5 Ways to Drastically Reduce Exception Payments & Returns

In a perfect world, we wouldn’t need to worry about exception payments. All of your customers would pay on time, payment methods would all be verified and up to date, and every payment would be guaranteed and unreturnable.

But it’s not a perfect world. Payment exceptions are a normal (and painful) part of doing business, and while you might not be able to eliminate all of them, there are tangible ways to reduce the number of returns, chargebacks and failed transactions.

What Are Exception Payments?

First, let’s get on the same page about a term I’ve already used a few times in this article.

An exception payment is any transaction that fails to post or requires manual intervention. This may include a long list of transaction types, with the four most common being:

- Non-sufficient funds (NSF) errors

- Failed transactions, due to technology issues, data input errors, etc.

- Chargebacks on card transactions

- ACH returns

These exceptions have different characteristics but carry similar results—a disruption in your ability to collect and a need for staff intervention.

The Negative Effects of Exception Payments

There are many ways exception payments can harm your business. Aside from the actual money lost in the returned transaction, you’ll have to deal negative outcomes that fall into six main themes:

- Compliance: You’re required to remain under allowable return thresholds set by various compliance standards (e.g. NACHA, PCI-DSS, etc.)

- Fees: In some cases, you may have to pay penalties above and beyond the lost revenue from the returned transaction.

- Employee Productivity: Each exception payment forces your employees to spend time on analysis, processing and resolution.

- Operations: In addition to time spent on individual exceptions, you’ll need to dedicate extra time creating processes to handle future cases.

- Cash Flow: Exceptions can cause the final payment to be made late, or in some cases, not at all.

- Reputation Management: When exceptions are your fault, you create negative customer service interactions with customers who excepted their payments to go through.

Five Ways to Reduce Exception Payments

Not all exceptions can be prevented. For example, legitimate fraud and accidental overdrafts are out of your control. Your focus needs to be on reducing exception payments that can be controlled, using risk management, processes and technology to minimize their effect on your bottom line.

Here are five ways you can influence and reduce exception payments.

1. Know Your Customers

The first step in reducing exception payments is knowing your customers. Aside from obvious controls like avoiding bad actors and collecting accurate information from customers, you’ll want to understand who you are doing business with on a micro and macro level.

For example, do your customers primarily use cards to make payments? If so, you’re at a higher risk for chargebacks than with customers who primarily pay with cash, ACH or check.

On an individual level, does a particular customer have a history of NSFs attached to their account? This person may be flagged as a repeat offender, and actions can be taken in the future to avoid more NSFs on their account.

Using a mix of internal data collection processes and external verification tools is the first step in understanding your risks for different exception payments, and eventually putting measures in place to prevent them.

2. Offer Lower Risk Payment Options

Some payment types are prone to exceptions, while others can offer a lower risk for your business. Cash, for example, is a guaranteed payment type that cannot be charged back, returned or disputed through a third party.

You may also choose to dynamically show different payment types based on the customer’s payment history. As mentioned in a previous example, a customer who is flagged as a repeat NSF risk may automatically be restricted to using cards or cash to complete future payments. This can be done on a case-by-case basis, or you can take advantage of configurable business rules to automate the process.

3. Improve Customer Communications

Arguably the most frustrating exceptions are the result of miscommunication between your business and customers. One of the most common examples of this is when your customer doesn’t recognize the name of your business on their card statement and initiates a chargeback due to confusion. Simply matching your merchant account name to your DBA or public brand can solve this issue.

Another step you can take is clearly communicating your payment schedule to customers. Let them know when a payment is due, how much is due, and a breakdown of the payment so they understand any additional charges or fees that are tacked on. For automatic payments, you’ll also want to let the customer know which payment account you’ll be charging to avoid conflicts.

Giving your customers a say in how they receive communications can ensure they get these messages. In addition to your paper or PDF statements, give customers the ability to opt into payment reminders by text message, email, digital wallets or push notifications, and allow them to select their language preferences to ensure the right messages get through.

4. Reduce Agent Errors

If your business uses a call center to collect customer payments, it’s critical that you don’t allow agent errors to result in exceptions. Agents mishearing customers, keying in the wrong payment amount or selecting the wrong payment date can all result in returned payments and unhappy customers.

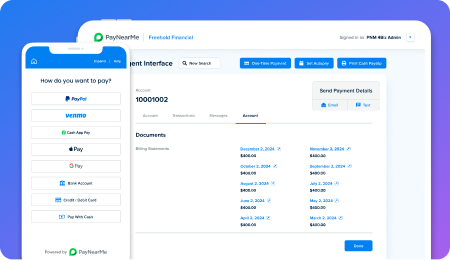

While human error is nearly impossible to completely eradicate, you can offset a lot of this risk by having your agents push payment details back to the customer. For example, with PayNearMe your agents can click a button to push a text message or email to a customer while on the phone, allowing the customer to type in their card details, verify the payment amount and complete the transaction on their own device.

This allows your agents to facilitate payments without having to handle any payment details, reducing their risk of errors.

5. Document and Digitize

Your last line of defense against exceptions is keeping a paper trail of all your interactions with customers. This is especially important when trying to win chargebacks and other disputed payments.

Begin by going back to step one. This is why it’s critical to capture and verify as much information about your customers as possible. You should also be capturing behavioral data, such as payment history, payment methods, locations (i.e. CNP vs. chip card on-site), autopay authorizations, message history and more.

Attaching this metadata to the customer’s account in your system of record will make it easier to prove that your charges are legitimate, and in many cases prove that the customer consented to the payment.

Using Technology to Reduce Exceptions

Many of the processes above can be easily implemented with the help of the right technology. PayNearMe gives your business more control over your payments, allowing you to streamline your collections processes and drastically reduce exceptions.

Learn how a leading non-prime lender used PayNearMe to cut their ACH returns in half, and contact us to see how we can help you do the same.