The Mobile Payment Options Your Customers are Demanding

In our previous blog in this series, we covered our 2021 consumer research study and a few of the insights it revealed. The survey aimed to find out how consumers want to pay their bills and how businesses can help make a better bill pay experience a reality.

One of the key takeaways from the report was consumers’ desire for more mobile payment options, including more payment types and payment channels.

More Payment Options, Please

For payment types, peer-to-peer payment app PayPal was at the top of the list as an “important” or “very important” option for 43% of respondents. This was closely followed by Apple Pay and Google Pay at 32% of consumers and Venmo, another P2P app, at 27%.

However, many of these payment options aren’t available to consumers today for bill payments. If your organization isn’t offering these options, it may be time to consider adding them, or at the very least, exploring what options are available from your payments provider.

More Mobile Payment Channels, Too

In addition to having the ability to pay using the mobile payment types above, consumers are interested in paying their bills using mobile channels, such as digital wallets (e.g. Apple Wallet), QR codes, email and SMS.

QR Codes: You Can Call It a Comeback

QR codes, for their part, have been on the rise since it saw a resurgence during the COVID-19 pandemic. According to our consumer survey, 33% of consumers would be likely or very likely to pay their bills by scanning a QR code on their mobile devices.

Surprisingly, the 30-44 age group (not the 18-29 group of payers) is most likely to use this payment channel to pay bills. Perhaps this is because many consumers in this age range have been using QR codes for years. QR codes aren’t brand-new technology, but they’ve definitely made a resurgence recently.

Digital Wallets for the Win

Digital wallets are another mobile payment channel that’s in high demand. Do you offer your customers the ability to store, manage and pay their bills directly from their Apple or Google Wallet on their mobile devices? If not, now may be the time to consider providing access to this feature.

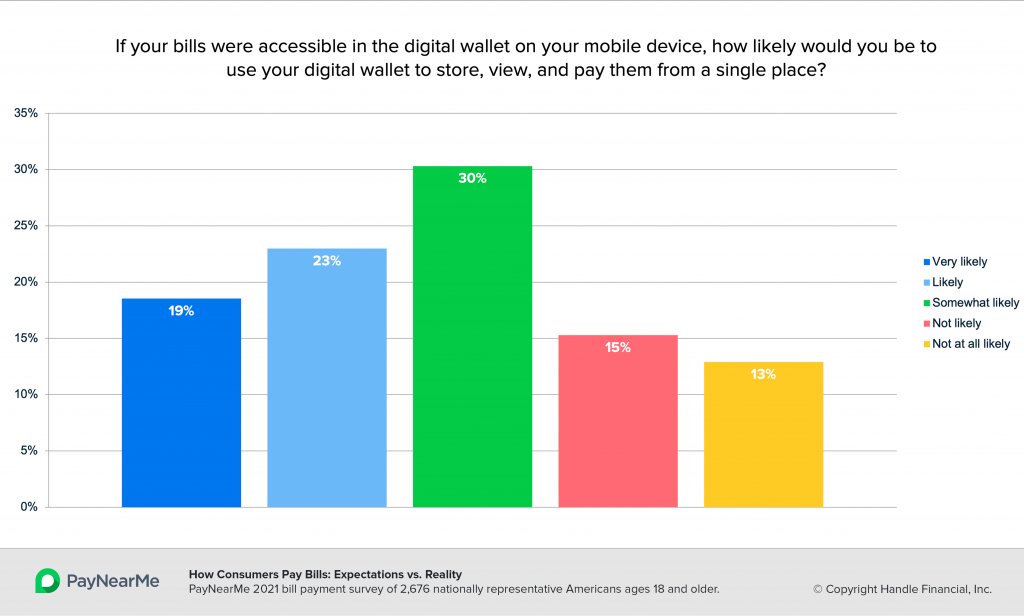

Over 40% of consumers would be likely or very likely to use their digital wallets to store, view and pay bills from a single place if given the opportunity.

