The True Cost of Accepting Card Payments

Try to answer this question as truthfully as you can: what’s your true cost of accepting card payments?

Most merchants can easily recite the advertised rate provided by their payment processors, but what many don’t realize is that this rate is only the bare minimum. On top of the advertised rate (for example, $0.05 + 2.05%), there are dozens of hidden fees, loopholes and soft costs that can drastically affect the amount you pay for each successful card transaction.

In particular, lenders that rely on card not present (CNP) transactions as a primary bill pay method are often baffled by the complexity of their merchant statements and the dizzying number of factors involved in card processing.

Here’s one recent example that mirrors hundreds of conversations we have with clients.

We spoke to a VP of Finance at an auto lender who was hesitant to change platforms because no other vendor could match the company’s blended rate of 1.65%. After a thorough interview and comprehensive statement analysis, however, we discovered that the actual blended rate was around 2.1%, plus additional fixed fees that were piled on by the previous vendor.

Here are some of the most common cost drivers that can affect card transaction costs.

Part 1: Per-Transaction Costs

The most obvious place to start your analysis is to understand your variable, per transaction costs. These fees grow with your revenue, negating some of the other savings you experience with scale.

Fee Model

We’ve already talked at length about the differences between card processing fee models, but given how important this is to your analysis, it’s worth doing a basic recap here.

- Tiered pricing is usually not an ideal fee model, with the exception being lenders that service an irregularly high amount of qualified transactions. This model tends to add costs over time and is typically charged by legacy processors.

- Interchange-plus (or cost-plus) pricing is becoming popular due to its perceived transparency and fairness. You’ll know exactly how much your processor is making on each transaction, but there can be a lot of variance on the interchange side (as we’ll show in the next section.)

- Fixed or flat fee pricing gives you a predictable rate that can help you understand your costs at different levels of scale. Variance in your card mix won’t negatively impact your costs, but it won’t create surprise savings either.

Choosing the right fee model up front can significantly change your per transaction pricing, and this should be the first thing you consider when shopping for a new processor. But as you’ll see below, it’s far from the only factor you should consider.

Least Cost Network Routing

Not all debit payments are the same. Dodd Frank, and specifically the Durbin amendment, require that debit cards have at least two non-affiliated networks as routing options. This means that instead of sending all your payments over major networks, including Visa and Mastercard, you can often get better per-transaction rates on regional debit networks such as Star, Pulse, NYCE, Accel and others.

This information isn’t always obvious in cost-plus models, as the cost can be hidden within the interchange portion on your statements. Making sure your card processor is incentivized to offer least-cost routing is an important step in realizing these savings.

Special Program Discounts

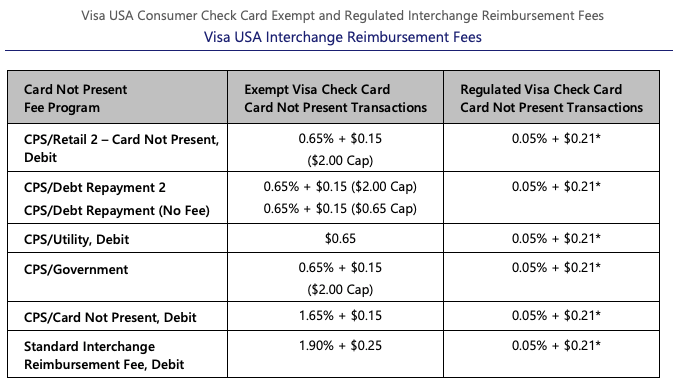

While not applicable to all transactions, Visa offers special program discounts for certain verticals to incentivize card payments. Specifically, there are sizable discounts for debt repayment and utility payments. See the difference these programs can make in the most recent Visa USA Interchange Reimbursement Fees chart:

These savings can be substantial compared to standard interchange rates.

But here’s the rub: enrollment in these programs isn’t automatic. You’ll need to coordinate with your payment processor and apply for these special rates.

There are other caveats to this program, and even after you’re registered, you may need to fulfill other requirements to get the special rates. But none of that matters if you aren’t enrolled.

Chargebacks and Card Declines

Chargebacks and card declines are an unfortunate, yet unavoidable, cost of doing business. Many times, these can result in extra fees from either your processor, the networks or both.

