Five Features Every Modern Payment Processor Needs to Have

For nearly every technology, there comes a time when usage shifts from early adopters and enthusiasts to a broader, mainstream market. Sometimes this shift is gradual, like the transition from records to cassette tapes to CDs.

In some cases, though, there’s a catalyst that causes a significant change in adoption trends. We saw this web mobile web usage after the introduction of the iPhone, and we’re seeing it again with the adoption of digital payments at the onset of the COVID-19 pandemic.

Consumers are now flocking to digital payments, taking advantage of the speed, convenience and instant gratification of online transactions.

At the same time, merchants need to be able to meet the growing demand and give their customers modern ways to pay bills. Much of this burden falls on payment processing platforms, which offer much of the front- and backend tools to facilitate the bill pay process.

While picking the right payments platform can be an in-depth, comprehensive process, there are certain features that signal how well a processor can meet the needs of modern consumers.

Apple Pay and Google Pay

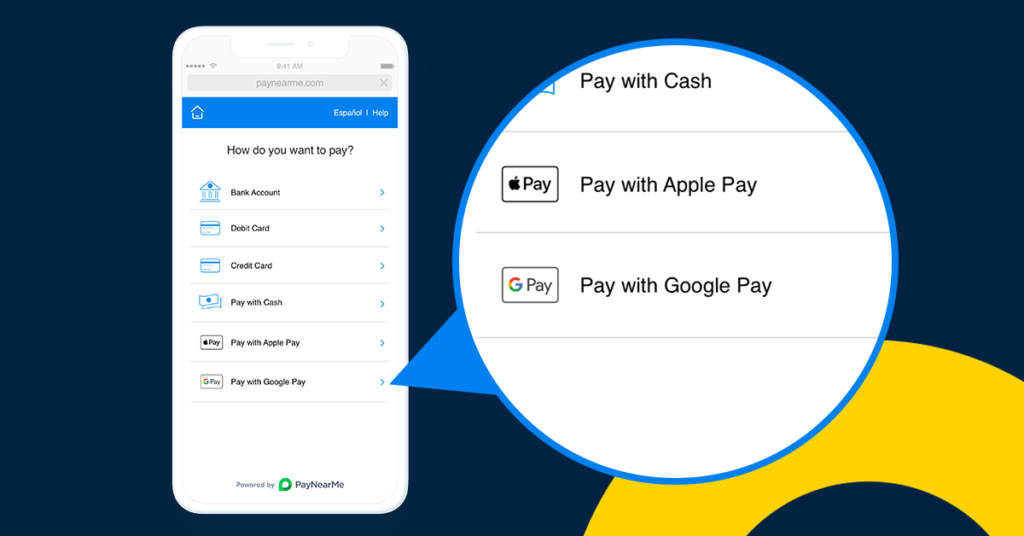

Apple Pay and Google Pay double as digital payment methods and mobile wallets that come standard with their respective operating systems. As payment methods, they offer a variety of benefits for consumers, namely the ability to securely make payments without typing or swiping payment cards. As wallets, they serve as a way to organize your financial life in one place, helping users keep track of payment information, upcoming bills, past transactions and more.

Since these free digital wallets are built into nearly every smartphone sold in the US (iOS and Android account for a combined 99.83% market share), it’s safe to assume that offering Apple Pay and Google Pay as native payment options is a smart play for billers.

The benefits of accepting Apple Pay and Google pay extend to merchants as well. For one, they reduce data input errors by prefilling card information on behalf of the user. This also means that customers will be using an up-to-date payment method, since expired or faulty payment types will likely be flagged by the apps.

Apple Pay and Google Pay also add another layer of security to online transactions, since the user often has to use a biometric (such as a fingerprint or face scan) to complete the transaction, lowering the likelihood of fraud.

Finally, Apple Pay and Google Pay cut down transaction times to mere seconds, allowing your customers to pay their bills anywhere and anytime—even when on the go.

Cloud-Based Updates

Cloud-based software has forever changed the technology update cycle. Gone are the days of numbered releases that require manual upgrades, planned downtime and significant IT resources. Modern payment platforms need to offer regular updates that release with little-to-no downtime.

Instead of waiting months or years for a manual update, you’ll always have the latest features, bug fixes and security enhancements as they are deployed. By limiting downtime and maintenance windows, you’ll ensure that you can accept payments whenever customers are ready to make them.

In addition, you’ll free up more time for your IT and development staff to work on mission-critical projects. And for businesses without in-house tech teams, this can mean saving thousands of dollars on maintenance and support costs each year.

Responsive Design

Mobile web browsing accounts for more than half of all web visits. So why is it that many bill pay platforms still don’t offer mobile-first payment experiences?

Responsive design offers an answer that appeals to nearly all users. Unlike dedicated mobile apps, responsive websites adjust automatically to any screen, allowing users to make payments on any connected device, regardless of operating systems or versions.

Responsive payment experiences also allow for unique experiences across devices. For example, on a large desktop screen you can show an image of a check being filled out as the account information is typed in, making it easier for your customers to input the correct payment information. On mobile, you can automatically detect if your customer is using an iOS or Android device, and give them the option to pay with Apple Pay or Google Pay, respectively.

