Why Operators are Losing Players: The cost of sub-par user experiences (and how to improve them)

The world of iGaming – online sports betting and online casino games – is becoming dramatically more competitive as more U.S. states legalize internet gambling. Many operators compete for the same players, making it imperative to deliver the most compelling and seamlessly easy experience. And that starts with payments.

All too often, operators focus only on promotions to get players to sign up, but they may be losing that investment quickly if bettors can’t easily fund their accounts and readily withdraw winnings.

Recently we released our 2023 research report where we dove into the payments experience of bettors who use iGaming websites and apps. The consumer research, conducted by Betting Hero, identified key pain points in the payment experience that often result in app abandonment and may significantly reduce retention. Here we’ll spotlight some key findings, and what operators can do to increase their competitive edge by earning player loyalty.

How big is the payments problem?

iGaming bettors want the agility to rapidly deposit funds and place bets, minutes before or even during an event, which requires a fast, flexible payment process. Yet our research shows that nearly one-third of bettors (29%) have run into roadblocks depositing or withdrawing funds, regardless of which app they used or their betting frequency.

29% of players

have had issues depositing

and withdrawing money

with their sports betting

and iGaming apps

23% of players

who had funding issues

left a betting site or app

and never came back

Perhaps even more important is the fact that almost a quarter of players who had trouble making deposits abandoned the betting site or app and never came back. And those aren’t one-off users, they are frequent bettors. 23% of players surveyed bet on sports or iGaming at least once a week. That’s a critical customer base that operators cannot afford to lose.

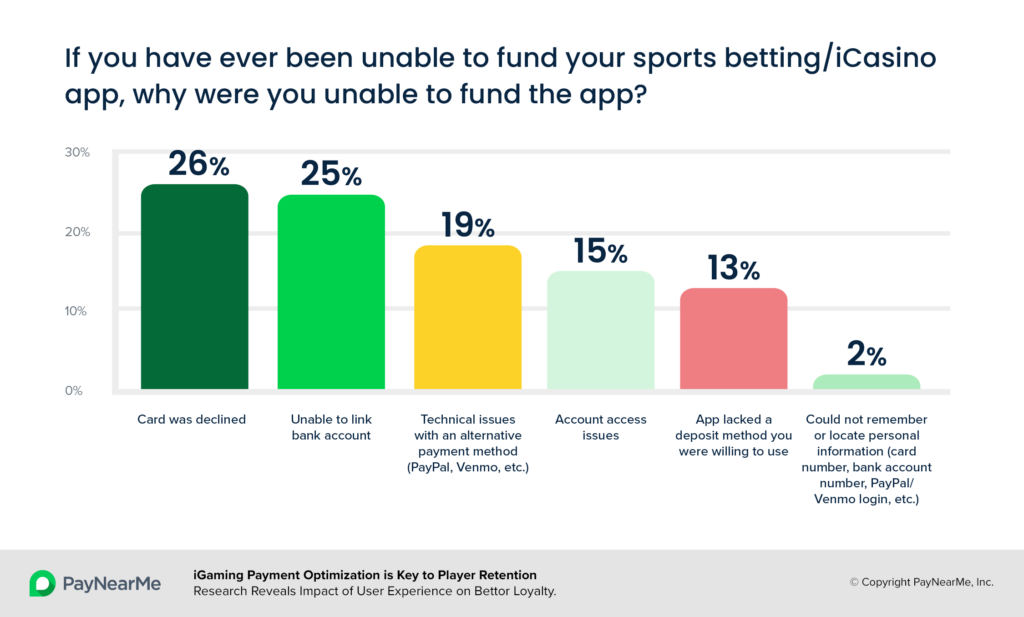

The most common hurdle in making deposits was card declines, affecting 26% of players surveyed. Part of the problem is that many banks and card issuers still view gambling transactions as high-risk. While card acceptance rates for internet gambling are on the rise, operators still face double-digit card declines that drive away players and erode their bottom line.1

Card declines are not the only frustration. Our research found that many bettors stall out because they cannot easily use alternative payment methods, such as Venmo, PayPal and Apple Pay. Yet these mobile wallets are increasingly the preferred option. In fact, 53% of Americans now use digital wallet payments more than traditional methods.

