Switching Bill Pay Providers? Follow These Steps First.

It can be argued that payments are widely overlooked at lending organizations. Customers are required to interact with bills every month, often over the course of years for most lenders. This makes payments one of, if not the most common interaction with your business over time.

And when you consider how many different departments are affected by the payments process—sales, finance, compliance, accounting, customer service, etc.—it becomes obvious that selecting the right payments platform is critical to your success.

If your business is thinking about selecting a new bill pay provider, it’s important to think through the steps beforehand to make the best decision when you’re ready to buy.

Time for a Change?

Given the size and scope of a payment platform migration, you’ll want to pay close attention to the signs that may require you to make the shift. There are many events that can trigger the need for change, and you’ll have to understand which ones should spur you into action.

Here are some of the biggest reasons to make the change:

- Contract Expiration: The most obvious reason, an expired contract means you have the freedom to evaluate new options that fit the needs of your business and your customers.

- Operational Efficiency: Technology should act as a tool to improve your operations. If your current provider doesn’t help to alleviate call center volume, reduce time spent on reconciliation, or a number of other high-labor activities, you might be better off finding a new vendor.

- Customer Demands: Following the old adage “the customer is always right” may lead you to make a change when your current billing platform can’t support customer demands (for example, not accepting mobile-first payment types like PayPal or Venmo.)

- Rising Costs: Not all bill pay providers operate on the same business model, and changing trends in interchange fees, add-on services and other processing costs can start to eat into your margins.

Whatever your reasons for changing, it’s important that you set proper goals and expectations for the buying process. The hard and soft costs associated with switching providers, including data migration, customer education, employee training, development resources, etc., can all be reduced with a well-thought out plan.

Three Steps for a Better Buying Experience

Before jumping in, we’ll lead with the caveat that no two buying cycles are the same. A smaller lender might be able to switch payment platforms in a few weeks, while a large captive lender may issue an RFP that could take months (or years) to complete.

Regardless of your particular situation, these three steps should help you simplify the process and plan for success.

Define Requirements

Those who still grocery shop in person know two important rules: never shop while you’re hungry and always bring a list. These same lessons can be applied to picking a new bill pay provider as well.

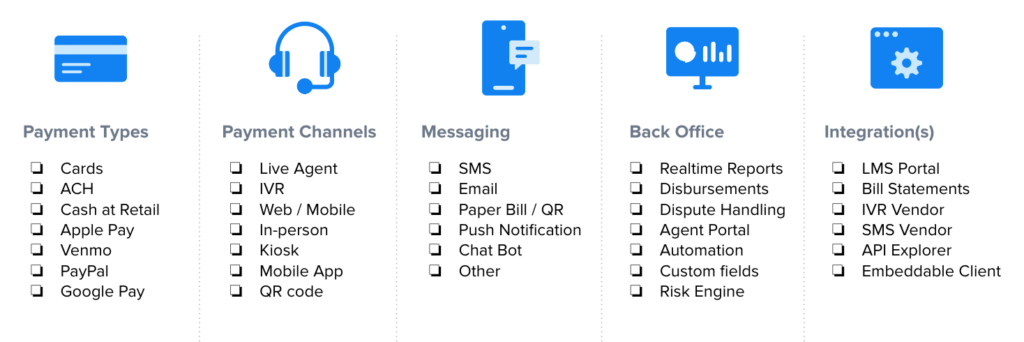

Modern payment providers offer a comprehensive and complex set of tools to manage the end-to-end payments process. Going into the process on an overly aggressive timeline, or without a ranked list of requirements, is a recipe for buyer’s remorse.

Give your team plenty of time to understand your current situation, identify your biggest pain points, and make a list of your desired features. Skip this step and you’ll end up falling for fancy features that don’t make sense for your business or solve your core payments problems.

Specifically, aim to do the following before you start shopping around:

- Stack rank your biggest challenges. Make a list of the biggest payments problems your business faces, and rank them in order of importance. This forces you to prioritize your needs upfront, allowing you to easily cross off vendors that don’t address your biggest concerns.

