3 Essential Reasons Lenders Need a Modern Self-Service Bill Pay Experience

Demand for consumer credit is still on the rise, despite recent years of escalating inflation and recession rumors. And as interest rates may start easing downward, competition among lenders will heat up. Banks, credit unions and consumer lenders are all vying for a piece of the consumer credit pie, estimated to top $24 billion by 2032.

Countering that growth, however, are the escalating rates of delinquency. According to 2023 PayNearMe research, 65% of surveyed lenders noted that they saw a rise in late payments. Industry projections expect more ahead, particularly for credit cards, personal loans and auto loans.

What does this mean for lenders in this highly competitive, yet volatile market? It’s important to offer a modern payment experience that makes your bill the easiest to pay, so it gets prioritized and paid on time.

Why is this so critical? Optimizing the payment experience can drive on-time payments and decrease operational expenses. Here are three reasons lenders should prioritize offering a modern, self-service payment experience.

1. Increase on-time payments and drive repeat customers

Growing a profitable customer base is imperative, and it takes more than competitive rates. Consumers now expect ease, convenience and personalization. That experience often influences how they choose a provider and become brand loyal. In fact, 79% of consumers say a company’s customer experience is as important as their products and services.

Increasingly, optimal experiences are defined as being seamlessly simple, mobile-friendly and enabling self-service—particularly for payments. In considering which digital channels to use for paying recurring bills, 41% of consumers say ease and convenience are the most important factors. And self-service is more in demand than ever, with 81% of people wanting more options to handle tasks on their own, such as bill pay.

Consider that consumers typically pay their life-essential bills first, with auto loans and personal loans often getting delayed or deferred. It’s essential to make a loan the easiest to track and pay in order to drive more on-time payments.

A modernized payment experience makes all that possible, giving lenders a powerful way to differentiate and the right capabilities to improve loan performance. When lenders offer all modern payment options, customers can easily pay bills in a few taps using their preferred method, including debit card, ACH, digital wallets (i.e. PayPal, Venmo, Apple Pay, Cash App Pay) and even cash at a retail location.

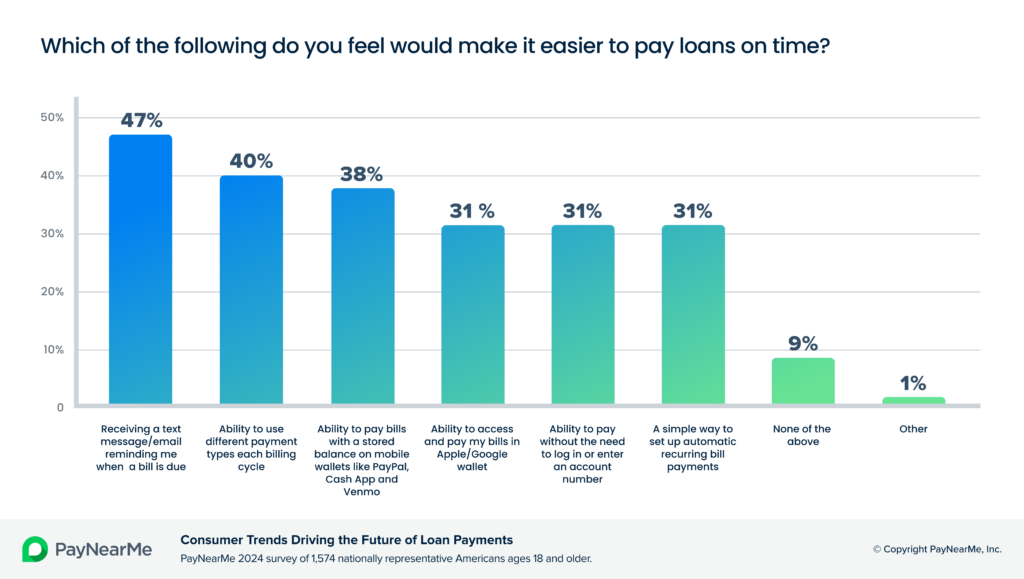

Automated reminders can also help increase on-time payments. 47% of consumers say that getting digital reminders (via text or email) would make it easier to pay their loans on time, according to PayNearMe’s recent survey.

To further reduce delinquencies, an optimal self-service experience can drive up autopay enrollment. Offering flexible options can help customers feel more confident about automatic payments. For example, they can choose a preferred date that may make cash flow easier for them, or opt to split payments throughout a month rather than paying one lump sum.

Payments are a foundational part of the loan relationship, and making that experience frictionless and flexible can help drive on-time payments and customer loyalty.

2. Reduce costs and improve productivity

Empowering borrowers with personalized, self-service payment tools can also help lenders save significant time and money. Contact centers are often consumed with calls about everyday issues that could easily be handled with automated self-service, freeing up agents to focus on more complex customer issues.

