Cash: Rumors of its death are greatly exaggerated

Lee Ault, CEO of the first check guarantee service, TeleCredit (which subsequently morphed into FiS Global), once described the moment his business exploded in the early 1970’s. In this era before ATMs, and when BankAmericard –-not yet renamed “Visa” -– was approaching critical mass, retailers avoided accepting personal checks because they were considered too risky. Ault broke his pick trying to sell TeleCredit as a loss reduction service to the few retailers that accepted them.

The breakthrough came when he brought the “no checks accepted” signs he gathered from auto dealers in LA to meetings with automakers in Detroit. He opened the meetings by dumping the pile of signs on the table, and stated: “This is how you greet your customers today –- the first thing they hear from you is ‘no!’”

One company immediately realized that they could dramatically increase their business by making it easier for customers to pay with checks, and the rest, as they say, is history: TeleCredit’s “Welcome Check!” signs soon appeared in store windows everywhere, consumers pulled out their checkbooks, and everyone benefited. All the while, credit card usage continued to grow.

So, here we are, fifty years later, and all eyes are on the great payment innovators of our day: Square, PayPal, Google, Intuit, WePay, Stripe, and many others who are revolutionizing or replacing “plastic.” But what about good ol’ cash? Is it going away, as a Fortune Magazine cover story recently suggested? With apologies to Mark Twain, reports of its death have been greatly exaggerated.

Although we don’t often hear consumers trumpet how easy, cool or innovative it is to pull out a dollar bill at the register, there are still perhaps as many as 100 million U.S. consumers who must or prefer to pay with cash. Yet, most online businesses in the U.S. treat them like check-writers in the age of Leisure Suits, before Lee Ault went to Detroit.

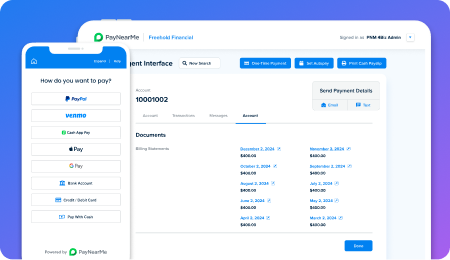

Outside of the US, a number of processes exist to serve cash consumers, including the Boleto system in Brazil and the Konbini systems in Japan. Within the U.S., Western Union’s WUPay enables cash payments through their walk-up bill pay agents; Walmart and Toys R Us have launched systems that facilitate cash payments through their own stores; and my own company, PayNearMe, enables cash payments for any merchant at 7-Eleven and ACE Cash Express stores, with other retailers coming soon.

Let’s take a look at who uses cash within the US, and why.

Many folks assume that cash consumers are not online or don’t carry smartphones, but it turns out that the opposite is true –- many are online (and have broadband access), and, interestingly, are more likely to carry smartphones than the population as a whole. Why? Because most cash consumers are younger, and the penetration of smartphones is more highly correlated with age than wealth. In fact, many less affluent cash consumers are ditching their PCs and expensive wired broadband connections altogether, opting instead to rely solely upon smartphones. Don’t believe it? Check out which devices are featured by the pre-paid operators.

Others assume that cash consumers are universally less affluent. This turns out to be false as well. “Cash consumer” and “underbanked” are not synonyms. While it is true that more than 25% of U.S. households are considered un- or under-banked — a population that has increased by 821,000 since 2009 – there are other giant audiences who simply prefer cash.

The most obvious are the roughly 21.5 million American teens, most of whom prefer to use cash because it’s the only form of tender they have (other than their parents’ plastic, anyway). Other groups consist of those who have maxed out their credit cards, use cash to budget, or simply don’t want their purchase histories to appear on their statements. These millions of people don’t come to mind when many of us conjure up images of cash consumers.

By the way, if you assumed I was referring to adult products when I mentioned hiding purchases, you’d be mistaken. Many consumers don’t want to share their purchases of shoes, fishing rods, games, and purses with their partners. Again, want proof? Ask the television shopping networks, trunk sellers, and other direct selling businesses about the lengths to which their consumers go to avoid using plastic. And, for further evidence that we’re not just talking about consumers in the lowest tax brackets, check out this independent study of Walmart’s highly successful Pay With Cash initiative, which concluded that “usage appears to be highest among households with an income of $100k or greater.”

The spending power of these consumers –- teens, privacy seekers, those who don’t want to use their cards for one reason or another, and the un- and under-banked –- represents a huge opportunity for those willing to serve them without penalties.

What do I mean by penalties? Some merchants assume cash consumers can simply use gift cards. But, while gift cards are perfect for gifting, they can be highly wasteful when used as a substitute for cash. Why? Because the thriving gift card industry is predicated on “overspending”– the observation that gift recipients tend to spend more than the face value of the cards they receive. On the other hand, if your sole means of payment is a gift card, you’ll inevitably end up with an unused (and likely unusable) balance. Other merchants assume cash consumers will happily buy a pre-paid debit card. Since they don’t use these products themselves, they don’t realize how many are laden with fees. Still others encourage cash consumers to buy and mail money orders, although it would be hard to name a more frictional process.

Clearly, inconveniencing cash consumers or burdening them with fees suppresses their ability to spend. Since these cash consumers visit and subsequently abandon online businesses every day, the revenue lost by companies who choose to ignore them is likely staggering.

I am not arguing that cash should limit the incredible innovation occurring in payments today. But just as Telecredit enabled businesses to serve consumers who preferred personal checks in the same era that credit cards were taking off, we should recognize again today that payments are not a “one-size-fits-all” phenomenon, especially in the current economy. Everyone wants, needs, and deserves payment options that make sense for them, and the merchants that recognize this will reap the benefits. Even if that means cash hangs around for a few more centuries.