Six Creative Ways to Increase Autopay Adoption

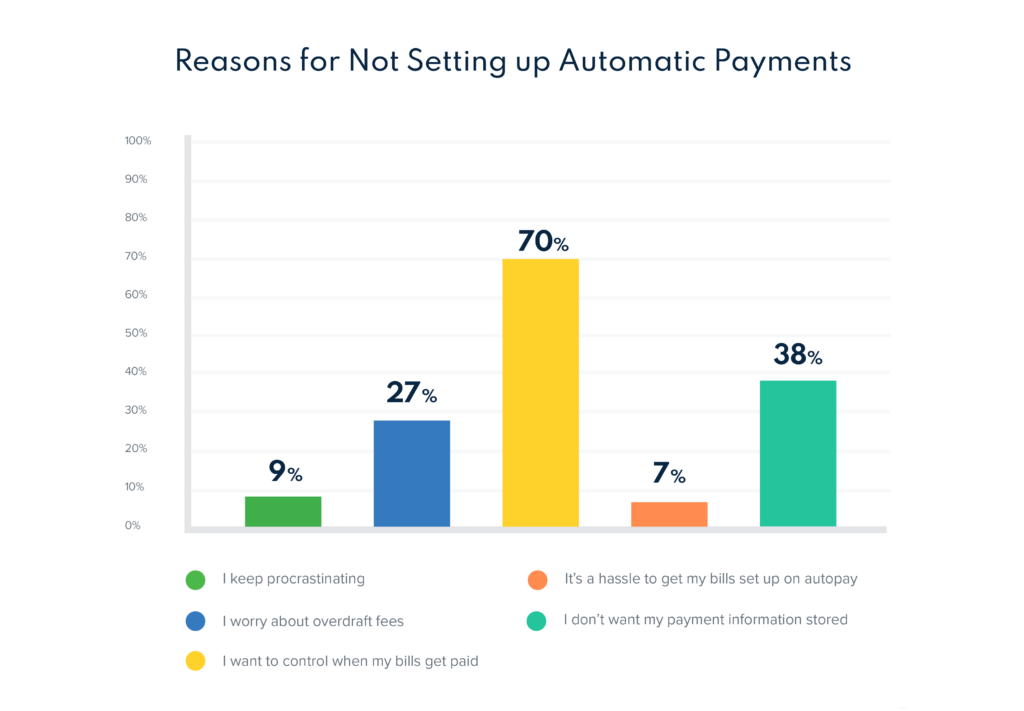

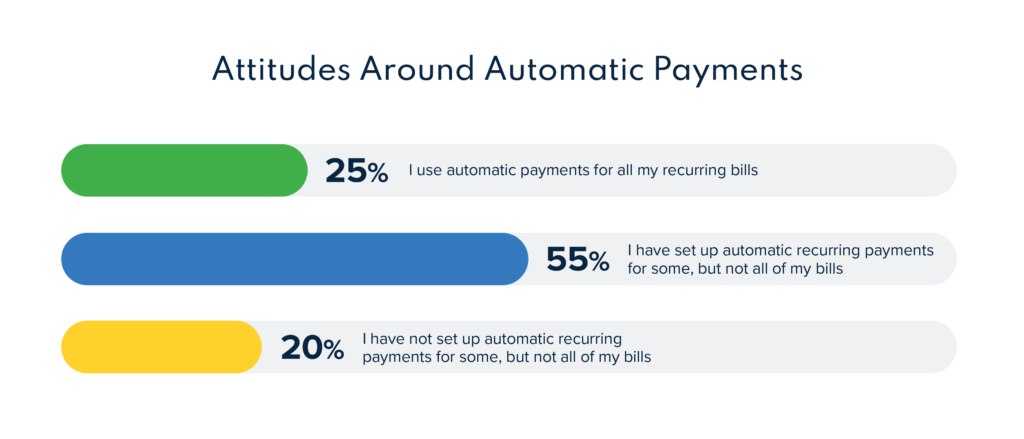

Automatic payments are a strange phenomena. They’re great for consumers because they can help reduce fees associated with one-time payments, while removing the need to manually pay each month. Billers love them because they create predictable cash flows and reduce the costs of accepting a payment. However, there are a couple of reasons why consumers are reluctant to set up automatic payments. See findings below from PayNearMe’s recent research report, Why Consumers Pay Late.

