The Anatomy of Engaging Billing Statements

Monthly billing statements are wildly underrated. Many businesses treat them as glorified invoices, mailed each month to share simple information such as balances, payments due, account notices and payment options. And while these are all worthy (and necessary) use cases, they don’t come close to unlocking the hidden engagement potential in your statements.

Think about the psychological attachment customers have to bills. They may ignore your calls, swipe past your tweets or opt out of your email promotions, but the statement always seems to get through. After all, most customers don’t want to miss a payment or lose access to their account information.

This bond with billing statements creates an excellent opportunity for your business. Imagine being able to share high priority messages to your customers each month, without having to opt them into a new communications channel.

In a recent webinar with our partner FSSI, we broke down the elements of an engaging statement and shared practical tips any biller can implement to make the most out of the monthly billing cycle. Here are some of the highlights.

Designing Statements with Purpose

Before you stop the presses and radically update your statements, it’s important that you first take a moment to decide the intended purpose of the document. What goals do you want to achieve with your statements? How do these goals support your higher-level business strategy?

In general, FSSI’s Dan Palmquist believes there are four primary areas to consider:

- Advise: Increase customer education to reduce costs and satisfy legal and/or compliance requirements.

- Inform: Help customers get the most out of a product or service and increase overall satisfaction.

- Advertise: Drive awareness of products, services or special promotions.

- Motivate: Move customers to take a desired action, such as setup recurring autopay.

Not all businesses will design statements with all four of these goals, nor should they. An old adage comes to mind: “When everything is urgent, nothing is.” Prioritize which goals are most important to your business and strive to stay focused on those in your redesign.

The Power of Color

There’s only so much you can accomplish with black ink alone. Adding color to your statements is a simple change that can create up to 20% lift in customer engagement, according to FSSI.

When used sparingly and on-brand, color makes your statements easier to read, better organized and highly engaging. Use color to:

- Highlight key information, such as past due amounts

- Assist in navigation, such as section headers and promotional callouts

- Improve the readability of charts and graphics

- Enhance the overall appearance and branding of the document

For example, if your core purpose of the document is to motivate, you may choose to highlight the “ways to pay” section of your statement with a colored heading and bullets.

On the contrary, for a municipal utility that aims to inform, you may want to use a colorful graph that compares the previous month’s electricity usage with current month, using color to highlight trend lines and make the graph easier to understand.

Personalization at Scale

Color may support the purpose of your statement, but it’s the messaging that drives it. Sharing the right messages with the right customers at the right time makes each statement a powerful engagement tool.

