How Inflation Has Impacted Bill Payments – and What Lenders Can Do to Climb the Payments Priority Ladder

Nearly two years of escalated inflation has been taking a toll on both consumers and lenders. With higher prices and economic uncertainty, 74% of Americans are feeling the pressure, with consistently troubling results across different age and income groups.

That could be especially troubling news for lenders, as consumers are prioritizing necessities like housing, utilities and food, and deferring loan payments. At times like this, improving the consumer payment experience may be more important than ever.

Lenders are feeling the squeeze too, with 65% seeing a rise in delinquency. Call centers are already overloaded, and 48% of lenders expect an increase in call volume. A high number of calls are due to login issues with biller websites, many others deal with payment problems or simply making payments over the phone—all of which amplify the need for more self-service processes that also motivate customers to pay on time.

Transforming the payment experience is now business-critical for lenders. As the tough economy is shifting consumer bill pay priorities, lenders need cost-efficient ways to climb that priority ladder.

To better understand the scale and scope of economic impact, let’s look at it from a consumer perspective.

How inflation is impacting consumer ability to pay bills

To be expected, the hardest hit by inflation are low-income Americans. In PayNearMe’s research, titled “How Economic Uncertainty Impacts Bill Pay Behavior”, 85% of those surveyed who earn less than $25K a year say they are struggling. But surprisingly, it’s not just low-income households: 6 in 10 people who earn over $150K per year also say inflation is affecting their ability to pay bills. Research from LendingClub corroborates this, showing that a whopping 51% of consumers earning more than $100K a year are living paycheck to paycheck (up 9% points from the previous year—a considerable jump).

Many of those who are earning well may also be at the stage in life to take on bigger expenses, like buying their first car, first home, and extending credit to cover the needs of a growing family. In fact, 82% of consumers age 30 to 44 (many who fall into the Millennial generation) say inflation has impacted their ability to pay bills.

Economic uncertainty also weighs heavily. 91% of consumers are worried about a potential recession, and more than half (54%) are concerned about how it might affect their ability to pay bills. Millennials are feeling the pressure of a potential recession more than any other group, and their highest concern is defaulting on loans such as mortgage, auto, and personal loans.

By contrast, younger individuals age 18 to 29 are most worried about losing their job. And they have good reason to be concerned. 20 to 24 year olds had a 6.9% unemployment rate in February 2023, more than double the 3.4 % overall unemployment rate.

How consumers are managing bills on a tight budget

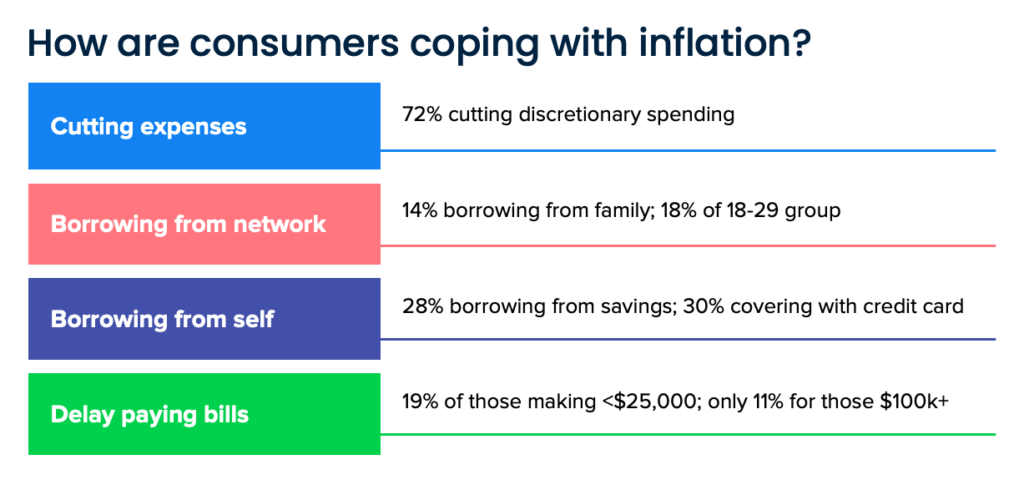

When budgets get stretched, usually the first thing to go are life’s little extras. 72% of consumers are cutting discretionary spending to help stay current with bills. But many are also turning to more concerning strategies to get by.

1 in 7 consumers have been borrowing money from family members to pay bills. It’s most prevalent in 18 to 29 year olds, where nearly 1 in 5 borrow from family to meet monthly expenses. This approach can help in the short term, but it’s not sustainable.

Inflation is also causing many people (28%) to dip into savings to pay bills. And nearly one-third of consumers are using credit cards for bill payment. According to Lending Tree, credit card balances have risen dramatically since third quarter 2021. Cards may work for covering essentials like groceries, gas, and certain utilities, but they don’t help get loans paid, as lenders can’t accept debt on debt payments.

