An Inside Look at PayNearMe’s Unique Cash at Retail Payment Network

Updated February 2023

Watching the news, you may get the false impression that cash has followed the same path of 35mm film, VHS tapes and New Kids on the Block albums, all once dominant forces replaced by more modern counterparts.

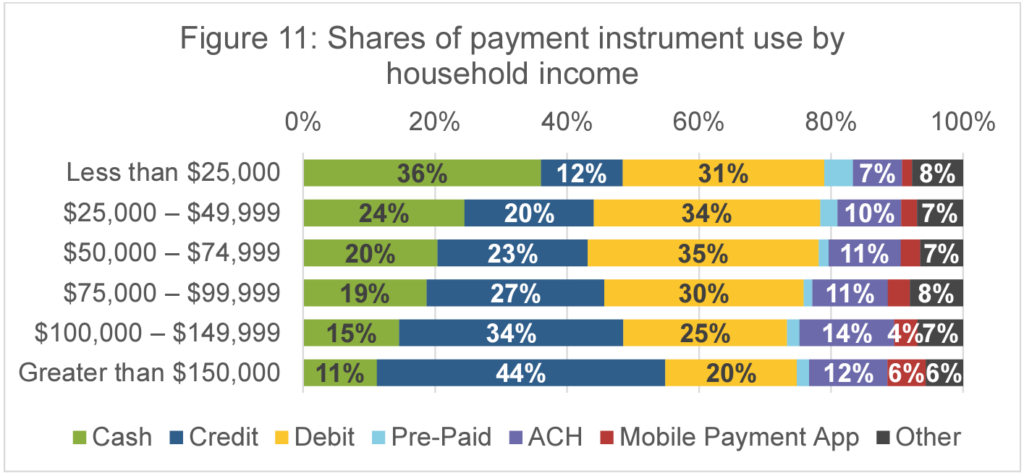

But unlike these fallen titans, cash remains an incredibly important role in the lives of many Americans. Cash is used in 20% of all transactions, and is especially important for low income households, where it is the dominant payment method. For tens of millions of American households that fall into the categories of unbanked or underbanked, it remains a necessary and critical way to pay bills and other key expenses.

Businesses and technology providers are finally waking up to the fact that cash has an important role to play in bill pay. Aside from traditional in-store cash transactions, technology has enabled a slew of new options for digitizing cash and simplifying the process for all parties involved. At PayNearMe, we’re proud to be leading the charge with our award-winning platform that features one of the largest and most convenient cash payment networks in the country.

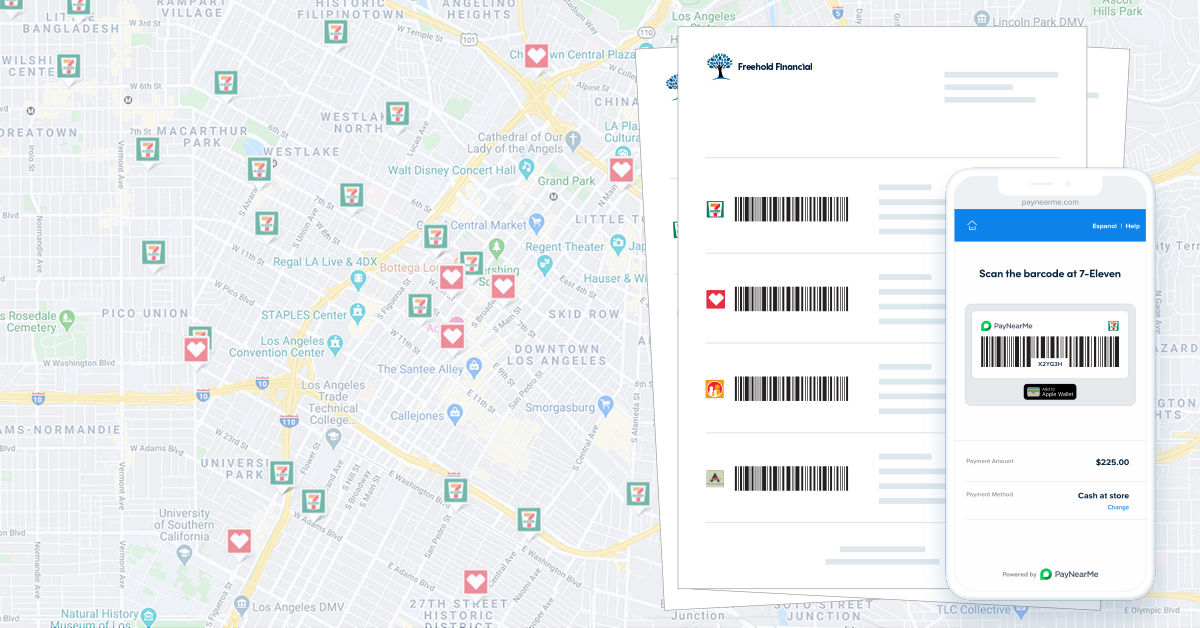

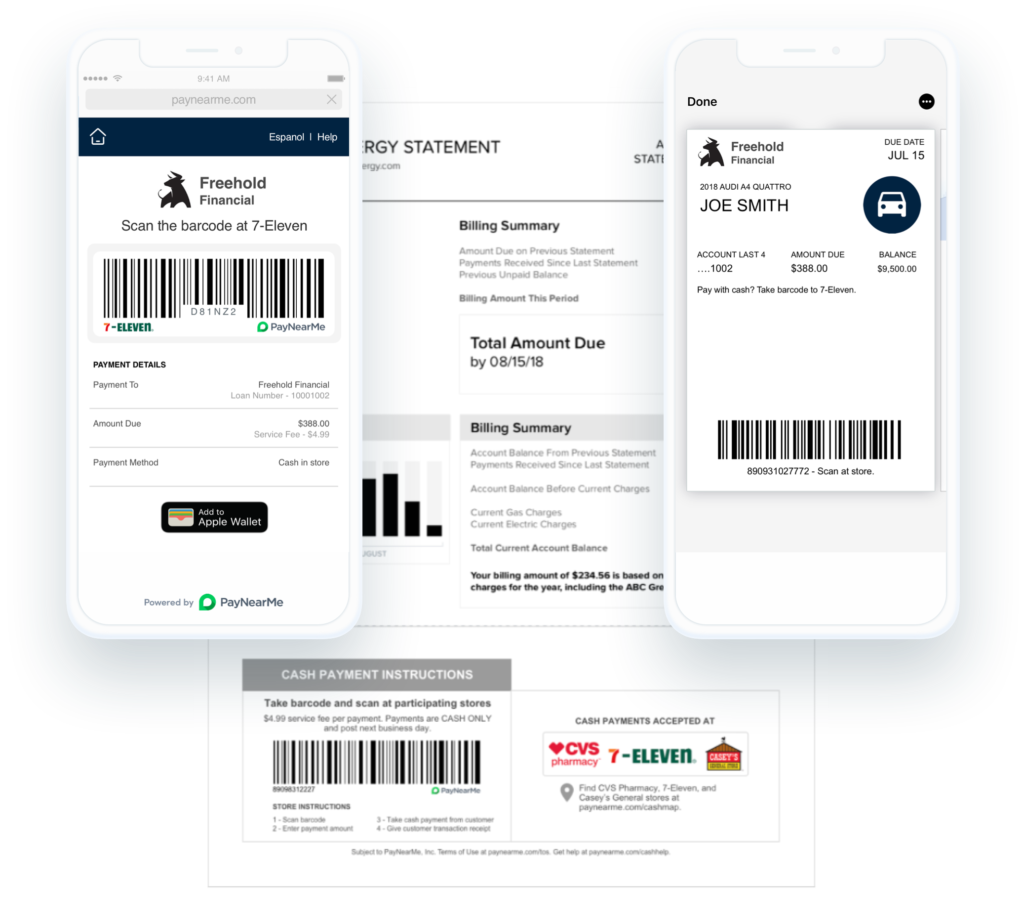

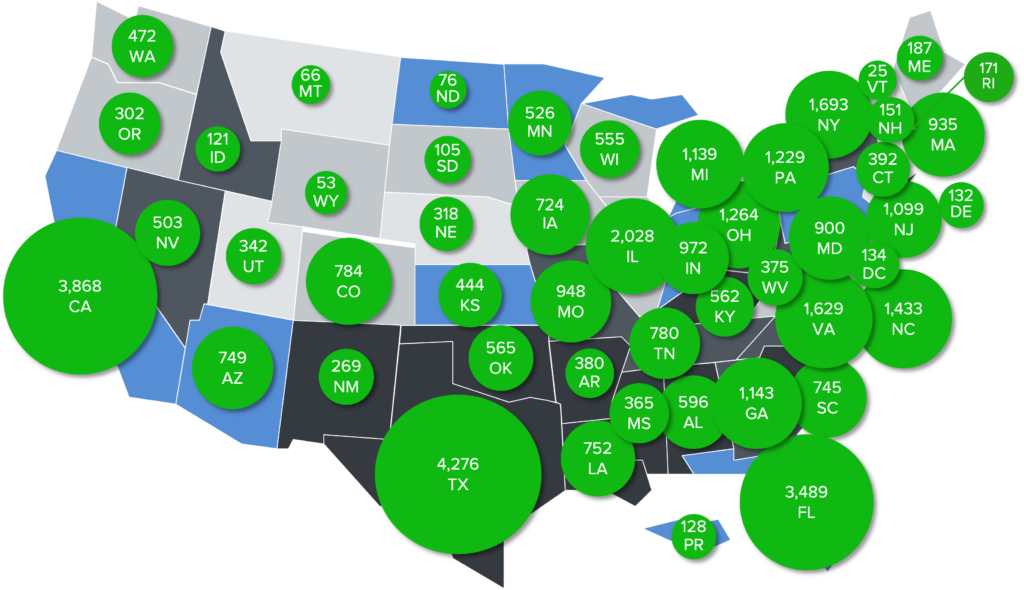

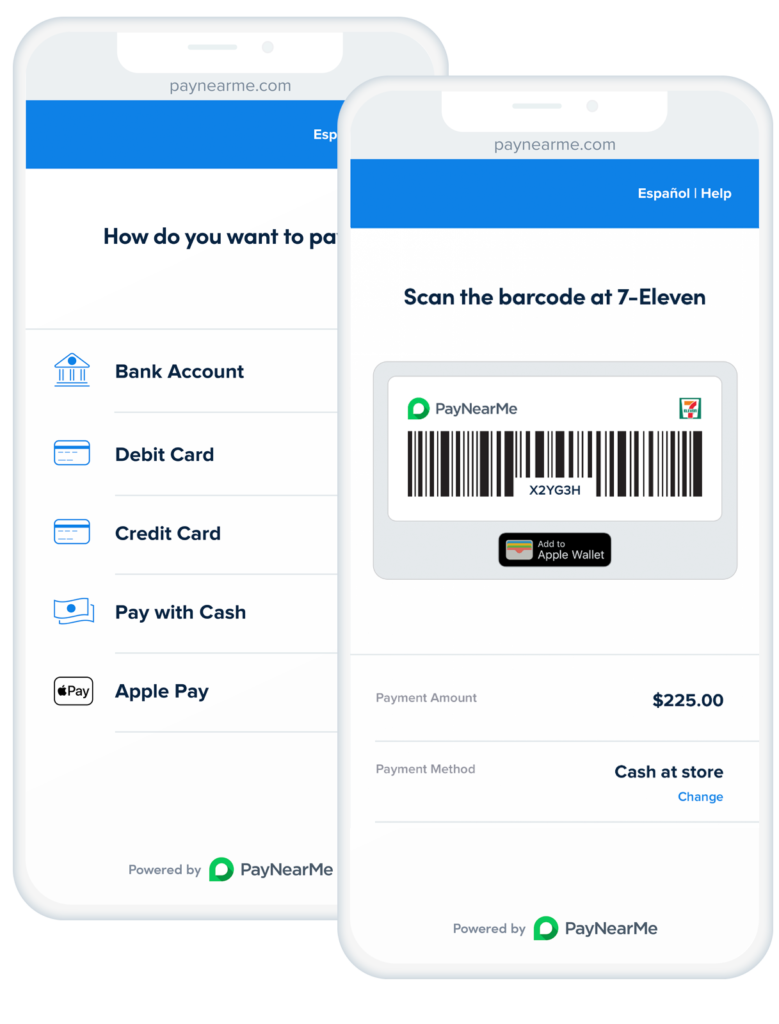

PayNearMe’s patented cash barcodes have been one of the key drivers of digitizing cash payments over the past decade. Our platform allows merchants to digitize cash acceptance, allowing consumers to pay bills at over 40,000 retail locations, including participating 7-Eleven, CVS, Walmart, Walgreens and others.

When choosing a payments provider, it’s important to understand if they have a cash payment option and understand how it differs from alternatives. Below is a quick look at what makes PayNearMe’s network so unique.

Skip ahead:

What makes PayNearMe’s cash network different?

Not all electronic cash options are created equal. PayNearMe has built a novel, secure and convenient solution that satisfies merchants, consumers and retailers alike.

Before we jump into the differences in our platform, here’s a quick overview of how our technology works.

So what makes PayNearMe different from other cash acceptance services?

Direct retail integrations

One of the keys to PayNearMe’s success is our direct relationship with both retailers and merchants. When a consumer scans their personalized barcode and pays with cash at any one of our 40,000+ retail locations, this information is electronically passed through our network and into the merchant’s account.

This allows us to instantly credit the payment, allowing the consumer to get a printed receipt at the retail location showing that their payment has been accepted. This payment information then posts to their biller’s system of record, giving consumers peace of mind that their payment has processed.

For billers, this simplifies the process and allows for accurate reporting, easier reconciliation and lower customer service calls (e.g. “has my payment posted yet?”).

Reusable payment barcodes

Some cash payment networks require consumers to generate a unique barcode for every payment they wish to make. In other cases, the barcodes have “fixed” payment options, meaning that each barcode can only be used to pay a certain amount, such as the balance due. This forces consumers to plan payments in advance and prevents them from quickly deviating from paying with exact change.

PayNearMe believes that flexible payments provide a better customer experience. Our personalized cash barcodes can be used over and over again, so that a consumer doesn’t have to worry about printing or presenting a new one each time they make a payment. This means that barcodes can be included on paper statements, sent digitally during onboarding, laminated and added to a keychain or shared any other way that makes sense for businesses.

This reduces the amount of work merchants need to do to distribute barcodes, while alleviating service calls associated with customers not being able to use an old barcode for a new cash payment.

Faster settlements & easier reconciliation

Reconciling cash payments separately from electronic transactions has long been an issue for merchants. It requires time and effort from your accounting team and reduces your ability to achieve true straight through processing.

By digitizing the flow of cash, PayNearMe makes reconciling these payments simple. Merchants who also use PayNearMe for processing cards, ACH and mobile-first payment types (i.e. Google Pay and Apple Pay) get all payments in a single file, allowing merchants to automate the reconciliation process and settle funds quickly. In some cases, we’ve seen clients reduce weekly reconciliation time by up to 87% each day.

In addition to making it easier, our cash payments are also guaranteed at the register, meaning consumers can’t initiate a chargeback or refund, and funds can’t bounce like a bad check. This reduces corrections for merchants, and allows for a new collection method for higher risk payers (i.e. those with multiple NSF history or high chargeback risks).

