Beyond Transaction Fees: Four Inefficiencies Driving Up the Cost of Accepting Payments

Measuring the true cost of accepting payments is hard. Many lenders place too much emphasis on singular metrics (like per transaction fees) that are easy to compare when shopping for providers, but often miss the hidden operational costs connected to payment acceptance.

These operational inefficiencies can dwarf your per transaction fees and create expensive bottlenecks that drive up the cost of doing business. This becomes even more evident in a high-rate environment where margins are already tight, and CFOs are searching for new ways to reduce costs and enhance profitability, as explained by PayNearMe CEO Danny Shader in the ‘Leaders in Payments’ podcast.

While there are dozens of ways to optimize payments and collections, we’ve identified four common scenarios that plague lenders.

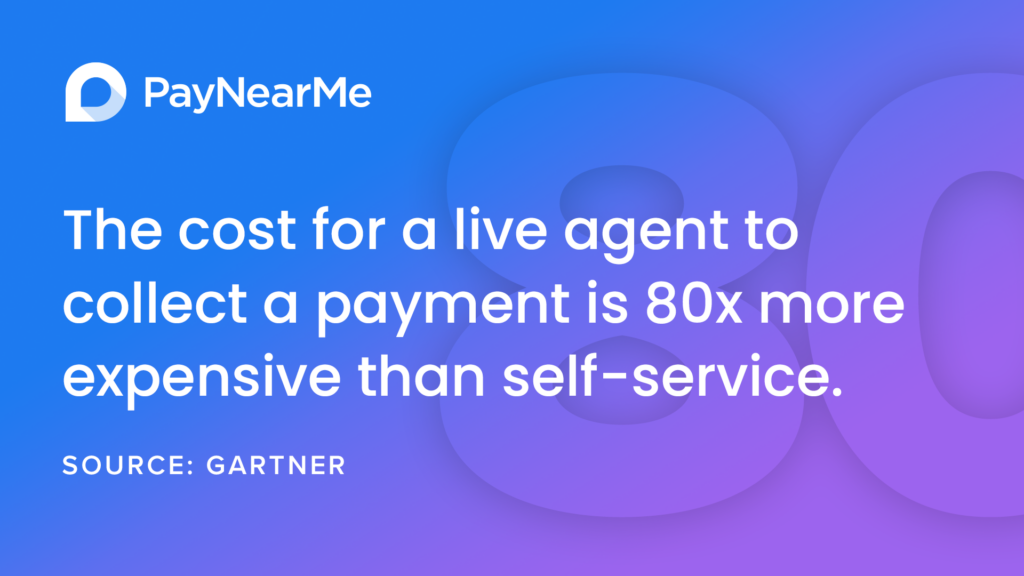

Accepting payments by phone

All too often, call center agents have to take payments by phone because customers had trouble doing it online. That’s an expensive use of time, considering each agent-led customer service interaction can cost up to $8 on average. By comparison, each self-service interaction may cost only 10 cents—or 80 times less.

In a 2023 consumer survey, PayNearMe found that 17% of consumers that call into a financial institution’s customer service line do so to make a payment. These are preventable, transactional calls that drive attention away from more serious customer service issues.

Lenders can reduce the time and cost of collections by giving customers a frictionless self-service payment experience. By combining a one-click payment solution such as PayNearMe’s Smart Link technology with other automated services, lenders can make it easier for customers to self-serve. And if people do call to make a payment, the IVR can route them to an automated system to handle it without needing an agent.

Manual account reconciliation

Studies indicate that more than one-third (34%) of businesses still use manual processes for critical payment operations. A company’s accounting team may have to reconcile several daily deposit files from multiple payment vendors, while separately matching additional files for chargebacks, cash payments and refunds. This can take hours per day and stack up costs significantly.

A Deloitte report estimates that 62% of costs related to processing payments stem from labor. And 51% of financial leads state that their teams waste an average of 8 hours a week on inefficient payment operations and manual reconciliation.

Simplifying this process can drive down the cost of acceptance significantly. Consolidating all reconciliation reports to a single file and automating the delivery and processing of these files can eliminate hours of manual effort.

Processing cash payments in person

Access to traditional banking services remains an issue in the United States, with over “15 million people living in a home with no connection to banks, and 48 million more in homes with only a tenuous connection to banks”, according to Jay L. Zagorsky, Clinical Associate Professor of Markets, Public Policy and Law at Boston University.

Subprime and non-prime lenders serve a large proportion of these customers, many of whom prefer to pay by cash or money order. As a result, staff spend inordinate amounts of time collecting, securing and transporting these payments to the bank.

That’s time and expense that could be avoided with the right digital capabilities. For example, PayNearMe’s cash at retail service enables cash payments at over 62,000 retail locations including participating 7-Eleven, CVS, Walmart and Walgreens stores. These payments are then processed and sent electronically to the lender, solving for many of the challenges associated with cash acceptance.

Mobile wallets (such as Venmo, PayPal and Cash App Pay) are increasingly popular with unbanked individuals, with one-third of people now storing money in payment apps instead of bank accounts. Enabling these self-service payment types can lower the cost of acceptance while also decreasing outbound collection calls.

Returns, disputes and other edge cases

Edge cases that make up a small percentage of your total payments can also account for an oversized share of your processing costs. For example, merchants pay on average around $3.60 for every dollar lost to a fraudulent or illegitimate chargeback. ACH returns, NSFs, outbound collections calls and other processes can significantly increase the cost of acceptance and eat into margins.

Finding ways to automate and streamline edge case processing can result in meaningful savings for lenders. Automated business rules should be set up to handle predictable situations, such as turning off ACH payments for customers who have 2 or more declines in a given time period, preventing repeat offenders.

In addition to business rules, many PayNearMe clients benefit from our built-in chargeback portal which streamlines the process of submitting evidence and managing disputes in a simple dashboard. Additional risk and fraud tools help to identify and prevent fraudulent activity before it happens to minimize the number of edge cases that need to be handled each month.

Speed the path to payments optimization

Going beyond simple transaction fees and digging into your true cost centers may take time and effort, but can be worthwhile when looking to reduce expenses and improve operational efficiency. Working with an innovative payments provider like PayNearMe can take much of the lift out of the process.

Learn more about how companies are leveraging our payments platform to streamline and optimize their payments stack by contacting us today.