How to Streamline Collections with Self-Service Payments

Updated May 2025

It’s no secret that today’s consumers expect convenience in virtually all aspects of their digital lives. Want that new book your co-workers are raving about? A few taps on your phone and it’s on your doorstep by dinner.

Your customers expect the same ease when managing their finances.

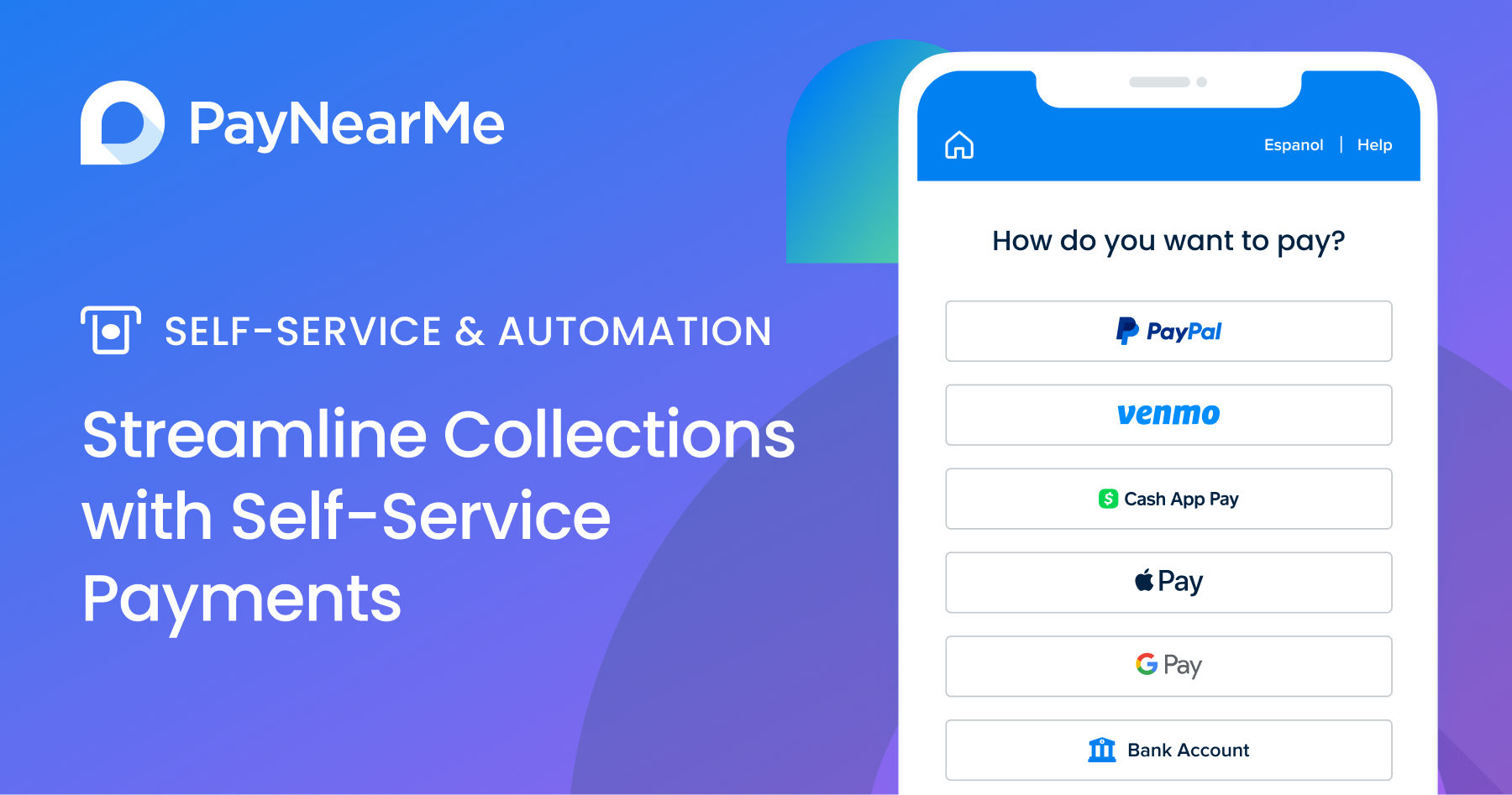

Today’s consumers expect a seamless, mobile-first experience when it comes to paying their loans. No lines. No hold music. No shouting “REPRESENTATIVE!” into the phone. Just quick, intuitive self-service.

And while this level of convenience delights customers, it also holds untapped value for businesses. Enabling self-service isn’t just good customer service—it’s a smart, scalable way to drive efficiency and reduce costs. But to unlock the full value, lenders must shift from thinking about payments as a transaction to managing them as an experience.

