Interview: How HCAC Finance and First Union Financial are Simplifying the Payments Experience with PayNearMe and Auto Master Systems

PayNearMe and Auto Master Systems were joined by HCAC Finance and First Union Financial to talk through their improved payments flow, leveraging both platforms to optimize the customer experience. You can listen to the entire conversation here, or continue reading for the edited transcript.

About the Speakers: Leaders in the BHPH Space

Arthur Helmick, COO of HCAC Finance Co., shared they are a small buy here pay here based in Wilmington, DE. They have been in the car business since 1960, and have been doing BHPH for the last 22 years. HCAC Finance has about a $10+ million dollar book, and Arthur has been COO of the operation for the past 10 years. With his leadership, they are a very forward thinking and progressive company in terms of technology and overall vertical integration. In servicing thousands of customers, they are well versed with the deep subprime market.

Govinda Romero, CEO of First Union Financial, shared they opened their doors in 2009 as a BHPH in Florida and have grown to five rooftops with approximately $17 million on the books. They are continuously looking for ways to expand and evolve with better technology and processes. Their priority is in making and collecting payments easier for both customers and First Union Financial staff members.

What did your organizations require from a payment provider?

Arthur Helmick, HCAC Finance: I was first made aware of PayNearMe by Auto Master Systems at one of their user groups. PayNearMe was already on my radar but the trigger to make a change was the lack of service provided by my prior payment processor. I was trying to gain new technologies and new ways to take payment, like features that are offered by PayNearMe, and just couldn’t get adequate service from them. They didn’t have the product we needed.

Govinda Romero, First Union Financial: I had another provider that was working with and they didn’t offer the ability for customers to go make cash payments at a local convenience store such as, 7-Eleven, CVS, Walmart or a gas station convenience store and so I started using PayNearMe for that reason. I wanted to use one company for payments—it just makes it a lot easier to reconcile the payments that are coming in. Compared to my previous provider, working with PayNearMe was much easier to reconcile and to be able to pull the reports of pending charges, back charges, etc.

Can you share some of your biggest challenges when it comes to collecting payments?

Arthur: Friday morning, when you’ve got hundreds of incoming calls and long wait times, customers might think about what else they can use their car payment money on. With self-service payments, that’s completely taken out of the equation. Now my collectors can concentrate purely on collecting and giving attention to difficult customers. Call volume has been significantly reduced and my staff can better manage incoming payments. Another challenge was when life happens for your employees. For instance, one of my collector’s cars broke down and he came in late. Before PayNearMe, we would have been short-staffed and the collections would have suffered.

Govinda: Customers can now have control if they want to make a full payment or partial payment because we accept both options and previously this wasn’t possible. We used to rely heavily on IVR for phone payments with an automated system but now with PayNearMe SmartLink™ we almost don’t even need the IVR. It’s much more convenient for customers to click the link on their phones and submit a payment vs. calling and manually entering card information. Smart Link™ is really changing the landscape of all of this and making it a lot more convenient for my customers to make their payment.

What has your experience been like now that you’re onboarded and live with an integrated payment system?

Arthur: It’s been good so far, we haven’t had any problems and I’ve been working very closely with all of the PayNearMe team, and whenever something comes up we just send an email and it gets addressed. I know that issues will be alleviated very quickly, and it’s been a smooth process since we’ve onboarded.

Govinda: I was impressed with the customer service that PayNearMe provided. The team stayed in touch with me in a really caring way to get issues fixed fast. Working through any issues didn’t bother me because I saw that they were caring and really working hard to solve them quickly. I was also impressed with the annual review process. PayNearMe scheduled time to explain what’s going well and what’s not going well. That was that was great big thumbs up there.

What are HCAC Finance Co. customers saying about the payment features available?

Arthur: The customers really like the service because it makes things a lot easier for them and specifically what I was surprised by is that they’re utilizing Apple Pay a lot. The customers absolutely expect this level of service as a baseline. Some of my prior payment processors were not capable of providing this level of service and I’m thankful that PayNearMe has been able to bring it to me.

How has the shift to digital payments and self-service changed your business?

Arthur: First of all, we’re not as reliant on employees processing payments. Secondly, we’ve been able to reduce the actual number of collectors that we have in house and reduce their hours too. Digital payments reduce our costs in a very tangible way, and collectors are able to focus on those accounts that need more attention.

How do you drive that adoption?

Arthur: As for the adoption, I followed what my PayNearMe account manager advised, which was maintaining a proper incentive structure to drive adoption. I came on without any convenience fee of any type, so adding that in to incentivize payment behavior for the business was challenging. That challenge was regulated after a couple of weeks without any issues. Over the past several months adoption has increased steadily and everything is going according to plan.

Looking for more ways to drive self-service payments? Read: How to Streamline Collections with Self-Service Payments

Is there anything you can share on what your customers are saying about their bill pay experience?

Govinda: Customers shared that the ability to make a cash payment at a retail store is extremely helpful for them. We don’t offer in-person payments at our finance office or dealership so having the option of cash at retail is something that they really like.

What has your team’s experience been like with reporting tools?

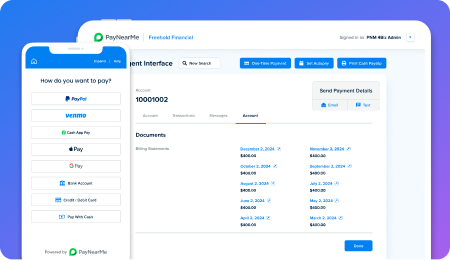

Govinda: Auto Master is working on a real-time API to accelerate posting so we’ll be able to have the PayNearMe portal up and refresh as needed. The visuals and the UI of the agent portal interface are very intuitive. Our previous provider was dated regarding visuals and capabilities, so going from extremely bad experience with reporting to going with what PayNearMe offers, we’re completely happy.

Learn more about PayNearMe’s reporting tools and capabilities.

Best Practices From The Pros

Arthur: The incentivization as I shared earlier is the best strategy that I could offer. We actually prefer to keep customers coming into the lobby, and we have a kiosk in which they pay cash at for free to drive adoption. For us, keeping customers coming in the door is a good way to upsell and build relationships. It’s the only free way to make a payment with us. Otherwise we offer a tiered system based on what the payment method is.

Govinda: My advice would be to highly encourage autopay at the moment of sale because it helps ensure payments from day one. With that strategy, the chance the customer is going to make that first payment is strong. I suggest encouraging that to not only increase autopay adoption, but guarantee on-time self-service payments. That way you can work toward at least 50% of your portfolio will be on autopay.

For the full conversation with audience Q&A, watch the full webinar here.

See Why PayNearMe is The Better Payments Platform for BHPH Dealers

PayNearMe makes it easy for your dealership and related finance company to collect every payment, every time. Give your customers more ways to pay with all payment types in a single flow, including cards, ACH, cash and mobile-first options such as Apple Pay and Google Pay, PayPay & Venmo. PayNearMe works flawlessly on any mobile or desktop device, with no app to download or update. And with a built-in Spanish flow, you’ll be able to serve more of your customers with self-service payments.We integrate with many of the most popular loan management systems, making it easy for you to get started without changing your existing workflows. Upgrade how you get paid with one platform, one invoice, and one simple pricing structure for all your payments needs. Schedule a demo today.