How PayNearMe Solves the Last Mile Problem in Payments for Fintechs

In late 2019, Andreessen Horowitz’s Angela Strange claimed that every company will become a fintech company. We’re seeing the early phases of this prediction come true, with companies across sectors embracing financial technology to bolster their bottom lines:

- Starbucks customers hold over $1.6 billion in unspent rewards and gift card balances, surpassing total assets of more than 3,900 US banks

- JP Morgan earmarked $12 billion per year in fintech investments and research to drive innovation for its 60+ million retail customers

- Walmart partnered with Ribbit to create its very own fintech startup, acquiring multiple companies along the way to speed this up

But while technology continues to solve many pressing financial challenges, one sticky problem remains: getting real money into and out of fintech apps.

Get Banked or Go Home?

For many prominent fintech applications, the main source of account funding is a bank account. Want to invest your PayPal balance into Robinhood? You’ll need to transfer it to your bank account and wait until it clears. Got a crisp $20 bill in a birthday card that you’d prefer to use in Cash App? You’ll need to deposit it in your checking account first.

Across the board, fintechs struggle to solve the last mile problem in payments—namely, the transfer of money in and out of financial apps without going through a bank first. For many consumers, this creates extra friction by forcing more steps that add more time to the process.

More troubling is the impact on un- and underbanked Americans. These individuals, who number in the tens of millions, are not given the same access to the financial tools and life-changing opportunities that fintechs promise. They simply cannot participate without having regular access to a checking or savings account.

Fintech leaders need to address this problem to create truly inclusive and frictionless experiences for all Americans, regardless of financial status and access.

How PayNearMe Solves the Last Mile Problem for Fintechs

PayNearMe has built a complete money movement platform to solve the last mile problem in payments. Here are four ways in which we create more nimble and accessible payments for our clients.