Most importantly, responsive websites have extremely low barriers of entry. Your customers won’t have to download an app and you won’t have to pay to develop and maintain one. This makes online payments as easy as tap, pay and go.

Built-In Messaging & Reminders

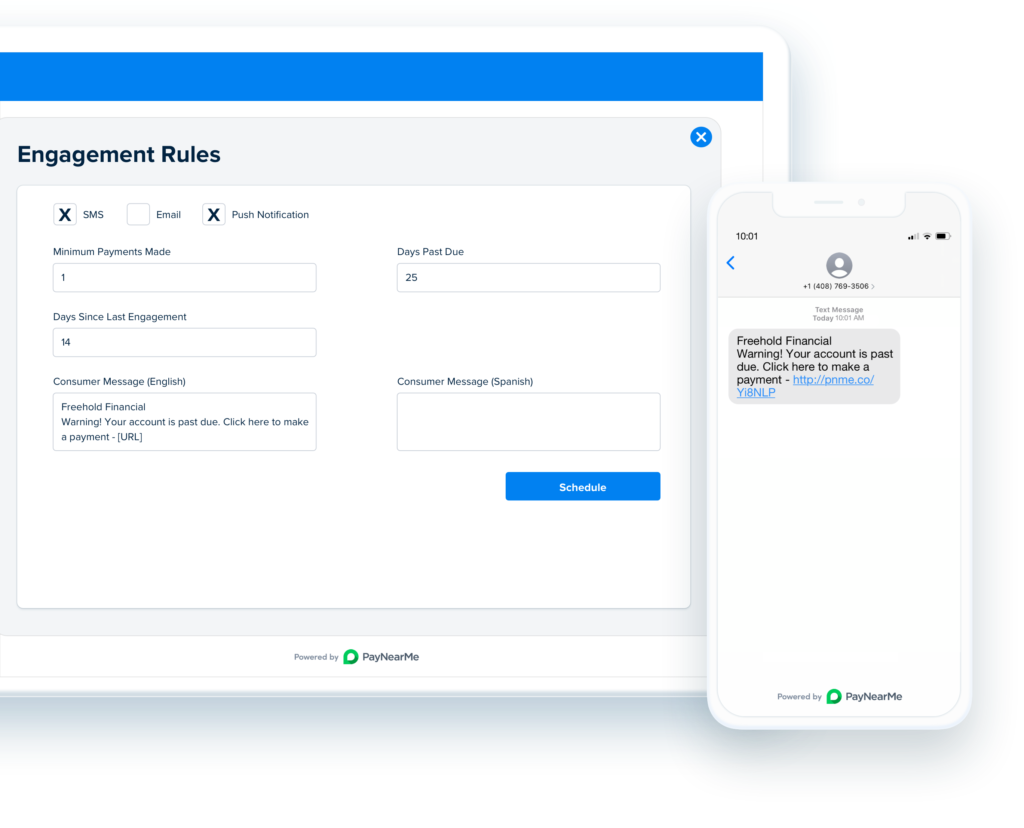

Pushing important payment reminders and notifications is just as important as accepting payments. After all, if your customers can’t easily remember where to pay and when their bill is due, you’re at risk of receiving the payment late.

That’s why your bill pay platform needs to have built-in messaging capabilities. At a minimum, this should include automated email and text message payment reminders that link back to your payment screens.

Taking it up a notch, you may also want to send one-off messages to all or part of your customer base. For example, if one of your branches needs to shut down for renovations, you may want to send a text message or email to all customers in the same zip code to let them know how long you’ll be closed.

Another advanced use of built-in messaging can be created segmented reminder streams for different groups of customers. In this case, habitual late payers could get more frequent payment reminders, while those who pay manually each month can get a reminder to sign up for autopay.

Without these capabilities built into your payment platform, you’ll need to connect a third-party platform, adding cost and integration challenges, or build your own solution that requires constant developer input and maintenance.

Payment Automation

The promise of technology has always been to help reduce manual input and increase efficiency. Payment automation is the logical iteration of this in the bill pay space.

When choosing a payment platform, it’s critical that you find one that can help reduce time spent on repeatable, mundane tasks. This can include cutting down reconciliation time with configurable reports, automatically sending payment reminders, simplifying chargeback management, and a myriad of other tasks.

Case Study: Auto Lender Cuts Reconciliation Time by 87% with PayNearMe

READ MORE

True automation comes when you pick a platform with the ability to create and run logic-based business rules. These rules allow you to build IF/THEN statements that automatically trigger at programmed times and drastically reduce the responsibilities of your staff.

For example, you may create a business rule that says, “if a customer has 3 or more failed ACH payments, then only let them pay with cards and cash moving forward.” This rule will help lower exception payments from repeat offenders, and free up time from staff that would otherwise have to remediate these issues.

Upgrade How You Get Paid with PayNearMe

PayNearMe is the modern bill pay platform that checks all the boxes above and more. Our award-winning technology puts your business at the forefront of digital payments, helping you delight customers, improve operational efficiency and save money.

Contact us today to request an interactive demo.