Why Cash Payments Aren’t Going Away Anytime Soon

A recurring trend in financial media is to proclaim that “cash is dead”. COVID-19 has only accelerated that rhetoric, as contactless payments and coin shortages have pushed more businesses away from cash transactions in 2020. At the same time, there is a common (yet not fully supported) theory that cash is not utilized as much by younger customers, who are more attracted to digital devices than previous generations.

The arguments against cash aren’t necessarily untrue, they just don’t tell a complete story. The reason that cash isn’t going away is because it still plays an incredibly important role for many Americans, particularly in unbanked and underbanked households. In addition, cash payments are still more prevalent than all but one payment type (debit cards), despite the cries of its demise for over a decade.

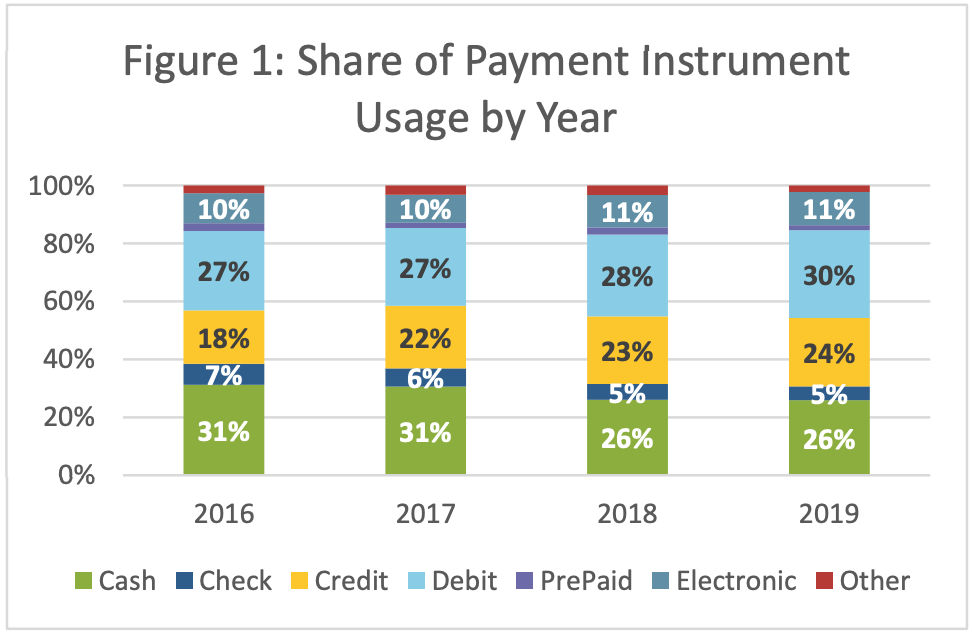

Source: The Federal Reserve System Diary of Consumer Payment Choice 2020

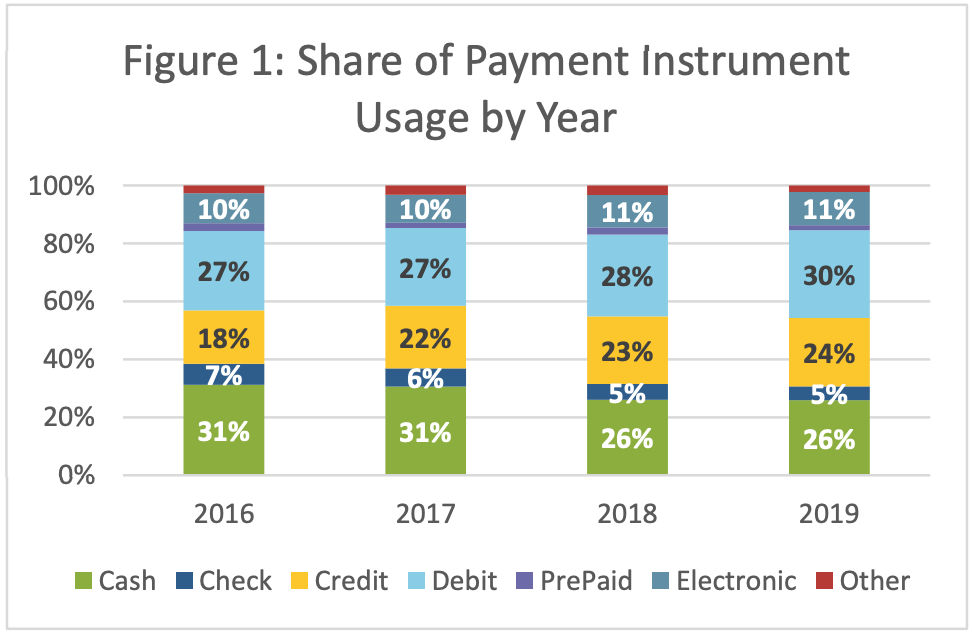

Source: The Federal Reserve System Diary of Consumer Payment Choice 2020

According to the Federal Reserve System’s Diary of Consumer Payment Choice, cash preferences for many Americans have remained the same between 2018 and 2019, with roughly a quarter of all transactions being made with cash the past two years.

