How Your Bill Pay Experience May Be Driving Up Costs and Delinquencies (and How to Fix It)

Businesses that rely on recurring payments know there are often a stack of related costs that can cut into profits. Billers may factor it in as part of doing business—but many underlying causes that drive up costs are preventable.

We’re going to unpack it in three tiers. We’ll look at:

- Common problems in the user experience that can lead to people paying late (or not at all)

- How those issues can translate into higher operating costs, and

- Innovative solutions that are helping billers and lenders reduce costs and friction for more profitable outcomes

Three user experience issues influencing late payments

Consumers have many competing demands for their monthly cash flow. But beyond lifestyle essentials (like shelter and food), research tells us that how people prioritize other bills is influenced by how easy they are to pay. That means billers and lenders may need to take a closer look at their payment processes, because some common pitfalls could be working against them.

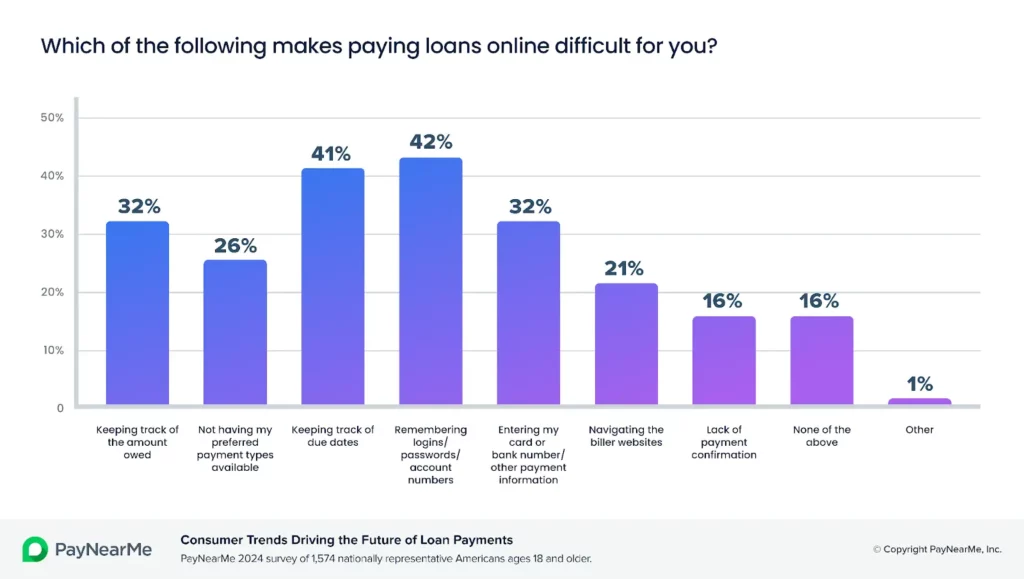

1. Poor interface or a complicated process

More than half of U.S. bill-payers (52%) have experienced at least one inconvenience when trying to pay bills online, and 29% have encountered multiple issues. Nearly 1 in 5 consumers paid a bill late because online bill pay was such a hassle they became frustrated and didn’t complete the payment. Millennials, in particular, have low tolerance for that friction. Of those aged 30 to 44, 38% said they did not complete their bill payment online because the process was too complicated.

Confusing online payment functionality is a contributing factor to a rise in the number of missed and late payments, according to a consumer survey by PayNearMe.

The Financial Brand

2. Remembering login details

While many consumers prefer to pay bills online, the login experience is a top challenge. 42% of consumers surveyed said that having to remember usernames and passwords makes paying loans difficult. Typically, they have to re-enter login details every month for all the various bill pay apps they need to access. In fact, 6 in 10 people encountered problems paying bills online, most commonly forgetting their username or password.

3. Remembering payment due dates

Another prevalent issue is keeping track of payment due dates and amounts. Customers may lose a paper or email bill, and rarely get a reminder, so payments may be late or missed entirely. As an example, 53% of younger payers (aged 18-29) may be likely to miss payments due to difficulty in keeping track of due dates.

PayNearMe’s 2024 consumer survey underscores the severity of these issues. More than half (51%) of consumers surveyed said that managing and paying loans causes them anxiety, and 60% wish that process was easier. For driving on-time payments, billers need to remove friction as much as possible.

Three ways poor online experience is driving up costs

When digital payment processes create headaches for customers, it often triggers more work for the business, and that means more cost. Here are some frequent examples:

1. Customers resort to paying by phone

41% of people surveyed by PayNearMe strongly agree they prefer to pay bills via digital channels rather than by phone. But if they have a frustrating experience online, people often turn to paying by phone. And that introduces risk as well as cost. For example, when faced with long waits in a call center queue, having to call during business hours or language barriers, customers may delay or skip a payment altogether.

