Mobile Payment Processing: How to Get Started & Avoid Common Pitfalls

With the proliferation of mobile web usage, consumers are increasingly using their phones and other mobile devices to complete digital payments. This means accepting mobile payments is no longer optional for businesses — but an expectation.

Millennials, as has long been predicted, are gradually taking up a larger percentage of the consumer base. This group has a strong affinity for tech and mobile, often spearheading adoption for new smartphone payment trends. In fact, a staggering 35% of all mobile wallet users are millennials.

If you haven’t incorporated mobile payments into your business yet, this guide will take you through the benefits of mobile payment processing and the potential pitfalls you need to be aware of.

Advantages of Embracing Mobile Payment Processing

Aside from the obvious benefits listed earlier, there are many advantages to accepting mobile-first payments. Here are some of the most prominent benefits.

Mobile Phones are Ubiquitous

About 96% of Americans own a cell phone of some sort. Out of this, 81% own smartphones that can connect to the internet and download mobile apps. For all intents and purposes, we can consider mobile devices to be as universal as televisions and automobiles in American households.

Given these stats, offering mobile payment solutions should be a no-brainer. Start by allowing mobile web payments, and give your customers even more options with digital wallets, SMS reminders and Apple Pay/Google Pay as payment types.

Phones are Always Nearby

Mobile payment processing offers unmatched convenience for your customers as they almost always have their phones on them. According to an IDC research report, 79% of smartphone owners carry their mobile devices with them up to 22 hours a day.

The implication is that your customers will be able to receive and pay bills much faster than with traditional mail, which many consumers will only check once or twice a day, and usually not on weekends.

Moreover, consumers tend to keep their phone numbers — even when they change addresses. This means you can still reach them throughout your entire relationship, which may span years for many businesses.

Mobile Phones Offer Many Ways for Consumers to Pay

Your customers will enjoy the versatile payment channels provided by mobile payment solutions, such as paying online, paying by text, calling a 24/7 IVR or even reaching out to your call center with a click-to-call option. They can conveniently complete payments anywhere, anytime. This is especially helpful for consumers with recurring bills.

Mobile payment solutions also allow your customers to save their preferred payment type for repeat usage. This allows customers to access their funds from a single device, eliminating the need to physically carry multiple cards and continuously type their payment account details over and over again.

Mobile Payments are Fast

Traditional payments, whether in-person, over the phone or by mail, all take time and can result in customer frustration. And because many payments happen in bunches (pay day, end of the month, etc.), customers are more likely to have to wait in line or on hold when making their payments.

Digital transactions, on the other hand, are nearly instant. Customers can skip the lines pay bills with a few clicks, especially when saving card or bank account information via digital wallets such as Apple Pay and Google Pay.

These time savings directly translate to better profitability for you as well, allowing your business to collect more payments on time and pay less per payment on in-person processing costs.

Mobile Payment Processing: Potential Pitfalls to Avoid

While mobile payments can be a boon for your business, it’s important you avoid some of the common pitfalls that can hinder the experience.

Make Mobile Payments Easy

Don’t make mobile payments a chore for your customers. Some businesses require customers to remember their username, password, account number and payment amount, while asking for the same information every time the customer tries to pay.

Instead, send customers smart payment links that autofill the most important information and allow them to pay you in less clicks. You can use texts, emails, and push notifications to make the payment process smoother, while also allowing customers to securely save their favorite payment accounts for future transactions.

Integrate with Digital Wallets

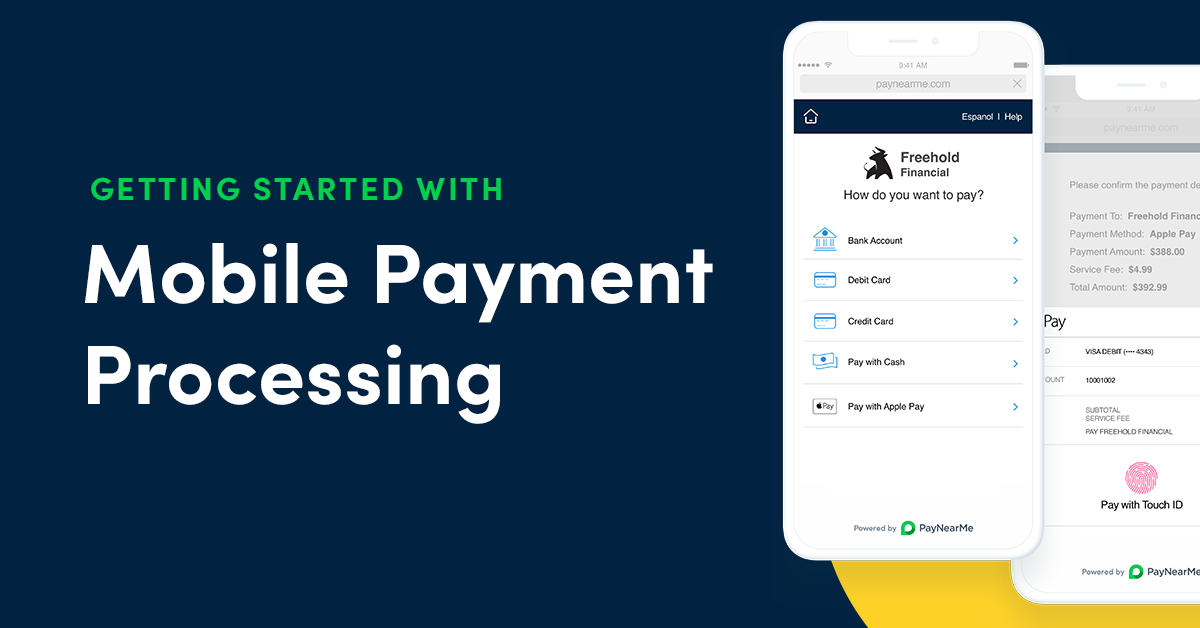

You can facilitate one-click payments by investing in a mobile payment solution that can be integrated with popular digital wallets like Apple Pay and Google Pay. These digital wallets allow customers to view bills, make payments, download statements and more, all without having to download a separate app on their phone.

Don’t Limit Payment Options

Limiting the number of payment types available to customers on mobile will inevitably cause frustration and drive adoption down. To overcome this, ensure your business’s payment platform is integrated with all the major payment options, including cards, ACH, cash payments and more.

Ensure Your Payment Experience is Mobile-Friendly

To ensure great customer experience, your platform should be mobile-first, not a relic of the desktop only days. Don’t make customers pinch and zoom trying to navigate a desktop landing page on their mobile phones.

Don’t forget to optimize the form fields for easy input as well. For example, if the interface prompts the customer to input their card number, change the keyboard to a number pad to make the process easier and faster for the customer.

Don’t Force Customers to Download an App

Apps can be cumbersome and might not be compatible with some customers’ phones. These apps also create more management and support costs for your business, making them less appealing to keep updated over time.

Instead, opt for mobile web payments, while incorporating digital wallets to mimic the dedicated app benefits such as push notifications and offline access.

Get the Best Mobile Payment Processing with PayNearMe

Payment technology is quickly evolving, and your customers or clients expect you to keep up. Mobile payment processing offers your customers a faster, easier, and more secure experience.

To ensure your business offers exceptional payment experiences, get an innovative and feature-rich payment platform.

PayNearMe gives your customers the convenience and flexibility they need while ensuring top-notch security standards and unrivaled uptime. Request a demo today.

Back

Back

Back

Back