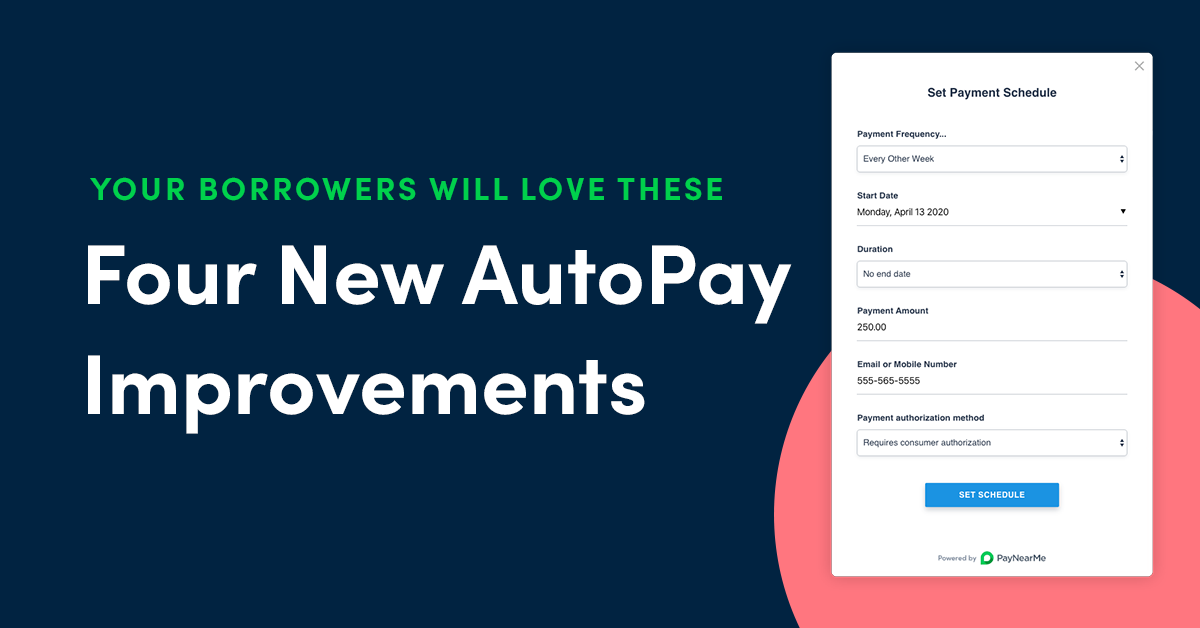

Four New Automatic Bill Pay Improvements Your Borrowers Will Love

Enrolling your borrowers in automatic bill pay is considered by many to be the holy grail in loan servicing. It often results in lower delinquency rates, higher customer satisfaction ratings and better profitability on your portfolio.

So then why tinker with something that already works so well? Partly because it’s in our nature, and partly because we still didn’t believe standard automatic payments were up to our high consumer experience standards.

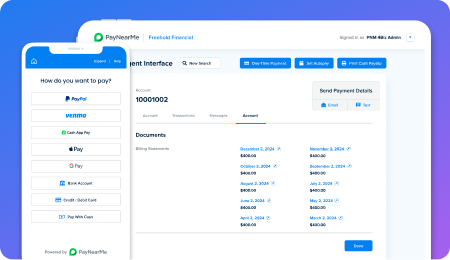

Here are four ways we’ve improved automatic bill pay in the PayNearMe platform to further delight your customers.

Card Account Updater

Nothing disrupts the auto pay experience like an expired card. This experience is frustrating for consumers, who often have no warning from the card issuer or the biller that their enrolled debit card is about to expire. It can also be a burden for lenders, who may have to expend unnecessary energy each month trying to collect from otherwise good paying customers.

Our card account updater feature is an elegant solution that clears up this issue without the need for consumer or lender intervention. When a debit card returns an expired error message, PayNearMe will automatically contact the network to update the information. No service disruptions, no late fees, and no manual outreach campaigns required.

Even More Scheduling Options

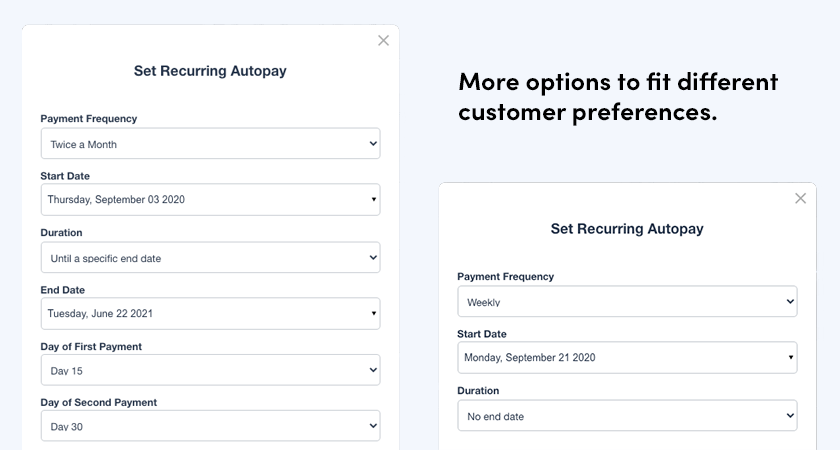

While the recurring monthly payment has become the norm for automatic bill pay, it doesn’t offer flexibility for all of your customers. PayNearMe has introduced new, flexible scheduling options that satisfy a broader range of preferences.

For example, an individual that is paid weekly may choose to set aside a small portion of their check each Friday to pay back their loan. There may be another customer of yours that works seasonally, and wants their automatic payments to stop on a specific date to coincide with their payday schedules. You may even have a customer that gets paid on an irregular payday, such as the 6th and 22nd of each month, and wants to set their automatic payment to hit on those same days.

PayNearme offers all of these options, allowing your customers to create an automatic bill pay schedule that works for them—allowing you to increase autopay adoption across your portfolio.

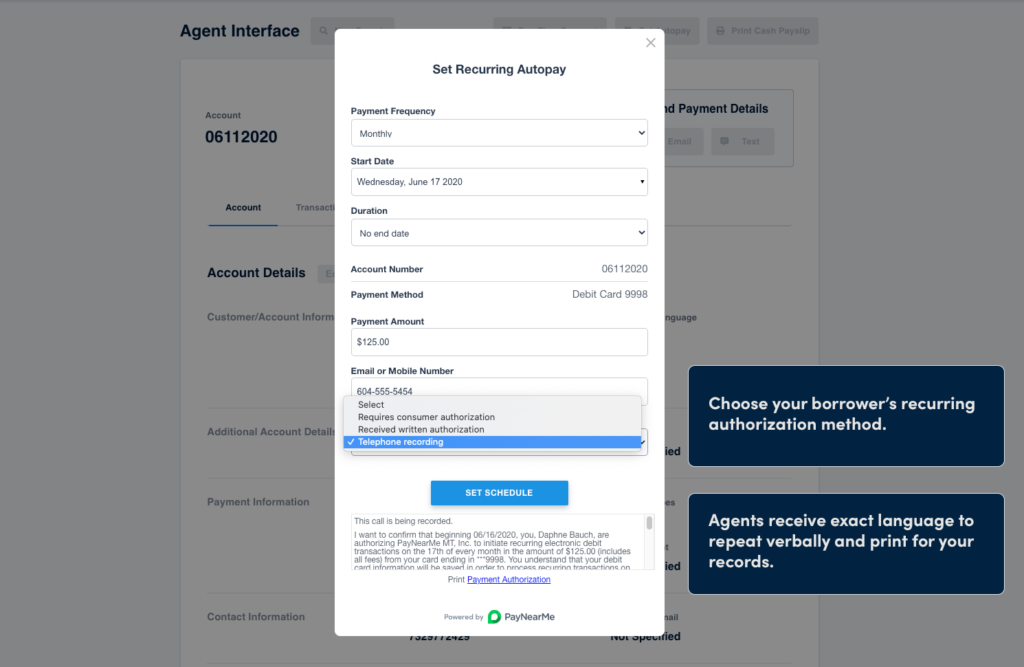

Effortless Authorizations

Failure to properly obtain and document recurring payment authorizations can be costly, possibly leading to lost chargeback disputes, regulator fines and other compliance headaches.

We’ve built in multiple authorization forms directly into the automatic bill pay screen to help you and your staff avoid any mishaps:

- Requires Consumer Authorization: This option sends the authorization to the consumer by text message or email, creating a digital signature that can be linked back to the account. By pushing the authorization to the consumer, you no longer need to record the call to remain NACHA compliant.

- Telephone Recording: This option allows your call center agent to obtain authorization over the phone, and provides them with a compliant script to read back to the customer.

- Written Authorization: If you received written authorization from the customer, the system prompts you to include the date of the authorization and then produces a statement for your staff to print.

Your customer service representative must pick one of the three in order to complete the auto bill pay transaction, ensuring you always capture the required authorization forms for each customer.

Future Dated One-Time Payments

This feels a little like cheating, because technically a future-dated one-time payment is not the same as an automatic bill payment. But our clients have asked for this feature, and so we must deliver.

By breaking out future dated payments into their own category, your borrowers can now schedule one-off payments in addition to their existing automatic bill payments. This can be a significant quality of life improvement for those that wish to pay off their debt earlier, or simply wish to take advantage of windfalls as they come.

See Automatic Bill Pay in Action

Want to learn more about our automatic bill pay options? Schedule a one-on-one demo with our sales team, or watch this 15-minute pre-recorded walkthrough today.