The New Payment Processing Trends to Know for 2020

There’s no doubt that we’ll look back at 2020 as a pivotal year for payment processing. The combination of changing consumer preferences, new technology and pandemic pressure is resulting in explosive shifts in bill payment habits. Let’s look at some of the most impactful trends in the space and how they are defining the future of payments.

Mobile Payments Are Going Mainstream

To meet evolving consumer preferences, many businesses are upgrading from legacy systems to more modern payment platforms. This has resulted in a massive shift in mobile bill pay options. There are a couple of strong drivers behind this trend.

1. The number of digital natives in the market is growing

Tech-savvy Millennials and Gen Z consumers are becoming a growing segment of the market – by 2026, 59 percent of consumers will be digital natives. These younger generations have grown up with mobile payment technology and are used to making payments with their smartphones. Seventy percent of Millennials use their phone for purchases, and 40 percent use mobile payment apps such as Venmo, Zelle and PayPal. Forty percent of Gen Z consumers have made a payment with a digital wallet app, and that number continues to grow as smartphone manufacturers push the limits of what is possible with mobile payment tech.

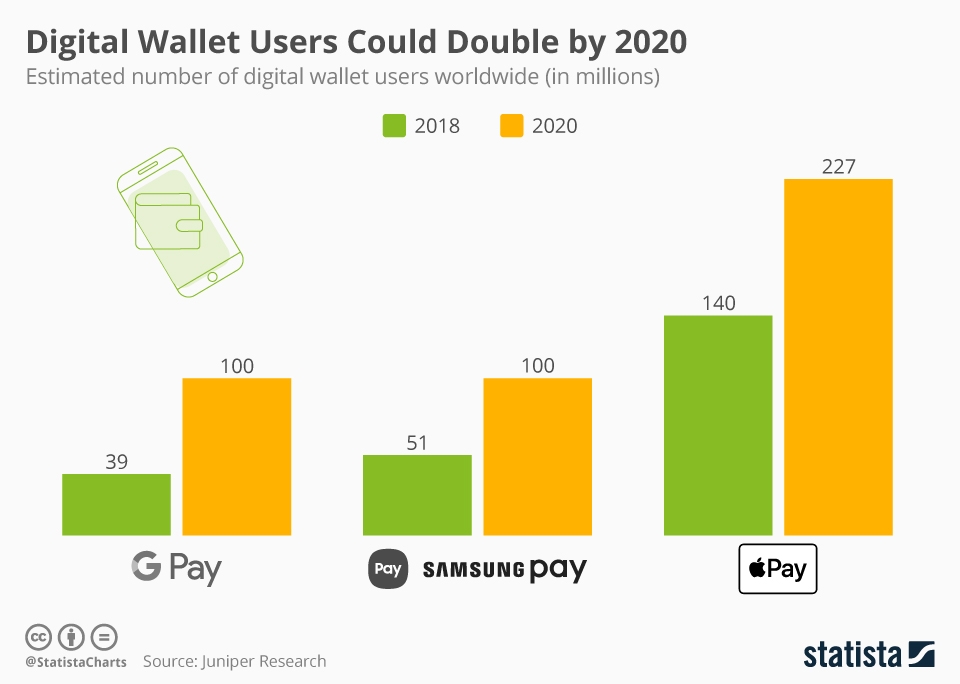

Image courtesy of Statista

Image courtesy of Statista

2. The coronavirus crisis has forced everyone to rethink in-person payments

Consumers are opting for contactless payments to help reduce the spread of the virus. While the public health concern may be temporary, the effects on payment processing won’t be. As people adopt digital wallets for everyday purchases, they’ll come to expect the seamless convenience of mobile pay. This will push digital wallets such as Apple Pay and Google Pay into the forefront for everything from loan payments to energy bills.

In the U.S., the use of digital wallets and mobile payment apps was already starting to show serious traction in recent years. Even before the pandemic shifted consumer payment preferences, 2020 was poised to be a fulcrum for mobile payment adoption. One study conducted by Jupiter Research predicted that the number of digital wallet users would double from 2018 to 2020, and recent times have made that prediction seem low.

So far, the pace of change is faster this year. The total payment volume for Venmo reached $39 billion in Q2 of 2020, up from only $24 billion in Q2 of 2019. While statistics on Apple Pay and Google Pay for 2020 aren’t released yet, consumer surveys point to an uptick in usage. According to a new J.D. Power survey, one in five respondents said they are using mobile payments more often in 2020 due to COVID-19.

New Payments Tech is Increasing Engagement

New tech is making it easier to engage with customers across devices, channels and platforms. These innovations are also bringing more flexibility to the payment process, which is empowering customers to tailor bill payments to their needs.

- Payment reminders sent by email, text message and push notification are helping customers pay bills on time. These reminders allow your customer to click a link and go straight to their payment page, without requiring a username or account number. The recipient can then quickly and easily make a secure payment using their smartphone in seconds.

- Chatbots relying on natural language processing and AI algorithms are starting to offer human-like experiences for customers. They can check information on their accounts or past transactions with a simple, friendly chat. Customers can also use natural language to initiate payments with these services.

- IVR is continuing to get better, making 24/7 payments possible. Formerly, interactive voice response technology used to provide only basic functions. Now, companies are building payments into IVR. Customers can pay by phone without ever needing to speak with a live agent.

These and other advances in technology are just the tip of the iceberg, with new enhancements hitting the market faster than ever before.

RTP Is Making Payment Processing Faster

The scope of real-time payments could be huge. With real-time payments (RTP), transactions are settled instantly, allowing merchants and customers to fast-track the payments process. This makes sending or receiving payments not much different than using cash – the original instant financial transaction.

This upcoming trend won’t just make payments faster. It also makes them seamless.

- Same day bill pay – customers won’t have to worry about mailing a check or making a card payment days ahead of a payment due date because the transaction happens in real-time.

- Less time and money wasted on tracking late payments that were already sent – your business receives payments immediately, which can improve cash flow management.

- Real-time disbursements – Insurance claims, account credits, and other disbursements can be sent to customers through debit card networks in a fraction of the time it takes to send money with traditional checks.

- Streamline the user experience – with real-time payments, customers won’t have to wait or worry. When your company partners with a payments platform that can integrate with an RTP system, payees are notified the moment funds are delivered. When making a payment, there are fewer steps involved. It’s as simple as tapping a button on their smartphone to authorize a payment.

Payment Processing Is Evolving Fast

Is your business ready for tomorrow? If you’re still operating on a legacy payment system, consider switching to a modern platform such as PayNearMe. To offer your customers the seamless experience these trends promise, you’ll need a platform that’s set up for easy integration with new technologies.

PayNearMe is a flexible, innovative platform designed to make payments easier for businesses and consumers. Contact us to learn more about how you can use it to provide customers with an exceptional user experience.