Five Ways to Modernize Your Bill Pay Processes

Updated April 2025

As profit margins tighten and operational costs rise, lenders are under more pressure than ever to streamline their payment operations. One often-overlooked area with outsized impact? The bill pay experience.

Today’s consumers expect fast, flexible, mobile-friendly ways to pay their bills—and when those expectations aren’t met, payment exceptions, delinquencies and support calls follow. This can result in a higher total cost of acceptance.

Prioritizing the payment experience isn’t just about delivering better bill pay experiences—it’s a smart business strategy. By rethinking the way you collect payments, you can reduce costly exceptions, increase self-service and eliminate unnecessary friction for your customers. In this article, we’ll cover five ways that prioritizing payment experience management helps reduce exceptions, improve poor payment experiences and ultimately lower your total cost of acceptance.

1. Adopt mobile-first web payments

Today’s consumers are used to making purchases with a swipe and a tap in seconds on their mobile devices. Yet, bill pay continues to lag behind. Why should paying a bill be any more complicated than buying a coffee?

Mobile is now the dominant channel for web access, accounting for over half of all global web traffic, according to Statista. In order to align with consumer behavior and expectations, lenders should deliver a payment experience that caters to and is optimized for mobile users across devices and platforms. To meet consumers where they are—and how they want to interact lenders must provide a payment experience that is mobile-first, responsive and personalized across all devices.

Encouraging self-service mobile payments has real cost-saving potential. It reduces reliance on live agents, lowers call center volumes and cuts back on expensive in-person or mailed-in transactions.

However, mobile-first doesn’t mean you have to mobilize your IT team to create an app. On the contrary, apps can lead to unnecessary technical debt, increasing your total cost of acceptance.

Responsive web apps neatly sidestep this problem, making it easy for customers to make mobile payments without any additional friction. Mobile-first, responsive payment flows scale backwards beautifully, working on larger devices without much additional work.

Using a fully-hosted platform can help you reach more mobile users with little-to-no IT resources, making each self-service payment more efficient and profitable.

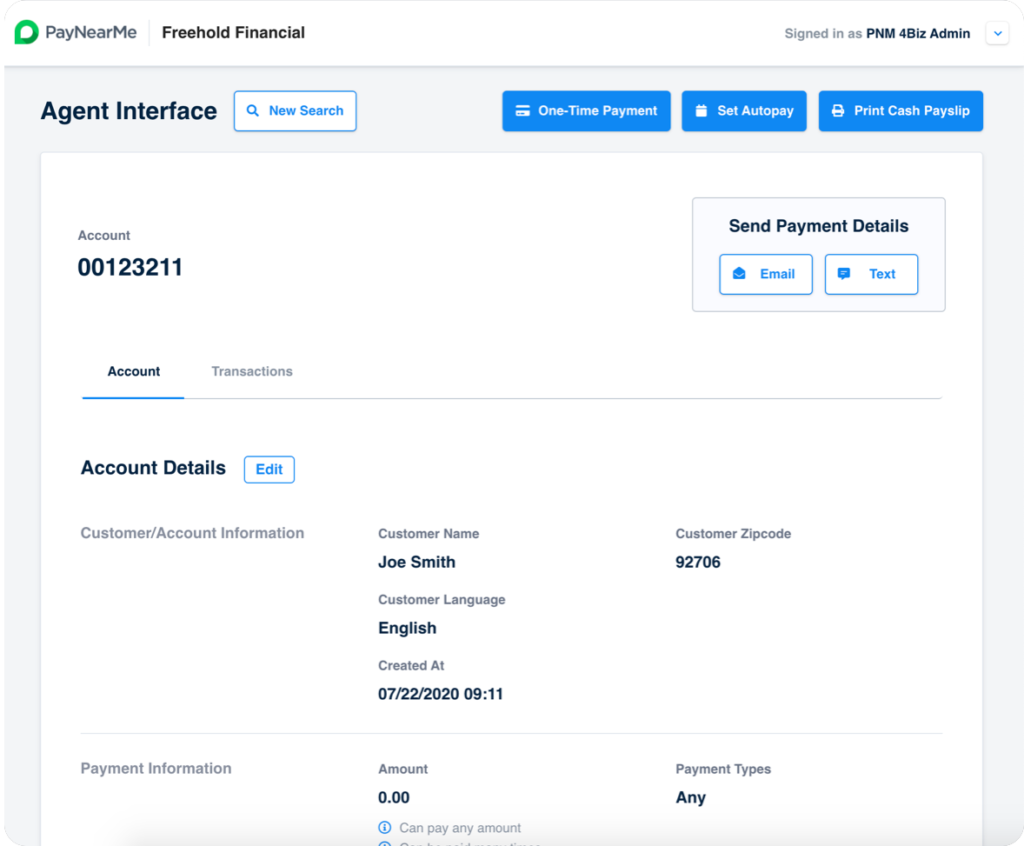

2. Give agents better tools

Poor payment experiences don’t just apply to your customers—they can apply to your agents as well. Every extra minute your agents spend navigating clunky systems on collections calls eats into your margins. The goal is to make each interaction as efficient and productive as possible—without sacrificing customer service.

