4 Bill Payment Experiences That Should Disappear Forever

When you think about bill payment as a lender or recurring biller, your priorities likely focus on collections: How can we reduce transaction costs, increase on-time payments, minimize exceptions and prevent fraud?

These are common, critical challenges; yet this perspective is somewhat narrow. Solving these problems effectively might require shifting your viewpoint to the consumer experience.

Today’s consumers are accustomed to frictionless transactions. Retail giants such as Amazon, Apple and Uber have raised expectations by offering personalized, flexible and effortless payment experiences.

When was the last time a bill payment experience did that? Bill pay tends to be an inflexible, multi-step process. It’s almost as if billers don’t want our money—because they make it hard to pay.

Here are four frustrating bill payment experiences consumers wish would disappear forever—and why your business should eliminate them now.

1. Remembering endless logins

Before paying a bill online, consumers typically must first log into an account. Managing usernames and passwords across dozens of billers is tedious. Forgetting passwords or navigating complicated login screens leads to frustration, late payments or lengthy customer service calls.

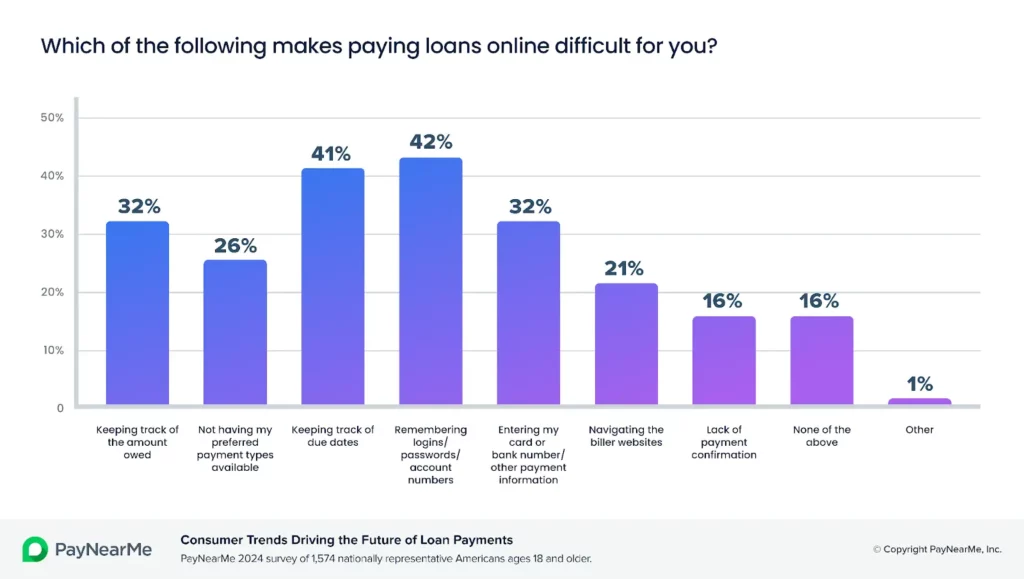

In fact, according to PayNearMe research, 42% of consumers say remembering logins, passwords and account numbers makes paying loans difficult. Nothing about those experiences makes us feel positive about that business.

Consumers want effortless access without cumbersome logins. A modern payments platform makes this possible by sending customers unique, personalized links via text message, email, mobile wallet or even through on-demand agent support.

2. Limited payment options

But logins aren’t the only barrier. Many lenders and billers also limit available payment methods to just bank accounts or debit cards. Consumers, however, increasingly prefer paying for goods and services with a digital wallet such as PayPal, Venmo or Cash App Pay. For example, nearly 60% of consumers surveyed said they would be very likely or likely to pay their loans with digital wallets such as PayPal, Venmo, Apple Pay or Cash App Pay—if those options were available.

When these options aren’t available, consumers must inconveniently transfer funds or navigate multiple interfaces, increasing the likelihood of missed or late payments.

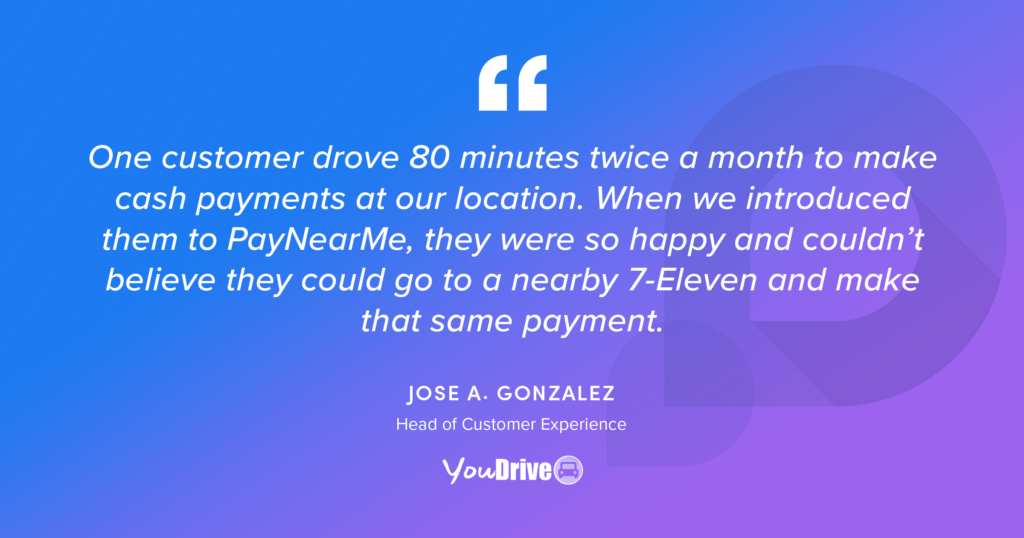

And what about consumers who prefer or must pay in cash? Traveling to a biller’s office during business hours can be inconvenient or impossible.

