How Credit Unions Can Build Relationships with Indirect Borrowers

Many credit unions face steep challenges to remain competitive and profitable—and it’s growing more difficult as loan delinquencies rise. Indirect lending is an important source of revenue, making up over 22% of credit unions’ portfolios. Yet late payment on indirect loans was 17 basis points higher than direct by late 2023, according to a study by creditunions.com. The pressure is on for credit unions to reverse that trend with compelling digital capabilities to help drive on-time payments.

Increasing borrower engagement for indirect auto lending is crucial. As of Q4 2023, credit unions held 12% of all new auto loans and a whopping 30% of all used auto loans in America. Unfortunately, indirect can often mean disengaged. People may see the institution as simply a generic finance company that provided their auto loan, and that impression persists if their primary engagement—making payments—is also generic.

But what if, instead, the payment experience was modern and surprisingly helpful? Enabling seamless and flexible digital payments could dramatically change an indirect borrower’s perception and open doors to more profitable outcomes.

Beyond improving loan performance, innovating the payment experience can also help credit unions convert indirect borrowers into long-term relationships to grow deposits. That’s a high priority, particularly as credit union loan originations have outpaced deposits in recent years, and concerns over liquidity spiked to 70% in 2023, a huge leap from 18% a year earlier.

So what does an optimal payment experience look like, and why is it so important? In this article, we’ll look at some critical success factors that credit unions can build into their digital strategy to improve their relationship with indirect borrowers.

Fast and frictionless options to improve on-time payments

Let’s be honest, nobody is ‘delighted’ by making a loan payment. But if the lender makes it the easiest bill to pay, it can make a difference in how someone prioritizes that payment and perceives that brand.

Traditionally, bill payment has been a hassle for many consumers. It often involves having to remember due dates and passwords for payment portals, or making time to call customer service during business hours to pay by phone. It’s an experience designed for how billers operate, not members—and it may be contributing to delinquencies.

An optimized payment experience is member-first and digital-first. Here’s a quick snapshot:

- It starts with digital reminders so people don’t have to remember due dates or call support to find out when their payment is due.

- A clean, modern interface should make it easy to pay in just a few clicks (both online and mobile), including a secure personalized connection to the member’s account so no login is needed.

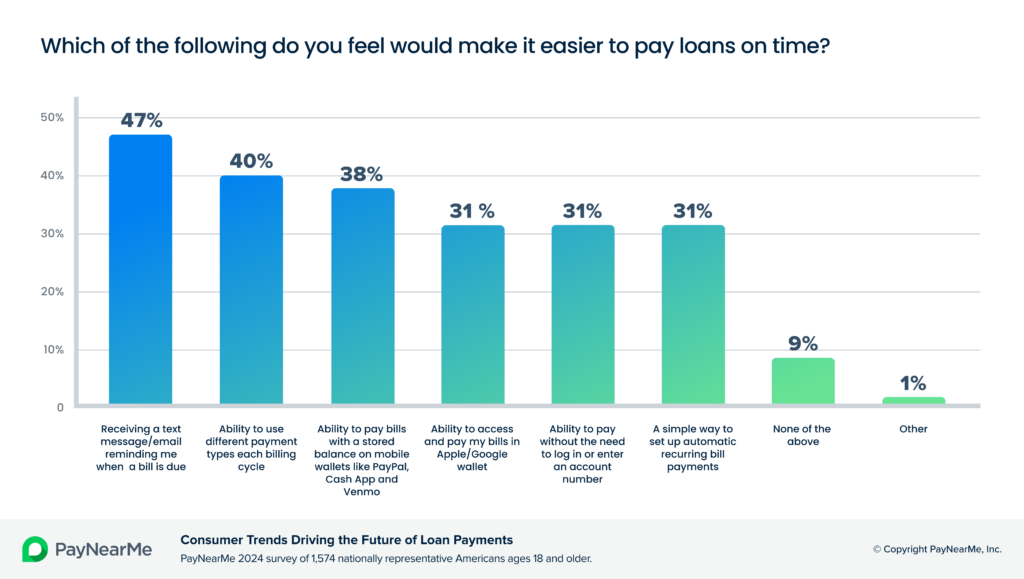

- An ideal experience also offers the convenience of paying with a variety of methods such as card, ACH, digital wallets (e.g., PayPal, Venmo, Apple Pay or Cash App Pay), even cash at a retail location.

- Borrowers should be given unique flexibility to make autopay more attractive, like selecting a preferred payment date and splitting payments within a month, options that may make it easier for them to pay.

Providing a helpful, frictionless experience can make indirect borrowers more likely to pay promptly and avoid delinquency. And with fewer late payments, the collections team has more time to focus on engaging delinquent borrowers to work out mutually beneficial solutions to minimize risk of default.

Self-service convenience to reduce costs

Some consumers still want to make payments by phone, but the majority of people prefer digital convenience. In fact, self-service is more in demand than ever, with 81% of consumers wanting more options to handle tasks on their own, including bill pay.

Nearly one in five consumers (19%) regularly call customer service to pay their loan, according to PayNearMe’s recent consumer loan report. That’s an expensive use of staff time, when on average a call can cost up to 80x more than self-service payments, according to Gartner.

Enabling borrowers to pay via self-serve can result in major cost savings. Rather than hiring and training multiple employees to accept phone payments, investing in a modernized digital payment solution can be much more cost-effective in the long run.

81% of consumers want more self-service options

CXM Today

In addition to reducing burden on the call center, an optimal self-service experience can help improve on-time payments and borrower satisfaction. With a new solution in place, credit unions can reach out to indirect borrowers before their next payment is due, welcoming them to enroll in autopay and other self-service channels.

Engaging experiences to open the door to future revenue

Providing an easy-to-use, personalized digital payment environment shows that the credit union understands consumer needs and cares about delivering high quality service. It’s a great way to build a positive impression with indirect borrowers who don’t have an existing relationship.

Offering more compelling digital experiences can be an opportunity for growth. More likely than not, an indirect borrower chose the institution based on a competitive auto loan rate, or the financing was through a dealership. Either way, they may not know anything about the credit union or its other products and services. Making a loan payment is the entry point for the relationship—and if that experience is exceptional, credit unions have a better chance of turning them into a multi-product member.

Beyond motivating borrowers to pay on time, the right digital experiences may make them more receptive to other products and services. Trying to cross-sell or upsell indirect loan relationships through traditional marketing efforts can be costly and might deliver minimal ROI. However, engaging these borrowers through a personalized payments experience enables an organization to tailor outreach to potential needs and preferred payment channels.

To enhance cross-sell and upsell efforts, a modern digital solution also empowers organizations to unlock value from payments data. Credit unions can capture useful insights about borrower behaviors and preferences to better understand how to deliver the right offer at the right time, on the right channel.

For example, soon after onboarding indirect auto loan borrowers, the institution might offer auto insurance or vehicle warranty products from third-party partners. Or perhaps ‘reward’ borrowers who consistently pay on time with offers for a credit card or high-yield savings account to encourage membership. If borrowers get a compelling experience from day one, it may be significantly easier for credit unions to evolve those relationships.

Fuel growth with the right payments foundation

Creating a meaningful first impression with indirect borrowers is key, and can be a powerful foundation for credit unions to grow profitable member relationships. PayNearMe offers a full range of payment options, including configurable solutions for credit unions.

See the PayNearMe Platform in action: