and improve customer care.

Mortgage Payment Processing Is Facing a Technological Revolution

Mortgage servicers have traditionally been slow to adopt modern technology, with digitization uptake lagging well behind other industries. The pressure put on mortgage servicers in light of the COVID-19 pandemic makes it clear that failing to keep up with technological advancements is ultimately detrimental for the industry and its consumers.

The pandemic has shone a spotlight on a few existing gaps in the mortgage servicing industry. Issues of note include a lack of digital innovation, over reliance on manual processing, and a general failure to adopt features that are already prevalent in other sectors, such as debit card acceptance and digital wallets.

Mortgage servicers can no longer afford to delay the adoption of such technological innovations. This becomes especially true when considering projections for the future. For example, the North American digital lending platform market is set to grow at a compound annual growth rate of 19% through 2025.

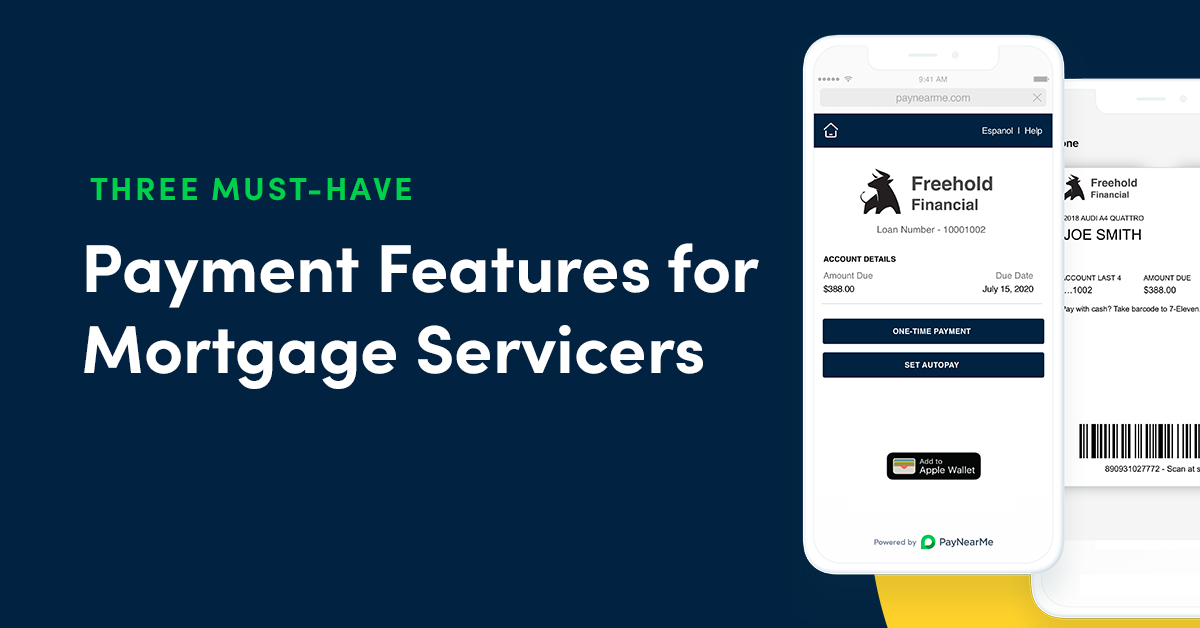

3 Essential Payment Processing Features for Mortgage Servicers

Mortgage servicers who want to get ahead of the technological revolution shaking up their industry must adopt responsive and configurable approaches to minimize business, operational, and regulatory risks.

We have developed these tech-driven features to modernize your payment processing.

