White Paper: Beyond Transaction Fees

Read Now

Business Login

Who we work with

Solutions

Auto & Consumer Lending

Modern, reliable platform for lenders.

TollingCollect more unpaid tolls.

iGamingOne platform for deposits, payouts & more.

Buy Here Pay HereEverything you need to collect payments.

Banks & Credit UnionsConvert indirect borrowers into customers.

Mortgage ServicingMeet the changing needs of customers.

Resources

Quick Links

Research Reports

View the latest research and trends.

Media ResourcesDownload brand assets, logos and more.

WebinarsView upcoming & on-demand webinars.

Case StudiesSee real results from current clients.

Buyer's GuideAn in-depth overview of the payments landscape.

VideosWatch on-demand webinars, podcasts and more.

Who we work with

Solutions

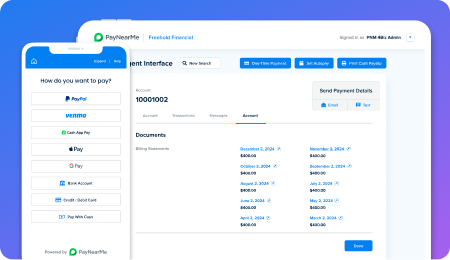

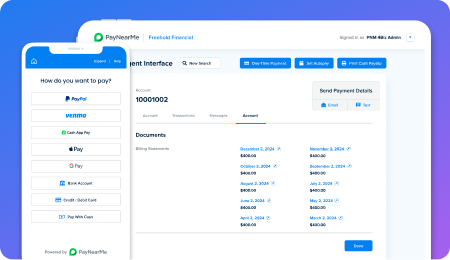

Auto & Consumer Lending

Modern, reliable platform for lenders.

Tolling

Collect more unpaid tolls.

iGaming

One platform for deposits, payouts & more.

Buy Here Pay Here

Everything you need to collect payments.

Banks & Credit Unions

Convert indirect borrowers into customers.

Mortgage Servicing

Meet the changing needs of customers.

Schedule a Demo

Uncover how our platform can transform your payment experience.

Schedule a Demo

Resources

Quick Links

Research Reports

View the latest research and trends.

Media Resources

Download brand assets, logos and more.

Webinars

View upcoming & on-demand webinars.

Case Studies

See real results from current clients.

Buyer's Guide

An in-depth overview of the payments landscape.

Videos

Watch on-demand webinars, podcasts and more.

Schedule a Demo

Uncover how our platform can transform your payment experience.

Schedule a Demo

Support

About PayNearMe

Schedule a Demo

Uncover how our platform can transform your payment experience.

Schedule a Demo