This is where payment experience management comes into play. Your agents will be more productive on each call when they have:

- All the information they need about a customer in a single screen

- Quick access to make one-time, recurring and future-dated payments

- A simple way to add new customers on the fly

- The ability to send payment info by text or email in a single click

When your agents are empowered with streamlined workflows, talk times shrink, productivity improves and support costs decline—driving down your total cost of acceptance over time.

3. Switch to digital billing reminders

Despite the rise of digital communication, paper bills still persist in lending—bringing with them high costs for printing, postage and processing. The solution? Make digital the default.

According to Consumer Affairs, a whopping 98% of the U.S. population has a mobile phone. Therefore, you can expect to reach nearly all of your customers through a combination of text messages, push notifications and emails. These communications cost a fraction of traditional mail, and cut down the time to send from several days to several seconds. This time and hard-dollar savings are yet another way to reduce your total cost of acceptance.

PayNearMe takes reminders a step further, offering one-click access to make a payment—no account number, username or password required. Why does this matter? Our research found that 52% of payment-related calls are about password resets because people have trouble remembering login credentials for the biller website. Imagine how much time and money you could save by removing this hurdle from your customers.

For example, look how elegant and simple the payment experience can be for your customers with pay by text:

By accepting payments via email and pay by text, you are supporting a more straightforward, intuitive and positive payment experience for your customers while cutting down on both outgoing and incoming paper processing costs.

4. Offer flexible payment options

Today’s bill pay experience should adapt to your customers—not the other way around. Consumers expect flexibility in how they pay, and nearly one-third of U.S. adults (29%) say that having more payment options would make it easier to pay bills on time. They also want the freedom to switch payment methods from one cycle to the next—whether that’s using a debit card one month and a digital wallet the next.

Offering this level of flexibility doesn’t just improve the payment experience—it directly impacts your operational costs. When customers can pay how and when they prefer, on-time payment rates rise, reducing the need for follow-ups, collections calls or exception processing. In fact, 35% of consumers say that being able to store bills in their Apple or Google Wallet and pay via smartphone would make paying bills easier. PayNearMe makes that possible with a simple, three-step process:

- The customer adds a biller card to their Apple or Google Wallet.

- Push notifications remind them to pay each billing cycle, with a personalized link—no login required.

- They select a preferred payment method and complete the transaction in seconds.

By enabling preferred payment types and removing unnecessary friction, lenders can deliver a more seamless payment experience that drives down the total cost of acceptance.

5. Personalize the payment experience

Offering a variety of payment types is table stakes—but it’s no longer enough. Today’s consumers expect payment experiences to be just as personalized as the rest of their digital lives. In fact, nearly 70% of survey respondents said it’s important that bill payment platforms recognize them and tailor the experience to their specific account.

Personalization helps lenders provide a better payment experience—and is a critical lever for reducing the total cost of acceptance because the more tailored and intuitive the experience, the more likely customers are to pay on time and without assistance.

Here are a few impactful ways to hyper-personalize the payment journey:

- Send personalized payment reminders via text or email. Forty-one percent of consumers say keeping track of due dates is difficult, and 47% say that reminders would make it easier to pay on time.

- Offer no-login, one-click access to make a payment. Over half of payment-related calls (52%) are for password resets—a clear sign that complex login requirements increase frustration and drive up call center costs.

- Pre-fill payment screens with key account details such as loan number and amount due. Eighty percent of consumers expect this level of personalization, and it’s a simple way to remove friction and reinforce trust.

Small enhancements like these go a long way toward delivering a frictionless, self-service experience—helping you streamline operations while making it easier for customers to pay.

Future-proof your payments strategy with PayNearMe

Here at PayNearMe, we provide innovative payment solutions for businesses looking to deliver a modern payment experience that reduces fricti

Improving your payment experience isn’t just about keeping up with consumer expectations—it’s a strategic move that directly lowers your total cost of acceptance.

From embracing mobile-first design and empowering agents with smarter tools, to offering flexible payment methods and hyper-personalizing the journey, these changes are simple to implement—but deliver measurable results. The less friction your customers encounter, the more likely they are to pay on time.

Get in touch with our team to learn more, or browse the features of our payments platform.