What Makes Bill Pay So Stressful?

This is the third blog of our research series, which follows trends uncovered in our April 2021 consumer survey and resulting consumer research study. The survey aimed to find out how consumers want to pay their bills and how businesses can help make a better bill pay experience a reality.

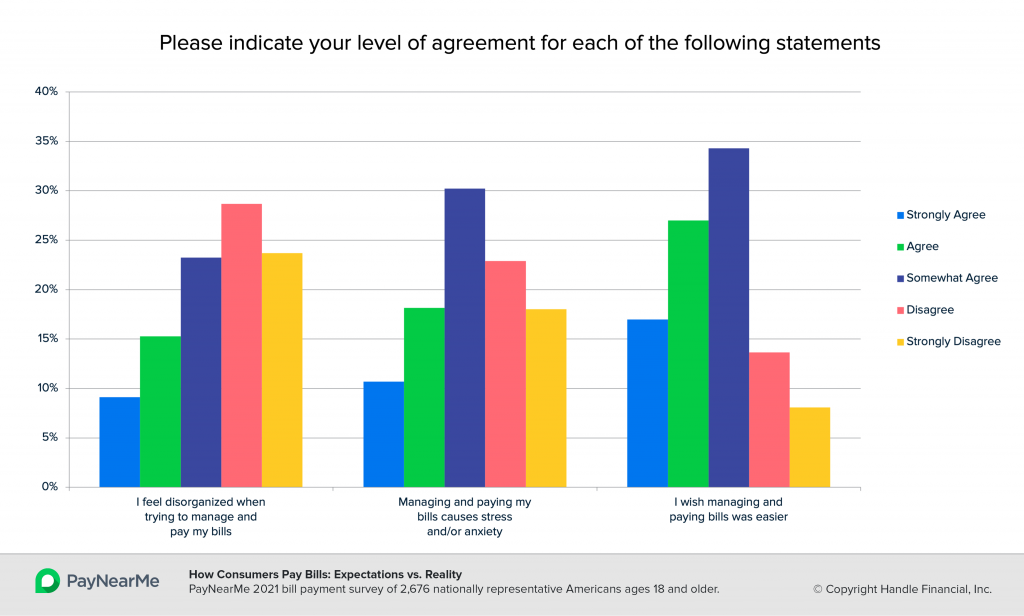

One thing was very clear from our recent consumer survey: consumers are stressed about paying bills. Nearly 1 out of four (24%) of consumers say they “agree” or “strongly agree” that they feel disorganized when trying to manage and pay bills, and even more (29%) say managing and paying my bills causes them stress and/or anxiety.

44% state that they “wish managing and paying bills was easier.” And while some consumers (64%) feel like they have a good handle on managing and paying their bills, there’s still a large percentage of consumers who don’t share the same confidence.

Stress and Delayed Payments

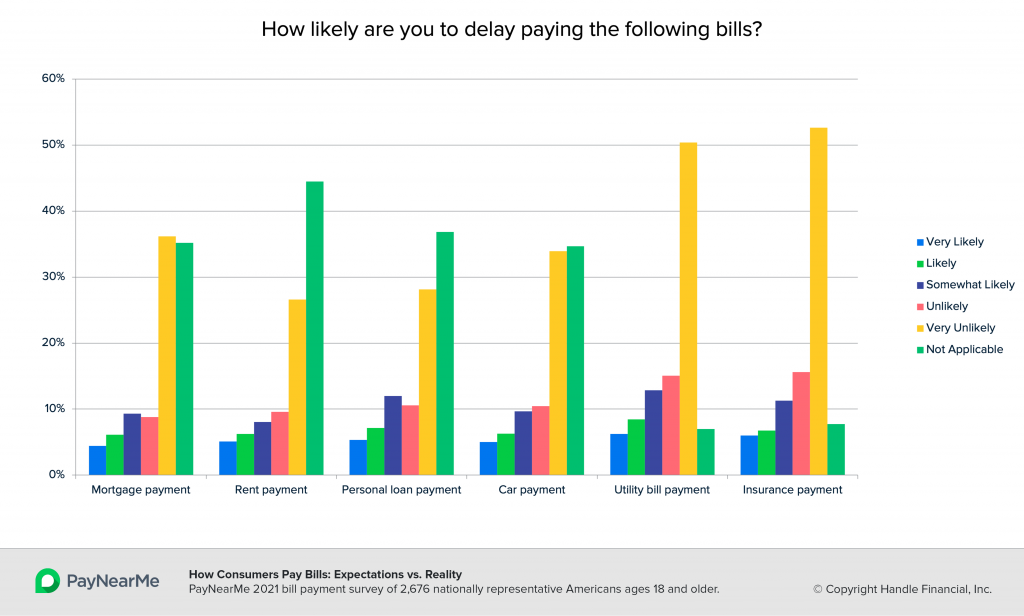

All of this stress, anxiety and disorganization can have a negative impact on a biller’s bottom line. Consumers are most likely to put off their utility bills, with 15% “likely” or “very likely” to delay a payment. This is followed by personal loans at 12%.