That’s where Payment Experience Management comes in—a strategy that optimizes every part of the journey—from customers to agents and operations.

The high cost of manual payments

Let’s talk about where the costs of manual payments pile up.

Each time your customers call your contact center to make a payment, it costs you—an average of $8.01 per call to be exact. That’s 80x more than the cost of a self-service payment. And many of these calls aren’t complicated—they’re routine tasks such as making a payment, setting up autopay, updating a payment date or resolving login issues. These repetitive issues point to a deeper problem: a broken payment experience.

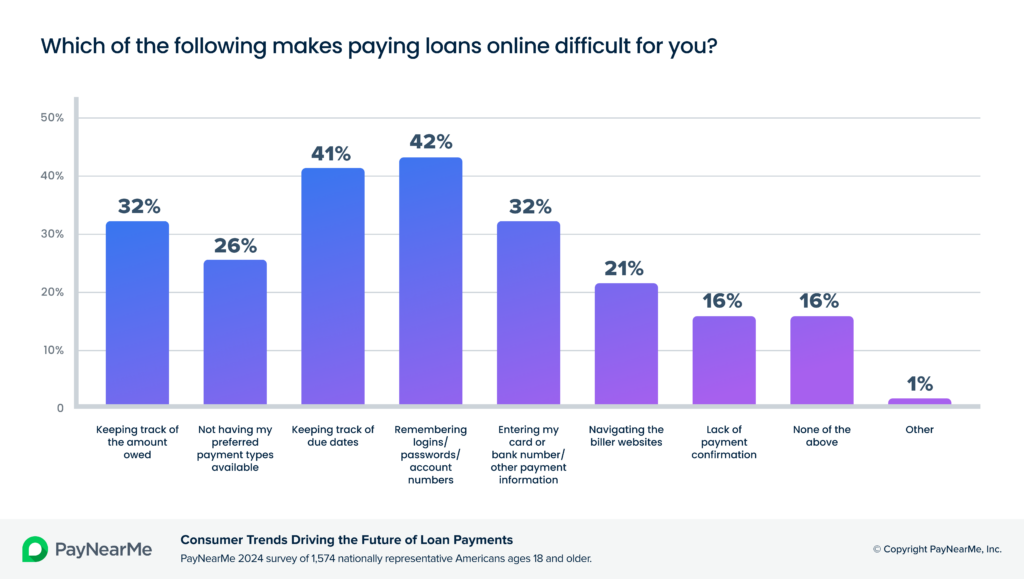

In fact, according to PayNearMe research, 42% of consumers say remembering logins and passwords is the biggest frustration when paying loans. That’s not a call center problem—it’s a payment experience problem.

Self-service was built to solve this. By shifting routine interactions to self-service channels, you can not only lower your total cost of acceptance, but also redirect your customer service representatives to focus on what matters most—delinquent accounts and complex issues.

