The New Auto Buying Urgency: How Lenders Can Win With a Better Payment Experience

You may be wondering, what’s going on in the automotive industry these days? Frankly, it’s a bit of a paradox. On one hand, threats of high tariffs may make production more costly and complex. Ironically, despite potentially higher costs, a sense of urgency is fueling demand among buyers who don’t want to miss out before prices spike.

And that can mean profits ahead for auto lenders—if they are prepared to serve borrowers with an optimal payment experience that improves on-time collections, while reducing exceptions and manual work.

Multiple factors driving up urgency to buy

Between steady inflation and rising tariffs, two-thirds of consumers now believe auto prices will increase soon, and 53% are more likely to purchase soon, according to a new report by Santander US. The good news is that there are positive incentives as well.

Over the past few years, financial stability has returned for many Americans. With job security on the rise and more people heading back to the office, the daily commute is making a comeback. In fact, 42% of those surveyed in the Santander US report say they have increased the number of days they drive to work. And that frequent commuting is adding to their urgency for a new vehicle.

Lenders take note: Nearly half of all consumers surveyed (47%) are considering a vehicle purchase in 2025, and 66% are already researching options. Most importantly, 65% of consumers expect to get an auto loan for their next vehicle.

This surge in auto buying could mean big gains for lenders, but success hinges on your payment experience. If your business still relies on inflexible legacy systems, it may be contributing to more exceptions and higher delinquency rates. And all of that? It can increase your total cost of acceptance and chips away at your profits.

The cost of borrower frustration

Today’s consumers expect paying a loan to be as easy as ordering takeout. But many lenders are still lagging behind—and that gap is proving costly. According to PayNearMe research, 60% of borrowers say managing and paying loans feels frustrating and stressful. That’s not just a frustrating experience—it’s a business problem waiting to be solved.

Further, when juggling monthly expenses and cash flow, consumers typically focus on essentials such as housing and food, while loan payments fall lower on the priority list. In an earlier study, we focused on how economic uncertainty influences bill pay behaviors. That research revealed that while consumers may prioritize their auto loan fairly high, the reality is that this bill is often paid last or late.

The bottom line is, lenders need to make it as easy as possible for their borrowers to pay their bills. A flexible payment experience is quickly becoming table stakes. It’s no longer enough to offer a basic online portal or accept only traditional payment methods. To meet borrower expectations and reduce operational friction, lenders must rethink their entire approach to payments. What’s needed now is a holistic, end-to-end strategy to capitalize on the current wave of auto buying—and whatever comes next.

How Payment Experience ManagementTM can shape lending success

Payments are the lifeblood for lenders, yet many don’t realize that the bill pay experience has become a defining part of the borrower journey. Consumers now expect the same fast, seamless interactions they’ve grown accustomed to with tech and retail giants—making the payment experience a competitive differentiator. To stay competitive, lenders must rethink payments not as a back-office function, but as a strategic lever for borrower satisfaction, loyalty and revenue.

That’s where Payment Experience Management comes in. Payment Experience Management is a modern approach to payment strategy that combines software and infrastructure to optimize every touchpoint—from borrowers to agents to back-office operations. Lenders that embrace this mindset are better positioned to reduce the total cost of acceptance, improve on-time collections and create a more profitable lending business.

Santander US’s study noted that nearly 70% of consumers consider it “very important” to be able to monitor their accounts digitally 24/7. You may already have an online payment portal, but that is no longer enough. A Payment Experience Management approach goes beyond a simple portal by offering frictionless, self-service options that allow borrowers to pay how and when they want—across any channel, using any available funds.

Here’s how Payment Experience Management translates into real-world benefits:

Personalized reminders and self-service

Some of the top pain points for borrowers can result in staggering costs for your business. Often the biggest hassle is having to remember logins, and 42% of survey respondents point to remembering logins and passwords as a major pain point. When support calls often cost more than $8 each, that’s a huge expense that spikes your total cost of acceptance. Keeping track of due dates is another key problem for people, which leads to more late payments and more costs for lenders.

Payment Experience Management improves both the borrower and agent experience. With Smart Link™ technology, borrowers receive personalized payment links via text or email that lead directly to their account—no password required. Meanwhile, support agents are equipped to resolve issues faster and even push reminders during a live interaction to drive real-time payment completion.