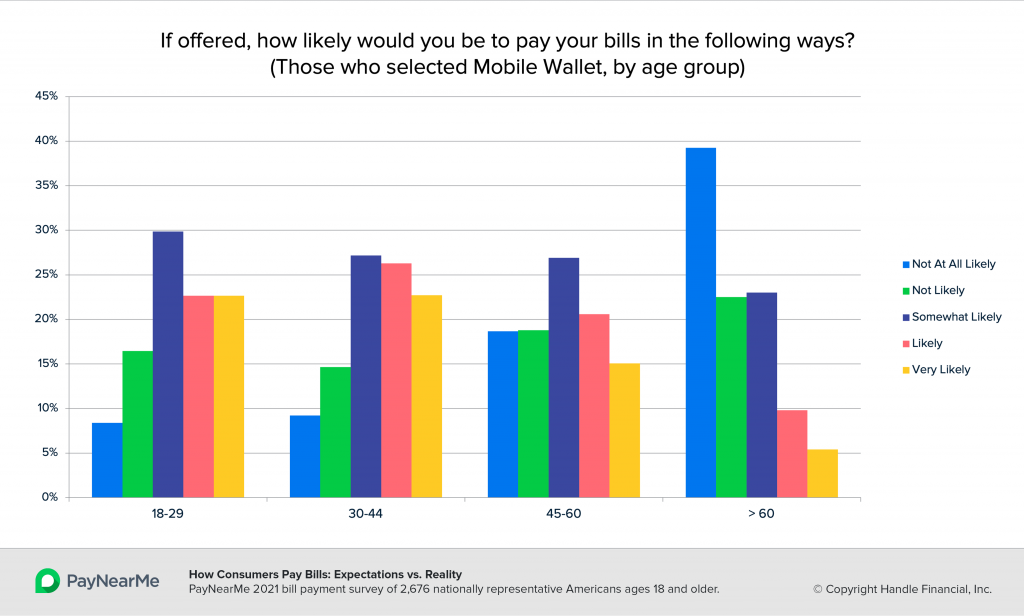

In addition, consumers would also be very likely to simply pay their bills from their mobile wallets, as we determined in another survey question shown below. 45% of young payers, in particular, would be likely or very likely to pay their bills this way.

So why are digital wallets so attractive to consumers? 4% of consumers aged 18-29 and 43% aged 30-44 say it’s an easy way to pay their bills. In other words, convenience is a major factor.

Late for a Very Important Date

Paying bills on time can be a difficult task for many consumers. We’ll dive into some of the reasons for late payments in an upcoming blog, but for now let’s focus on some of the options that could help mitigate those late payment behaviors.

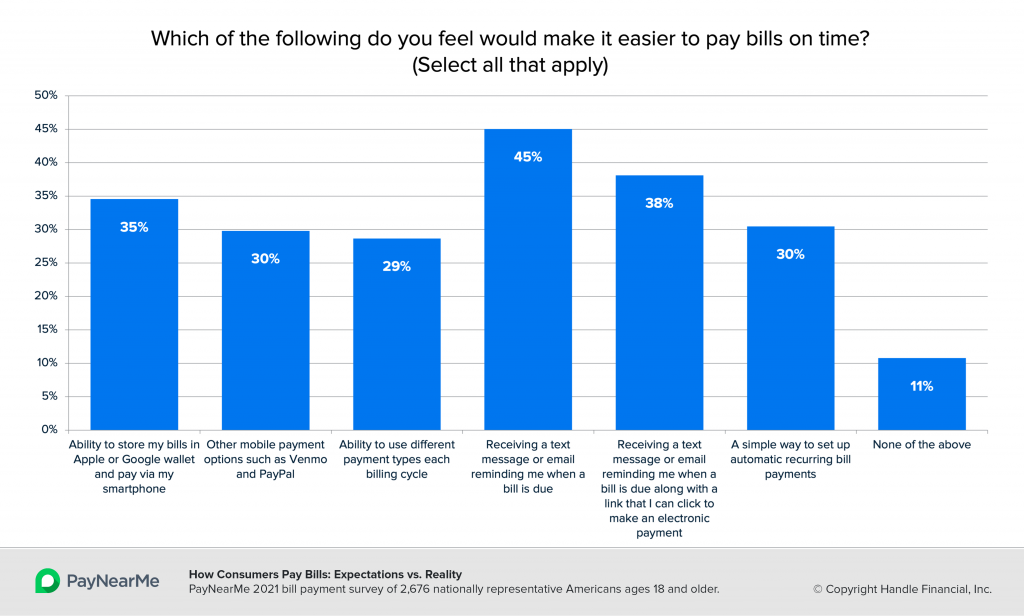

Many of the options consumers chose to help them make more on-time payments were mobile-centric. For example, having more mobile payment options such as Venmo and Paypal would be helpful in driving on-time payments for 30% of respondents. 45% of respondents stated that receiving a text message or email would help them pay on time, and 38% of those individuals would find it most helpful if that text or email reminder contained a link they could use to go directly to their payment flows.

Going back to digital wallets for a moment, consumers not only said that digital wallets could make managing and paying bills easier—but also that it could help them pay more bills on time. A whopping 44% of consumers aged 18-29 and 43% of consumers 30-44 said the ability to pay bills via Apple/Google Wallet could help them make fewer late payments.

The Mobile Revolution

What do consumers want? More mobile payment options!

When do they want them? Now!

We understand that your customers may not be protesting in the streets for more mobile payment choices, but based on our data, these options could make their lives easier and drive more on-time payments.

If you haven’t already, poll your customer-facing employees and customers themselves to ask them if they’re interested in adding new mobile payment types and channels like Apple Pay & Google Pay via their digital wallets. You may be surprised how likely consumers are to self-serve when given the option, helping you remove traffic from your in-person location and your call centers and saving you money.

When you’re ready to add new mobile options to your payments mix, PayNearMe can help. Not only do we have several options available today, but we have more coming on our product roadmap very soon. Contact us today for more information on how you can make the bill pay process easier for you and your customers.