How consumers are prioritizing bills

So what happens when people are struggling just to cover the necessities? Loans may be the monthly bill that gets paid late or not all.

Consider that 1 in 6 consumers have delayed paying bills due to inflation. And in terms of priority, personal installment loans have been the expense most often paid late in the last 12 months. Paying an auto loan ranks as a middle priority (#4 out of 7 categories), after essentials of housing and electric/water utilities. That’s the intention anyway, but in reality, car payments were the second most likely to be paid late in the last 12 months, just ahead of personal loans.

Further complicating things is the pressure to stay on top of credit card debt. As people are relying more on cards to cover basic needs, they need to keep up with monthly minimum payments. As a result, they may be deprioritizing loan payments.

These bill pay behaviors underscore the urgency for lenders to take action to “climb the payments priority ladder.”

Climbing the payments priority ladder

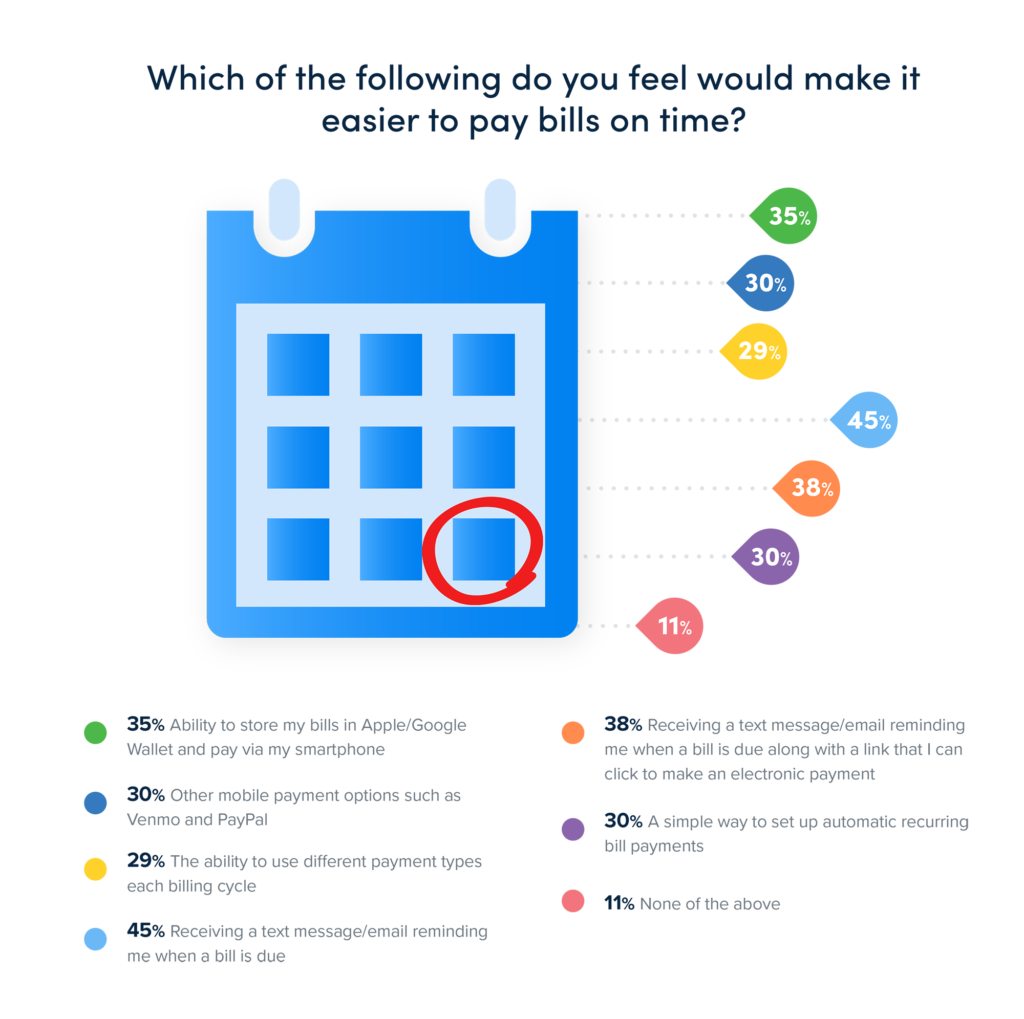

Lenders can’t control the economy, but they can work to make consumer payments more convenient. If a loan bill is the easiest to keep track of and pay vs. the hardest, lenders could see a meaningful increase in bills paid on time. Offering a modern mobile self-service payment experience can make all the difference.

For starters, a self-service automation solution (like PayNearMe) delivers a massive cost savings for lenders, as they alleviate the burden of inbound calls from the contact center. Compared with an average of $8.01 per call, each self-service interaction costs only $0.10. Lenders gain another operational win as agents have more time to focus on solving customer issues and making outbound collection calls.