1. Digital Disbursements

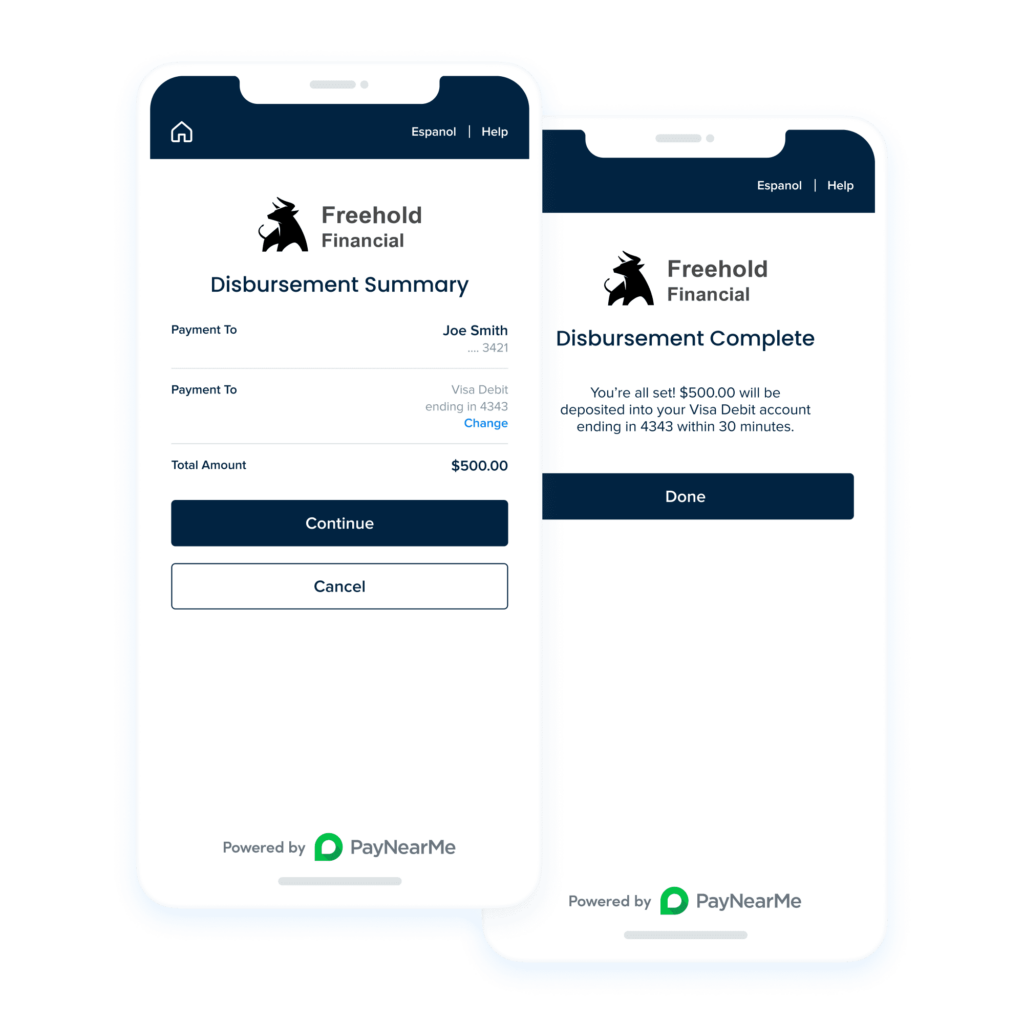

Consumers may receive disbursement payments from their mortgage for various reasons, including overpayments, refunds, etc.. For example, say a consumer overpays their escrow, they may apply this overage to their mortgage cost, request a lower monthly escrow fee, or request cash. If they request cash, a disbursement is needed.

Traditionally, disbursements were sent via a check in the mail. This posed hurdles in terms of efficiency and security. Making this process digital offers a few advantages – the mortgage servicer saves money and administrative burden by eliminating paper checks. Additionally, the workflow becomes more streamlined, improving customer service reaction time.

Moving to digital also alleviates some security concerns. Customers can input card numbers themselves, for instance, helping to alleviate mistakes in data entry by customer service agents. Multiple security checkpoints, such as customer phone number verification, can be instituted to reduce fraud and errors.

PayNearMe’s digital disbursement feature allows you to send funds directly to customers via their existing debit cards. The disbursement can be triggered by an API, or manually sent by a customer service agent. The consumer can choose how they receive the money via self-selection, for example, through a text message.

