Lenders Predict a Rise in Delinquencies and Call Center Volume in 2023

The past year and a half has been ripe with economic uncertainty. First quarter real GDP saw a slow increase of 1.1% from 4Q 2022 compared to 2.6% from the previous quarter. Yet, while inflation-adjusted GDP continues to grow, albeit slowly, consumer spending in both goods and services increased. Additionally, U.S. households saved 5.1% of their disposable income in March 2023 compared to February’s savings rate of 4.8%.

Meanwhile, inflation is rampant and the Federal Reserve continues to raise interest rates in an attempt to stave off a recession. These are confusing times, making forecasting difficult for lenders. In February 2023, PayNearMe conducted a consumer survey to determine how inflation has impacted consumers’ monthly finances, their ability to pay bills and how news of a potential recession has them preparing for a potential economic downturn.

After getting an understanding of how consumers were dealing with the economic climate, we wanted to talk to lenders* to see how they are perceiving and preparing their organizations for this period of economic uncertainty. This blog post outlines our findings from the lender survey and compares them to our recent consumer survey.

Delinquencies and Defaults

Of the lenders we surveyed, 83% say they anticipate real impacts to their organization in 2023. In fact, 8 in 10 expect to see a rise in delinquencies of more than 30 days and 48% expect an increase in 60-day delinquencies, while 70% anticipate an increase in loan defaults.

These bearish predictions on delinquencies and loan defaults are not completely surprising considering current macroeconomic conditions continue to impact consumers’ ability to pay their bills. Of the lenders we surveyed, 65% said that they’ve already seen a rise in delinquency, aligning with recent data from TransUnion reporting a rise in delinquencies for credit cards, personal loans, as well as a deterioration in credit quality on auto loans. A rise in delinquencies is concerning, and it will require lenders to balance loan demand while effectively managing risk.

The Impact to Call Centers

Another prediction lenders have for the remainder of 2023 is a rise in call center volume—all while struggling to fill open job positions for call center representatives. Nearly half (48%) expect to see a rise in customer service calls related to delinquencies, and 44% reported they are having difficulty filling collections and customer service jobs.

We learned in the aforementioned consumer survey that 62% of consumers called customer service with a bill-related question in the last 12 months. It’s troubling to learn that lenders are struggling to staff and retain their call center agents in a time when service calls are increasing. In general, call centers can see turnover as high as 45% each year, so adding additional stress to current agents could impact call wait times, ultimately leading to missed payments for customers who rely on agents to make their bill payments.

The Cost of a Phone Call

Another interesting finding from our lender survey is that less than half (48%) of lenders have automated or plan to automate collection activities in 2023. This was surprising considering the impact automation and self-service can have on lowering call volume and improving margins. The fact is, live-agent interactions are far more expensive than self-service interactions. According to Gartner, live contact channels (calls, email, chat, etc.) cost 80x more than self-service channels.

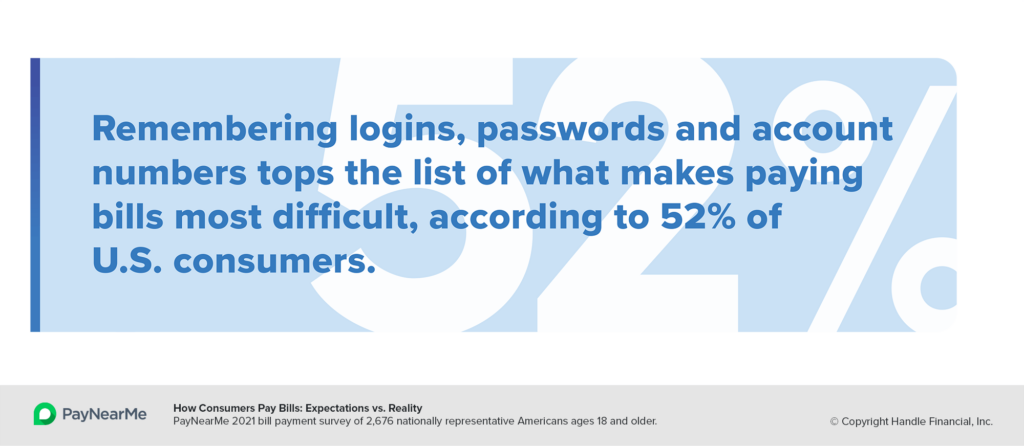

Our consumer survey revealed that in the last 12 months, 17% of respondents called customer service to make a payment over the phone and 12% called due to account login issues. Surprisingly, 18-29 year olds were the most likely to call in to make a payment or to troubleshoot login issues, casting doubt on the perception that younger consumers hate phone calls.

The more likely issue, however, is that this cohort of consumers does not want to call in, but rather has to. If lenders make it difficult for this demographic of bill payers to easily make loan payments on their phones without having to login, remember a password or key in payment details, they are ultimately increasing the total cost of acceptance by forcing customers to call in.