Our research found that 52% of payment-related calls are about password resets, because people have trouble remembering login credentials for the biller website. With personalized links that are connected to the customer’s account, no login is necessary. The customer can simply tap the secure link in a text or email reminder, jump right into the payment flow and make payment.

Offering this seamless experience also helps reduce calls to pay by phone, which are costly for the business. On average, each call can cost up to $6 and take about 8 minutes per customer. A self-service interaction, however, may cost only $0.10 cents.

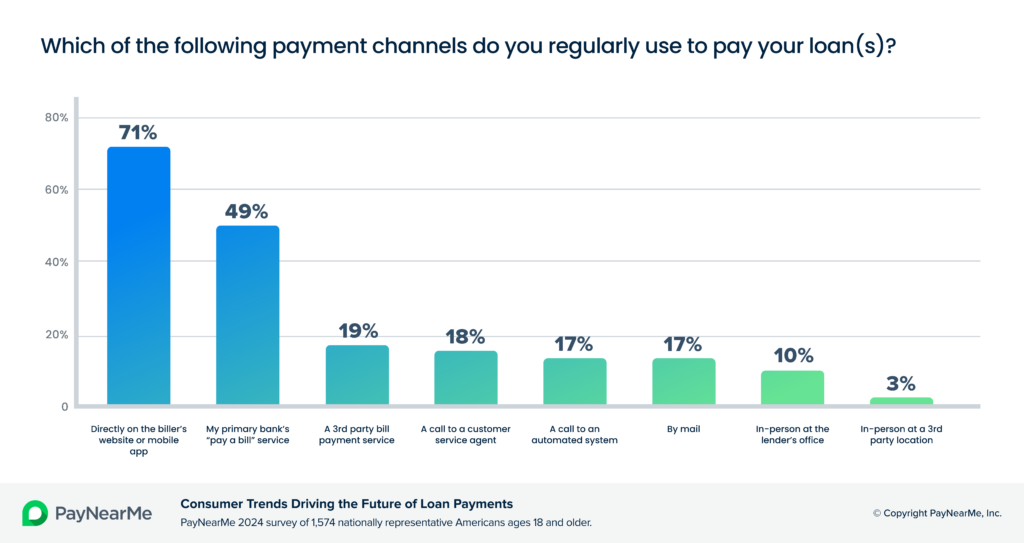

PayNearMe’s research also found that 17% of respondents said they regularly use an automated IVR system to make their loan payment, which tells us there is a preference for self-service convenience. That number was up 70% from PayNearMe’s 2021 report. It’s likely that phone and IVR payers may overlap, and consumers are using IVR to pay only when the lender makes it easy to do so, or the wait for a live agent is too long.

Providing optimized self-service payments also enables cost-saving efficiencies for back-office staff. Legacy processes to manually reconcile payments (particularly those made by phone or in cash) can be incredibly costly. It’s also complicated reconciling across multiple payment vendor platforms.

Deloitte estimates that 62% of costs for processing payments is the labor involved, so imagine the lift if many repeatable tasks are automated. Lenders can dramatically reduce costs and the risk of errors.

A modern system can also automatically monitor payment activity and flag customers that have repeated NSF declines, then dynamically restrict their payment options to guaranteed methods.

3. Keep pace with lenders who’ve optimized

Another strategic reason for lenders to transform payment operations is that their competition is doing it. Companies poised to meet and exceed consumer expectations will come out the winners.

Need a real-world example? Consider this success story of LoanMart, a leading subprime lender and servicer.

LoanMart’s biggest challenge was to increase operational efficiency and cut costs, but do it without sacrificing customer service or satisfaction. For years they had been using two payment processing vendors, plus add-on services, which made accounting difficult and time-intensive.

Partnering with PayNearMe, LoanMart transformed the payment experience with more flexible self-service, including new payment methods to better meet customer preferences. Along with debit cards and ACH, the lender offers customers the ability to pay with cash at retail locations where they already shop.

To further reduce operational hurdles and costs, the lender was able to consolidate processing for multiple payment types into one contract, one integration and one reconciliation file. PayNearMe has made it easy to manage everything within one powerful bill payment platform.

A highlight of their new self-service payment experience is the addition of PayNearMe’s Smart Link™ technology across multiple customer touch points. Smart Links send personalized links to users for one-click payments without logging in. By implementing in reminder messages, online loan documents and statements, and welcome emails, LoanMart immediately saw click-through rates up to 40%.

Read the full case study here.

Take the fast-track to optimized self-service payments

Traditionally, loan payment has given customers very limited options and little flexibility. Transforming the experience with innovative self-service and in-demand options can help boost satisfaction and improve on-time payments, while automated efficiency can reduce operating costs.

Learn more about how PayNearMe can help lenders dramatically improve their bottom line. Click here to view an instant, on-demand demo.