Cash is alive and well as a payment type, and should be a part of your bill pay program as well.

4 Reasons Why Cash Payments Still Matter

Here are some reasons why cash remains an important tender type for Americans.

1. Convenience is Key

American consumers prefer the use of cash over other forms of payments when transactions are low in amount. When purchases or bills cost less than 10 dollars, for instance, customers find it more convenient to pay in cash. Some people may also find it complicated to go online and sift through different financial institutions and digital payment platforms. If this is the case, they will prefer to conduct outright payments with cash, which is simple and uniform.

Cash has also been universally adopted, and the established routine is part of what makes it so convenient. Physical money is generally accepted by most entities, so customers have less to worry about when carrying around cash.

2. Younger Consumers Still Rely on Cash

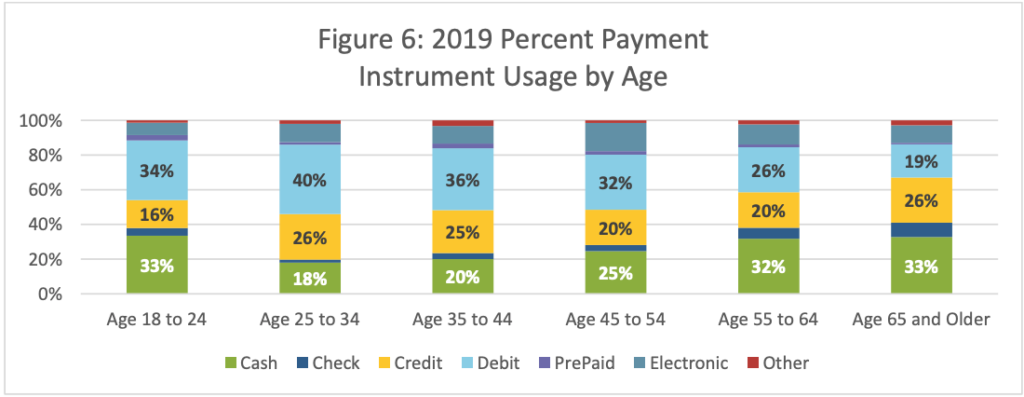

Source: The Federal Reserve System Diary of Consumer Payment Choice 2020

Source: The Federal Reserve System Diary of Consumer Payment Choice 2020

Despite the common belief that young people are least likely to use cash, research has shown that this is not true. The Federal Reserve study cited earlier finds that young adults between the ages of 18 to 24 actually make up the highest proportion of cash users, tied with the 65+ age group. We can see that while many young customers have adapted to using debit cards, there is still a third of the demographic that remains reliant on cash.

One reason for this trend is that younger adults may not have the same access to credit. More established adults tend to have higher average incomes and be more financially stable, making them more desirable for credit options. Due to these reasons, young adults are less likely to have high credit scores, which reduces their desire for going cashless with a financial institution.

By opening up cash payments, your business will follow the market trend that will maximize your reach into a younger pool of customers.

3. Unbanked and Underbanked Individuals

Unbanked and underbanked individuals make up a significant proportion of the population, and this group tends to drive up the number of cash transactions. According to a 2019 FDIC National Survey of Unbanked and Underbanked Households, 25.2% of American households are considered unbanked or underbanked. Half of this groups pointed to having inadequate funds to justify opening a credit account as the reason why they have shied away from doing so.

This is a problem if your business only provides cashless forms of payment. If more than a quarter of the population cannot access your service, this prevents you from maximizing your reach into the market.

Your business can gain an edge from competitors by considering cash payment options. Some states such as New Jersey and San Francisco have already enacted laws that ban cashless stores because they are not inclusive to people with less access to cashless alternatives. By opening up a cash payment option, you will actively promote equal access to your services for people from all income groups.

4. Cash is Guaranteed

Unlike ACH and card transactions, cash is guaranteed. It can’t be disputed, it doesn’t bounce and it clears to your bank quickly. This can go a long way in ensuring payments from customers with a history of failed transactions, or for higher risk industries where the threat of NSFs and other exceptions can harm your bottom line.

Cash can also be more secure, as it cannot be stolen like a credit card number or used by criminals to make fraudulent purchases.

Accept Cash Payments with PayNearMe

You can experience the best of both worlds with PayNearMe’s cash payment feature. Our service enables you to provide an offsite cash payment option for your customers that is then digitized and sent to your business.

Simply send your customer a barcode, ask them to visit a participating retail store out of the 27,000 possible locations, and they can immediately process their cash payment. It’s as simple as scan, pay and go.

Take a look at our cash payment feature page to learn more about this service.