Ease and convenience are now table stakes with consumers. Operators that offer a variety of payment methods—such as debit or credit card, ACH, mobile wallets and even a cash option—could dramatically improve the bettor experience and long-term player retention.

“With [my preferred] app, any type of deposit takes maybe 30 seconds to a minute, so I think that’s an important part of choosing an app and choosing to stick with it.”

Surveyed bettor

Tangible costs to iGaming operators

The risk of players abandoning an iGaming site or app translates to real costs for operators that can chip away at already-narrow profit margins.

Acquisition costs

Consider the average cost-per-acquisition for new players. Marketing and promotions often range from $200-300, and for some operators, acquiring a new monthly active user can cost up to $2000. If a player leaves because their first deposit attempts fail, they can’t deposit with their preferred methods, or their first payout takes too long, then the operator loses all of their initial investment, as well as any potential future revenue from that bettor.

Customer service costs

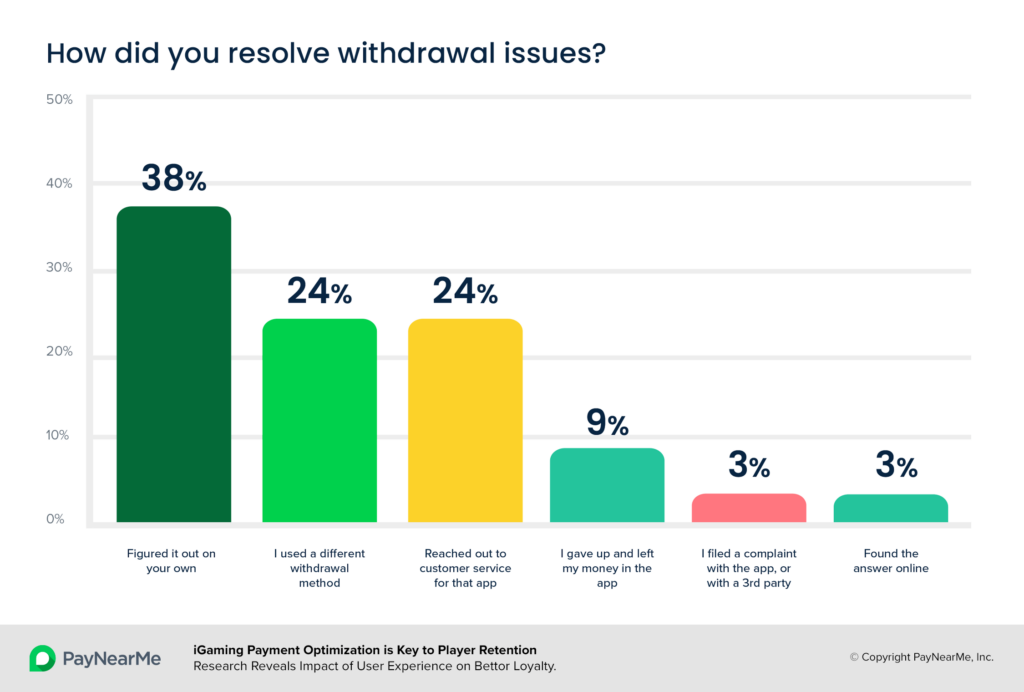

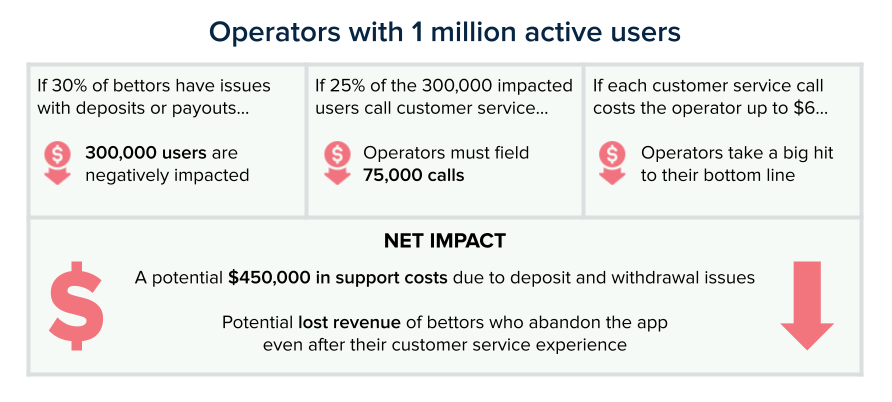

A negative payment experience can also rack up costs for operators handling customer service calls. Nearly 25% of players with either a funding or withdrawal issue contacted the app’s customer service. When on average, businesses pay up to $6 a call, costs can rapidly add up.

