Communication, Education & Accuracy – Lessons from the Post-Enrollment Operations for Health Insurance Exchanges Summit

With a host of stakeholders that range from government agencies and insurance carriers to health-care providers and consumers, ACA reform can only be successful if all parties adhere to the three pillars of working with entities of different agendas: communication, education and accuracy of information.

The 3 Pillars

1) Break down communication barriers across divisions and companies

Although most insurers at the conference agreed that they have traditionally worked in silos, the need to succeed within the ACA framework has forced them to change their ways and build bridges across company divisions.

State-based exchanges (SBEs), being relatively newer and nimbler organizations than their government counterparts, have been designed from the ground up to avoid silos so that knowledge is fluidly shared across groups.

The trend of collaboration has transcended company boundaries as well, with many SBEs now sharing best practices and holding weekly calls with their insurers.

Another fantastic example of this collaboration is the Health and Human Services (HHS) and federally facilitated marketplace (FFM)’s ‘alpha program’. The ‘alpha program’ brings together a group of major insurers, such as Blue Cross Blue Shield of Tennessee and Blue Cross Blue Shield of Michigan, for early access to review new HHS/FFM proposals and systems.

2) Share accurate information among HHS, FFM, SBEs and Insurers

Agreement on a consumer’s membership status is paramount for insurers to receive the correct level of federal subsidies and for consumers to receive coverage. The key to agreement is proper base-lining and reconciliation, ensuring that all entities are provided with the same information about enrollment, effectuation and overall membership.

Many insurance carriers have thousands of open ‘HIX Cases’. These are records that are either orphan (members that appear in the SBE/FFM records but not in those of the insurer, or vice versa), or have discrepancies with the information shown in the SBE/FFM records. In this case, the problem that needs to be addressed is agreement on which entity is the ‘source of truth’. In other words, who has the final say in case of a dispute?

Although there is no official guideline, the assumption has always been that the SBE/FFM would resolve any disputes, but what has transpired over time is that the entity that holds the consumer payment information is the one best positioned to be that ‘source of truth’.

Except in the case of the state of Washington, where the state’s Health Benefit Exchange collects all payments, the insurers are responsible for billing, and thus have the most accurate and up-to-date information.

3) Ensuring the best education and overall experience for the consumers

This idea was best communicated at the Post-Enrollment Operations for Health Insurance Exchanges Summit by Peter B. Nichol of Access Health CTwhen he said “Think through the eyes of the consumer.”

He asked the attendees – all representing major insurers and exchanges – to raise their hands if they had gone through the experience of enrolling on a health plan through their state marketplace. Not a single hand went up. How can we think through the eyes of the consumer when we do not know what they see?

Nichol pointed out that based on Access Health CT’s consumer behavioral studies, 80 percent of consumers on their website only did comparison shopping based on plan prices. Visitors were not checking plan details, ratings or network coverage. This means they are not making educated decisions that will bring them the most benefit.

How do we present the information so that they will make better choices?

It was also interesting to hear that 25- 40 percent of visitors to Access Health CT were accessing the site on their mobile devices. This could be due to convenience, or maybe because this is their only point of access to the web, but it begs the question – how many exchanges and insurers use responsive design for their mobile websites or launch native mobile apps?

Are insurers and exchanges considering the un- and under-banked when developing and improving their consumer experience?

In line with the topics of consumer experience and the importance of payments, there is a lot of conversation around the needs of the un- and under-banked and their associated demographics – age, ethnicity and income level.

For example, looking at income level, data from the Consumers Union ‘Fair Premium Payment Policies and Practices in Covered California’ shows that nearly 38 percent of households earning less than $50,000 are un- or under- banked.

According to the same report, “Persons of color are disproportionally unbanked: 1 in 5 African American households lacks a bank account; and Latinos are nearly 3 times more likely to be unbanked than whites.”

If we analyze how age affects payment behavior, we find that Millennials, regardless of income level, often prefer to use alternative financial services. For example, 34 percent in the lowest income bracket have used a check cashing service, which is comparable with 29 percent in the highest income bracket who have also used the service.

The main reasons Millennials provide for using AFS are convenience (42%) and predictable fees (31%).

What is the best way to reach such a diverse un- and under- banked population and what key services will they require?

At the conference, there was a lot of discussion around outreach, education and mobile-centric experiences, given that this segment of the population often relies on their mobile phones as their sole point of access to the web.

From a payments perspective, there was overall agreement that leveraging an existing retail presence from well-known and trusted national brands would be a winning proposition.

This model, when implemented through the right retailers, can provide the level of reach that makes cash payments easy, convenient and safe, through well-lit and secure sites that are easily accessible via public transport, open during convenient hours and multi-lingual.

There were concerns with currently available options – such as money orders, cashier checks and pre-paid cards – because of associated consumer fees and inconvenience.

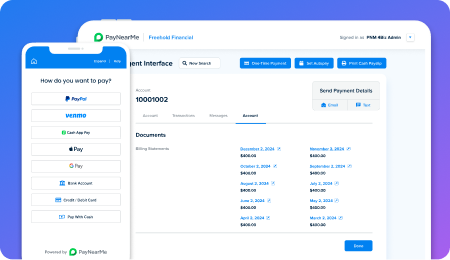

In general, insurers and those working for the exchanges are searching for options that can be more closely controlled by – and integrated with – the company receiving the payment. Options that can provide a more automated and friendlier payment experience will come out on top.

What’s next?

PayNearMe will be attending HFMA Fall Conference and Florida Association of Health Plans Annual Conference in September.

If you’re interested in hearing more about how PayNearMe allows you to accept cash for premiums while integrating with your existing systems and automating the payment experience, or you’d like to meet with me in person, email me and say hello!