Top 5 Consumer Loan Payment Preferences

Today’s consumers are challenged to manage cash flow amid inflation and rising debt. Keeping up with loans is a key part of that, and it’s often made more difficult with inflexible legacy payment processes. Our latest consumer research found that over half (51%) of borrowers say managing and paying loans causes them anxiety, and 60% wish that process was easier.

In these times of rising delinquencies, it’s imperative for lenders to remove friction by making loan payment easy, convenient and flexible.

PayNearMe’s 2024 survey explored consumer perceptions and preferences about the loan payment experience. A number of trends emerged that can help lenders better understand where to focus improvements to increase on-time payments, customer retention and gain a competitive advantage.

1. Importance of having more ways to pay

Consumers pay their loans in a variety of ways, based on available options. With many billers, their choices are limited and do not align with their customers’ preferred ways to pay.

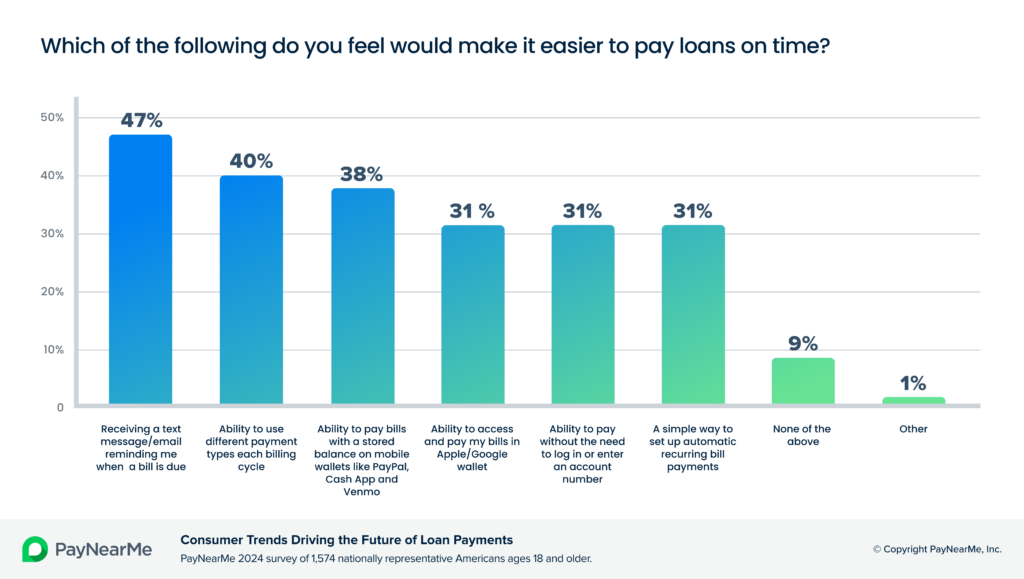

We asked consumers, what would make it easier to pay loans on time? Many agreed that having more ways to pay, including digital wallets, is very important. And how people choose to pay may vary periodically, depending on how they are managing their finances. Of those surveyed, 40% said they want the flexibility to use different payment types each billing cycle (e.g., pay via debit card one month, PayPal the next month, etc.).

Another critical incentive for lenders to offer more flexible payment options is that it’s a key driver behind autopay enrollment. 65% of consumers who do not use autopay said it’s because they want more control over when bills get paid.

This is a recurring theme. In earlier research, we found that 65% of consumers would be more likely to enroll in autopay if it offered more scheduling flexibility. With legacy processes, this can be difficult for lenders—but a modern payments platform, like PayNearMe, can make it easy.

By tailoring autopay options to better meet customer needs, billers can drive up enrollment and increase predictable on-time payments. For example, they can enable customers to choose an autopay date that works around when they get paid. Or allow them to split payments within a month rather than paying one lump sum, so they can more easily manage cash flow.

2. Rising demand for digital wallet options

Improving lender profitability often relies on motivating on-time payments and improving customer satisfaction to prompt repeat business. Payments are intrinsically part of that relationship, and becoming more of a factor in how consumers choose a lender and how consistently they pay on schedule.

The days of accepting only ACH and debit cards are fading fast. Enabling customers to pay with digital wallets is now essential for lenders to drive growth and stay competitive. According to Forbes, 53% of consumers now use digital wallets more often than traditional payment methods, and Juniper Research estimated that by 2026, over five billion people worldwide—more than half the world’s population—will use digital wallets.

While mobile wallets have grown popular for lifestyle activities, our survey revealed consumers want to pay their loans that way as well. And it’s not just the youngest borrowers. People of all ages want the flexibility to make loan payments with a digital wallet such as PayPal, Venmo or Cash App Pay.