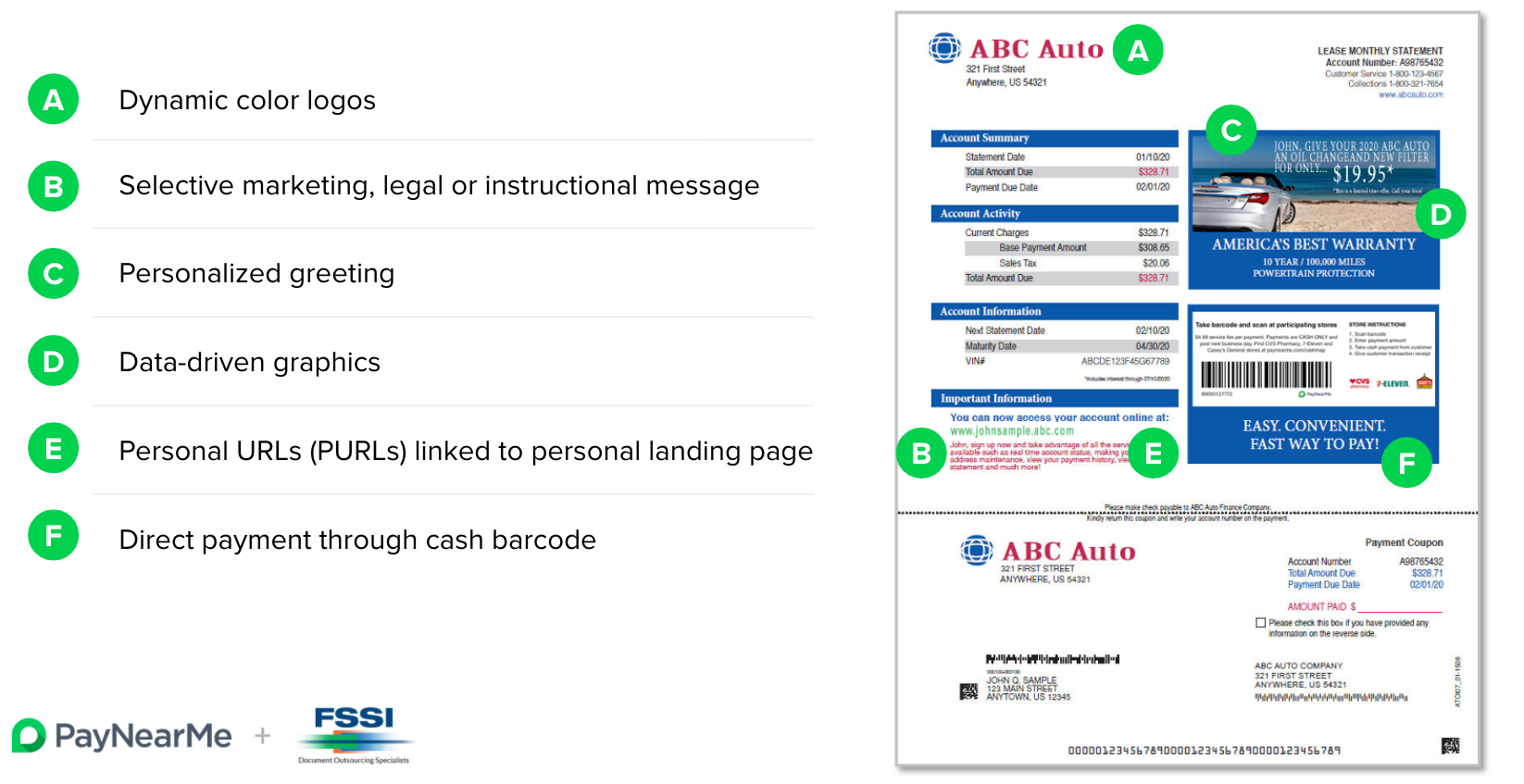

There are many ways to personalize your statements to the reader, especially when working with innovative providers such as PayNearMe and FSSI. For example, you can:

- Print personalized payment QR codes, that when scanned go directly to the customer’s online payment page—no need to create an account or log in

- Promote unique up- or cross-selling offers depending on which products and services the customer already has

- Incentivize new payment behaviors, such as including autopay instructions for those who only pay with checks or money orders (an in the case of lenders, offer rate reductions)

- Add specific contact instructions depending on which department the customer should be dealing with, especially for larger companies with many sub-brands

The options for personalization are endless. Not only does this allow your business to accomplish highly specific goals, but it also creates a much better experience for the end customer.

Avoiding Negative Engagement

There is a counterweight to everything mentioned above. It’s important that you always consider the potential for negative engagement when designing your statements.

Negative engagement is when a customer is paying close attention to your statement for all the wrong reasons. For example, obfuscating important information like account number, balance, or due date can cause serious confusion. This can lead to more customer service calls, late payments, frustrated customers and permanent reputation risks.

Negative engagement tends to happen when you skip the first step in this article, designing with purpose in mind. By trying to do too much with your statement, or by not focusing on what your customer’s want, you’ll invite the wrong type of engagement and do more harm to your business than good.

What a Great Billing Statement Looks Like

There is no “best” way to engage your customers on your statements, as all that depends on our intended purpose and goals (have we drilled that point enough?) You may also have different ideas for your paper vs. paperless statements, as each has their own strengths to bring to the table. For example, paper statements are a great place to include scannable QR codes and perforated payslips, while digital statements can often include clickable links and more dynamic elements.

That said, great statements have purpose, use color, are personalized and improve the customer experience over time. These documents help your business achieve strategic goals and build stronger customer relationships and do so on a regular cadence.

Build Better Billing Statements with PayNearMe & FSSI

The best way to create engaging statements is to employ the help of experts. PayNearMe and FSSI have partnered to bring you more options for your statements, backed by industry-leading technology and award-winning experiences. To learn more, contact us today or visit our partners at www.fssi-ca.com.