No forms, no paperwork, no hassles

Consumers don’t want to wait in line to make a payment. Having them fill out long paperwork is a recipe for low participation in your cash acceptance process.

PayNearMe eliminates the need for paperwork at the point of sale by pre-staging all the KYC work. Practically speaking, a customer doesn’t get a cash barcode until they’ve been vetted by the merchant (in the case of lenders, iGaming, etc.)

This approach means that the actual payment process is as simple as scan, pay and go for consumers. When bills can be paid alongside purchasing a gallon of milk or igaming deposits can be added while picking up game day snacks, consumers are much more likely to adopt electronic cash payments as an option.

Why cash still matters

As we alluded to earlier, cash is still an important payment method for nearly a quarter of all Americans. The FDIC’s most recent Report on the Economic Well-Being of U.S. Households found that 6% of US adults are completely unbanked, meaning that “no one in the household had a checking or savings account at a bank or credit union.” In addition, another 13% are underbanked, meaning they have actively used an alternative financial service product such as money orders, check cashing services, etc.

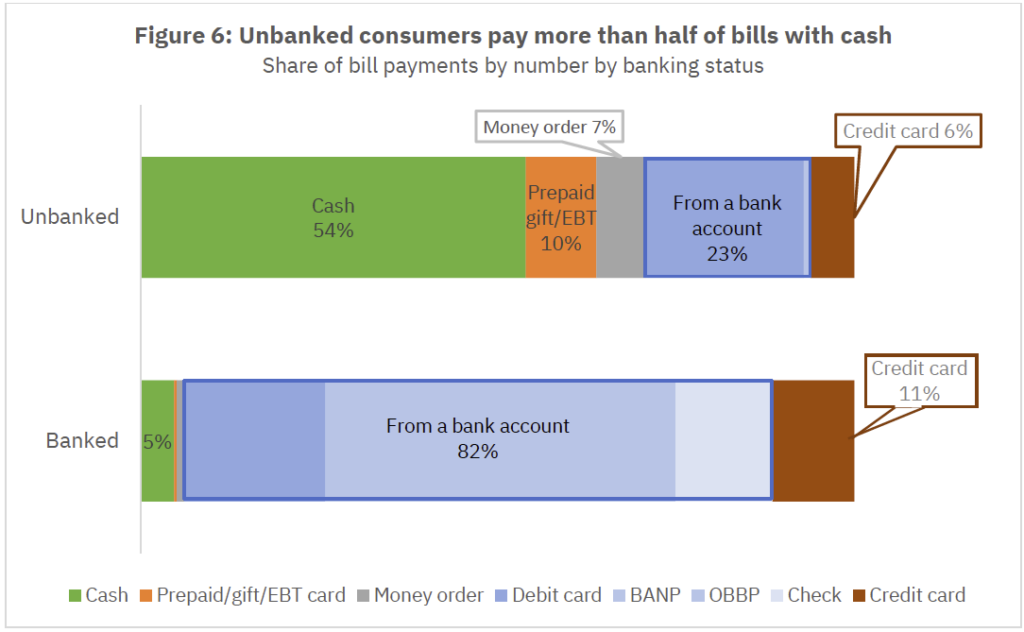

For these individuals, cash remains a lifeline for participation in the financial system. In fact, unbanked individuals pay 54% of their bills with cash, a significant increase over their banked counterparts.

An interest in cash payments can also be seen as a growing trend over time. Looking at anonymous Google search data over the past five years, interest in the phrase “pay with cash” has consistently risen over the past five years, showing the most interest from individuals searching in the southeastern states.

