Why Now Is the Perfect Time to Run a Merchant Statement Analysis

When is the last time you did a deep dive into your merchant statements? These monthly statements may seem unassuming, but a closer look will reveal a wealth of information about your current payment processing costs, customer mix and opportunities to grow.

Unfortunately, many statements aren’t laid out in a way that encourages quick analysis. You might find yourself piecing together multiple statements just to build an objective picture of your card acceptance situation.

Performing an annual merchant statement analysis can reveal valuable insights about where your money is going, helping you take control back—and ultimately save you money.

The Benefits of a Merchant Statement Analysis

We’ve already detailed many of the benefits of a merchant statement analysis in an in-depth webinar, but for those without time to watch, there are a few that stand out.

Unlock Valuable Insights About Your Customers

A merchant statement analysis can put your customers’ payment behavior into perspective, allowing you to leverage it to better understand your customers and business.

For example, you might be interested to learn about your payment mix, like tender type, regulated credit cards, unregulated credit cards, prepaid cards, debit cards and cash.

One PayNearMe client learned via a statement analysis that they received 65% of payments in unregulated credit card transactions. Unregulated credit cards involve banks with less than $10 billion in assets, like small banks, credit unions and some prepaid cards.

Using this information, you can learn more about the likely interchange fees associated with different customer groups, helping you understand how your current processing costs align with expected costs.

Decipher Separate Fixed vs. Variable Fees

Some payment processors split their costs between variable fees (such as per transaction) and fixed fees (such as a monthly compliance and reporting charges).

This can create a false assumption for many merchants, who believe their per transaction fees are competitive without factoring in the fixed monthly charges.

In one example, a PayNearMe client in the auto lending industry thought they were paying a 1.65% blended rate with their previous vendor. After adding in all the fixed costs and combining it with the per transaction fees, however, it was discovered their actual effective rate was closer to 2.10%—a significant difference in an industry with tighter margins.

Uncover Payment Trends Over Time

If you’ve remained with the same vendor for years, you may not notice the incremental changes to your card rates over time without doing an in-depth analysis of your statements.

These changes can come in the form of volume adjustments, unregulated vs. regulated card mix, interchange rate adjustments and many other seemingly small updates. However, over time these small changes can make a big difference in your bottom line.

For example, many merchants are still on a tiered fee system, meaning they pay different rates on different card types. (Aside: learn more about different card processing fee models.)

You may have the same rates in each tier, but the type of transactions that fall into each tier might change. This can give you the illusion that your rates have stayed the same, while causing an increase to your processing costs over time.

This kind of movement is hard to see unless you dig deep into your merchant statements.

What To Look for in a Statement Analysis

A proper analysis will uncover the true cost of processing payments, helping you make better decisions on which payments providers to work with in the future.

Here are some of the most important factors to consider when analyzing your merchant statements:

- Transaction Fee Model: Does your processor charge a fixed fee, a tiered set of fees or an interchange-plus model?

- Network Routing: Do all your debit card payments go through a single network (i.e. Visa), or are they routed on the lowest cost network (i.e. Star, Pulse, etc.)?

- Special Pricing Programs: Are you eligible to receive discounts for special programs, such as the Visa Debt Repayment program?

- Miscellaneous Fees: What additional fees do you pay each month on your statement, and how much do they add to your rates?

- Add-on Services: Are you paying additional fees for services such as messaging, web payments, etc.?

- Payment Mix: How are your customers paying, and has this created an increase or decrease in your rate over time?

- Chargebacks: What are the penalties associated with chargebacks, and how many are you getting each month?

- Channel Pricing: Do you pay a separate cost for different channels, such as IVR or phone?

While these are some of the most telling metrics, the list can go on and on depending on how much time you spend on your analysis.

Get a Clear View of Your Merchant Statements

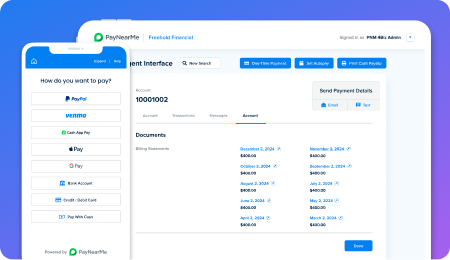

The bottom line is simple: Understanding your merchant statements is critical when evaluating your next payment processor. If you need help understanding your statements, or would like more information about PayNearMe’s all-in-one payments platform, reach out to our team today to learn more.