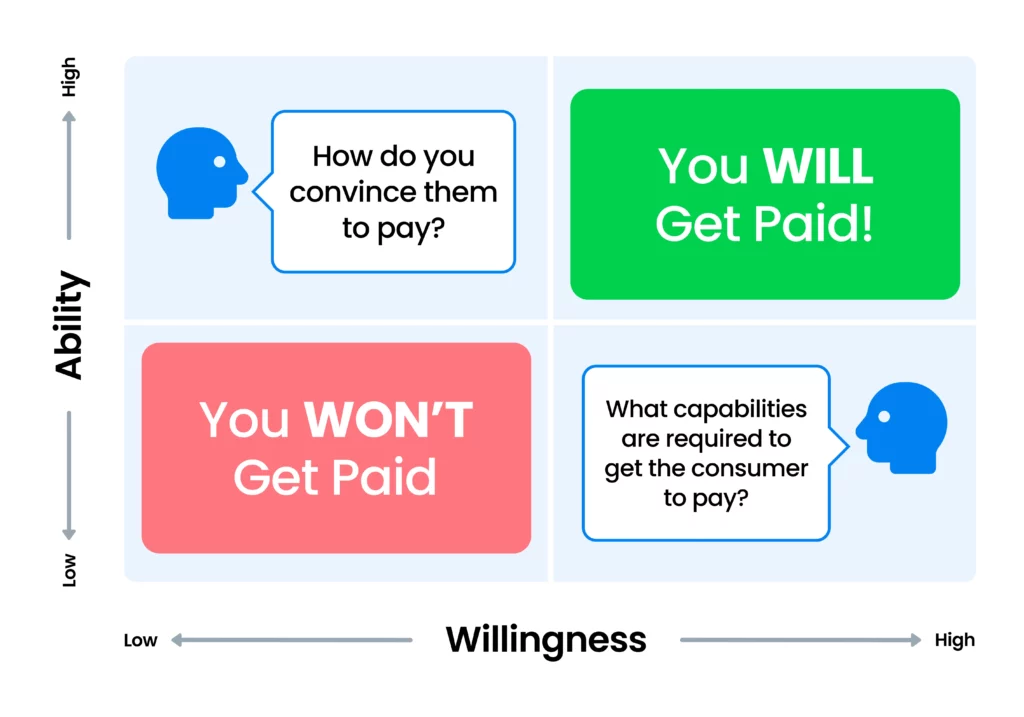

The willingness and ability matrix

Reducing call volume is one piece of the puzzle.Understanding why customers don’t pay on time is another. The simple truth is, most customers aren’t trying to avoid payment—they’re simply caught between their willingness and ability to pay. To drive better outcomes, you must meet customers where they are—emotionally and financially.

- Willing and able: These customers just need an easy, convenient way to pay. For them, frictionless self-service options—such personalized payment links, saved payment methods and passwordless entry—make it easy to stay current without agent intervention.

- Willing but not able: These customers want to pay, but life gets in the way. Offering flexible tools such as partial payments, future-dated options and a wider range of payment types and channels can help them self-cure before they slip further behind.

- Able but not willing: These are the procrastinators. For this group, removing friction is critical. Smart reminders, push-to-pay links and frictionless flows can convert intent into action with less effort—and fewer calls.

- Not willing or able: No one starts in this category. Often, poor payment experiences such as clunky interfaces and limited payment options push people here. Proactive outreach, early identification and automation can help minimize the number of accounts that fall into this high-risk segment.

By aligning your payment experience to each customer’s situation, you can reduce payment friction, improve recovery rates and ultimately lower your total cost to collect.

Four smart ways to increase self-service payments

Once you understand where your customers are coming from, the next step is making it easy for them to stay current—without picking up the phone. Here are four proven strategies to encourage self-service adoption and lower your cost to collect:

- Send proactive payment reminders

Give customers a gentle nudge when a payment is coming due—or if they’ve missed one. Automated SMS, email or push reminders with embedded payment links make it fast and easy to take action in the moment. The easier it is to pay, the more likely they are to do it without needing agent support. - Increase autopay enrollment

Autopay is one of the simplest ways to reduce missed payments and manual follow-ups. You can drive enrollment by surfacing the option in reminders, offering it during self-service flows, or training your agents to promote it during live interactions. Once it’s set up, it becomes one less thing for your customers—and your team—to worry about. - Empower agents to promote self-service

Not every call needs to end with an agent taking a payment. In fact, many interactions can be used to guide customers toward self-service options for next time. Arm your agents with tools like Smart Links and training that helps shift customer behavior and set the stage for more self-service the next time they have to pay. - Offer alternative payment methods

Different customers have different preferences—and limitations. Some don’t use traditional bank accounts, while others expect to use digital wallets such as Apple Pay or PayPal. By offering more ways to pay, including cash at retail, you meet customers where they are and give them the flexibility they need to pay on time.

Managing the entire payment experience

To truly unlock the value of self-service, you need to look beyond the transaction and focus on the full payment journey.

It begins with managing the entire end-to-end journey—not just the payment itself, but every moment around it. That’s the power of Payment Experience Management.

From the first payment reminder to the final confirmation message, every interaction can be optimized to reduce effort, improve clarity and increase success rates. And behind the scenes, your teams gain better tools to manage exceptions, reduce failed payments and drive better outcomes—all with fewer manual touchpoints.

Modern payment platforms make this easier by combining payment acceptance with robust experience management tools. Features such as Smart SwitchTM, automated messaging and flexible autopay schedules help you reduce failed payments and improve customer satisfaction—all while keeping operational costs in check.

Legacy systems are holding you back

Of course, even the best strategies will fall short if your technology can’t support them.

Legacy systems often limit payment types and restrict flexibility. They force every customer through the same rigid process—regardless of their needs or preferences. That creates friction, increases delays and ultimately, increases your cost to collect.

Make self-service work for you

Done right, self-service payments can lower your total cost of acceptance, reduce staff workload and help more customers stay current on their loans.

At PayNearMe, we believe managing payments should be as easy as making them. That’s why we help you build flexible, intuitive self-service payment experiences that meet your customers where they are—and improve your bottom line.

Learn more about how PayNearMe can help lenders dramatically improve their bottom line. Click here to view an instant, on-demand demo.