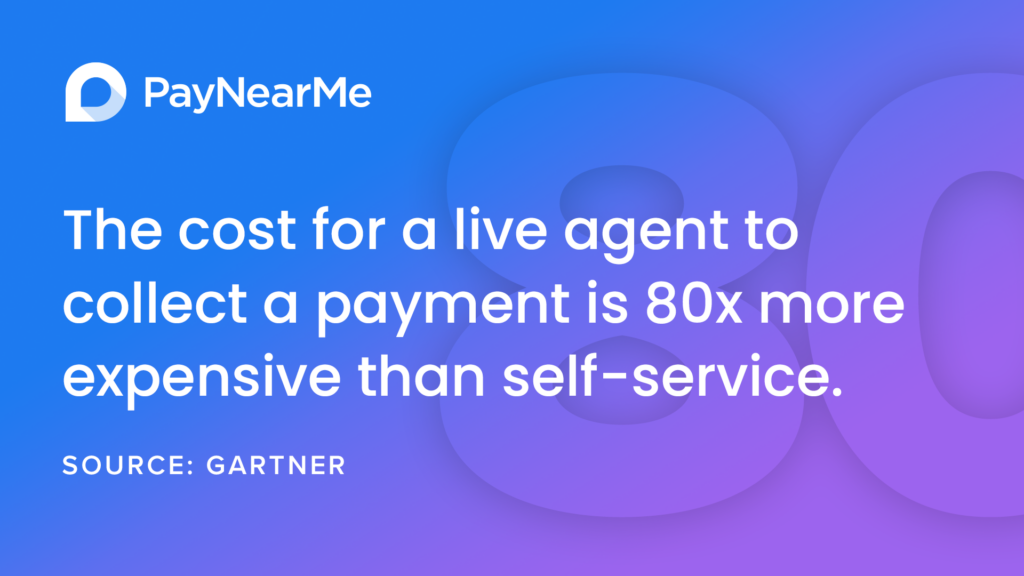

Beyond risking the cost of delinquencies, billers have to absorb the call center expense. Consider that each support call can cost up to $8, whereas self-service channels cost around $0.10 per interaction. It’s a powerful incentive for billers to modernize their payment experience with easy and flexible self-serve digital options.

2. Staff time wasted on calls for password resets

When live agent calls take an average of eight minutes and can cost up to 80x more than digital self-service, that adds up to a lot of waste for the business. And quite often, it is. Our research found that 52% of payment-related calls are about password resets, because people have trouble remembering login credentials for the biller website.

To improve cost-efficiency and productivity, it’s critical to reduce calls for tasks that might easily be handled through self-service. Billers need the agility to keep agents focused on strategically important work such as more complex customer service issues.

3. Increased likelihood of switching providers

According to Pymnts, 41% of consumers cite ease and convenience as the most important factors for choosing a digital channel to pay recurring bills. Now, that’s also the criteria for how people assess their overall experience with a brand. Negative interactions can cost more than just late payments, it can mean losing return business. Case in point: 82% of consumers say a poor loan payment experience would influence their decision to switch to a different lender in the future.

Three CX improvements to help increase on-time payments

Big Tech companies have set a new standard for seamless payment experiences. Billers and lenders that keep pace with the latest consumer expectations may have greater opportunity to boost profitability and gain a competitive advantage.

Modernizing operations can help eliminate many of the problems and costs related to payment acceptance. It’s a powerful way to amplify efficiency, reduce manual work and offer the personalized experiences that customers want. Here are three key examples:

1. Offer modern self-service payment options

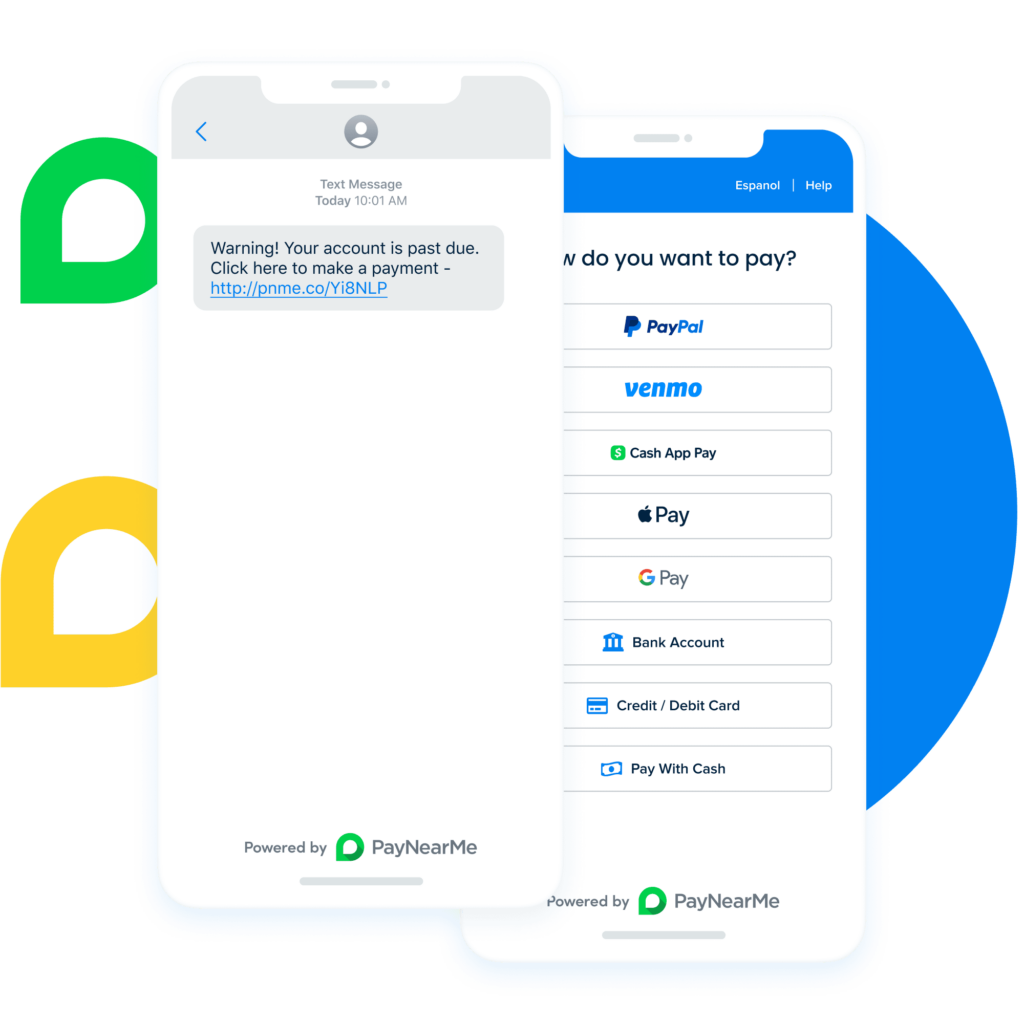

Removing friction in the payment experience can help billers avoid costly issues and boost acceptance rates. That means making interactions seamlessly simple, mobile-friendly and convenient. With the right fintech partner, companies can quickly go to market with a modernized web and mobile experience that integrates multiple payment options, from debit card and ACH, to digital wallets (PayPal, Venmo, Apple Pay, Cash App Pay, etc.) and cash at retail.

And, billers can gain a competitive edge with a payment experience that eliminates login hassles that customers dislike. For example, using PayNearMe Smart Link™ technology across multiple touch points, the business can send personalized links to customers for one-click access into their account, without ever having to type in login credentials.

2. Send digital reminders

Billers can remove the common pain point of having to remember due dates that can lead to late or missed payments. With an innovative payments platform, customers could receive a reminder via text message or email that includes a personalized link taking them directly into their personalized payment flow. It’s a popular improvement, considering 47% of people we surveyed agreed that receiving a digital reminder when a bill is due would make it easier to pay on time.

3. Drive autopay adoption with flexible options

Typically, autopay is an ‘on or off’ option, and the lack of flexibility keeps people from enrolling. In fact, 70% of consumers say they don’t use autopay because they want more control over when bills get paid. A modern payments platform can enable customers to personalize autopay to better fit their monthly cash flow cycles.

For example, people could choose a due date that syncs with when they get paid or split payments within a month instead of paying in one lump sum. 54% of surveyed consumers told us that splitting payments would make it easier to pay bills on time.

Modernizing bill payment to improve profitability

The payments landscape is changing rapidly, and delivering a modern, flexible and personalized payment experience is now crucial for billers to drive growth. Yet as companies juggle competing priorities, updating legacy payment processes can seem daunting. The right fintech partner can make it easier and faster to roll out a transformative customer experience that also simplifies back-end operations.

See for yourself with our on-demand virtual demo of the PayNearMe platform, or contact us for a personalized demo.