New Research: Consumer Trends Driving the Future of Loan Payments

View Report

Business Login

Who we work with

Solutions

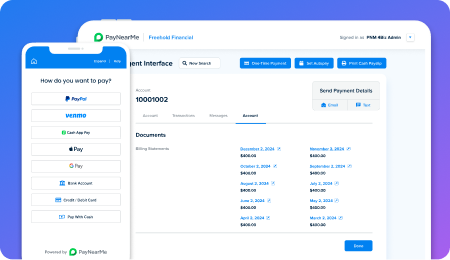

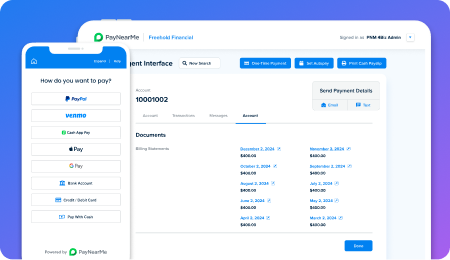

Auto & Consumer Lending

Modern, reliable platform for lenders.

TollingCollect more unpaid tolls.

iGamingOne platform for deposits, payouts & more.

Buy Here Pay HereEverything you need to collect payments.

Banks & Credit UnionsConvert indirect borrowers into customers.

Mortgage ServicingMeet the changing needs of customers.

Who we work with

Solutions

Auto & Consumer Lending

Modern, reliable platform for lenders.

Tolling

Collect more unpaid tolls.

iGaming

One platform for deposits, payouts & more.

Buy Here Pay Here

Everything you need to collect payments.

Banks & Credit Unions

Convert indirect borrowers into customers.

Mortgage Servicing

Meet the changing needs of customers.

Schedule a Demo

Uncover how our platform can transform your payment experience.

Schedule a Demo

Support

About PayNearMe

Schedule a Demo

Uncover how our platform can transform your payment experience.

Schedule a Demo