2. Customer Engagements

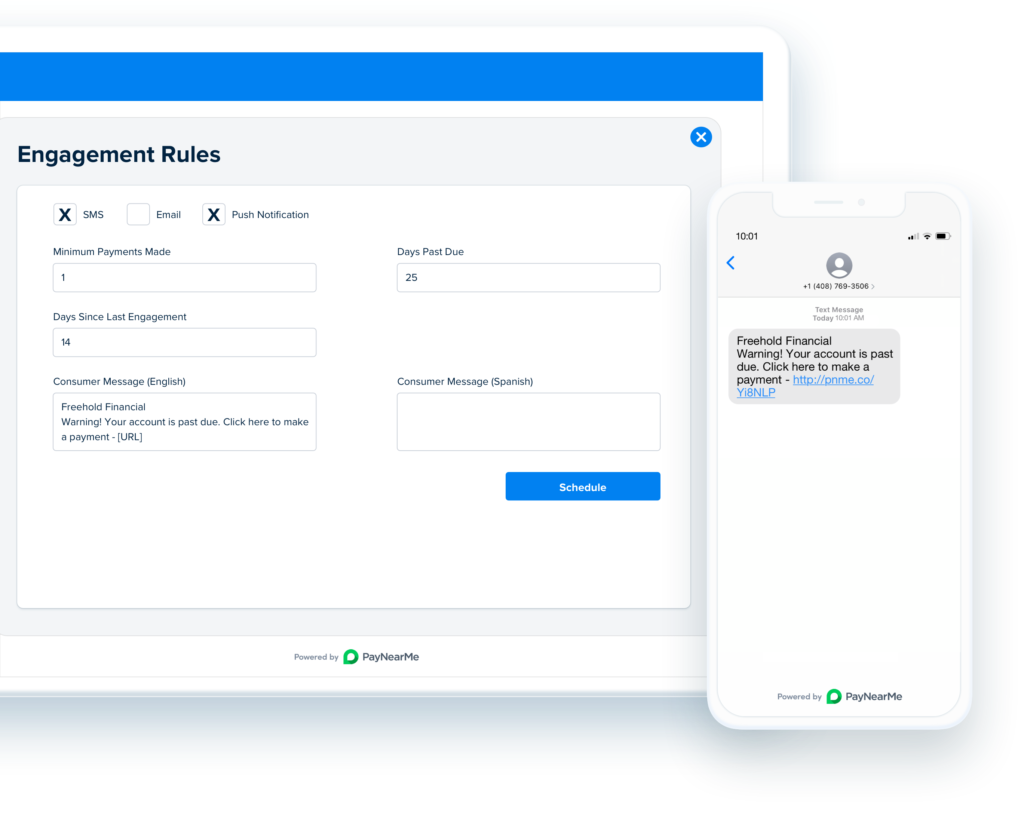

Successful bill payment processing is heavily influenced by customer communications. Automatic payment reminders are necessary to keep customers informed and on-time. However, it’s critical to engage with consumers on their terms – meaning, a medium they are comfortable with and eager to use. For most modern consumers, that means digital media such as texting, email and push notifications.

PayNearMe makes digital-first engagement a top priority. You can use the platform to send SMS messages, emails, or push notifications directly to consumers’ devices, in the language they prefer.

Whether it’s a payment reminder or an initial welcome message upon signup, you can adapt the content and its delivery to suit your consumers’ needs, ensuring you are reaching them via their preferred mode of communication.

3. Self-Service Payment Tools

Digital technology can also be used to encourage the customer to self-serve. For example, you can include a personalized QR code on paper bills that will take the customer directly to their payment account. This allows you to turn traditionally offline customers into online payers.

Such tools also reduce the number of inbound calls, lowering demands on customer service teams, and potentially allowing you to decrease overhead costs.

Other self-service tools include:

- Interactive Voice Response (IVR) Systems: Telephone transactions can require significant customer service resources and expenses. You can minimize this hassle by redirecting inbound calls to IVR. Making this a customer’s first point of contact often relieves the need for them to speak with a customer agent at all. With IVR, the customer can help themselves.

- Autopay: For many servicers, autopay is the ideal state for all customers. Offering more autopay options, such as including additional payments to principal or splitting payments into bi-monthly or weekly transactions, can encourage more customers to enroll.

- Push to Text: For mortgage servicers using call centers, agents can actively promote self-service to customers by pushing texts to them while on the phone. For example, if an inbound call regarding payment comes in, the agent can ask the customer whether they want to pay via email or text in the future. The agent can then send customers payment links directly.

PayNearMe Simplifies Bill Payment Processing for Mortgage Servicers

Mortgage servicers ready to embrace these payment processing features will benefit – and so will their customers. PayNearMe’s modern technology makes it easy to implement the above features. Improve operations and customer care with our practical tools. Find out how.

Back

Back

Back

Back