In addition, lenders and financial institutions that drive high autopay adoption rates are positioned to improve portfolio profitability, lower collection costs and create better customer experiences.

Yet despite being a win-win for both parties, only 16% of auto loans are setup with autopay, according to internal PayNearMe benchmarks.

Here are six creative ways you can increase autopay adoption for your customers that can help shift the below attitudes around setting up automatic payments.

Bundle autopay into your origination process

Loan origination is one of the most high-touch interactions between lenders and borrowers, making it a perfect opportunity to evangelize the perks of autopay.

Traditional brick and mortar lenders need to include a recurring bill payment form into their onboarding processes, securing a payment method and customer authorization on the spot. This will help establish good habits from the get-go and save you the trouble of reading the rest of this article.

For digital-first lenders, this same process can be achieved with even less friction by including a digital authorization form and a simple walkthrough video at the time of origination. The more customers you can onboard into an automatic payment habit, the more likely you will be able to keep those customers paying on-time.

Offer customers financial incentives to enroll

Like paperless billing, there’s a clear economic incentive to autopay for lenders. Depending on your customer base and typical rates, you may be inclined to offer financial incentives for autopay customers while disincentivizing one-time payments (within legal and moral reason).

Offering a rate reduction or promotional reward (e.g. a gift card) can be an immediate motivational carrot, while charging one-time payment fees can serve as the proverbial stick to encourage more autopay sign-ups.