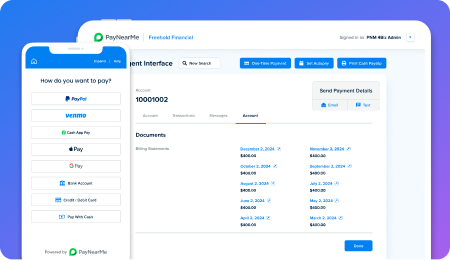

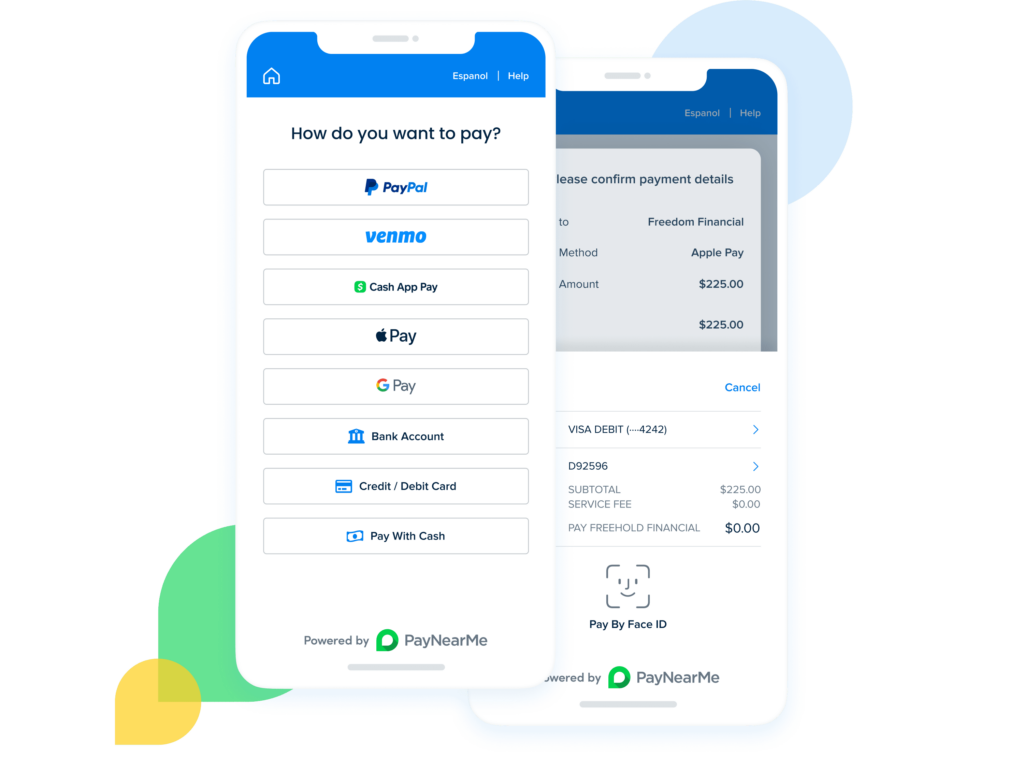

More Payment Types and Channels

Consumer payment preferences are changing at breakneck speeds, and fintechs must match both the needs and expectations of all their customers. PayNearMe puts the most common payment types and channels in a single integrated platform, allowing for unrivaled accessibility.

For example, imagine if an online brokerage app, after integrating with PayNearMe, could offer all the following options to their customers:

- Scan a personalized QR code on a direct mail piece to add funds to an existing account with no username or password required

- Buy a gallon of milk at 7-Eleven with a $50 bill and instantly use the change to fund a retirement account

- Use leftover funds from a Venmo balance to fund a trading account to buy shares of desirable stock

All these scenarios allow for a seamless transfer of funds without having to visit a bank branch or enter sensitive payment information online.

And while consumers would love the convenience and simplicity of the experience, businesses can serve a greater portion of the population.

Money Out, Faster

For many fintechs, getting money back into the hands of consumers has been even more difficult than getting money in. PayNearMe delivers options beyond traditional ACH disbursements, providing consumers with a choice in how and where they get paid. For instance, disbursements onto debit cards can offer near-instant transfers, enabling fast fund transfers that are critical in industries such as insurance and lending.

Video: Learn how United Auto Credit improves customer outcomes and reduces paperwork with digital disbursements.

On the business side, these digital payouts can reduce paperwork and help streamline disbursement practices. For example, businesses can allow consumers to send funds back the same way they paid to eliminate entering payment details a second time. Or, in the event a new account is required, businesses can send a one-time link that allows consumers to type in their own payment details, removing the risk of an employee keying in the wrong account or sharing sensitive account information over the phone.

By offering more payout options in both physical and digital channels, fintechs can create better payment experiences on both sides of a transaction.

Cash at Retail

For nearly a decade, cash payments were PayNearMe’s raison d’être. Our patented cash barcodes gave (and continue to give) millions of Americans the ability to pay bills, rent and more at tens of thousands of popular retail locations.

Video: See how easy PayNearMe makes cash payments with our patented cash barcode technology.

This unique part of our platform truly closes the gap between fintechs who operate completely online and individuals who still want—and often need—to pay with cash in physical stores. PayNearMe’s cash barcodes are incredibly easy to use. Customers can generate a reusable barcode that can be scanned at 40,000+ participating retail stores (including 7-Eleven, CVS, Walmart, and others). Customers can choose how much they want to pay in real-time, unlike other one-time use systems that require pre-set amounts.

In addition to serving new customer groups, fintechs can take advantage of the 40,000+ locations as pseudo branches for payments and deposits, many of which are open 24/7 and are specialized in handling cash transactions. Cash payments are also guaranteed, meaning the funds cannot bounce or be charged back, significantly reducing the opportunity for fraud.

Licensed Money Transmitter

As a licensed money transmitter in all required states, PayNearMe can facilitate a variety of regulated transactions across the country. This means that our clients often don’t have to go through the lengthy, legally intensive process of obtaining their own money transmission licenses, allowing for faster go-to-market and broader reach.

To put it simply, PayNearMe has extensive knowledge and experience in the space, giving our clients confidence in the security of the payment process.

Move Money More Effectively with PayNearMe

By working with PayNearMe, fintechs can simplify the movement of money into and out of their apps, helping to solve the last mile problem in payments. Consumers get more choice in how they send and receive money, all in a consistent, reliable experience.

Learn how you can offer more payment options, reach a wide range of customers and simplify the payment management process with PayNearMe. Schedule a demo today.