For customers, a self-service web portal or IVR can make paying their loan dramatically easier. No more needing to call during business hours or remember yet another username and password. In a few moments, they can pay in whatever way they prefer, including debit card, digital wallets (e.g., PayPal, Venmo, Apple Pay, Cash App, Google Pay), ACH, or cash at tens of thousands of retail locations. Given that 8 in 10 consumers use mobile wallets, providing those options could help loan payments become a higher priority, particularly with younger customers who are used to paying other expenses that way.

Mobile wallets are also popular with unbanked individuals, where one-third of people store money in payment apps instead of bank accounts. Providing this flexibility could help improve on-time loan payments with subprime and non-prime borrowers.

Another way to climb the payments priority ladder is enabling customers to split their monthly payment. A self-service app can allow people to pay multiple times per month instead of a single lump sum. More than half of consumers say splitting payments would help them pay on time, and 48% would split bill pay between different payment methods (e.g., half on Venmo stored cash, half on debit card).

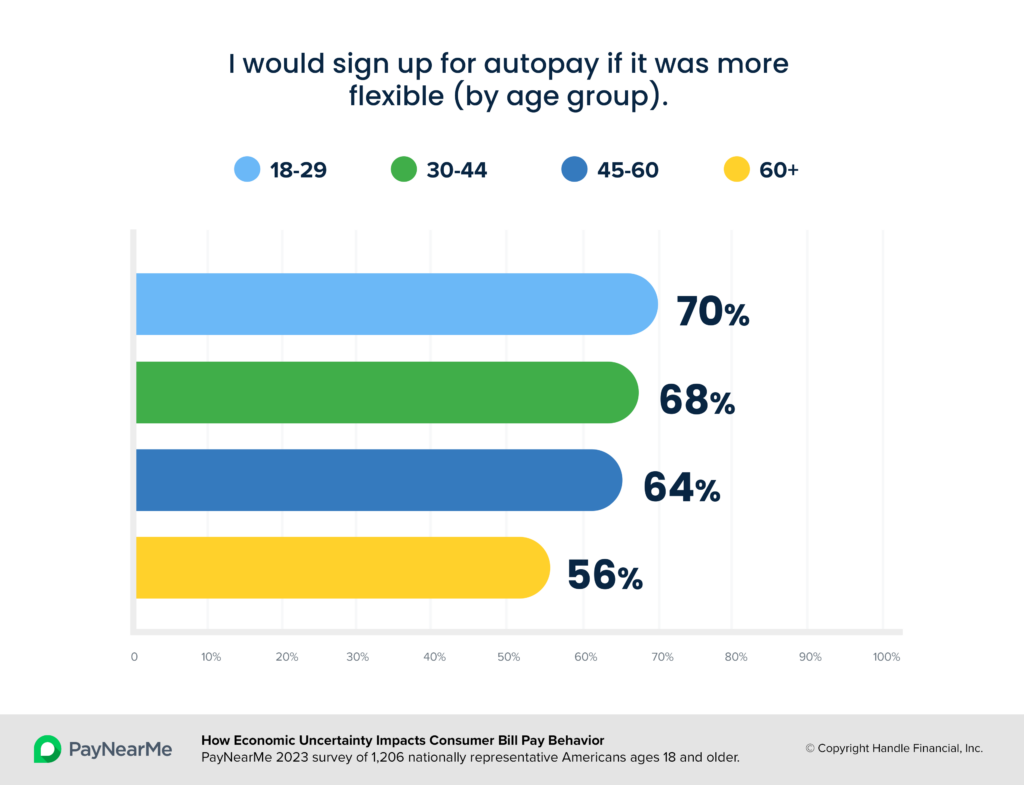

Of course, there’s also the holy grail of getting customers to enroll in autopay. Often the biggest resistance is the lack of flexibility. 65% of consumers say they are more likely to set up autopay if they had more control over scheduling. An optimal self-service experience could allow customers to set a specific day (or days) for their automatic payments, alleviating the fear of a surprise overdraft.

And no modern self-service solution would be complete without digital reminders to drive on-time loan payments. Nearly two-thirds of consumers say reminders such as text message, email or push notification, would make it easier to pay bills. Helping customers stay aware of due dates gives lenders a better chance of getting paid on time.

Deliver a flexible self-service payment experience with PayNearMe

Empowering customers with seamlessly easy self-service experiences to pay how, when and where they choose – while enabling lenders to significantly lower costs – is what the PayNearMe platform is all about.

With PayNearMe’s Smart Link™ technology, customers simply click once to enter a payment flow and can select from all major payment types, including debit cards, ACH, mobile wallets, and cash at retail at 40,000 locations across the U.S.

Lenders can dramatically improve their bottom-line by reducing the cost of payment acceptance. Self-service automation eliminates the majority of transactional payment calls and the related PCI compliance scope. It also enables lenders to boost agent productivity with streamlined processes to push self-service links to customers and handle collections outreach.

Learn more and request a demo – See PayNearMe in action with a personalized demo or email us at sales@paynearme.com.