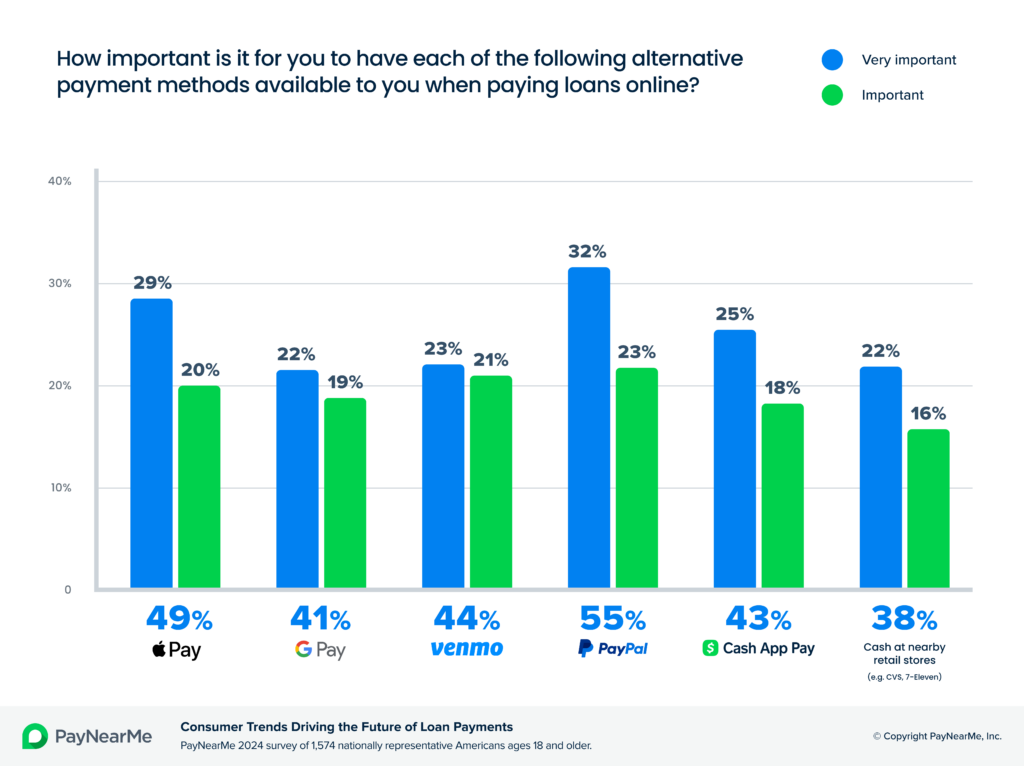

59% of those surveyed said they would be very likely or likely to pay loans with a digital wallet, a big leap up from 37% since our 2021 survey. Among the most popular wallets, consumers indicated a leading preference for PayPal. 55% of people consider it very important or important to be able to use PayPal to pay their loans. Apple Pay is a close second with 49% of respondents saying it’s an important payment option, and 43% prefer to use Venmo.

Another noteworthy factor about digital wallets is that many people use them to store cash balances. Our survey found that 38% of borrowers would prefer to pay their loans with a stored balance. That number spikes up for low-income consumers, where 47% want the ability to pay loans from their mobile wallet.

Particularly for lenders serving subprime and non-prime borrowers, accepting digital wallet payments could be a vital opportunity to improve outcomes and reduce risk of default.

3. Enduring preference to pay with cash

While digital payments have grown in popularity, a surprising number of consumers still want the option to pay loans with cash. Our survey found that a whopping 84% of survey respondents who said they pay some or all of their loans with cash consider it very important or important to be able to pay with cash at a retail location. Those who prefer using cash may typically pay loans in person at their lender’s local office. But the overwhelming preference is to take care of payments where they already shop, such as 7-Eleven, Walmart or CVS.

For lenders, that means it’s not time to phase out accepting cash, but to digitize cash payments. Partnering with a payments platform provider that supports cash at retail, lenders can give each borrower a personalized barcode they can use in the checkout line of popular stores.

4. Critical need for mobile-optimized bill pay experience

Most any business today must offer a mobile-friendly experience – including for bill payment. More than 60% of consumers pay loans with their smartphone, nearly twice as many as those using a computer.

Having some type of digital payment portal is a start. But if the user experience is not easy, fast and convenient, people might delay or even skip making a payment.

Lenders that prioritize optimization of mobile and online channels may have a significant advantage. Beyond giving customers an intuitive modern interface, with an optimal payments platform, companies can remove common pain points to make loan payment easier.

For starters, 41% of consumers complain that it’s a hassle to remember payment due dates. Younger payers find it the most problematic, where nearly half (48%) of those aged 18-29 struggle to keep track of due dates. Yet there is a welcome solution: digital reminders. 47% of people say receiving a text or email reminder when a bill is due would make it easier to pay on time.

Next is accessing biller websites when it’s time to pay. Having to remember logins, passwords and account numbers is the biggest pain point for many people. 42% say it’s the top reason loan payment is difficult. And 31% think that being able to pay loans digitally without having to remember login details would make payment easier.

What does that look like? A modern payment platform like PayNearMe can send customers a personalized link via text or email that enables them to jump right into their payment flow, and pay in a few taps.

5. Personalized experiences

Many lifestyle activities have set the bar for personalized experiences, and consumers now want and expect the same for essentials like paying bills. 69% of those surveyed consider it very important or important to have a tailored experience.

A critical improvement for loan payment is to personalize the process by pre-populating screens with a customer’s payment details (e.g., loan number, amount due, etc.). 80% of consumers consider this feature very important. They expect lenders to ‘know’ them, and not have to repeat data entry every time they make a payment.

Another strategic consideration is that 68% say they would be very likely or likely to recommend a lender if it offered a highly personalized experience, so offering customers a personalized experience can have a direct impact on current and future revenue.

Put insights into action with optimized payments

Increasing on-time payments is a high priority for most lenders—and achieving that requires making it as seamless as possible for customers to pay. That means addressing top consumer preferences for more flexibility like digital wallets and cash at retail, and the ease of a personalized, mobile-optimized experience.

Partnering with PayNearMe, lenders can easily deliver a modern payment experience built for what consumers need most. For a deeper dive into more loan payment insights, download our 2024 Research Report.