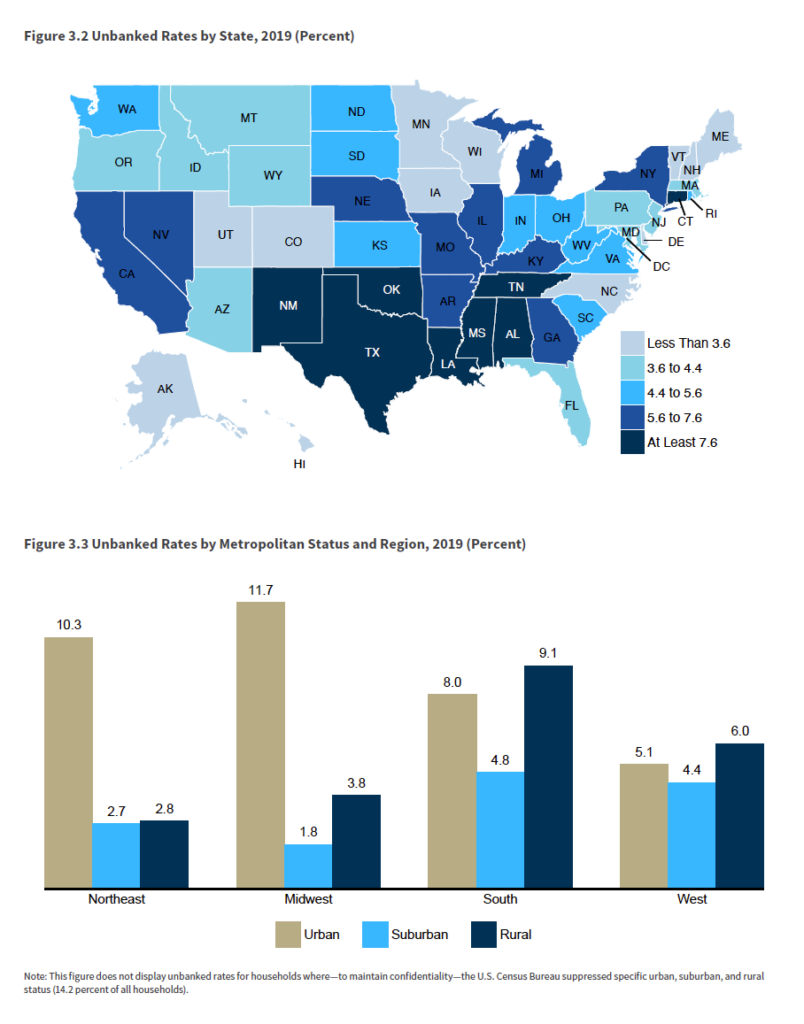

This has serious implications for billers. For one, it means that you need to offer cash payment options to serve the needs of all your customers. This is especially true for those who operate in areas with disproportionately high numbers of unbanked individuals, such as the Southern states or urban zones in the Northeast and Midwest.

