5 Strategies to Prevent Chargebacks (and Win Disputes)

Chargebacks are often one of the most costly and challenging types of payment exceptions to resolve. Billers are under pressure to respond quickly, with all the right evidence on hand to win disputes. Staff must be well trained and at the ready to tackle chargebacks, all while maintaining positive customer relationships.

In other words, anything your business can do to proactively avoid chargebacks can be a substantial win.

Billers cannot ensure disputes will never happen, but you can minimize cost and risk by reducing the likelihood of chargebacks, and being better equipped to win disputes. Preventing these issues is about more than keeping costs down, it’s also about mitigating the risk of losing card processing capabilities altogether.

The key is to ensure that both your customers and your support staff have the right information at the right time. Typical legacy payment processes are not built for that. More often, there are stumbling blocks that can be frustrating for payers and add complex manual work for teams trying to manage payments data. A modern payments platform can help remove the hurdles and deliver transformative impact with automated efficiency and digital self-service.

To help prevent chargebacks and make it easier to win disputes that do occur, here are five strategies that billers should consider.

1. Keep customers informed with clear and timely communications

Setting clear expectations about payment is a first line of defense. It also helps set the stage to be in a winning position if a dispute occurs, which is critical because the burden of proof is on the business.

There are two important ways to approach this:

- Make it easy for customers to understand their responsibilities upfront. Ensure loan or service agreements, and terms and conditions are explained in simple, plain language. Avoid industry jargon and legalese. Consider providing a quick reference one-pager of top takeaways customers should know. Remember that consumers tend to ignore the fine print and may not be aware of certain terms, which could spark a dispute.

- Send digital reminders about payment due dates. PayNearMe research found that 41% of consumers consider it a top pain point to remember payment due dates. What’s more, 47% of people say receiving a text or email reminder when a bill is due would make it easier to pay on time. That may not stop a legitimate payment dispute, but it’s a crucial step toward removing the friction that all too often leads to exceptions.

2. Empower customers with self-service payment options

Making your bill the easiest to pay is a valuable way to prevent chargebacks. Along with helping to increase acceptance rates, a modern self-service experience enables customers to resolve some payment issues on their own, without escalating into a dispute.

Simplify payments into a few quick steps. Self-service options can enable customers to pay bills with just a couple taps, including personalized seamless account access. With modern technology like PayNearMe’s Smart Link,TM there is no need to remember logins or type in account details every time the user needs to make their payment. Why does this matter? 80% of consumers consider it important to have their information pre-populated in payment screens, and minimizing data entry helps prevent errors that could otherwise lead to disputes.

Driving autopay adoption is another powerful way to avoid chargebacks and increase predictable monthly revenue. An optimal self-service payment experience makes it easier, providing a personalized link to enroll when a customer completes a manual payment. But just getting them there isn’t enough.

