Build vs. Buy: Which Path is Right for You?

One of the most important questions decision makers have when considering a technology upgrade is can you build in-house a solution that better meets your needs than what’s on the market? The answer to this question is: It depends. When it comes to a payments platform, many organizations find it can be too challenging to go it alone.

Why? Accepting recurring bill payments—and doing it cost-efficiently with minimal exceptions—takes more than just a basic gateway. The payments landscape is complex and changing rapidly, and consumer behaviors and preferences are changing along with it.

What are some of the key factors for businesses when considering if they should build or buy? Let’s step through it.

Required expertise and capabilities

Whether you build or buy, there are many moving parts involved in bringing an optimal payments platform to market. It’s critical to have an experienced team that can develop and manage the following crucial elements of the final product:

- Platform infrastructure: Provide a secure, compliant, API-flexible system that can grow with your business and easily adapt to changes in the payments industry.

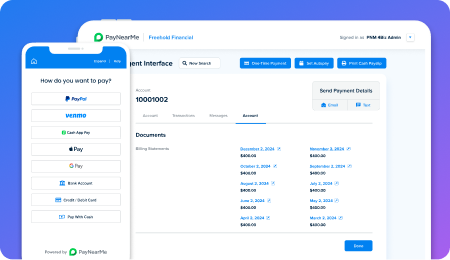

- Technology integrations: Enable you to offer payment options beyond ACH and debit, including digital wallets such as PayPal, Venmo, Apple Pay and Cash App Pay, as well as cash at retail. Giving customers more ways to pay is now vital to improving on-time payments. Alternative payment methods are important considering research found that nearly 60% of respondents would be very likely or likely to pay their loans with digital wallets.

- User experience: Deliver a modern, user-friendly payments interface optimized for both mobile and desktop. Focusing on the bill pay experience is increasingly important to reduce costly exceptions and delinquencies, and drive repeat business. In fact, 82% of people we surveyed said a poor loan payment experience would influence their decision to switch to a different lender in the future.

- Compliance: Ensure the right payments compliance expertise is in place to consistently monitor and advise about regulatory requirements. Regulations and laws are frequently changing to adapt to new payment rails, consumer privacy issues, UDAAP guidelines, Consumer Financial Protection Bureau (CFPB) scrutiny and more.

- Uptime and Maintenance: Maintain and upgrade the platform over time, and avoid disruptions and outages that can cause late or missed payments, and drive up costs related to exceptions. Building a new system requires a significant investment in technology and development resources, but maintaining that system adds on-going expenses that can increasingly put cost pressure on your business. Finding qualified employees to learn and manage the system is also a concern in the long-term.

- Scalability: Ensure the system can scale with your transaction volume, add features to match new customer expectations and leverage emerging technologies. If you handle it in-house, how agile are your teams and can you afford to add more resources to address technology changes?

As you can imagine, handling all of the essentials within your organization is a tall order. Stakeholders often have competing priorities and may not have the resources and expertise to commit to such a complex, time-intensive project.

An easier, faster and more cost-effective way to go to market with a modern bill pay platform is to collaborate with a fintech partner whose entire company is dedicated to optimizing payment solutions for their clients.

The reality of development cycles

Building in-house can be even more complicated when you consider all the cycles needed to get releases out the door. It requires time and resources to plan, build, test, deploy, support and evolve.

Think about it this way:

- Buying: Your staff will need to engage in different stages of the journey, including the vetting process, onboarding the new solution and occasional maintenance after you go live.

- Building: You’ll need in-house technical resources through all cycles, from initial planning to building and testing, reliability failover testing, security and compliance. You’ll also have to repeat those cycles as you add new features that customers want, like a text or email payment reminder.

For organizations that have highly specialized needs and want complete ownership over the technology, building may be the right approach. Typically, that’s reserved for businesses that have vast resources and time for development.

In other cases, a hybrid approach could help reduce effort. Your company might build part of the platform and try to bolt on external components, or patch onto your legacy system. But you still need the expertise to make sure all the parts work together seamlessly, and that adding or changing components will not disrupt the whole.

Buying a fully integrated solution from payment technology specialists eliminates the heavy lift and extended delivery time, while still enabling you to configure it to your business needs and brand.

Defining requirements and timing

Two other key considerations will influence both whether you build vs. buy, and if you buy, how you choose a partner. Those considerations are your requirements and your timeline.

As you map out your requirements, be sure to focus on:

- What are the biggest payment problems you need to solve? Making a prioritized list can help you better assess your in-house capabilities vs. the need to collaborate with a fintech partner. The upside of partnering is that you don’t need to think through how the problems get solved; that’s the vendor’s job.

- What are your must-have and wishlist features? Think across multiple areas, starting with payment types, and all the channels and messaging options you want for engaging with customers. Then consider back-office needs such as automating tasks, real-time reporting, dispute resolution and integrations with your other systems.

The longer and more detailed your lists, the bigger the lift for developing a solution in-house. This planning, however, also prepares you with a blueprint of what to look for in a solution provider if you decide to buy instead.

Timeline is, of course, another gating factor. The longer you wait to update legacy payment processes, the more it may be costing your company in agent calls, exceptions and late payments. And that’s just with existing customers. Increasingly, an outdated payment experience may also limit your ability to attract new business and compete in a crowded market.

With that in mind, buying a payments platform can empower you to roll out a flexible, frictionless payment experience much more quickly than building a system from scratch.

Choosing to buy

If you have tackled the ‘build vs. buy’ decision and are looking for your next bill pay platform, PayNearMe can simplify your buying journey. Check out our Buyer’s Guide: Choosing the Right Payment Provider to help you choose how to select your next payment provider.