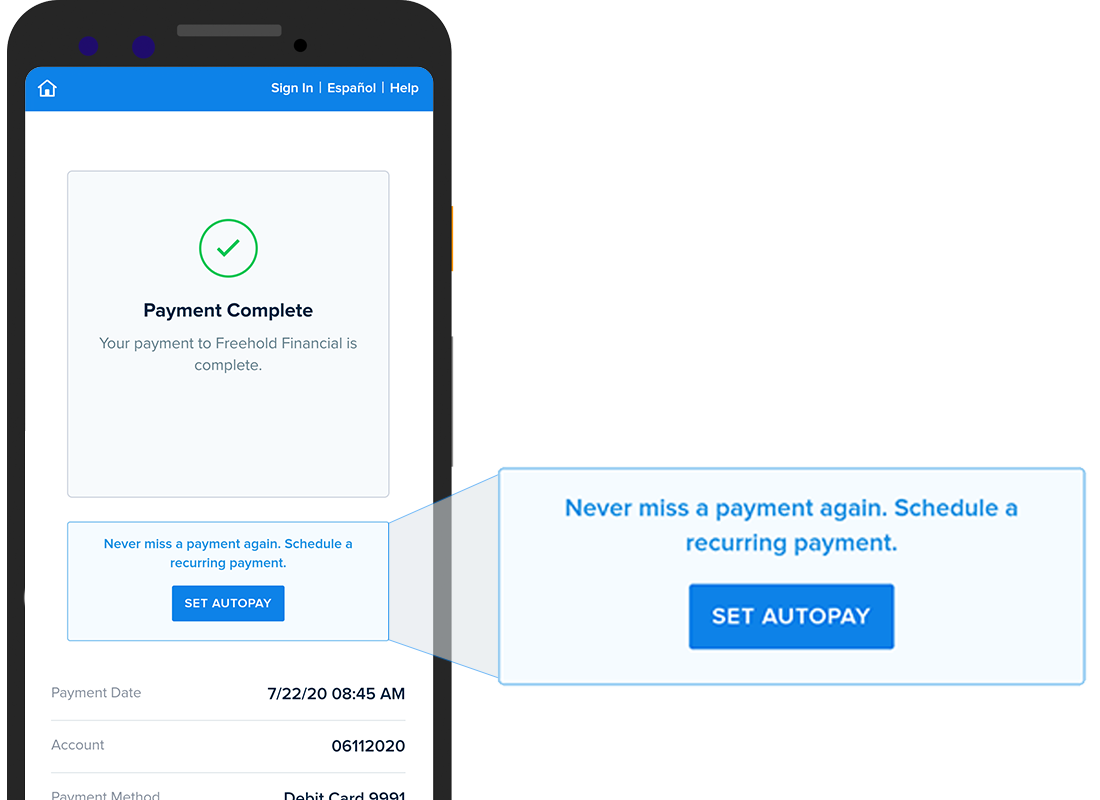

Promote autopay in payment receipts

Even if you don’t enroll a customer in autopay during the early phases of their loan repayment cycle, you still have the opportunity to passively enroll them each month.

For example, PayNearMe autopay includes a prompt after customers complete a one-time payment that simply states “never miss a payment again” followed by an “Enroll in Autopay” button. This gentle reminder continuously nudges customers to take action after making a manual payment.

Run targeted enrollment campaigns to different customer segments

One customer segment that benefits most from autopay is the “paid late but within the same billing period” group. These individuals never trigger a 30-day delinquency notice but could benefit from a hands-free, automated payment solution.

By looking at your payment data internally, or with the help of a payments platform like PayNearMe, you can identify borrowers who have an average payment date >5 and <30 days from the due date and send an email or text message to them prompting them to sign up for automatic payments.

Other groups you may want to target include customers who make all their payments at the call center (a group that disproportionately affects margins), customers who only pay with ACH or customers with saved payment methods on file.

Give customers more autopay options

A monthly recurring payment will likely be more attractive to customers if they have more control over when they pay. 65% of people say they would be more likely to enroll in autopay if it offered more scheduling flexibility. Offering more autopay options can increase sign-ups for those who have different financial needs.

For example, you may have borrowers who wish to chip away at their balance weekly or those whose payrolls fall on irregular days (e.g., the 9th and 22nd of the month). In fact, 54% of consumers say that splitting payments within a month would make it easier to pay on time. These individuals would benefit from flexible autopay schedules that make financial sense for them.

Lenders who use PayNearMe have the ability to offer monthly, weekly, twice monthly and every other week payments to customers—or any combination of these options.

A further twist on flexibility is letting customers pay with different methods. 48% of people say they would prefer to split bill pay between different payment options (e.g., half on debit card, half on Venmo). This option could be especially attractive to younger borrowers. More than half of 18 to 29 year olds and 30 to 44 year olds prefer to split bills using different types of payment.

Enabling non-traditional autopay methods, such as Venmo or Cash App Pay, can give more customers the ability to setup automatic payments without the fear of over-drafting a bank account.

