Find Out What Consumers Want from Mobile Bill Pay in PayNearMe’s Newest Research Report

There are plenty of research reports that highlight past consumer payment behavior. But knowing what consumers have done doesn’t always give insight into what they want to do in the future.

PayNearMe’s original research study aims to address this gap in a series of reports focused on expectations about bill pay, mobile preferences, demographic breakdowns and more.

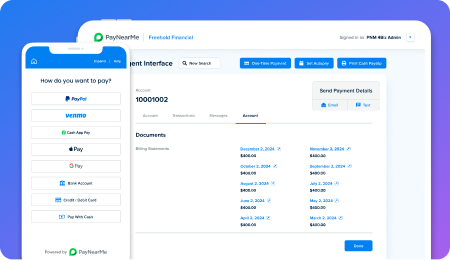

The second report highlighting our findings, “U.S. Consumers Expect More Mobile Options for Bill Pay“, is now available. This report looks specifically at consumer attitudes and preferences toward mobile payment types and channels and can be downloaded here. (If you haven’t already seen our primary report, “How Consumers Pay Bills: Expectations vs. Reality,” you can also find that one here.)

What’s in the Report?

Along with key insights, data and charts around mobile payment types and channels, you’ll also get recommendations around how to convert constant callers and at-location payers into mobile-first payers who self-service—allowing you to lower operational costs and improve customer satisfaction. You’ll also get a look at some of today’s mobile payment best practices to help you on your way.

Here’s a sneak peek of some of the tips you’ll find in our mobile research paper.

Why Focus on Mobile?

According to a report by Nuance Communications, “nearly 9 in 10 consumers say they have used an automated self-service system to complete a transaction, such as paying a bill or scheduling an appointment with a company with whom they do business.”

Consumers are increasingly turning to self-service payments instead of stopping by a business in-person or picking up the phone. And many of those self-service options are facilitated through mobile channels.

Here are a few ways you could focus on moving your customers to mobile self-service options:

- Send automated or agent-led text, email or push notifications with a direct payment link to make mobile payments easy.

- Remove service fees for mobile self-service channels like digital wallets and QR codes to encourage adoption, while continuing to charge for more operation-heavy channels such as phone payments.

- Build digital wallet and QR codes options into your online and paper bill pay experience to facilitate mobile payment adoption.

- Provide consumers the option to add their bill as a “living” pass to their Apple or Google Wallet to always stay on track with bill due dates.

For more mobile payments findings, download the full report and be sure to stay tuned for future PayNearMe research.