With an innovative payments platform, such as PayNearMe, you can deliver the payment flexibility customers demand—whether ACH, cards, digital wallets or cash payments at convenient retail locations. Offering this choice improves consumer satisfaction and boosts on-time payments.

3. Remembering due dates

Even with flexible payment options, consumers still face the challenge of tracking multiple due dates across numerous bills. While some billers send digital reminders, many don’t—even for essential expenses such as mortgages or utilities. Yet, proactive engagement reminders significantly improve payment timeliness.

In fact, 47% of consumers surveyed by PayNearMe agree that digital reminders make bill payments easier.

Text Engagements have not only helped us reduce our past due accounts, we’ve also been able to eliminate more than half of the late notices we send in the mail. This has created a huge savings on postage for us.

Bethany Berg, Vice President of Operations, Automotive Partners Funding

Give customers a gentle nudge when a payment is approaching—or even if they’ve missed one. Automated SMS, email or push notifications containing embedded payment links allow customers to pay immediately—directly from the reminder—eliminating friction, increasing payment rates and eliminating the need for agent assistance.

4. Rigid autopay terms

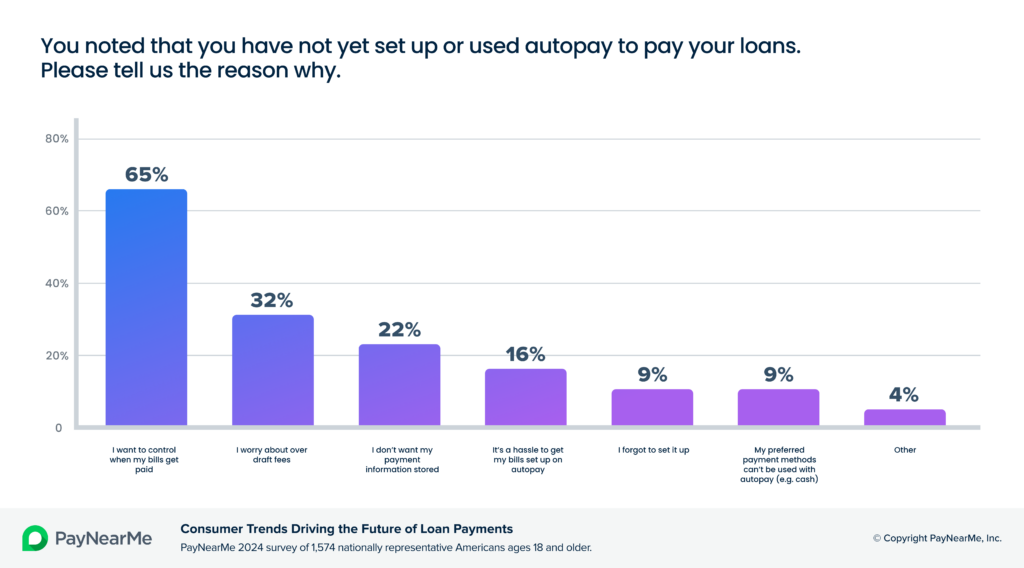

Finally, while automated reminders help, consumers also desire greater flexibility in autopay arrangements. Ironically, though predictable payments benefit billers, autopay often remains rigid and inflexible. Many consumers resist autopay because they can’t tailor payment schedules or methods to align with their personal cash-flow cycles.

Consumers prefer autopay that’s flexible enough to select their preferred due dates, split payments or vary payment methods. This is especially helpful if their funds are distributed across multiple sources or they need to adjust due dates based on their pay schedules.

When autopay is just an ‘on or off’ choice, you are missing a crucial opportunity. Our research found that 65% of consumers would enroll in autopay if it offered more flexible options.

With an advanced payment platform, businesses can quickly implement personalized autopay experiences that increase consumer adoption and reduce delinquency.

Make bill pay effortless—and profitable

Outdated payment technology doesn’t just frustrate consumers—it costs you money. Complex, cobbled-together platforms are expensive, challenging to upgrade and don’t align with today’s consumer expectations.

Now is the time to modernize your bill payment experience. Offer seamless digital reminders, secure, login-free account access, flexible autopay options and comprehensive payment choices. You’ll benefit from fewer exceptions, reduced delinquency and less manual intervention—substantially lowering your total cost of acceptance.

At PayNearMe, helping you create exceptional payment experiences is our mission. Let’s discuss how we can transform your bill payments for the better.