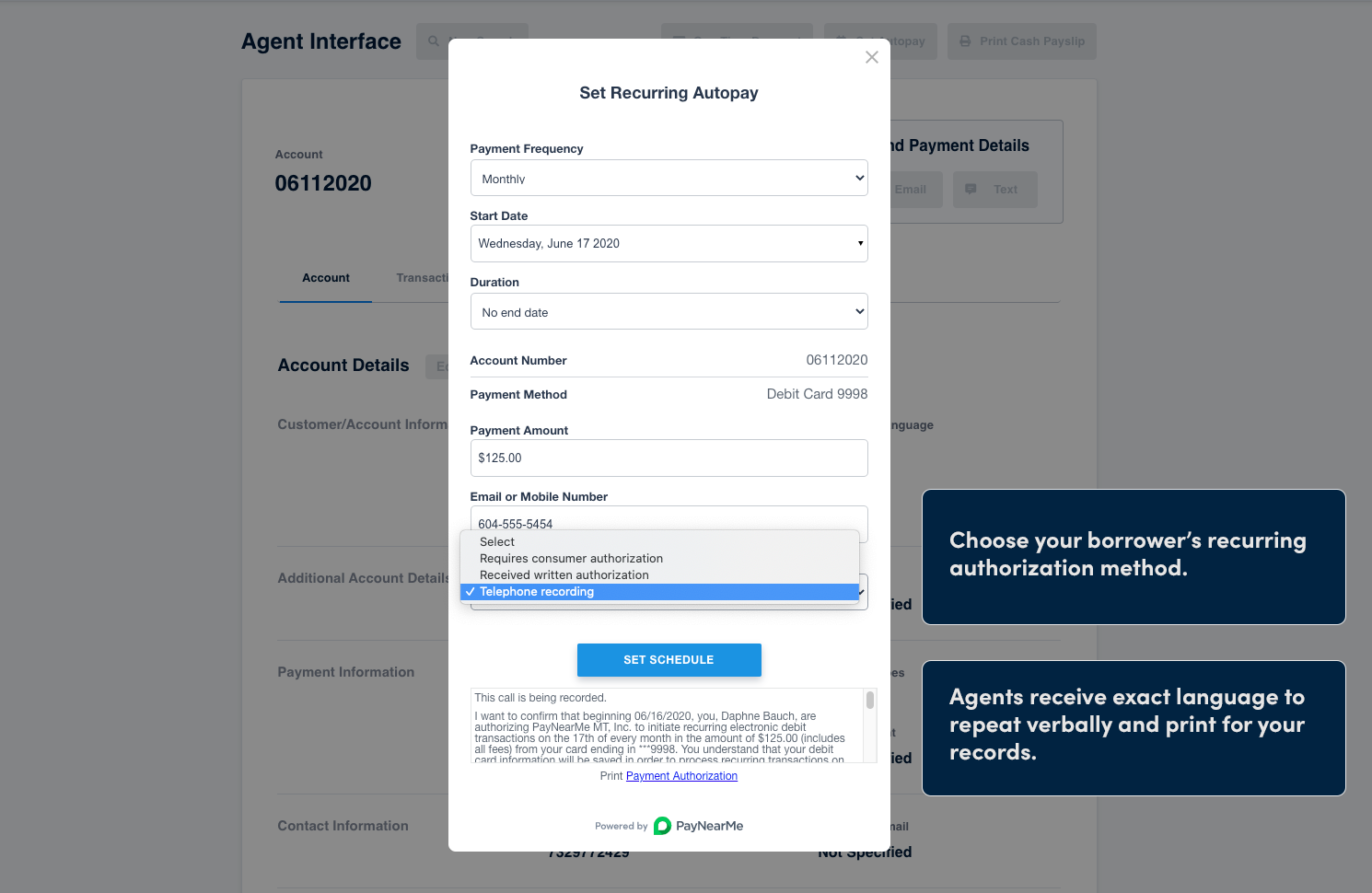

Train agents to lead with autopay

Autopay doesn’t require self-service enrollment—your call center agents or customer service reps can also be your biggest promoters. Training collections agents to begin and end their scripts with a simple question such as “Can I sign you up for automatic payments?” can nudge your customers to enroll without doing it themselves.

And with an autopay platform like PayNearMe, you can still simplify the authorization process by pushing the final autopay confirmation to the consumers email or phone. This process keeps your call center agents compliant, while still giving them the ability to sign customers up for recurring payments.

A better way to get paid

PayNearMe helps you drive autopay adoption by including these processes—and more—directly into our technology. With PayNearMe, you can give your customers additional ways to pay and collect more on-time loan payments with our innovative, feature-rich platform.

To get started, request a personalized live demo. Or, get instant access to our on-demand demo now.