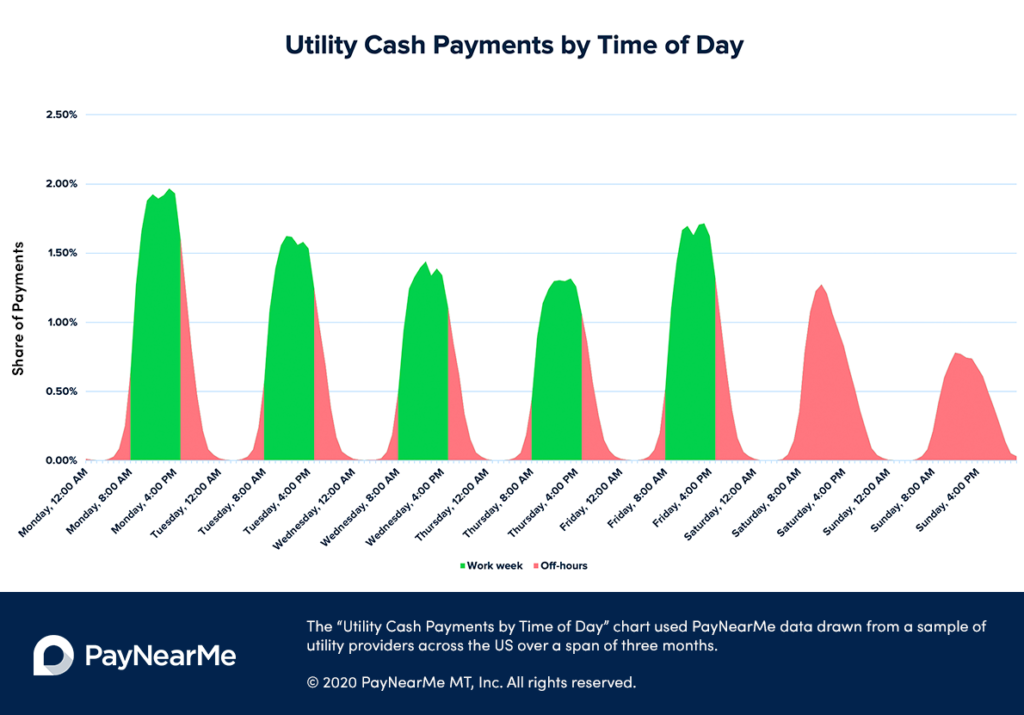

Timing is also important, as you’ll need to make accommodations for those who don’t have the time or means to pay you in cash during business hours. Data from PayNearMe’s utility clients showed this to be true, with 41% of utility bills being paid with cash outside of standard 9:00-5:00 hours and a significant 23% being paid on weekends.

To address this, merchants have to consider two equally unappealing options: either keep a dedicated cashier open outside of traditional work days and hours, or accept that consumers may pay with cash alternatives such as money orders—creating more work for your business to accept and process these payments.

The benefits of electronic cash payments

If you’ve made it this far into the article, you’ll note that we’ve established a few facts:

- Cash is necessary for tens of millions of Americans

- It’s difficult for merchants to accept cash payments

- PayNearMe knows how to solve cash payments for all parties

Agreeing with the first three points leads us to the question: what exactly do I gain from transitioning to an electronic cash solution?

Below are some of the most prominent benefits we’ve collected from our clients over the last 12+ years.

Financial inclusion

By allowing all Americans to participate in the financial system, we can create a better outcome for everyone involved. Incorporating electronic cash payments allows billers to serve more customers while also empowering these customers to make timely and complete payments.

Security

Accepting cash in-person comes with real risks for merchants. There are the obvious risks of taking cash, storing it on-site and transporting it to a bank, all of which create security checkpoints that need to be addressed.

For larger organizations, there’s a liquidity risk: what happens to your receivables if you can no longer accept cash payments at your physical locations? How can customers without digital payment alternatives make timely, complete payments?

Many of these concerns are mitigated with an electronic cash solution, as retail stores are built for handling cash transactions in high traffic, convenient locations.

Guaranteed payments

As we’ve mentioned, PayNearMe’s cash payments are guaranteed at the register. Once the transaction is completed, your customers get near-instant credit for their payment along with a receipt, and your business gets credited for the payment amount as well.

The customer cannot initiate a refund, chargeback the amount or have a bounced transaction. This helps you reduce exceptions and simplify your reconciliation process.

Expanded footprint

Accepting cash at your physical location creates a few problems. First, there’s the issue of staffing a cashier during, and possibly after, business hours to accept these payments. It also limits you to working with customers within driving distance.

PayNearMe’s retail network of 40,000+ stores allows you to expand your cash acceptance footprint, allowing you to serve customers nearly anywhere. Many of these locations are open 24/7 and are already frequented by your customers for other daily purchases. This includes thousands of 7-Eleven, CVS, Walmart, Walgreens, Family Dollar, Casey’s General and other stores.

Single customer experience

When you work with PayNearMe, all payment options—including cash—exist in a single payment experience. This gives your customers unrivaled payment choices, allowing them to choose how they want to pay every time a bill is due.

Not only does this improve adoption of electronic cash payments, it also allows your customers to switch between payment types as needed (for example, cash one month and debit card the next).

Get started with PayNearMe

Start offering electronic cash payments to your customers today. Learn more about our cash payment options, or contact us today to set up an interactive demo.