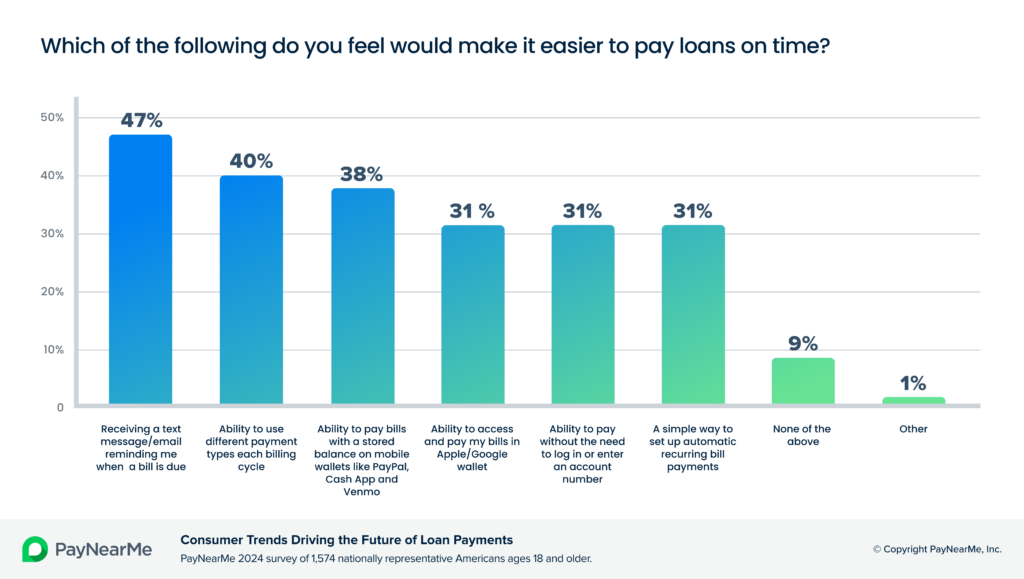

This level of convenience and coordination reduces friction, lowers support volume and increases on-time payments. In fact, in the aforementioned report, 47% of consumers surveyed said reminders would help them pay on time.

Empower borrowers with flexible payment options

Typically, loan payments have been limited to ACH, debit card, cash or check, required on a rigidly fixed due date. But today’s consumers control their cash flow across different sources, including digital wallets such as PayPal, Venmo and Cash App Pay. In fact, nearly 60% of people noted they would be very likely or likely to pay their loans that way.

Payment Experience Management supports a broad range of payment options, enabling borrowers to pay instantly using the method that works best for them. These inclusive options reduce barriers, exceptions and manual processing—lowering costs and improving operational efficiency.

Flexible autopay controls

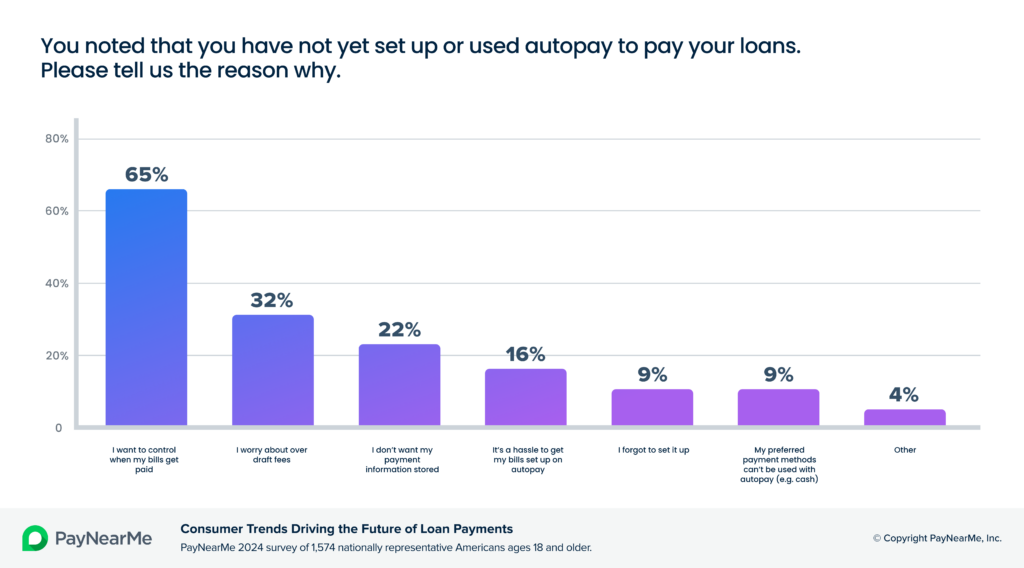

Why don’t more people use autopay? It’s not that they don’t want to—it’s that most systems don’t provide the kind of flexibility that works around their real life. Most payment platforms only offer binary options: on or off. But borrowers need flexibility to work around paychecks and other expenses. In fact, 65% of consumers who do not use autopay say it’s because they want more control over when bills get paid, highlighting the need for a more flexible payment experience.

A modern payment platform provides the flexibility to dramatically increase autopay adoption. For instance, borrowers can choose their due date, split payments and switch between payment methods—giving them the control they need to stay current. More choices can translate into more confidence in their ability to stay current with their loan—which is ideal for both borrowers and lenders.

The bottom line

- Auto loan demand is rising—lenders have a major opportunity.

- But outdated payment systems are creating friction, exceptions and lost revenue.

- A modern, flexible payment experience is no longer optional—it’s a competitive differentiator.

Get ready to capitalize on auto buying trends

Despite ongoing concerns about inflation, many consumers are actively pursuing a vehicle purchase and will be seeking an auto loan. Particularly for BHPH dealerships and other auto lenders, now is the ideal time to modernize your payment experience. Being equipped to meet the latest consumer payment expectations is your path to significantly better business outcomes.

Partnering with PayNearMe makes it easier to deliver an optimized platform that helps maximize on-time, self-service loan payments, while reducing exceptions and lowering your overall costs. And with automated workflows and less manual intervention, your staff can increase efficiency to focus on growing your business.

Learn more on our website and schedule a personalized demo.