Organizations can adopt cutting-edge technologies by partnering with payment processing companies like PayNearMe that offer their customers options that make paying bills frictionless. For example, with Smart Link™ powered QR codes, consumers can scan and pay a bill without logging into their online accounts. They can store card information in their digital wallets and pay bills directly from their mobile devices with a couple of taps to their phone screens–completely forgoing the need to remember account numbers and passwords.

Even though on its face, 17% of consumers calling in to make their payment isn’t alarming, this is a group of callers that could be redirected to self-service channels, further reducing traffic to call center agents. Reducing transactional calls allows more time for call center reps to focus on solving more complex customer service issues or to make outbound collection calls.

Payment Reminders

In our consumer survey, 63% of consumers reported that digital payment reminders, such as text message, email and push notifications, would make paying bills easier. When we asked this same question two years ago, only 45% indicated they wanted these reminders. This demonstrates the continued shift in consumer behavior over the years toward self-service interactions.

This preference was strongest for the youngest bill payers (18-29-year-olds), 68% of whom favored getting reminders. The majority of the lenders (78%) we surveyed revealed that they have put bill payment reminders in place for their organization, so it seems that most lenders do understand the power of a simple reminder.

Customized Payment Options

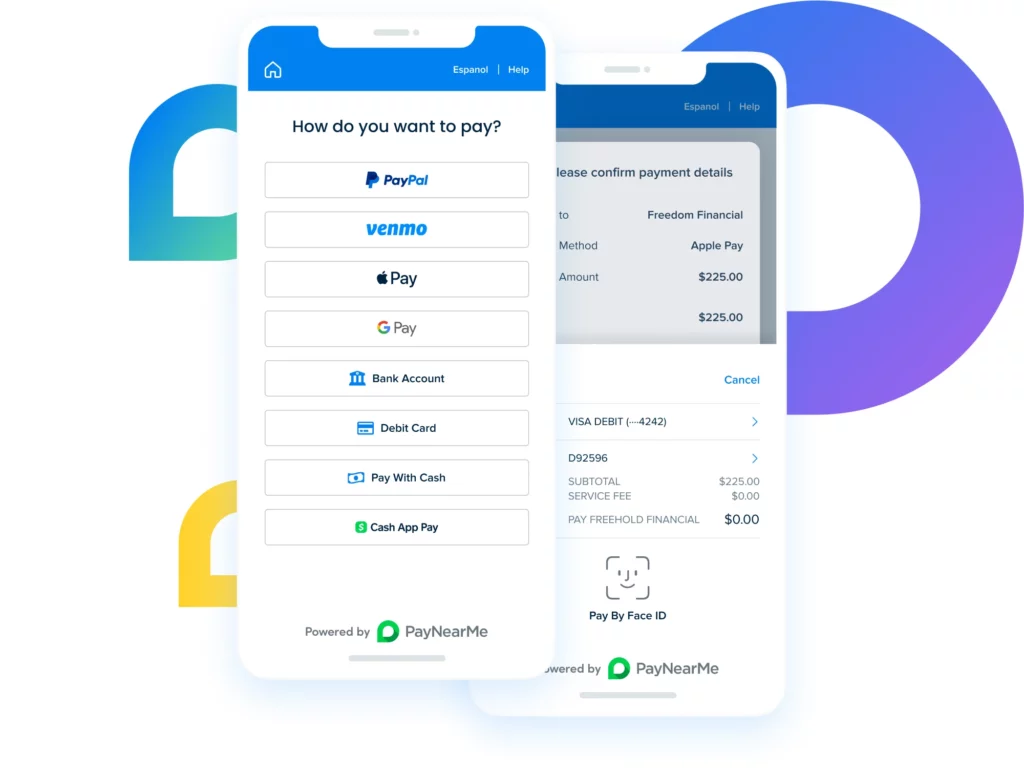

Another interesting insight we learned in our consumer survey is that consumers prefer flexibility surrounding bill payments, including:

- The option to make multiple smaller payments (54%)

- The ability to split their bill payment between multiple payment types, such as cash, Apple Pay/Google Pay, Venmo, PaPal, Card, etc. (48%)

- Having the flexibility to set their payment due date (76%)

Survey respondents indicated this type of payment flexibility would help them pay their bills on time. Interestingly, our lender survey revealed that many lenders have no plans to offer customers the option to make multiple smaller payments (35%); the ability to split bill payment between multiple payment types (48%); or the flexibility to set payment due dates (26%).

These types of flexible, customized payment options are available to lenders and their customers through modern payments platform providers like PayNearMe. With or without economic uncertainty, offering customers flexibility surrounding their bill payments is a smart and strategic way to help customers make on-time payments.

Focus on User Experience

In order to meet the needs of customers who may be under stress surrounding inflation and economic headwinds, it’s more important than ever for billers to partner with companies that are focused on the user experience. If your organization desires a payments provider that is on the cutting edge of user preferences, technological advances and keeps security top of mind, consider partnering with PayNearMe. PayNearMe offers a full set of payment options in a single platform, including cards, ACH, cash and mobile wallets such as Apple Pay and Google Pay. To learn more, contact our team today.

*PayNearMe conducted an online survey of 23 lenders in February 2023.