Typically these types of returns only affect a very small number of transactions, but because of the size of the fees and the labor involved in resolving these issues, the costs can add up over time.

The obvious advice to lower these costs is to find ways to reduce or win more chargeback disputes, but you should still factor in a percentage of these each month to understand the true cost of your card payments.

Level 2 Processing

For some merchants, the number of business credit card transactions processed each month can play an important role in determining costs. B2B card transactions generally come with a higher interchange cost than consumer cards when processed the same way.

To lower this cost, your processor needs to submit additional data that allows Visa and Mastercard to offer a lower rate, known as Level 2 and Level 3 data. While Level 3 requires some serious legwork, Level 2 interchange rates are fairly easy to achieve, requiring only a few tax related fields to be submitted on top of standard Level 1 data.

If you regularly processes B2B credit payments, you absolutely need to consider Level 2 rates into your cost calculations.

Part 2: Fixed and Shared Costs

This is where things start to get tricky. Which fixed fees should be incorporated into your analysis, and where do you draw the line?

In general, we advise you to focus on costs that are primarily driven by your choice of card processor. If swapping Vendor A for Vendor B, C or D doesn’t change the cost, then you’re probably safe to exclude that expense row from your analysis.

Miscellaneous Statement Fees

When looking at your merchant processing statements, you’ll notice that there is a section dedicated to transaction and interchange fees, as well as a separate “miscellaneous” or “other fees” section. This is typically where you’ll find a laundry list of flat fees that are left out of your advertised processing rate.

Since there is no standardization in the names of these fees, it’s impossible to know exactly what to look for on your statement. Here are a few of the more popular (and sometimes deceptive) fees we’ve seen listed on our clients’ statements

- Monthly Statement Fee: Yes, you’re reading this right—this is a flat fee for creating and sending your statement!

- Settlement Fee: A per transaction or monthly fee for depositing your funds, sometimes charged for expedited settlements.

- PCI Compliance Fee: We assume this is a fee you pay vendors so they can remain compliant, but we’re not sure why this should be passed on to merchants.

- Channel Fee: In some cases, you may be charged a different rate based on how the customer pays, e.g. IVR, online or over the phone.

These fees should all be factored into your cost of processing payments, as they are determined solely by your payment processing provider and can have a profound impact on your costs.

Add-on Feature Fees

In addition to miscellaneous statement fees, you may also have a separate statement of work with your payment processor that outlines the costs associated with different features or functionality.

For example, do you pay per email or text message that is sent to your customers? Do you have to pay separately for services like IVR or mobile payments? Is reporting included in your package? Are there different tiers for customer support and service?

All these factors play into the price of accepting card payments, but they may be hidden in documents that exist outside your standard merchant processing agreement.

Soft Costs

Sometimes the most expensive part of accepting card payments has nothing to do with the technology you use, but rather the people and processes that interact with it. This will likely be the most difficult part of your analysis, since these expenses may exist in multiple documents (e.g. employee salaries) or are simply not measured at all (e.g. cost per inbound call vs. cost of self-service payments).

While a definitive list of these costs needs to be examined on a per-merchant basis, here are some of the most important questions to consider in the process:

- PCI Compliance: How many card payments fall under your PCI compliance scope, and what are your PCI compliance costs each year? Can you lower these costs by lowering scope? What’s your total financial burden of compliance, including IT and consulting expenses?

- Call Center Agents: How many card payments are collected by agents making outbound or taking inbound calls? Could these employees be handling other functions if they weren’t accepting payments?

- IT & Development: How much do you spend on IT and development to keep your card processing software working with your other systems?

- Vendor Management: How many third party software contracts do you manage to accept card payments? What overlap exists?

- Fee Flexibility: Are you able to offset any card processing fees with convenience fees on different payment channels?

Answering these questions will point you in the right direction and help you determine your total cost of accepting cards, both today and as you scale.

Performing Your Review

As you perform your annual vendor reviews and do your own merchant statement analysis this year, make sure to consider all the above variables when determining your true cost of taking card payments. This methodology can also be adapted and applied to different parts of your payment processing business, including ACH, cash and other payment methods.

Need help? Talk to PayNearMe to see how we can help you drive more on-time payments with technology that works to lower your costs and improve your portfolio profitability.