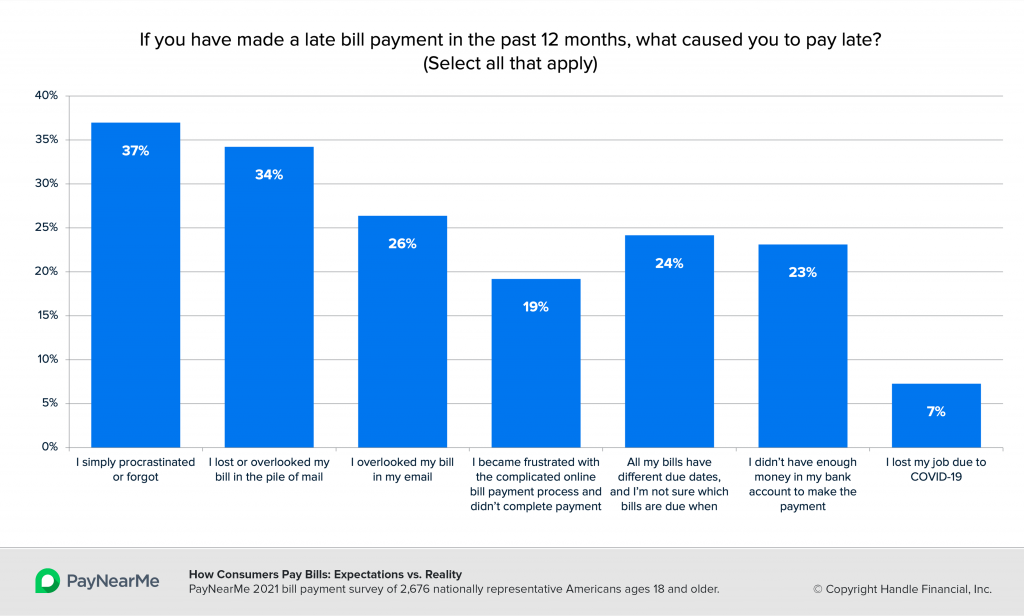

These stats may have you thinking that consumers are stressed because they’re short on funds; but according to our respondents, that’s not what’s causing the issue.

37% simply procrastinated or forgot, while others overlooked their bills in their physical (34%) or digital (26%) mail. Compare this to 25% that didn’t have enough money in the bank, and it becomes clear that disorganization could be more of a problem than lack of funds.

Solving the Issues at Hand

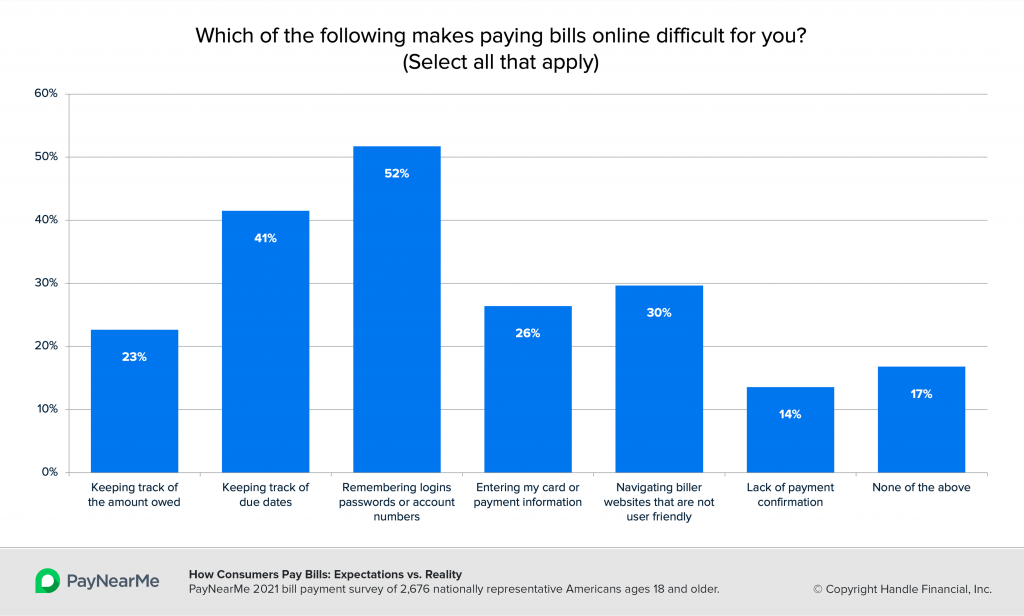

When we asked specifically about what makes the online bill payment process difficult, respondents gave a wide range of answers that provide us with some hints on how to improve their experiences.

Remembering Passwords / Login Information

Scoring highest on consumers’ list for online bill pay challenges was remembering logins, passwords and account numbers at 46%.

The PayNearMe Smart Link™ can help with this issue. With PayNearMe Smart Link™, there’s no need to remember complicated login information.* Customers are verified and sent their personalized one-time payment links. These links drive them directly to their registered payment flows to complete payments in as little as two clicks.

These links can be embedded in a text message, email, push notification, QR code, digital wallet and even chat conversations to make payments easy across a number of channels. These links are instrumental in driving customer self-service payments.

By giving customers an easy way to make payments on their own, without the need to call and speak to an agent, helping billers reduce operational costs.

Keeping Track of Due Dates / Amount Due

Consumers also told us that they have trouble keeping track of the amount they owe (31%) and when bills are due (42%). Billers can help consumers stay up-to-date with their billing information in a number of ways, including sending automated payment reminders (tips here) and providing access to billing information via Apple or Google Wallets so that consumers can easily view it any time.

Navigating Confusing Websites

Navigating biller websites that aren’t user-friendly is also frustrating for consumers. One-fourth of consumers say these poor experiences make paying bills online difficult. But there are ways that organizations can help. By providing a clean, user-friendly payment experiences (see our previous blog for specific steps you can take), organizations can significantly increase customer satisfaction.

For more information about how you can reduce bill pay stress for your customers, get the full research report “How Consumers Pay Bills: Expectations vs. Reality.”

*Only applies to one-time payments. For autopay or to review payment history, saved payment types or sensitive account information, further authentication is required.