Support calls could put a serious dent in an operator’s bottom line, especially as the business scales up. In addition to the cost per call, operators will have to look at adding headcount to their support teams to accommodate the extra volume of support requests. The last thing an operator wants to do is spend hundreds of thousands on additional personnel whose primary focus isn’t market share acquisition or improving their product.

The example below illustrates some potential hard costs of failed payment experiences, even before this added headcount factored in:

Increase market share with winning payment experiences

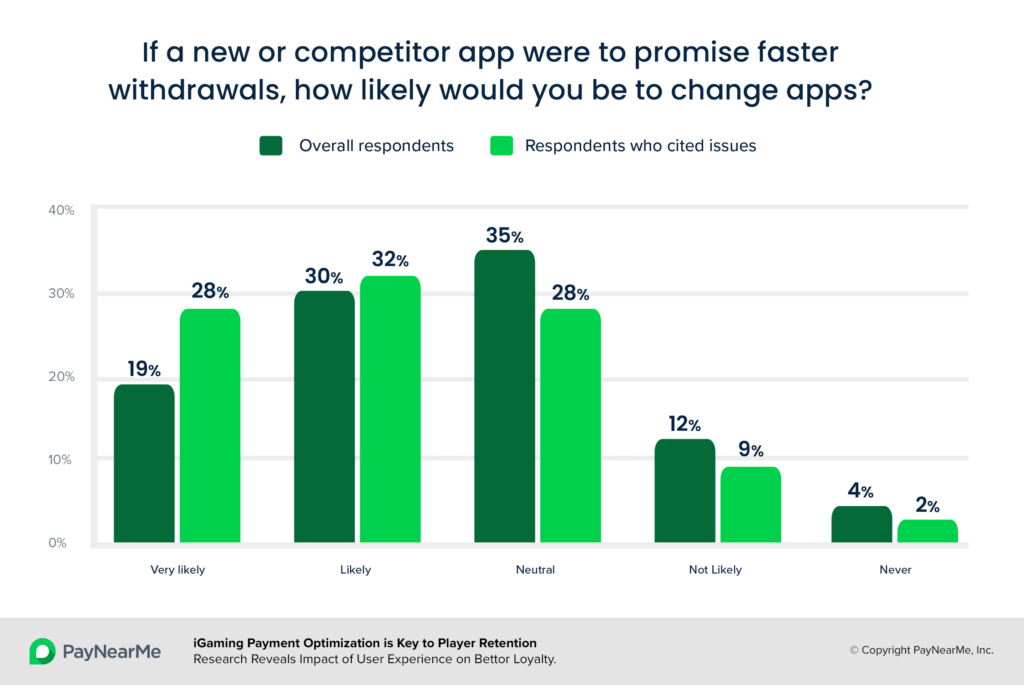

To stay competitive and profitable in a rapidly growing market, operators will need more ways to control costs and optimize customer engagement. Now is a pivotal time to solve payment problems. While a few iGaming operators dominate the market, no single sports betting or i-casino app owns all the players. Payment experiences are moments that matter – providing operators a distinct opportunity to stand out.

Operators that can facilitate fast, flexible, and reliable deposits and payouts have a pathway to greater market growth. As an example, 60% of the players who experienced payment issues said they would be likely to switch to a competitor app if it promised faster withdrawals.

Quick action is part of the thrill in online sports betting and casino games. The right payment experiences can keep bettors focused on entertainment and sustain their momentum as loyal customers.

MoneyLine™, powered by PayNearMe, simplifies end-to-end money movement for iGaming and iGaming operators. It delivers the most reliable payment experience across key touch points with bettors, streamlining the payment journey and improving the overall user experience—helping operators retain their most valuable customers.

For more information on MoneyLine: https://home.paynearme.com/moneyline/

To download the full 2023 research report: Research: iGaming Payment Optimization is Key to Player Retention