- Gather answers to probing questions. Nearly every salesperson you talk to will ask the same questions up front, such as number of payments you handle, mix of different payment types, payment channels used, etc. List out the answers to these questions in two columns—one that shows your current state and another that shows your future / desired state. This allows you to evaluate options that will fit your business today and in the future.

- Build your feature wishlist. You may be open to creative ways to solve problems, but in some cases you’ll have specific feature needs. For example, if you operate a call center that collects payments, you will likely need an interface your agents can use to collect payments. Jot down as many of these features that you think are necessary and feasible, as well as a separate list of “nice to haves”.

It’s important to level expectations here though, since you want the stack ranked challenges to guide your purchase while the other two help to pare down your shortlist.

Assemble Your Team

Once you’ve defined the requirements and built your wishlist, it’s time to assemble your team. This is where you’ll determine who needs to be a part of the buying process, what role they’ll play and who has authority to sign off on key decisions.

At a minimum, you should consider the following stakeholders:

- Executive sponsor(s)

- Finance

- Customer Service

- IT

For smaller businesses, these may all roll up into one or two people, while larger organizations will often delegate responsibilities to entire committees. It may also help to include project managers, system users, compliance officers and legal advisors for more complex buying cycles.

An important consideration that often comes up in this part of the process is “should we buy or build” different components. This can completely transform how you shop for, evaluate and implement your next payment provider.

For example, how much of the customer experience do you want to design in-house? In the rare case that your business employs a considerable number of developers and designers, you may wish to build your own payment experience and plugin a processor or gateway mainly to facilitate transactions. If you’re like many others, you’ll want your bill pay provider to handle the customer experience from top to bottom.

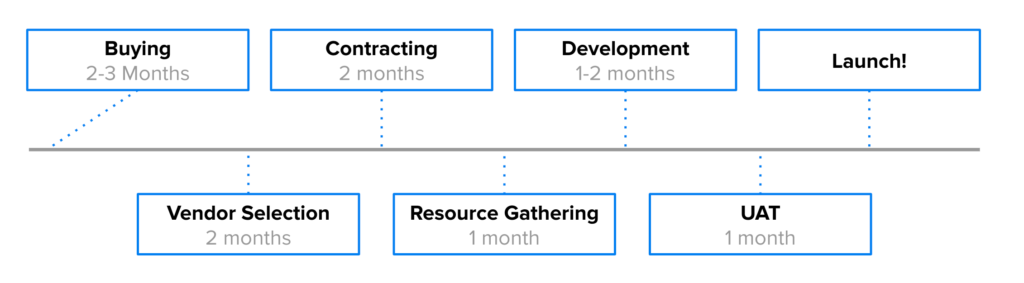

Finally, consider your timeline and decide how you’ll deploy your resources throughout the buying process. You’ll need to understand if there are any competing priorities, how many technical resources are required, and if there are any hard deadlines (such as a contract expiration) that will shift priorities.

The timeline for this process will vary from business to business, sometimes taking weeks, and in other cases many months. Here’s a sample timeline that many larger organizations will find familiar.

Compare Vendor Capabilities

Now that you’ve defined requirements and built your team, it’s time to begin the selection process. The initial search should be fairly quick due to all the work you’ve put in up front. You’ll be able to cross off vendors that don’t meet your requirements or timeline, often leaving a handful of close competitors on your shortlist.

This is where it pays to understand what differentiates bill pay providers and how to pick the right one for your business. For example, everyone on your shortlist may offer debit card processing as a payment method. But what is their fee model? How much will it cost per transaction? Is the vendor able to charge different fees by channel?

There are dozens, if not hundreds of factors to consider, but some of the most important ones are listed below:

- Fee / pricing model

- Reporting capabilities

- Product roadmap and release schedule

- Reliability and uptime standards

- Customer service requests

- Risk and compliance support

- Platform configurability / customization

- Scalability

For even more detailed questions to ask and options to consider, download our free Bill Pay Buyer’s Guide, which has an exhaustive list of questions and an interactive checklist to help you manage this part of the process.

Simplify Your Choice

Simplify your buying process by considering PayNearMe for your bill pay provider needs. Start by watching a short on-demand demo, and see how we can help you collect every payment, every time with our innovative payments platform.