What’s Changed in iGaming Payments?

Two facts stand out when it comes to the current state of online gaming payments:

- Operators must shift their focus to providers who help them increase profitability

- Players have new expectations about the payment experience that impact retention

If you’re an operator with an older payment system, you’re likely facing steep challenges with limited options and slow processes that make it harder to retain bettors.

Just after the repeal of PASPA, operators scrambled to integrate whatever payment methods they could, as quickly as possible, at any and all cost. If you’re now leading the charge for payments in your organization, it’s time to take a step back to critically evaluate your payment processes and learn where you can reduce the overall cost of accepting payments while driving up acceptance rates.

No doubt you’re looking to improve efficiency, profitability, and competitive advantage. That’s why it’s important to understand what’s happening in the industry and how certain trends are influencing the requirements for choosing a gaming payments platform. Here we’ll hit on three critical areas for consideration.

Consumer behavior

Many operators benchmark their payment processes against their industry peers, but consumers think very differently. People now compare every interaction against their best experiences, such as seamlessly simple payments enabled by Uber, Amazon, Starbucks and Venmo.

These user-centric brands have set new standards that are reshaping consumer payment behavior. Operators need to meet new expectations, including:

- Mobile-first: As smartphones continue to have more biometric security, it’s no surprise that more than 96% of Americans rely on these devices. Particularly for iGaming and online sports betting, many players prefer engaging through mobile apps, rather than a desktop computer. Some studies highlight that three out of every four people ages 18-34 prefer to use their phones for online gambling.

- Alternative payment options: Consumers across all ages, but especially digital native generations, have adopted non-bank payment options to send, receive and store funds. In fact, 53% of Americans use digital wallets (e.g., PayPal, Venmo, and Cash App Pay) more often than traditional payment methods like cash or plastic, according to a Forbes report.

PayNearMe’s consumer research found that nearly a quarter of bettors surveyed (23%) will abandon a gaming app if it doesn’t offer their preferred payment types. Operators that offer flexible options for deposits and fast payouts can significantly improve player retention and profitability.

- Ease and speed: As modern mobile apps continue to redefine payment simplicity, consumers now want to do everything in a few taps. Having to remember logins, enter account details, and navigate multiple steps are now seen as pain points that may drive away players at the gate.

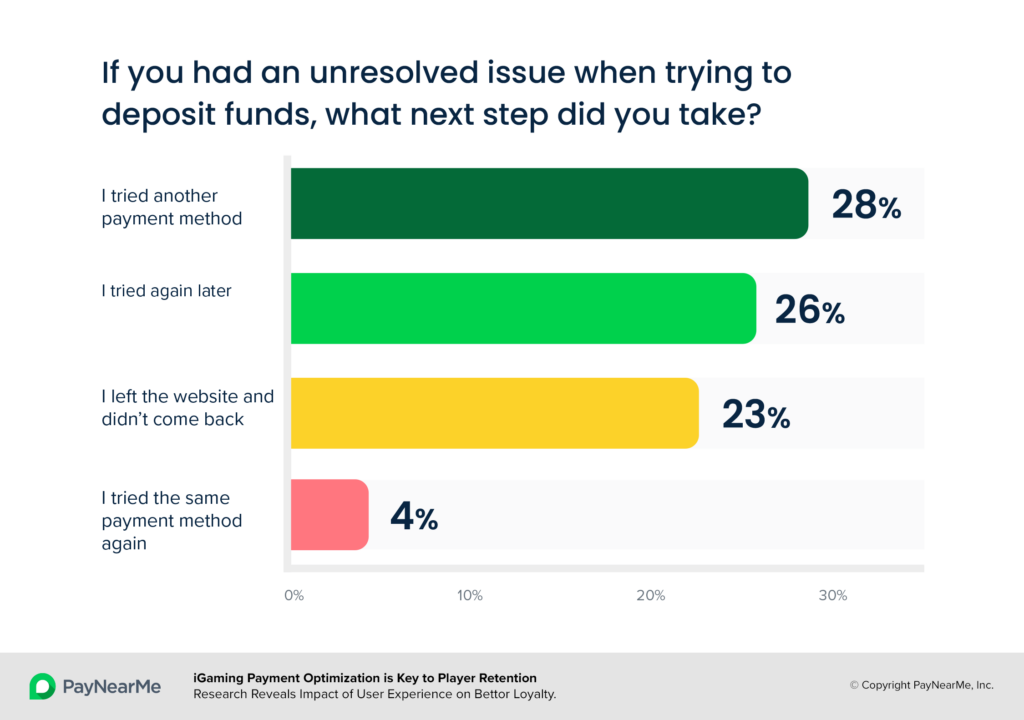

More than one-third (32%) of bettors we surveyed said they would abandon a betting app if it takes too long to fund their account. And 23% who had funding issues left the app and never came back. On the positive side, we found that 16% of players make weekly deposits and nearly a quarter fund their accounts monthly. Operators with an optimized modern payments platform can capitalize on the momentum of frequent bettors to drive revenue growth.

Technology advancements

As consumer expectations evolve, payment systems and their underlying technologies are growing more complex. For operators, bolting new options onto older payment systems no longer works without a lot of heavy lifting and compliance risk. How can businesses more cost-efficiently offer traditional options like ACH and card alongside proprietary digital wallet providers?

Interoperability is key. That’s why the latest fintech innovations are built with API flexibility, enabling many disparate systems to ‘talk’ to each other end-to-end, from payment origination, to processing and settlement. This interconnectedness is essential for a payments platform to integrate seamlessly with an operator’s system of record (such as a player account management system or CRM).

A modern payments platform also needs to efficiently pass transaction data to numerous business systems, for everything from the messaging platform to analytics for business intelligence. Operators should never underestimate the value of payments data. It can provide a wealth of insights to better understand and predict payment behaviors and preferences to improve and personalize the betting experience. These advanced capabilities give operators a powerful edge to increase player retention and attract new bettors.

Regulatory considerations

Across industries, payments are increasingly scrutinized by regulators – but it’s even more complicated for operators. The regulatory landscape of online gaming keeps changing, and multi-state operators need to stay on top of shifting regulations on a state-by-state basis. Payments are a core factor; for example, a certain payment type may be allowed in New Jersey, but not in Ohio.

Getting to market as a new operator or operating in a new state or territory comes with a slew of compliance hurdles. For two-fifths of operators, it can take up to 12 months to fulfill compliance requirements ahead of entering a new territory, according to a study by IDnow.

Keep in mind that gaming payments sit at the intersection of two highly regulated industries: gambling and money movement. For operators considering their next payments platform, choosing a fintech partner that understands these challenges is critical. The right provider can help the business onboard and implement faster, and more easily meet compliance requirements to speed time to market.

A modern payments platform for iGaming is also purpose-built with the latest technologies for fraud prevention and KYC authentication of user identities and funding sources, which are crucial for operators to remain compliant and mitigate risk.

What’s next for choosing a new payments platform

Building buy-in and alignment across an organization for a new technology solution can be challenging amid many stakeholders and priorities. To help smooth the journey and empower businesses to make informed decisions, PayNearMe has developed a Buyer’s Guide for iGaming operators with insights on what to look for in a modern payments platform and fintech partner.

Take advantage of our Buyer’s Guide online here: Choosing Your Next Payments Provider