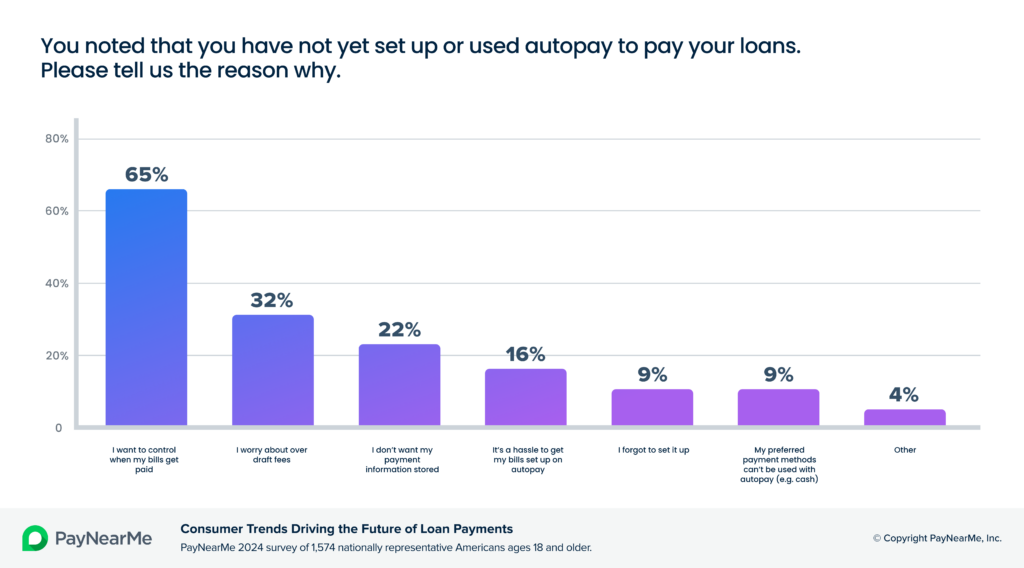

Typically, autopay has been an on or off option, with little or no flexibility. But consider that 65% of people who do not use autopay say it’s because they want more control over when bills get paid. Billers can motivate enrollment by offering flexible autopay options, such as allowing customers to choose the payment date and method, split payments within a month and more.

3. Offer digital wallet payments

With 81% of people using digital wallets, enabling them to pay bills that way can help improve on-time payments and customer satisfaction – and it can drive down disputes. Our client research found that among billers and lenders who offer Apple Pay, the rate of chargebacks has been 25% lower than for traditional card transactions.

Success is potentially fueled by the biometric authentication and concrete audit trails built into Apple Pay transactions (and possibly other wallet apps like PayPal, Venmo and Cash App Pay). To complete a payment, users must confirm consent with a fingerprint or facial recognition. It helps prevent payments from being issued without the account holder’s authorization. That makes this payment method an ideal solution to help avoid chargebacks, and can provide the right transaction data to make it easier for billers to win disputes.

4. Automate tracking of customer data

Managing payments data is a common challenge, particularly for companies that rely on recurring billing. You need to maintain detailed records of all transactions, confirmations and related customer interactions, which are essential for the audit trails needed to win chargebacks. If you’re doing that manually, you may be putting your business at risk.

Manual data entry heightens the risk of errors and missing details critical for making a case. Add to that the hours invested by staff, valuable time better spent on strategic work and serving complex customer needs.

Automation is key. For example, PayNearMe’s Chargeback Dispute portal enables companies to streamline workflows and quickly compile all necessary data for handling disputes. It simplifies data collection and reporting, and can include:

- Contact information – How customers are verified (e.g., full name, date of birth, phone number, billing address, email address).

- Documentation – Loan documents or service agreements, including all parties and signatures.

- Communications – From emails and notices, to chat and call transcripts, track details that confirm the customer has received the product or service, accepted the terms and conditions, has been notified about fees or charges, and so on.

- Payment activity – Historical transaction data and payment trends over time.

Having fast, efficient access to complete customer data empowers your business to respond quickly to chargebacks, and be prepared with the right details in place to win disputes.

5. Gain insights on predictable payment patterns

Last but not least, an effective strategy to reduce chargebacks is understanding what is ‘normal’ payment behavior (or not) for each customer. Being able to tap into comprehensive historical data can enable your business to more readily identify if a disputed charge is out-of-pattern for that person. This insight can help you discern whether the chargeback is more likely criminal fraud, or possibly friendly fraud (by the customer themselves).

A modern payments platform can make it easy to automatically track customer transaction data and patterns over time. The system can also help you spot customers that may be trending toward late payment, frequent chargebacks and more.

Prevent chargebacks and win disputes with PayNearMe

Avoiding the costs and risks of chargebacks is vital for improving profitability and productivity. PayNearMe’s modern payments platform empowers your business to reduce manual work and amplify efficiency.

Faster, easier, smarter capabilities help you prevent more exceptions and win more disputes – all while delivering the personalized, self-service payment experience that consumers want.

Learn how PayNearMe can help billers prevent chargebacks and win disputes. Click here to view an instant, on-demand demo.